Category: Interest Rates

Mortgage Rates Impact on 2017 Home Values

Mar

02

2017

There is no doubt that historically low mortgage interest rates were a major impetus to housing recovery over the last several years. However, many industry experts are showing concern about the possible effect that the rising rates will have moving forward.

The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are all projecting that mortgage interest rates will move upward in 2017. Increasing interest rates will definitely impact purchasers and may stifle demand.

In a recent study of industry experts, “rising mortgage interest rates, and their impact on mortgage affordability” was named by 56% as the force they think will have the most significant impact on U.S. housing in 2017. If rising rates slow demand for housing, home values will be impacted.

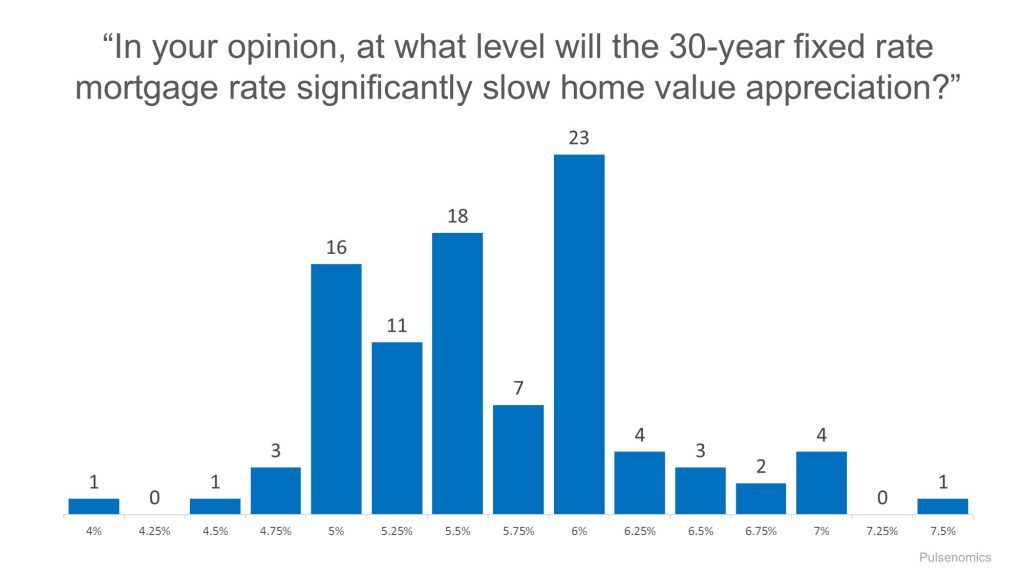

To this point, Pulsenomics, recently surveyed a panel of over 100 economists, investment strategists, and housing market analysts, asking the question “In your opinion, at what level will the 30-year fixed rate mortgage rate significantly slow home value appreciation?” The survey revealed the following:

Bottom Line

Most experts believe that rates would need to hit 5% or above to have an impact on home prices.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

How Low Interest Rates Increase Your Purchasing Power

Jan

24

2017

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history!

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain monthly housing budget.

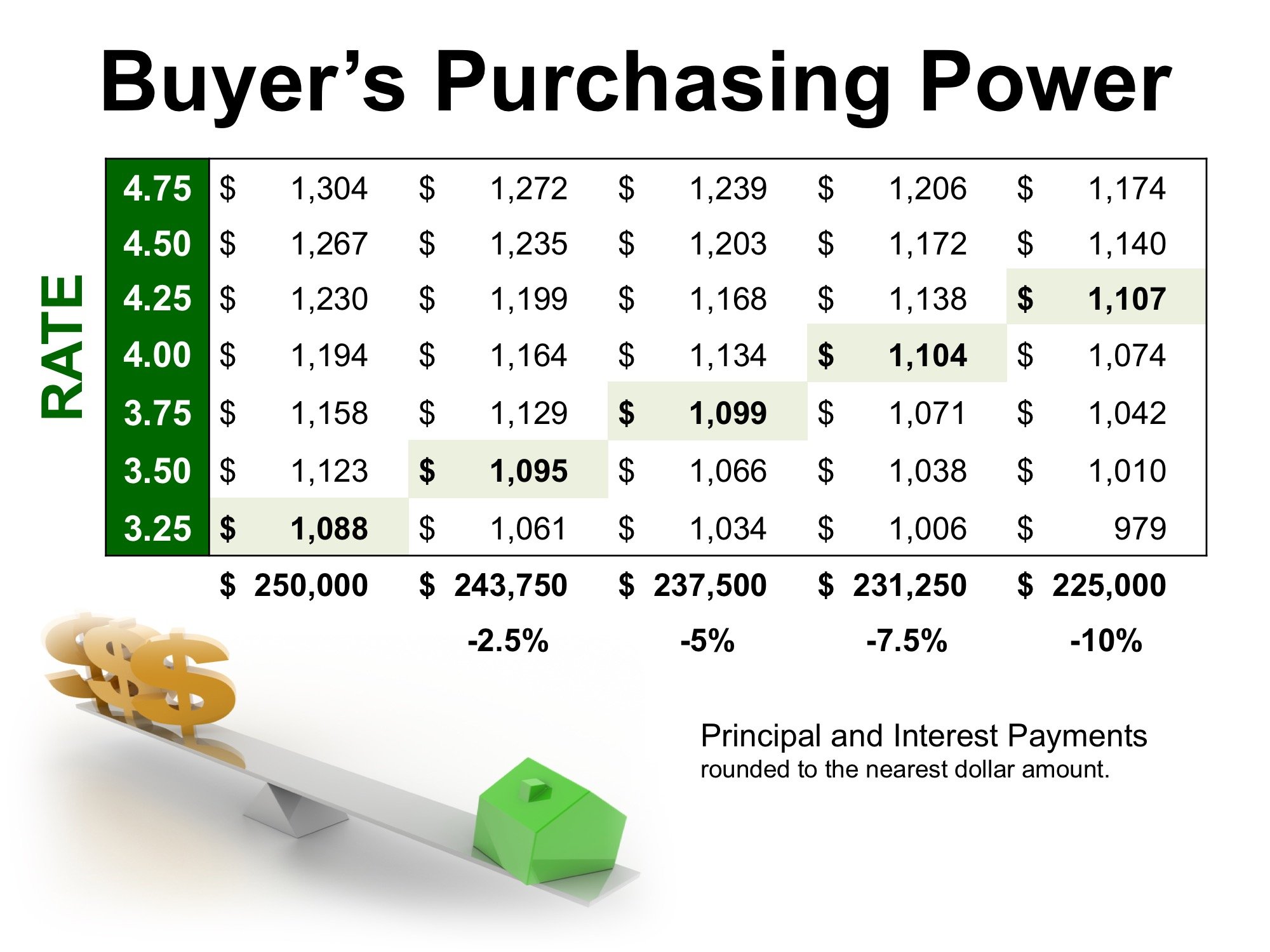

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the national median price range, and planned to keep your principal and interest payments at or about $1,100 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5%, (in this example, $6,250). Experts predict that mortgage rates will be closer to 5% by this time next year.

Act now to get the most house for your hard-earned money.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

Is This the Year to Move Up to Your Dream Home? If So, Do it Early

Jan

12

2017

It appears that Americans are regaining faith in the U.S. economy. The following indexes have each shown a dramatic jump in consumer confidence in their latest surveys:

- The University of Michigan Consumer Sentiment Index

- National Federation of Independent Businesses’ Small Business Optimism Index

- CNBC All-America Economic Survey

- The Conference Board Consumer Confidence Survey

It usually means good news for the housing market when the country sees an optimistic future. People begin to dream again about the home their family has always wanted, and some make plans to finally make that dream come true.

If you are considering moving up to your dream home, it may be better to do it earlier in the year than later. The two components of your monthly mortgage payment (home prices and interest rates) are both projected to increase as the year moves forward, and interest rates may increase rather dramatically. Here are some predictions on where rates will be by the end of the year:

HSH.com:

“We think that conforming 30-year fixed rates probably make it into the 4.625 percent to 4.75 percent range at some point during 2017 as a peak.”

Svenja Gudell, Zillow’s Chief Economist:

“I wouldn’t be surprised if the 30-year fixed mortgage rate hits 4.75 percent.”

Mark Fleming, the Chief Economist at First American:

“[I see] mortgage rates getting much closer to 5 percent at the end of next year.”

Lawrence Yun, NAR Chief Economist:

“By this time next year, expect the 30-year fixed rate to likely be in the 4.5 percent to 5 percent range.”

Bottom Line

If you are feeling good about your family’s economic future and are considering making a move to your dream home, doing it sooner rather than later makes the most sense.

Posted in For Buyers, Interest Rates, Move-Up Buyers