If you plan on purchasing your first home this year, let’s get together to determine how much house you can afford. You may be pleasantly surprised.

Category: First Time Home Buyers

Millennials Are Skipping Starter Homes for Their Dream Homes

May

30

2018

A new trend has begun to emerge. With home prices skyrocketing in the starter home category, many first-time homebuyers are skipping the traditional starter homes and moving right into their dream homes.

What’s a Starter Home?

According to the National Association of Realtors (NAR), simply put, a starter home is a one or two-bedroom home (sometimes even a small, three bedroom). “Prices vary widely by market but starters on average cost $150,000 to $250,000 while trade-up and premium homes cost upwards of $300,000.”

Finding Their Forever Homes Now

A recent CNBC article revealed that there are many factors that delayed older millennials (ages 25-35) from buying a home earlier in their lives. The aftereffects of the Great Recession teaming up with larger education costs forced many to either remain living in their parent’s homes or to rent.

With the economy continuing to improve, many millennials have been able to break into better-paying jobs which has helped spur down payment savings. As the dream of homeownership comes closer to reality, many millennials are saving for their forever homes.

According to the latest statistics from NAR, 30% of millennials bought homes for $300,000 or more this year (up from 14% in 2013). Diane Swonk, Chief Economist at Grant Thornton weighed in saying, “They rented for longer. Now they’re going to where they want to stay.”

More and more millennials are settling down, getting married, and starting families, which is a huge factor driving them to look for larger homes.

Increased competition in the starter home market has also been a driving force in waiting to afford their dream homes. Inventory in the starter home market is down 14.2% from last year, according to research from Trulia. This has driven prices up and has led to bidding wars.

Many first-time buyers who were originally looking for starter homes are realizing that for just a little bit more of an investment, they could afford trade-up or premium homes instead.

Bottom Line

Posted in First Time Home Buyers, For Buyers, Millennials

Why Have Interest Rates Jumped to a 7-Year High?

May

23

2018

Interest rates for a 30-year fixed rate mortgage have climbed from 3.95% in the first week of January up to 4.61% last week, which marks a 7-year high according to Freddie Mac. The current pace of acceleration has been fueled by many factors.

Sam Khater, Freddie Mac’s Chief Economist, had this to say:

“Healthy consumer spending and higher commodity prices spooked bond markets and led to higher mortgage rates over the past week.

Not only are buyers facing higher borrowing costs, gas prices are currently at four-year highs just as we enter the important peak home sales season.”

But what do gas prices have to do with interest rates?

Investopedia explains the relationship like this:

“The price of oil and inflation are often seen as being connected in a cause-and-effect relationship. As oil prices move up or down, inflation follows in the same direction.”

You may have noticed that filling your gas tank has become substantially more expensive in recent months. The average national gas price has climbed nearly $0.50 from the beginning of the year, leading to the highest price for Memorial Day weekend since 2014.

As rates go up, your purchasing power goes down, but don’t worry; rates are still well below the averages we’ve seen over the last four decades.

“Freddie Mac said this year’s higher rates have not yet caused much of a ripple in the strong demand levels for buying a home seen in most markets, but inflationary pressures and the prospect of rates approaching 5 percent could begin to hit the psyche of some prospective buyers.”

Buying sooner rather than later will help lock in a lower rate than waiting, as the experts believe rates will continue to climb. Even a small increase in interest rates can have a big impact on your monthly housing cost.

Bottom Line

If you are planning on buying a home this year, keep an eye on gas prices the next time you’re at the pump. If you start to feel a big jump in price, know that rates are probably on their way up, too.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers

How Current Interest Rates Can Have a High Impact on Your Purchasing Power

May

22

2018

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.61%, which is still near record lows in comparison to recent history!

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford to buy will decrease if you plan to stay within a certain monthly housing budget.

The chart below shows the impact that rising interest rates would have if you planned to purchase a home within the national median price range while keeping your principal and interest payments between $1,850-$1,900 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, $10,000). Experts predict that mortgage rates will be closer to 5% by this time next year.

Act now to get the most house for your hard-earned money.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

5 Ways Tax Reform Has Impacted the 2018 Housing Market

May

10

2018

Starting late last year, some predicted that the 2018 tax changes would cripple the housing market. Headlines warned of the potential for double-digit price depreciation and suggested that buyer demand could drop like a rock. There was even sentiment that homeownership could lose its coveted status as a major component of the American Dream.

Now that the first quarter numbers are in, we can begin to decipher the actual that impact tax reform has had on the real estate market.

1. Has tax reform killed off home buyer demand? The answer is “NO.”

According to the Showing Time Index which “tracks the average number of buyer showings on active residential properties on a monthly basis” and is a “highly reliable leading indicator of current and future demand trends,” buyer demand has increased each month over the last three months and is HIGHER than it was for the same months last year. Buyer demand is not down. It is up.

2. Have the tax changes affected America’s belief in real estate as a long-term investment? The answer is “NO.”

Two weeks ago, Gallup released its annual survey which asks Americans which asset they believed to be the best long-term investment. The survey revealed:

“More Americans name real estate over several other vehicles for growing wealth as the best long-term investment for the fifth year in a row. Just over a third cite real estate for this, while roughly a quarter name stocks or mutual funds.”

The survey also showed that the percentage of Americans who believe real estate is the best long-term investment was unchanged from a year ago.

3. Has the homeownership rate been negatively impacted by the tax changes? The answer is “NO.”

Not only did the homeownership rate not crash, it increased when compared to the first quarter of last year according to data released by the Census Bureau.

In her latest “Z Report,” Ivy Zelman explains that tax reform didn’t hurt the homeownership rate, but instead, enhanced it:

“We have been of the opinion that homeownership is most highly correlated with income and the net effect of tax reform would be a positive, rather than negative catalyst for the homeownership rate. While still in the early innings of tax changes, this has proven to be the case.”

4. Has the upper-end market been crushed by new State and Local Taxes (SALT) limitations? The answer is “NO.”

In the National Association of Realtors latest Existing Home Sales Report it was revealed that:

- Sales between $500,000 and $750,000 were up 4.5% year-over-year

- Sales between $750,000 and $1M were up 15.1% year-over-year

- Sales over $1M were up 17.3% year-over-year

5. Will the reforms in the tax code cause home prices to tumble over the next twelve months? The answer is “NO.”

According to CoreLogic’s latest Home Price Insights Report, home prices will appreciate in each of the 50 states over the next twelve months. Appreciation is projected to be anywhere from 1.9% to 10.3% with the national average being 4.7%.

Bottom Line

The doomsday scenarios that some predicted based on tax reform fears seem to have already blown over based on the early housing industry numbers being reported.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

How Much Has Your Home Increased in Value Over the Last Year?

May

01

2018

Home values have risen dramatically over the last twelve months. In CoreLogic’s most recent Home Price Index Report, they revealed that national home prices have increased by 6.7% year-over-year.

CoreLogic broke down appreciation even further into four price ranges, giving us a more detailed view than if we had simply looked at the year-over-year increases in national median home price.

The chart below shows the four price ranges from the report, as well as each one’s year-over-year growth from February 2017 to February 2018 (the latest data available).

It is important to pay attention to how prices are changing in your local market. The location of your home is not the only factor that determines how much your home has appreciated over the course of the last year.

Lower-priced homes have appreciated at greater rates than homes at the upper ends of the spectrum due to demand from first-time home buyers and baby boomers looking to downsize.

Bottom Line

If you are planning to list your home for sale in today’s market, let’s get together to go over exactly what’s going on in your area and your price range.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Freddie Mac: Rising Mortgage Rates DO NOT Lead to Falling Home Prices

Mar

22

2018

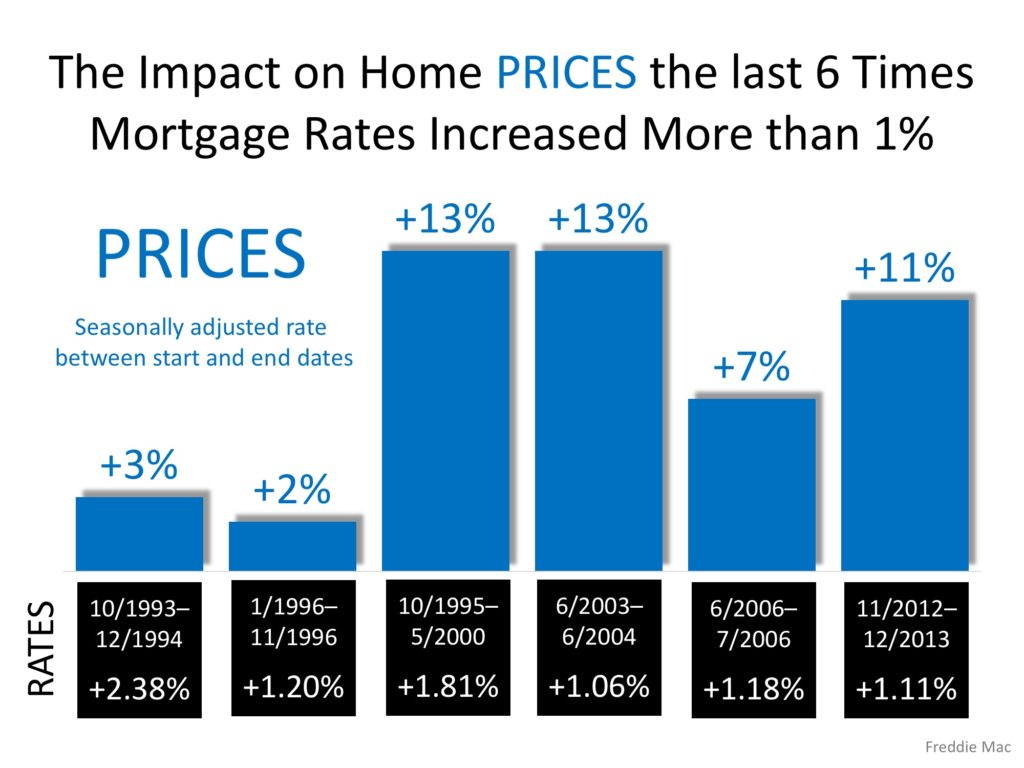

Recently, Freddie Mac published an Insight Report titled Nowhere to go but up? How increasing mortgage rates could affect housing. The report focused on the impact the projected rise in mortgage rates might have on the housing market this year.

Many believe that an increase in mortgage rates will cause a slowdown in purchases which would, in turn, lead to a fall in house values. Ultimately, however, prices are determined by supply and demand and while rising mortgage rates may slow demand, they also affect supply. From the report:

“For current homeowners, the decision to buy a new home is typically linked to their decision to sell their current home… Because of this link, the financing costs of the existing mortgage are part of the homeowner’s decision of whether and when to move.

Once financing costs for a new mortgage rise above the rate borrowers are paying for their current mortgage, borrowers would have to give up below-market financing to sell their home.

Instead, they may choose to delay both the sale of their existing home and the purchase of a new home to maintain the advantageous financing.”

The Freddie Mac report, in acknowledging this situation, concluded that prices are not adversely impacted by higher mortgage rates. They explained:

“While there is a drop in the demand for homes, there is an associated drop in the supply of homes from the link between the selling and buying decisions. As both supply and demand move together in this way they have offsetting effects on price—lower demand decreases price and lower supply increases price.

They went on to reveal that the Freddie Mac National House Price Index is…

“…unresponsive to movements in interest rates. In the current housing market, the driving force behind the increase in prices is a low supply of both new and existing homes combined with historically low rates. As mortgage rates increase, the demand for home purchases will likely remain strong relative to the constrained supply and continue to put upward pressure on home prices.”

The following graph, based on data from the report, reveals what happened to home prices the last six times mortgage rates rose by at least 1%.

Bottom Line

Whether you are a move-up buyer or first-time buyer, waiting to purchase your next home based on the belief that prices will fall because of rising mortgage rates makes no sense.

Posted in Buying Myths, First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers, Pricing

Dreaming of a Luxury Home? Now’s the Time!

Mar

19

2018

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! Recently, the Institute for Luxury Home Marketing released its Luxury Market Report which showed that in today’s premium home market, buyers are in control.

The inventory of homes for sale in the luxury market far exceeds the number of people searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer or can be found at a discount.

Those who have a starter or trade-up home to sell will find buyers competing, and often entering bidding wars, to be able to call their house their new home.

The sale of your starter or trade-up house will help you come up with a larger down payment for your new luxury home. Even a 5% down payment on a million-dollar home is $50,000.

But not all who are buying luxury properties have a home to sell first.

A recent Bloomberg article gave some insight into what many millennials are choosing to do:

“A new generation of affluent homebuyers powered by a surge in inherited wealth is driving the luxury-home market, demanding larger spaces and fancier finishes, according to a report heralding ‘the rise of the new aristocracy.’”

Bottom Line

The best time to sell anything is when demand is high, and supply is low. If you are currently in a starter or trade-up house that no longer fits your needs and you are looking to step into a luxury home, now’s the time to list your house for sale and make your dreams come true.

Posted in First Time Home Buyers, For Buyers, Luxury Market, Millennials, Move-Up Buyers

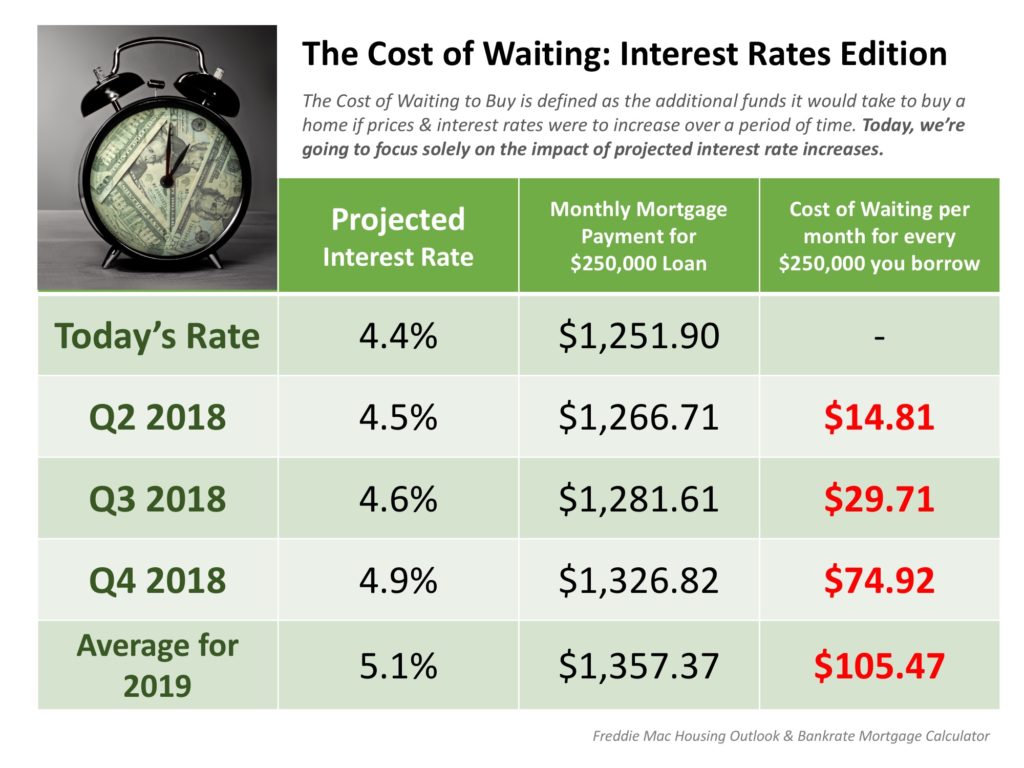

The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC]

Mar

16

2018

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/03/09132142/20180316-Share-STM.jpg)

Some Highlights:

- Interest rates are projected to increase steadily heading into 2019.

- The higher your interest rate, the more money you end up paying for your home and the higher your monthly payment will be.

- Rates are still low right now. Don’t wait until rates hit 5% to start searching for your dream home!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Move-Up Buyers

You Can Save for a Down Payment Faster Than You Think!

Mar

13

2018

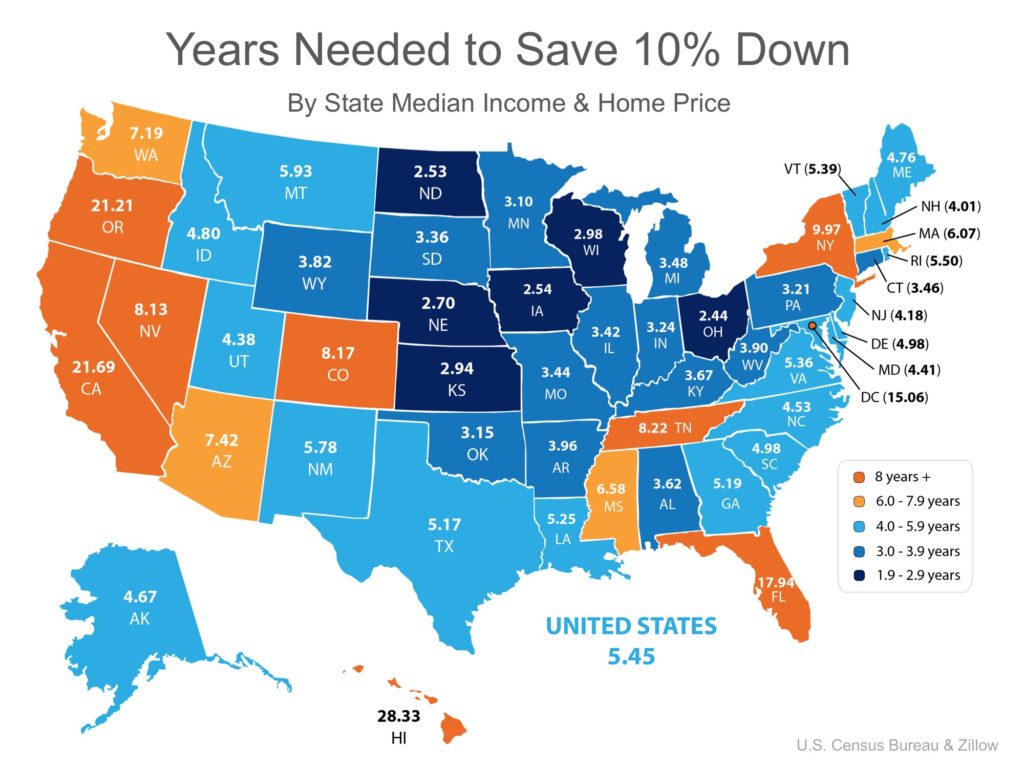

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Ohio can save for a down payment the quickest in just under 3 years (2.44). Below is a map that was created using the data for each state:

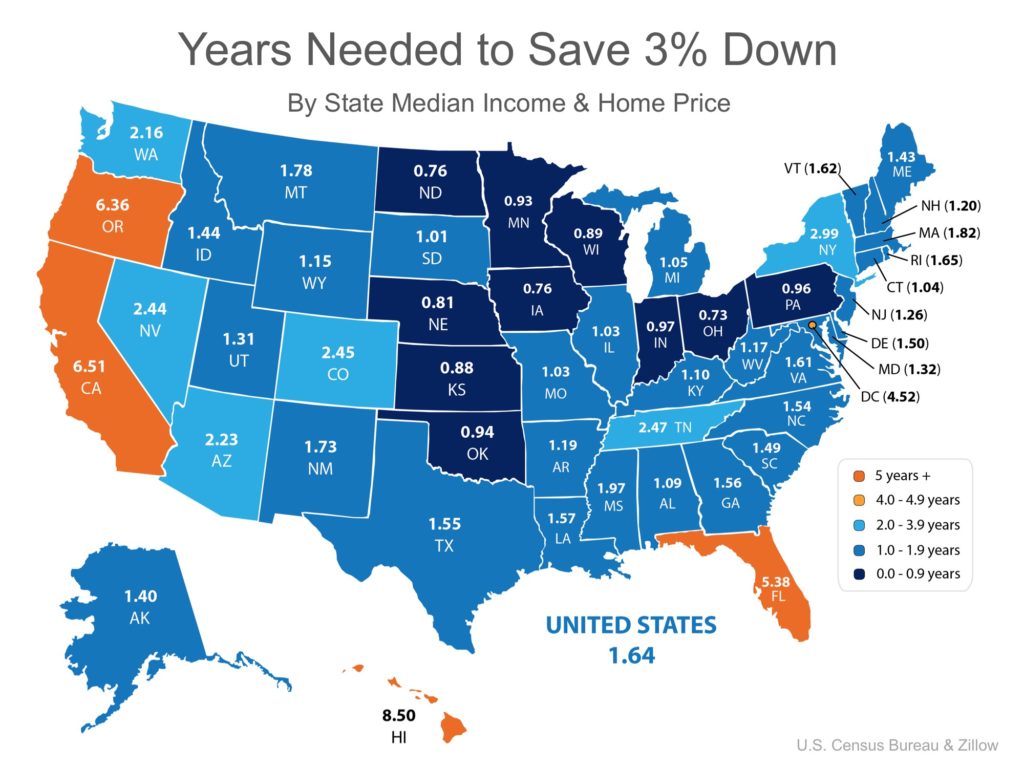

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes possible in a year or two in many states as shown on the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

Posted in Down Payments, First Time Home Buyers, For Buyers

4 Reasons Spring is a Great Time to Buy a Home!

Mar

12

2018

Here are four great reasons to consider buying a home today instead of waiting.

Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.6% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.3% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage hovered close to 4.0% in 2017. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison, projecting that rates will increase by nearly a full percentage point by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

Either Way, You Are Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers