Category: Buying Myths

Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

Nov

22

2017

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in just the last year:

- More buyers are putting less than 20% down to purchase a home

- The average credit score on closed mortgages is lower

- More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

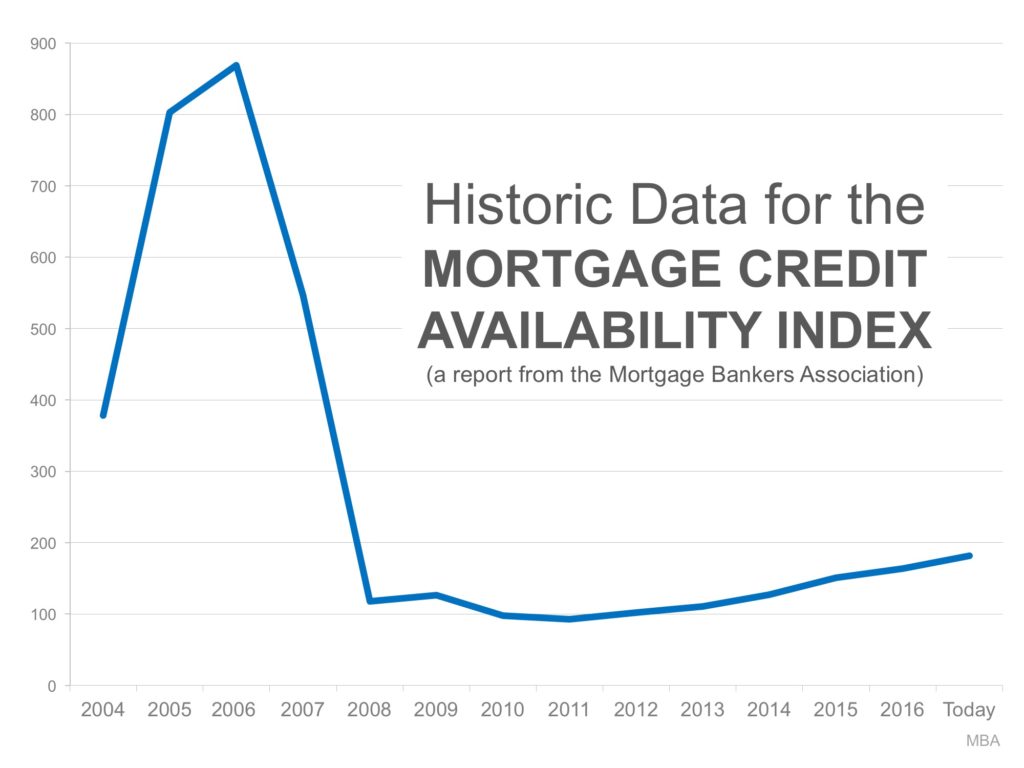

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

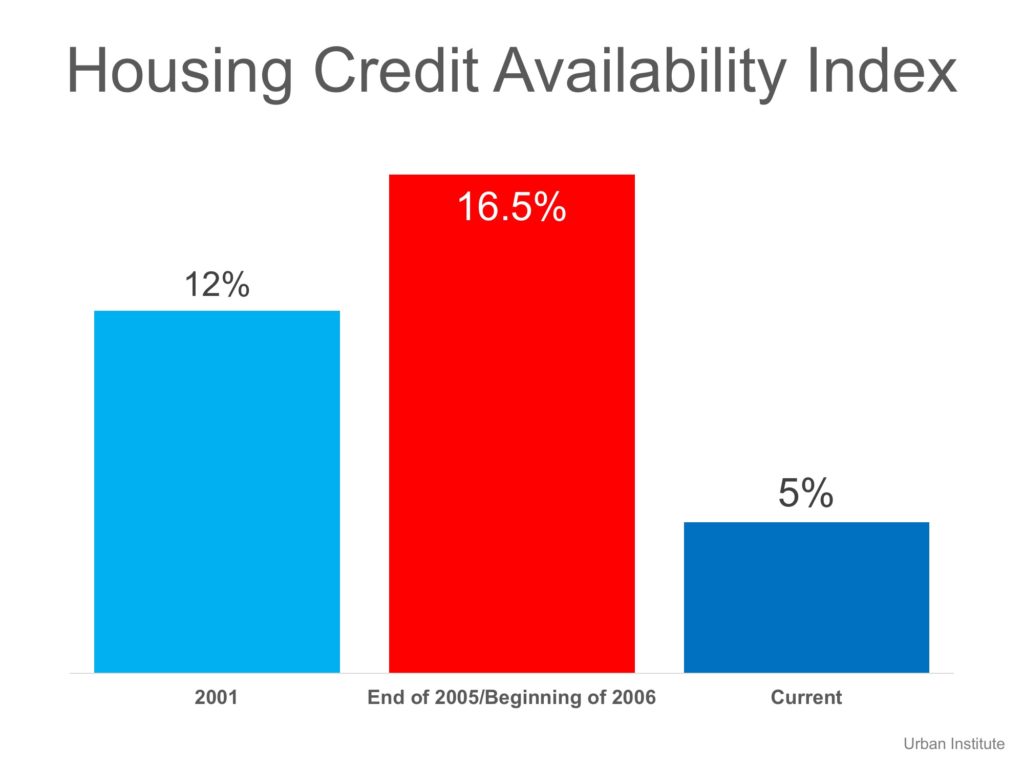

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the Institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates … it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

Posted in Buying Myths, First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Your Friends Are Crazy Wrong If They’re Telling You Not to Buy

Nov

16

2017

The current narrative is that home prices have risen so much so that it is no longer a smart idea to purchase a home. Your family and friends might suggest that buying a home right now (whether a first-time home or a move-up home) makes absolutely no sense from an affordability standpoint. They are wrong!

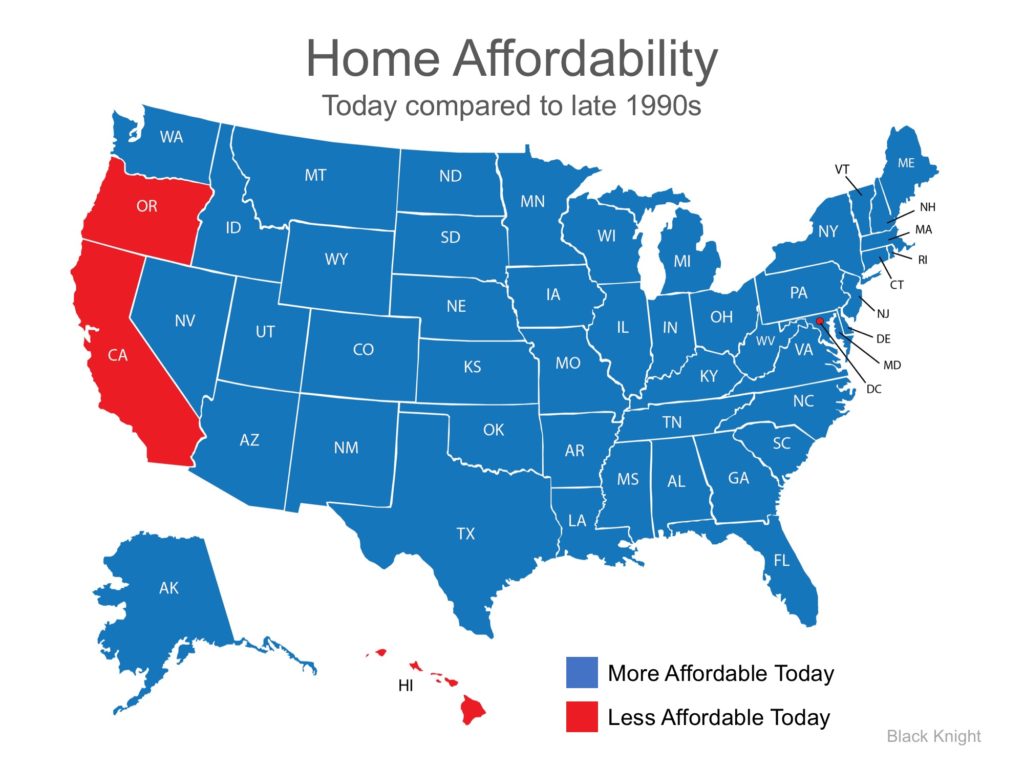

Homes are more affordable right now than at almost any time in our country’s history except for the foreclosure years (2009-2015) when homes sold at major discounts. As an example, below is a graph from the latest Black Knight Mortgage Monitor showing the percentage of median income needed to buy a medium-priced home in the country today in comparison to prior to the housing bubble and bust.

As we can see, the percentage necessary is less now than in those time periods.

The Mortgage Monitor also explains that home affordability is better today than it was in the late 1990s in 47 of 50 states.

Bottom Line

Your friends and family have your best interests at heart. However, when it comes to buying your first home or selling your current house to buy the home of your dreams, let’s get together to discuss what your best move is, now.

Posted in Buying Myths, First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers

Buying a Home Can Be Scary… Unless You Know the Facts [INFOGRAPHIC]

Oct

27

2017

Some Highlights:

Many potential homebuyers believe that they need a 20% down payment and a 780 FICO® score to qualify to buy a home, which stops many of them from even trying! Here are some facts:

- 40% of millennials who purchased homes this year have put down less than 10%.

- 76.4% of loan applications were approved last month.

- The average credit score of approved loans was 724 in September.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Infographics, Millennials

Millennials Flock Towards Low Down Payment Programs

Oct

24

2017

A report released by Down Payment Resource shows that 61% of first-time homebuyers purchased their homes with a down payment of 6% or less.

The trend continued among all buyers with a mortgage, as 73% made a down payment of less than 20%.

An article by Chase points to a new wave of millennial homebuyers:

“We teamed up with Google to help us better understand what customers are searching for and how the home buying landscape is evolving. We found that millennials and first-time homebuyers are making a big splash in the market, and affordability remains top of mind.”

Among millennials who purchased homes, David Norris, Loan Depot’s Head of Retail Lending, said:

“It’s clear from the survey results that Millennials have a lot of anxiety built up about the home buying process.

There is good news, however, as there’s more flexibility than most Millennials think regarding how to qualify for a loan and what’s needed for a down payment.”

Bottom Line

If you are one of the many millennials who is debating a home purchase this year, let’s get together to help you understand your options and set you on the path to preapproval.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

The Cost of Renting vs. Buying a Home [INFOGRAPHIC]

Oct

20

2017

![The Cost of Renting vs. Buying a Home [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/10/19155904/20171020-Share-STM.jpg)

Some Highlights:

- Historically, the choice between renting or buying a home has been a tough decision.

- Looking at the percentage of income needed to rent a median-priced home today (29.2%) vs. the percentage needed to buy a median-priced home (15.8%), the choice becomes obvious.

- Every market is different. Before you renew your lease again, find out if you can put your housing costs to work by buying this year!

Posted in Buying Myths, For Buyers, Infographics, Rent vs. Buy

The Mortgage Process: What You Need to Know [INFOGRAPHIC]

Oct

06

2017

![The Mortgage Process: What You Need to Know [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/10/05103803/20170428-Share-STM.jpg)

Some Highlights:

- Many buyers are purchasing a home with a down payment as little as 3%.

- You may already qualify for a loan, even if you don’t have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

Posted in Buying Myths, First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers