Category: Down Payments

Are You Spending TOO Much on Rent?

Oct

30

2018

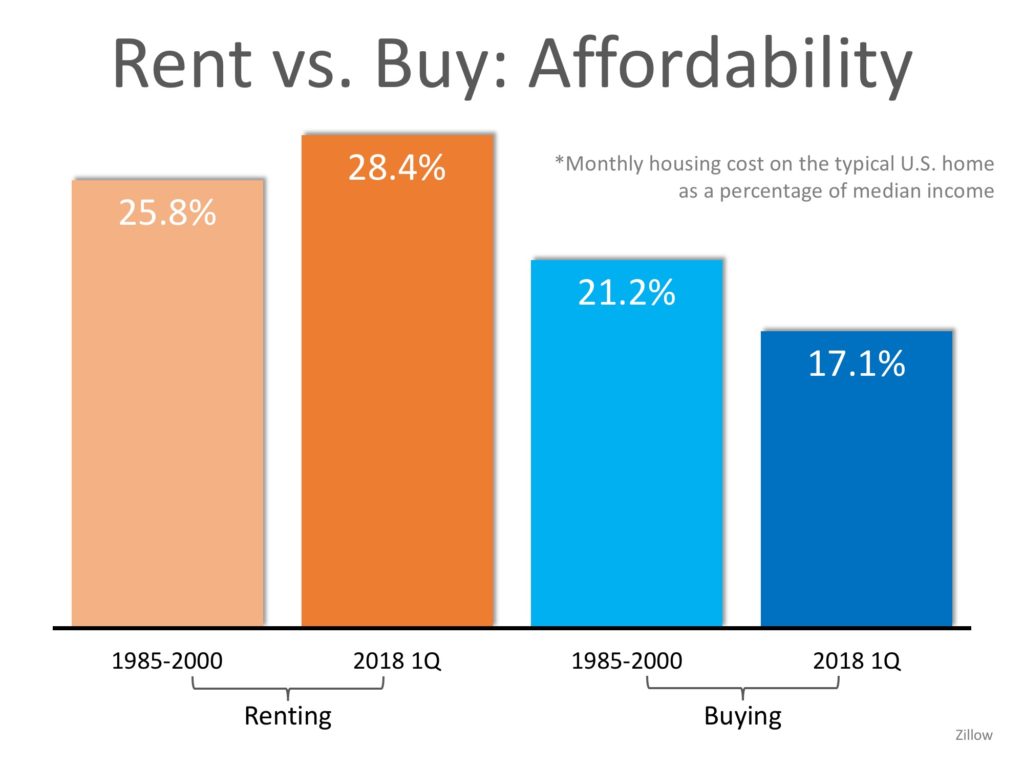

Chances are if you are renting you are spending too much of your income on your monthly housing expense. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their rent or mortgage payment. This percentage allows the household to save money for the future while comfortably covering other expenses.

According to new data released from ApartmentList.com, 49.5 million renters in the United States were cost-burdened in 2017, meaning they spent more than 30% of their monthly incomes on rent. This accounts for nearly half of all renter households in the country and is up 3.1 million from 2007.

When a household is cost-burdened by their monthly housing expense, they are not as easily able to save money for the future. This is a big factor for many renters who dream of owning their own homes someday.

But there is hope for those who are able to save at least a 3% down payment! The percentage of income needed in the US to buy a home is significantly less than renting at 17.1%!

The chart below compares the historic percentage of income needed to rent and buy from 1985-2000 to the first quarter of 2018. As you can see, the cost of renting has climbed above historic numbers while the cost of buying dropped over the same period of time.

Bottom Line

If you are one of the many renters who is spending too much of their monthly income on rent, consider saving money by getting a roommate, moving into a less expensive apartment, or even moving in with family. These are all ways to save for a down payment so that you can put your housing costs to work for you!

Posted in Down Payments, First Time Home Buyers, For Buyers, Rent vs. Buy

The Cost of NOT Paying PMI

Sep

26

2018

Saving for a down payment is often the biggest hurdle for a first-time homebuyer as median incomes, rents, and home prices all vary depending on where you live.

There is a common misconception among homebuyers that a 20% down payment is required, and it is this limiting belief that often adds months, and sometimes even years, to the home-buying process.

So, if you can purchase a home with less than a 20% down payment… why aren’t more people doing just that?

One Possible Answer: Private Mortgage Insurance (PMI)

Freddie Mac defines PMI as:

“An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.

Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. The monthly cost of your PMI depends on the home’s value, the amount of your down payment, and your credit score.

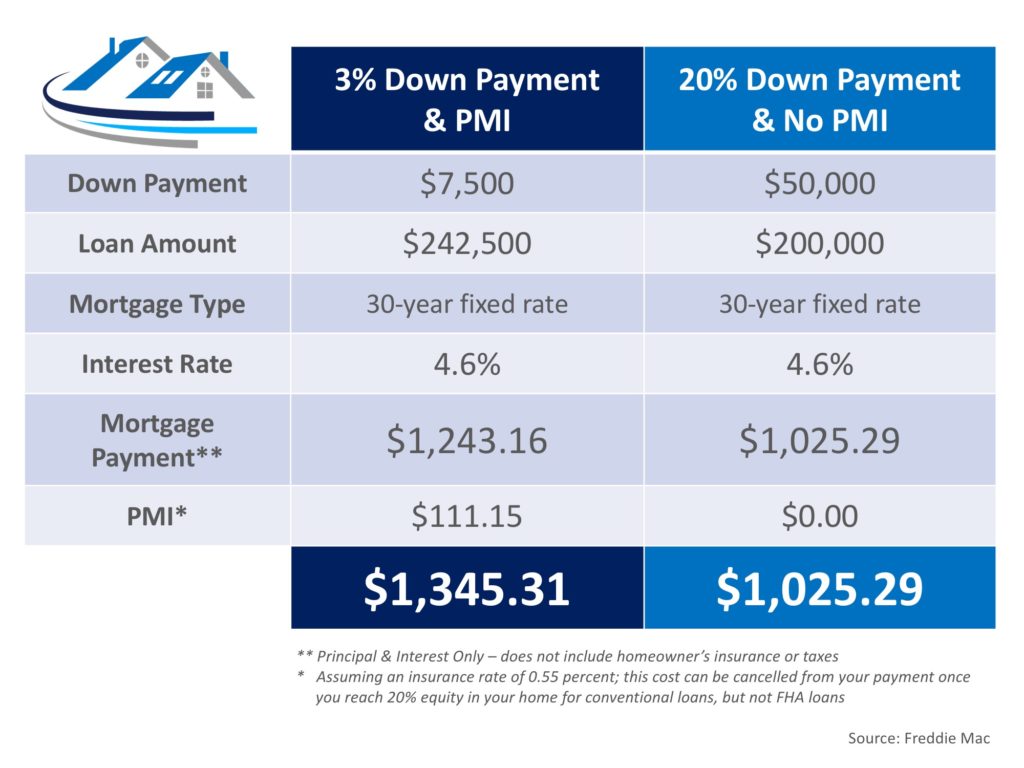

Below is a table showing the difference in monthly mortgage payment for a $250,000 home with a 3% down payment and PMI vs. a 20% down payment without PMI:

The first thing you see when looking at the table above is no doubt the added $320 a month that you would be spending on your monthly mortgage cost. The second thing that should stand out is that a 20% down payment is $50,000!

If you are buying your first home, $50,000 is a large sum of money that takes discipline and sacrifice to save. Many first-time buyers save for 5-10 years before buying their homes.

To save $50,000 in 10 years, you would need to save about $420 a month. On the other hand, if you save that same $420 a month, you could afford a 3% down payment in less than a year and a half.

In a recent article by My Mortgage Insider, they explain what could happen in the market while you are waiting to save for a higher down payment:

“The time it takes to save a (larger) down payment could mean higher home prices and tougher qualifying down the road. For many buyers, it could prove much cheaper and quicker to opt for the 3% down mortgage immediately.”

The article went on to say,

“Since renters typically devote a higher percentage of their income to housing than homeowners, providing flexible down payment options can help renters with solid earnings purchase a home – and gain a fixed-rate mortgage with principal and interest payments that will not increase over the life of the loan.”

If the prospect of having to pay PMI is holding you back from buying a home today, Freddie Mac has this advice,

“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.”

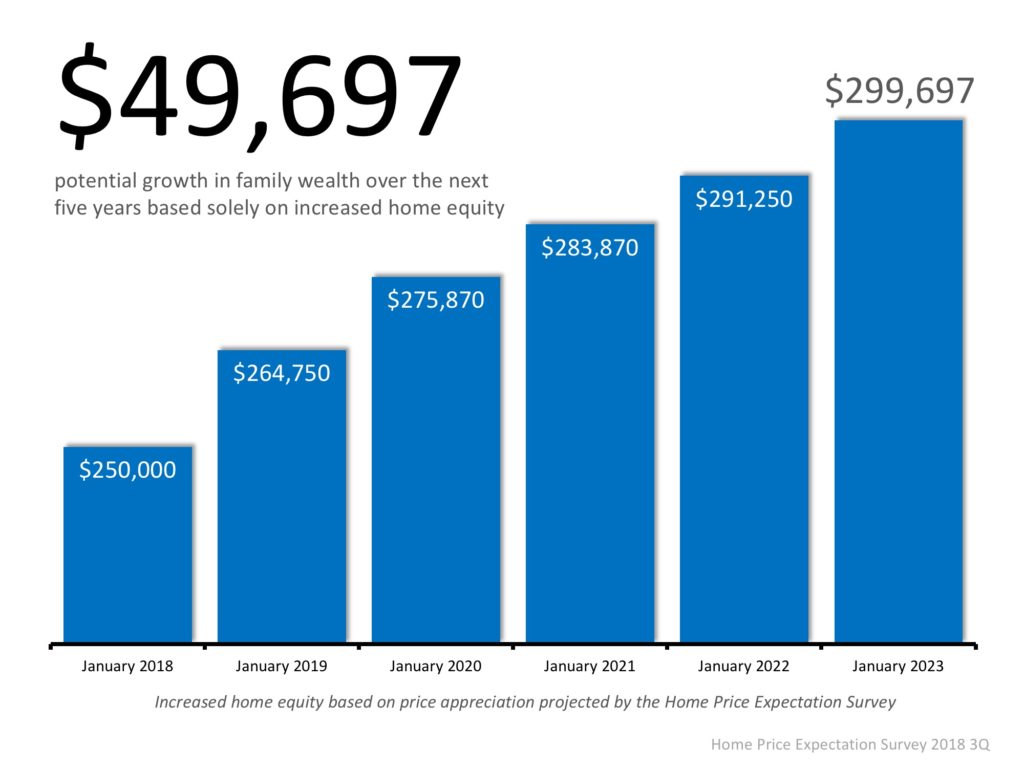

Based on results of the most recent Home Price Expectation Survey, a homeowner who purchased a $250,000 home in January would gain $50,000 in equity over the next five years based on home price appreciation alone (shown below).

Bottom Line

If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, let’s get together to discuss our market’s conditions and help you make the best decision for you and your family.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

Having Trouble Saving Enough for Your Down Payment? Crowdfund It!

Aug

22

2018

You read that right! First-time buyers across the country are getting creative when it comes to saving the necessary down payment to buy a home.

Many couples are asking their wedding guests to contribute to their “Down Payment Fund” rather than fulfilling a traditional registry. This is fueled by the fact that many couples live together prior to marriage and already have the necessary items to make a house a home…they just need the house!

The average wedding in the United States has 120 guests who give wedding gifts valued, on average, at $186. This means that couples could walk away from their nuptials with over $22,000 towards their down payment!

Services like HomeFundMe allow friends, family members, and almost anyone else in a buyer’s network to contribute funds toward the buyer’s down payment. Contributors can determine, at the time of their donation, if their gifts are ‘conditional’ or ‘non-conditional’ on the beneficiary buying a home.

According to a recent Wall Street Journal article, “about 400 borrowers have used HomeFundMe to help buy homes since the program launched in October and on average, they raise about $2,500.” The article went on to explain that most borrowers use these funds in combination with their personal savings to shorten the time needed to achieve their goal of homeownership.

There are more and more programs surfacing from lenders that allow buyers to put down as little as 3% to buy their dream home. Fannie Mae and Freddie Mac loan programs require 3% down payments, while FHA programs require as little as 3.5%, and VA Loans are often approved with 0% down!

Bottom Line

Gone are the days of 20% down or no loan! If your dreams include buying a home of your own in the next year, you can get creative with your down payment savings to make it happen!

Posted in Down Payments, First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

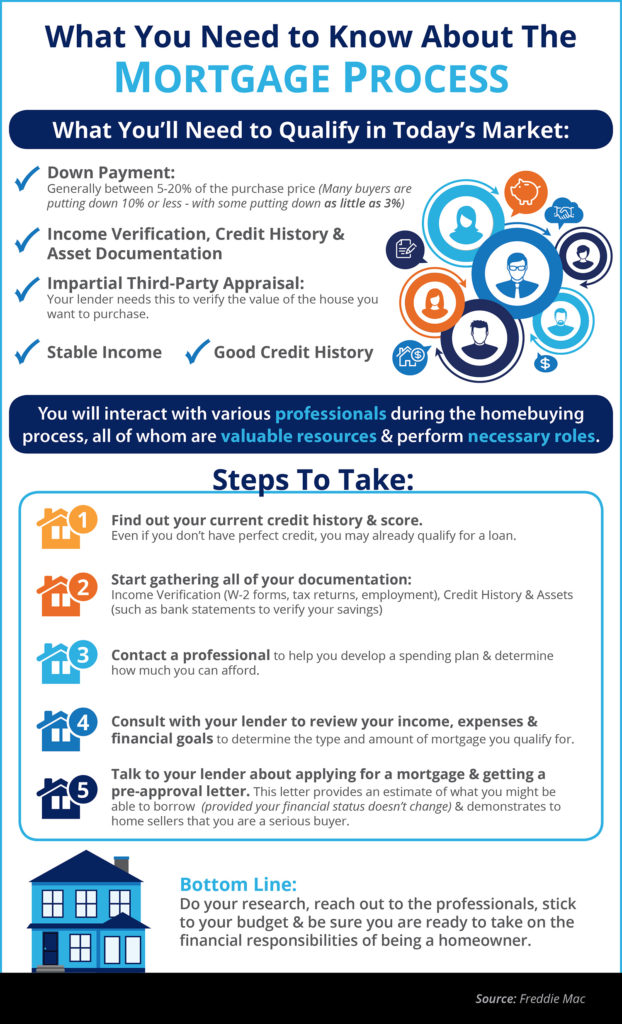

What You Need to Know About the Mortgage Process [INFOGRAPHIC]

Jul

20

2018

![What You Need to Know About the Mortgage Process [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/17145720/20180720-Share-STM.jpg)

Some Highlights:

- Many buyers are purchasing a home with a down payment as little as 3%.

- You may already qualify for a loan, even if you don’t have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

You DO NOT Need 20% Down to Buy Your Home NOW!

Jun

25

2018

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that the main reason why non-homeowners do not own their own homes is because they believe that they cannot afford them.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

A recent survey by Laurel Road, the National Online Lender and FDIC-Insured Bank, revealed that consumers overestimate the down payment funds needed to qualify for a home loan.

According to the survey, 53% of Americans who plan to buy or have already bought a home admit to their concerns about their ability to afford a home in the current market. In addition, 46% are currently unfamiliar with alternative down payment options, and 46% of millennials do not feel confident that they could currently afford a 20% down payment.

What these people don’t realize, however, is that there are many loans written with down payments of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO®Scores

An Ipsos survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores for approved conventional and FHA mortgages are much lower.

The average conventional loan closed in May had a credit score of 753, while FHA mortgages closed with an average score of 676. The average across all loans closed in May was 724. The chart below shows the distribution of FICO® Scores for all loans approved in May.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but you are not sure if you are ‘able’ to, let’s sit down to help you understand your true options today.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers

You Can Save for a Down Payment Faster Than You Think!

Mar

13

2018

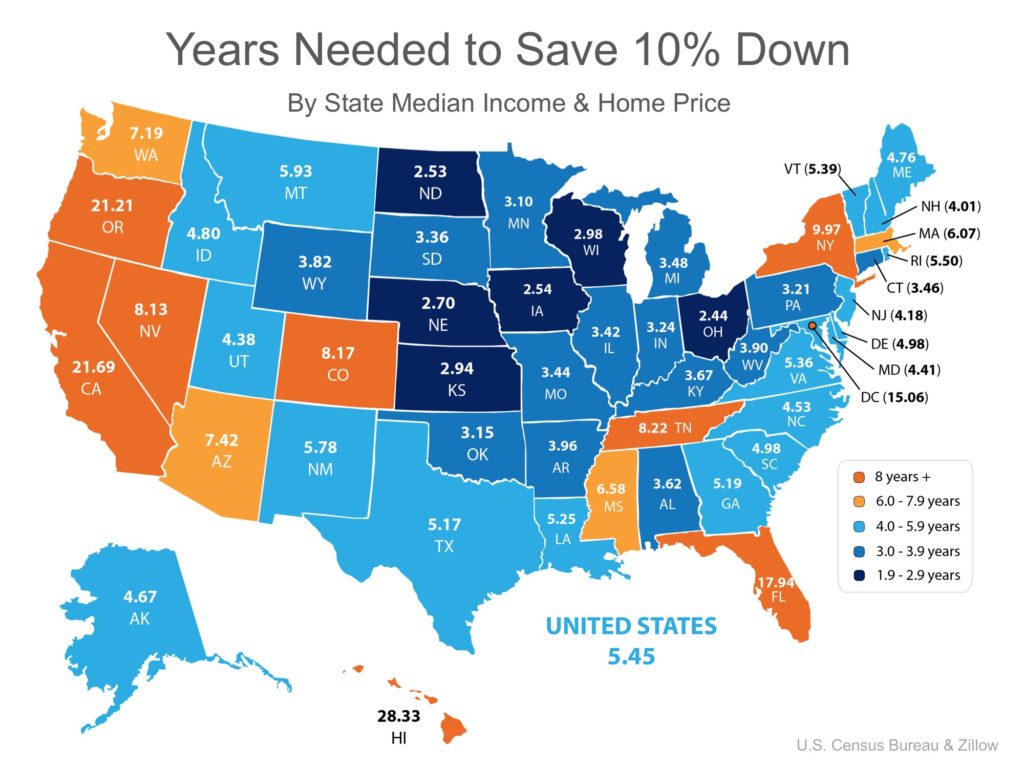

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Ohio can save for a down payment the quickest in just under 3 years (2.44). Below is a map that was created using the data for each state:

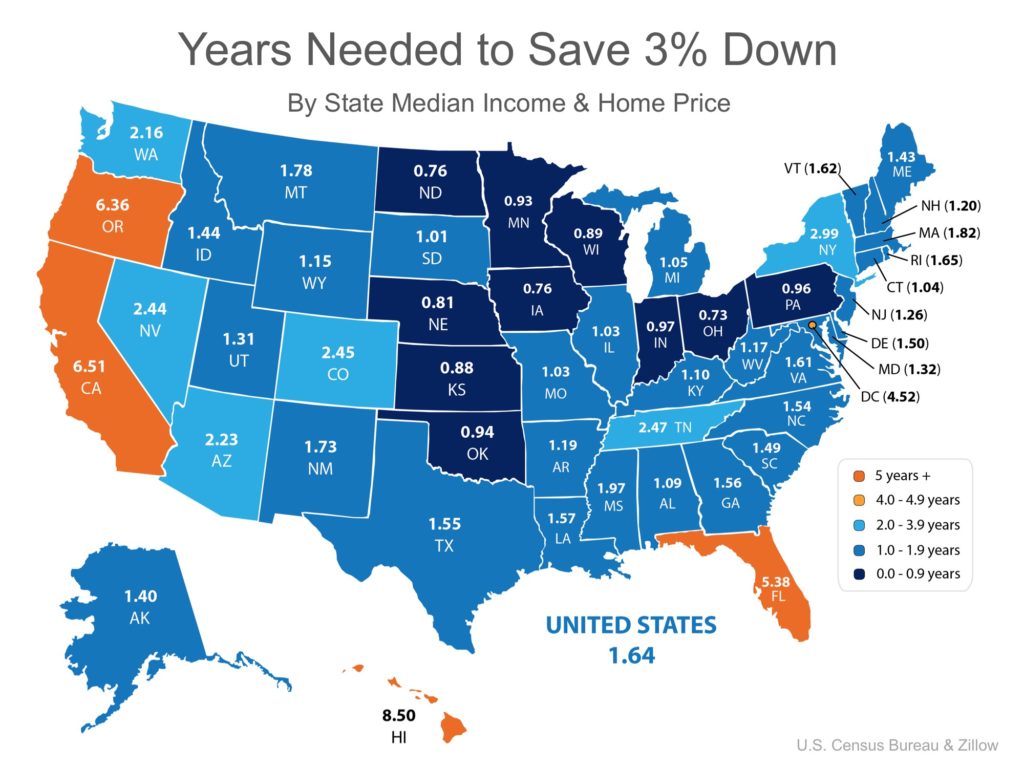

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes possible in a year or two in many states as shown on the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

Posted in Down Payments, First Time Home Buyers, For Buyers

2 Major Myths Holding Back Home Buyers

Jan

30

2018

Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership,” which revealed that “eighty percent of consumers either are unaware of how much lenders require for a down payment or believe all lenders require a down payment above 5 percent.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the down payment funds needed to qualify for a home loan. According to the same report:

“Consumers are often unaware of the option to take out low-down-payment mortgages. Only 19% of consumers believe lenders would make loans with a down payment of 5% or less… While 15% believe lenders require a 20% down payment, and 30% believe lenders expect a 20% down payment.”

These numbers do not differ much between non-owners and homeowners; 39% of non-owners believe they need more than 20% for a down payment and 30% of homeowners believe they need more than 20% for a down payment.

While many believe that they need at least 20% down to buy their dream home, they do not realize that programs are available that allow them to put down as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined with programs that have emerged allowing less cash out of pocket.

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Similar to the down payment, many either don’t know or are misinformed about what FICO® score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As you can see in the chart above, 53.5% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

61% of First-Time Buyers Put Down Less than 6%

Jan

17

2018

According to the National Association of Realtors’ latest Realtors Confidence Index, 61% of first-time homebuyers purchased their homes with down payments below 6% from October 2016 through November 2017.

Many potential homebuyers believe that a 20% down payment is necessary to buy a home and have disqualified themselves without even trying. The median down payment for all buyers in 2017 was just 10% and that percentage drops to 6% for first-time buyers.

Zillow Senior Economist Aaron Terrazas’ recent comments shed light on why buyer demand has remained strong,

“Looking into 2018, rent is expected to continue gaining. More widespread rent growth could mean home buying demands stay high, as renters who can afford it move away from the unpredictability of rising rents toward the relative stability of a monthly mortgage payment instead.”

It’s no surprise that with rents rising, more and more first-time buyers are taking advantage of low-down-payment mortgage options to secure their monthly housing costs and finally attain their dream homes.

Bottom Line

If you are one of the many first-time buyers who is not sure if you would qualify for a low-down payment mortgage, let’s get together and set you on your path to homeownership!

Posted in Down Payments, First Time Home Buyers, For Buyers

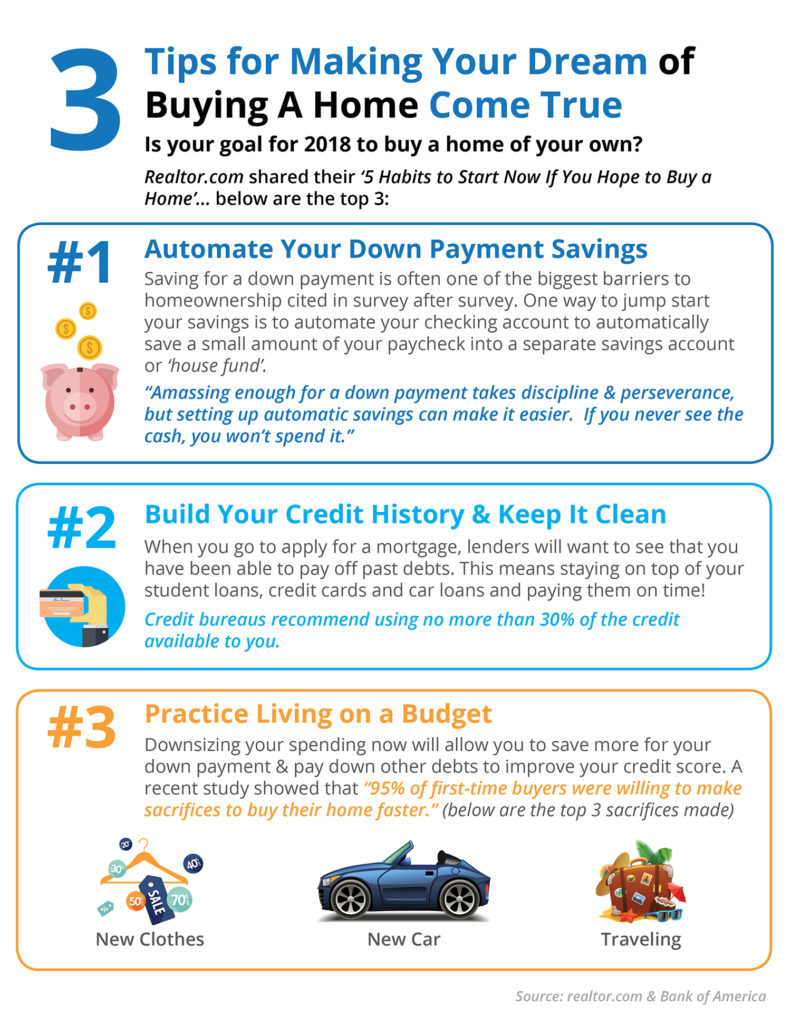

3 Tips for Making Your Dream Home a Reality [INFOGRAPHIC]

Dec

08

2017

![3 Tips for Making Your Dream Home a Reality [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2017/12/06164805/20171208-Share-STM.jpg)

Some Highlights:

- Realtor.com shared their “5 Habits to Start Now If You Hope to Buy a Home.”

- Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking a lot about it.

- Living within a budget will not only help you save money for down payments but will help you pay down other debts that might be holding you back.

Posted in Down Payments, First Time Home Buyers, For Buyers, Infographics

Home Prices Up 7% from Last Year

Dec

06

2017

According to CoreLogic’s latest Home Price Index, national home prices have appreciated by 7.0% from October 2016 to October 2017. This marks the second month in a row with a 7.0% year-over-year increase.

A lack of supply of homes for sale has led to upward pressure on home prices across the country, especially in areas where both existing and new home inventory have not kept up with buyer demand.

CoreLogic’s Chief Economist Frank Nothaft elaborated on the significance of such a large year-over-year gain,

“Single-family residential sales and prices continued to heat up in October. On a year-over-year basis, home prices grew in excess of 6 percent for four consecutive months ending in October, the longest such streak since June 2014.

This escalation in home prices reflects both the acute lack of supply and the strengthening economy.”

This is great news for homeowners who have gained over $13,000 in equity in their home over the last year! Those homeowners who had been on the fence as to whether or not to sell will be pleasantly surprised to find out that they now have an even larger profit to help cover a down payment on their dream home.

CoreLogic’s President & CEO Frank Martell had this to say,

“The acceleration in home prices is good news for both homeowners and the economy because it leads to higher home equity balances that support consumer spending and is a cushion against mortgage risk. However, for entry-level renters and first-time homebuyers, it leads to tougher affordability challenges.”

Any time the price of a home goes up there will likely be concern about the affordability of that home, but there is good news. Mortgage interest rates remain at historic lows, allowing buyers to enter the housing market and lock in a low monthly housing cost.

Rents Are Also Rising

The report went on to mention that over the same 12-month period, median rental prices for a single-family home have also risen by 4.2%.

With rents and home prices rising at the same time, first-time buyers may find the task of saving for a down payment a little daunting. Low down payment programs are available and have been a very popular option for first-time buyers. The median down payment for first-time buyers in 2017 was only 5%!

Bottom Line

If you are looking to enter the housing market, as either a buyer or a seller, let’s get together to go over exactly what’s going on in our neighborhood and discuss your options!

Posted in Down Payments, First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Pricing