Category: First Time Home Buyers

Millionaire to Millennials: Don’t Rent a Home… Buy!

Feb

06

2018

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”

Then he explains the secret in order to buy that home!

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”

What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.

He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

Feb

05

2018

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers, Rent vs. Buy

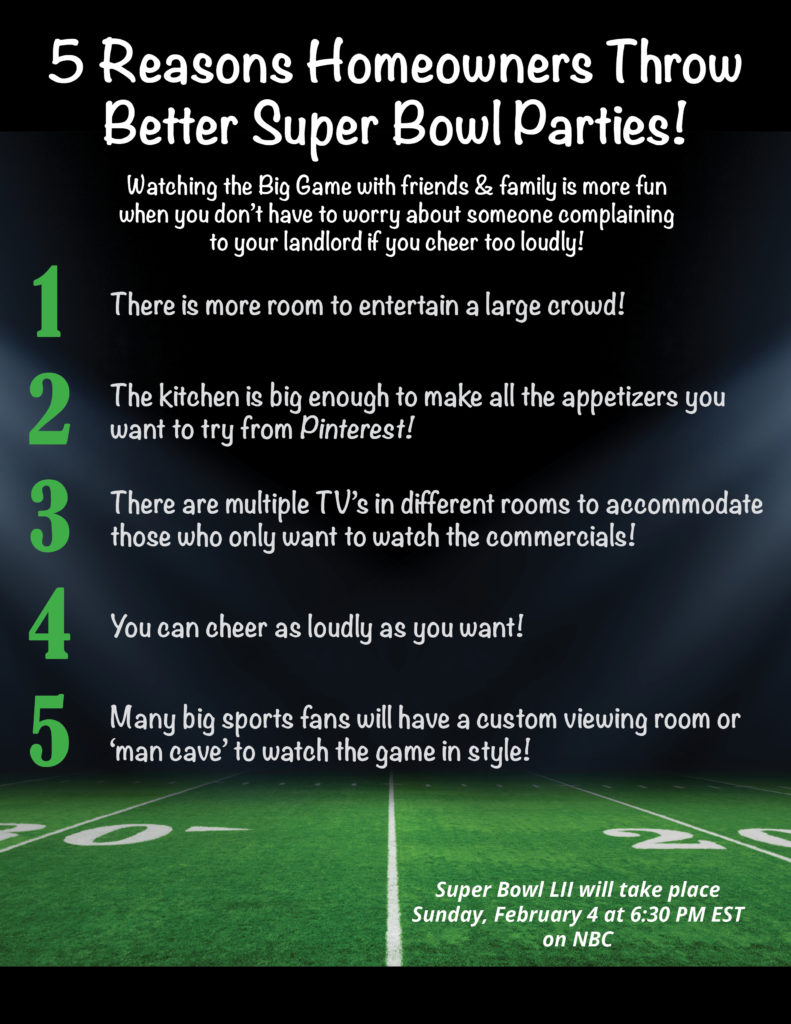

5 Reasons Homeowners Can Throw Better Super Bowl Parties! [INFOGRAPHIC]

Feb

02

2018

![5 Reasons Homeowners Can Throw Better Super Bowl Parties! [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/25125455/20180202-Share-STM.jpg)

Highlights:

- Watching the big game at home with your friends & family offers many advantages.

- There’s more room to entertain a large crowd and you don’t have to worry about complaints to your landlord if you cheer too loudly!

- The kitchen is big enough to make as many appetizers as you want, and if some of your guests are only there to watch the commercials, they can do so on a different TV in another room!

Posted in First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

Study Shows “Millennials Deserve More Credit”

Jan

31

2018

When it comes to talking about millennials, there are many stereotypes out there that have influenced the way the public feels about the generation. Whether it’s the assumption that millennials are irresponsible with money and would rather buy avocado toast than save for a down payment, or that millennials jump from job to job, the majority of these stereotypes paint the generation in a negative light.

A new study by Bank of America entitled Better Money Habits Millennial Report recently came to the defense of the generation when it reported that:

“Millennials deserve more credit – both from themselves and from others – for their mindfulness when it comes to money and their lives.”

Here are some key takeaways from the study proving that millennials deserve more credit for what they are already doing:

- 63% are saving – (47% have $15,000 or more in savings)

- 54% are budgeting – (73% who have a budget stick to it every month)

- 57% have a savings goal – (67% who have a goal stick to it every month)

- 46% have asked for a raise in the past 2 years – (80% who asked for a raise got one)

- 59% feel financially secure – (16% have $100,000 or more in savings)

Many have wondered if millennials even want to own their own homes or if they would choose to rent instead. Well, not only do they want to own their own homes, but many already do and are looking to trade up! A recent study by realtor.com shows that 49% of Americans who plan to sell their home in the next 12 months are millennials!

Danielle Hale, realtor.com’s Chief Economist, gave some insight into why millennials are looking to sell,

“The housing shortage forced many first-time homebuyers to consider smaller homes and condos as a way to literally get their foot in the door. Our survey data reveals that we may see more of these homes hitting the market in the next year.”

Bottom Line

Not every millennial fits into the stereotypes that are so prominent in our society. Those who have risen above the stereotype are ready and willing to buy a home of their own, and many others already have!

Posted in First Time Home Buyers, For Buyers, For Sellers, Millennials, Move-Up Buyers

2 Major Myths Holding Back Home Buyers

Jan

30

2018

Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership,” which revealed that “eighty percent of consumers either are unaware of how much lenders require for a down payment or believe all lenders require a down payment above 5 percent.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the down payment funds needed to qualify for a home loan. According to the same report:

“Consumers are often unaware of the option to take out low-down-payment mortgages. Only 19% of consumers believe lenders would make loans with a down payment of 5% or less… While 15% believe lenders require a 20% down payment, and 30% believe lenders expect a 20% down payment.”

These numbers do not differ much between non-owners and homeowners; 39% of non-owners believe they need more than 20% for a down payment and 30% of homeowners believe they need more than 20% for a down payment.

While many believe that they need at least 20% down to buy their dream home, they do not realize that programs are available that allow them to put down as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined with programs that have emerged allowing less cash out of pocket.

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Similar to the down payment, many either don’t know or are misinformed about what FICO® score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As you can see in the chart above, 53.5% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

5 Reasons Millennials Choose to Buy [INFOGRAPHIC]

Jan

26

2018

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day when they will be able to paint the walls whatever color they’d like, or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials

Why You Need a Professional on Your Team When Buying a Home

Jan

23

2018

Many people wonder whether they should hire a real estate professional to assist them in buying their dream homes or if they should first try to go through the buying process on their own. In today’s market: you need an experienced professional!

You Need an Expert Guide If You Are Traveling a Dangerous Path

The field of real estate is loaded with landmines; you need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and is ready for you to move into can be tricky. An agent listens to your wants and needs, and can sift through the homes that do not fit within the parameters of your “dream home.”

A great agent will also have relationships with mortgage professionals and other experts that you will need in order to secure your dream home.

You Need a Skilled Negotiator

In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands, of dollars. Each step of the way – from the original offer to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

Realize that when an agent is negotiating his or her commission with you, they are negotiating their own salary; the salary that keeps a roof over their family’s head; the salary that puts food on their family’s table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family?

If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal.

Bottom Line

Famous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money…not cost you money.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Buying A Home Is More Affordable Than Renting In 54% Of US Counties

Jan

22

2018

According to ATTOM Data Solutions’ 2018 Rental Affordability Report, “buying a median-priced home is more affordable than renting a three-bedroom property in 240 of 447 [or 54% of] U.S. counties analyzed for the report.”

For the report, ATTOM Data Solutions compared recently released fair market rent data from the Department of Housing and Urban Development with reported income amounts from the Department of Labor and Statistics to determine the percentage of income that a family would have to spend on their monthly housing cost (rent or mortgage payments).

Daren Blomquist, Senior Vice President of ATTOM Data Solutions had this to say:

“Although buying is still more affordable than renting in the majority of U.S. housing markets, the majority is shrinking as home price appreciation continues to outpace rental growth in most areas.”

However, the report also shows that the average fair market rent rose faster than average weekly wages in 60% of the counties analyzed in the report (266 of 447 counties). With rents rising, many renters should consider buying a home soon.

Bottom Line

Rents will continue to rise, and mortgage interest rates are still at historic lows. Before you sign or renew your next lease, let’s get together to help you determine if you are able to buy a home of your own and lock in your monthly housing expense.

Posted in First Time Home Buyers, For Buyers, Rent vs. Buy

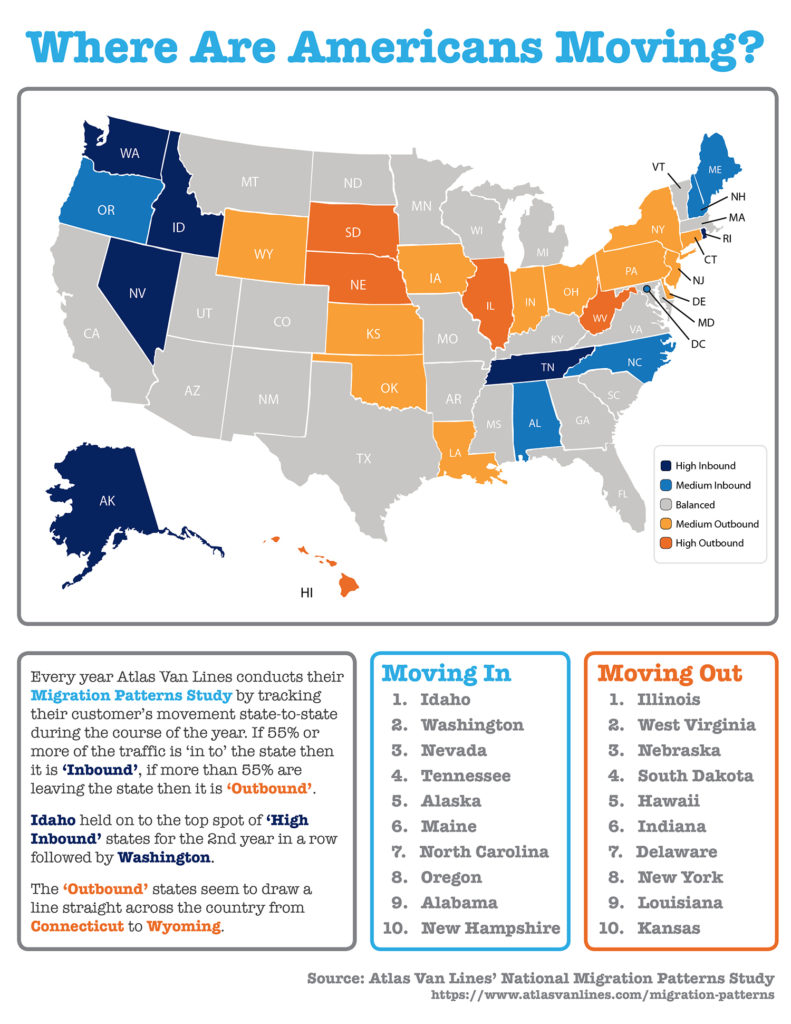

Where Did Americans Move in 2017? [INFOGRAPHIC]

Jan

19

2018

![Where Did Americans Move in 2017? [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/09171302/20180119-STM-Share.jpg)

Some Highlights:

- Atlas Van Lines recently released the results of their annual Migration Patterns Survey in which they tracked their customer’s movement from state-to-state over the course of 2017.

- Idaho held on to the top spot of ‘high inbound’ states for the 2nd year in a row followed by Washington.

- The ‘outbound’ states seem to draw a line straight across the country from Connecticut to Wyoming.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

What Impact Will the New Tax Code Have on Home Values?

Jan

18

2018

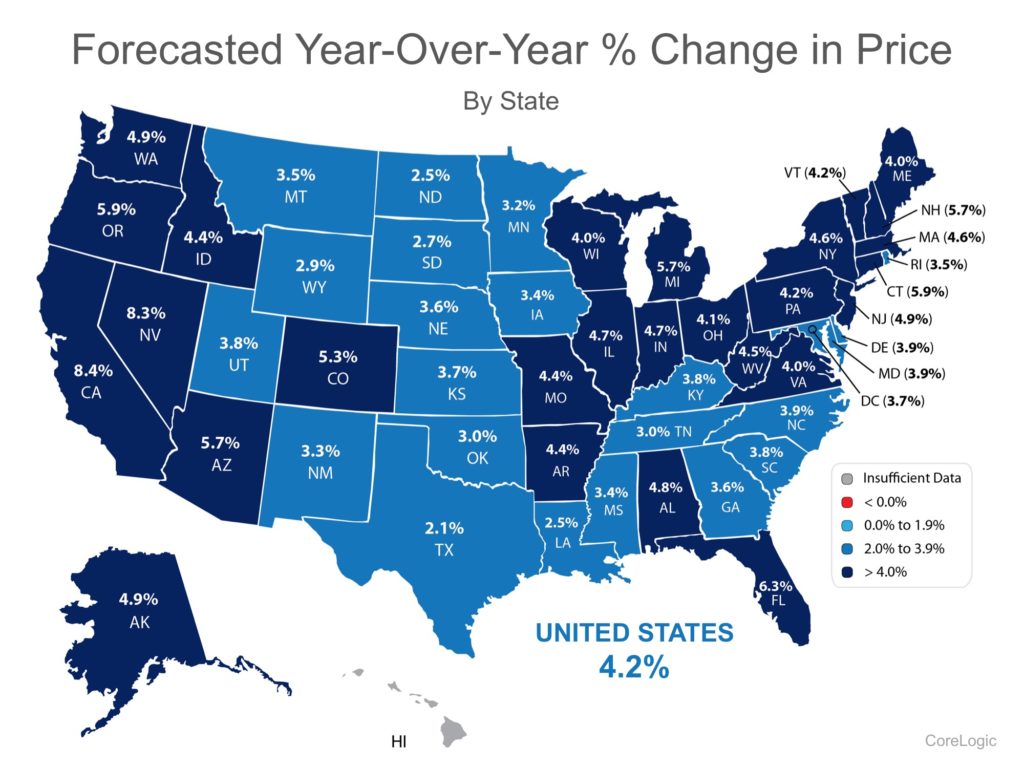

Every month, CoreLogic releases its Home Price Insights Report. In that report, they forecast where they believe residential real estate prices will be in twelve months.

Below is a map, broken down by state, reflecting how home values are forecasted to change by the end of 2018 using data from the most recent report.

As we can see, CoreLogic projects an increase in home values in 49 of 50 states, and Washington, DC (there was insufficient data for HI). Nationwide, they see home prices increasing by 4.2%.

How might the new tax code impact these numbers?

Recently, the National Association of Realtors (NAR) conducted their own analysis to determine the impact the new tax code may have on home values. NAR’s analysis:

“…estimated how home prices will change in the upcoming year for each state, considering the impact of the new tax law and the momentum of jobs and housing inventory.”

Here is a map based on NAR’s analysis:

Bottom Line

According to NAR, the new tax code will have an impact on home values across the country. However, the effect will be much less significant than what some originally thought.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, Pricing