Category: For Buyers

A Housing Bubble? Industry Experts Say NO!

Nov

09

2017

With residential home prices continuing to appreciate at levels above historic norms, some are questioning if we are heading toward another housing bubble (and subsequent burst) like the one we experienced in 2006-2008.

Recently, five housing experts weighed in on the question.

Rick Sharga, Executive VP at Ten-X:

“We’re definitely not in a bubble.”

“We have a handful of markets that are frothy and probably have hit an affordability wall of sorts but…while prices nominally have surpassed the 2006 peak, we’re not talking about 2006 dollars.”

Christopher Thornberg, Partner at Beacon Economics:

“There is no direct or indirect sign of any kind of bubble.”

“Steady as she goes. Prices continue to rise. Sales roughly flat.…Overall this market is in an almost boring place.”

Bill McBride, Calculated Risk:

“I wouldn’t call house prices a bubble.”

“So prices may be a little overvalued, but there is little speculation and I don’t expect house prices to decline nationally like during the bust.”

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices:

“Housing is not repeating the bubble period of 2000-2006.”

“…price increases vary unlike the earlier period when rising prices were almost universal; the number of homes sold annually is 20% less today than in the earlier period and the months’ supply is declining, not surging.”

Bing Bai & Edward Golding, Urban Institute:

“We are not in a bubble and nowhere near the situation preceding the 2008 housing crisis.”

“Despite recent increases, house prices remain affordable by historical standards, suggesting that home prices are tracking a broader economic expansion.”

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, Pricing

5 Reasons Homeownership Makes ‘Cents’

Nov

08

2017

The American Dream of homeownership is alive and well. Recent reports show that the US homeownership rate has rebounded from recent lows and is headed in the right direction. The personal reasons to own differ for each buyer, but there are many basic similarities.

Today we want to talk about the top 5 financial reasons you should own your own home.

- Homeownership is a form of forced savings – Paying your mortgage each month allows you to build equity in your home that you can tap into later in life for renovations, to pay off high-interest credit card debt, or even send a child to college. As a renter, you guarantee that your landlord is the person with that equity.

- Homeownership provides tax savings – One way to save on taxes is to own your own home. You may be able to deduct your mortgage interest, property taxes, and profits from selling your home, but make sure to always check with your accountant first to find out which tax advantages apply to you in your area.

- Homeownership allows you to lock in your monthly housing cost – When you purchase your home with a fixed-rate mortgage, you lock in your monthly housing cost for the next 5, 15, or 30 years. Interest rates have remained around 4% all year, marking some of the lowest rates in history. The value of your home will continue to rise with inflation, but your monthly costs will not.

- Buying a home is cheaper than renting – According to the latest report from Trulia, it is now 37.4% less expensive to buy a home of your own than to rent in the US. That number varies throughout the country but ranges from 6% cheaper in San Jose, CA to 57% cheaper in Detroit, MI.

- No other investment lets you live inside of it – You can choose to invest your money in gold or the stock market, but you will still need somewhere to live. In a home that you own, you can wake up every morning knowing that your investment is gaining value while providing you a safe place to live.

Bottom Line

Before you sign another lease, let’s get together to help you better understand all your options.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Rent vs. Buy

Multigenerational Households May Be the Answer to Price Increases

Nov

07

2017

Multigenerational homes are coming back in a big way! In the 1950s, about 21%, or 32.2 million Americans shared a roof with their grown children or parents. According to an article by Realtor.com, “Nearly 1 in 5 Americans is now living in a multigenerational household – a household with two or more adult generations, or grandparents living with grandchildren – a level that hasn’t been seen in the U.S. since 1950.”

Another report that proves this point is the National Association of Realtors’ (NAR) 2017 Profile of Home Buyers and Sellers which states that 13% of home buyers purchased multigenerational homes last year. The top 3 reasons for purchasing this type of home were:

- To take care of aging parents (22%, up from 19% last year)

- Cost savings (17%)

- Children over the age of 18 moving back home (16%, up from 14% last year)

Valerie Sheets, Spokesperson for Lennar, points out that,

“Everyone is looking for the perfect home for any number of family situations, such as families who opt to take care of aging parents or grandparents at home, or millennials looking to live with their parents while they attend school or save for a down payment.”

For a long time, nuclear families (a couple and their dependent children) became the accepted norm, but John Graham, co-author of “Together Again: A Creative Guide to Successful Multigenerational Living,” says, “We’re getting back to the way human beings have always lived in – extended families.”

This shift can be attributed to several social changes over the decades. Growing racial and ethnic diversity in the U.S. population helps explain some of the rise in multigenerational living; “Data suggest that multigenerational living is more prevalent among Asian (28%), Hispanic (25%), and African-American (25%) families, while U.S. whites have fewer multigenerational homes (15%).”

Additionally, women are a bit more likely to live in multigenerational conditions than are their male counterparts (12% vs. 10%, respectively). Last but not least, basic economics.

Valerie Sheets brings to light the fact that home prices have been skyrocketing in recent years. She says that, “As home prices increase, more families tend to opt for living together.”

Bottom Line

Multigenerational households are making a comeback. While it is a shift from the more common nuclear home, these households might be the answer that many families are looking for as home prices continue to rise in response to a lack of housing inventory.

Posted in For Buyers, For Sellers, Move-Up Buyers, Pricing

Low Inventory Causes Home Prices to Maintain Fast Growth

Nov

06

2017

The National Association of Realtors (NAR) released their latest Quarterly Metro Home Price Report last week. The report revealed that severely lacking inventory across the country drained sales growth and kept home prices rising at a steady clip in nearly all metro areas. Home prices rose 5.3% over the last quarter across all metros.

Lawrence Yun, Chief Economist at NAR, discussed the impact of low inventory on buyers in the report:

“Unfortunately, the pace of new listings were unable to replace what was quickly sold. Home shoppers had little to choose from, and many had to outbid others in order to close on a home. The end result was a slowdown in sales from earlier in the year, steadfast price growth and weakening affordability conditions.”

What this means to sellers

Rising prices are a homeowner’s best friend. As reported by the Washington Post in a recent article post:

“The rise in median sales prices has made current homeowners much more willing to sell their home, and that willingness is one of the main drivers behind the inventory that does make it on to the market. While it hasn’t been enough to meet demand, it has made the situation much better, compared with even three or four years ago.”

What this means to buyers

In a market where prices are rising, buyers should take into account the cost of waiting. Obviously, they will pay more for the same house later this year or next year. However, as Construction Dive reported, the amount of cash needed to purchase that home will also increase.

“These factors have created a situation where the market keeps moving the goalposts in terms of the down payment necessary for first-time homebuyers to get into a home.”

Bottom Line

If you’re thinking of selling and moving down, waiting might make sense. If you are a first-time buyer or a seller thinking of moving up, waiting probably doesn’t make sense.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Pricing

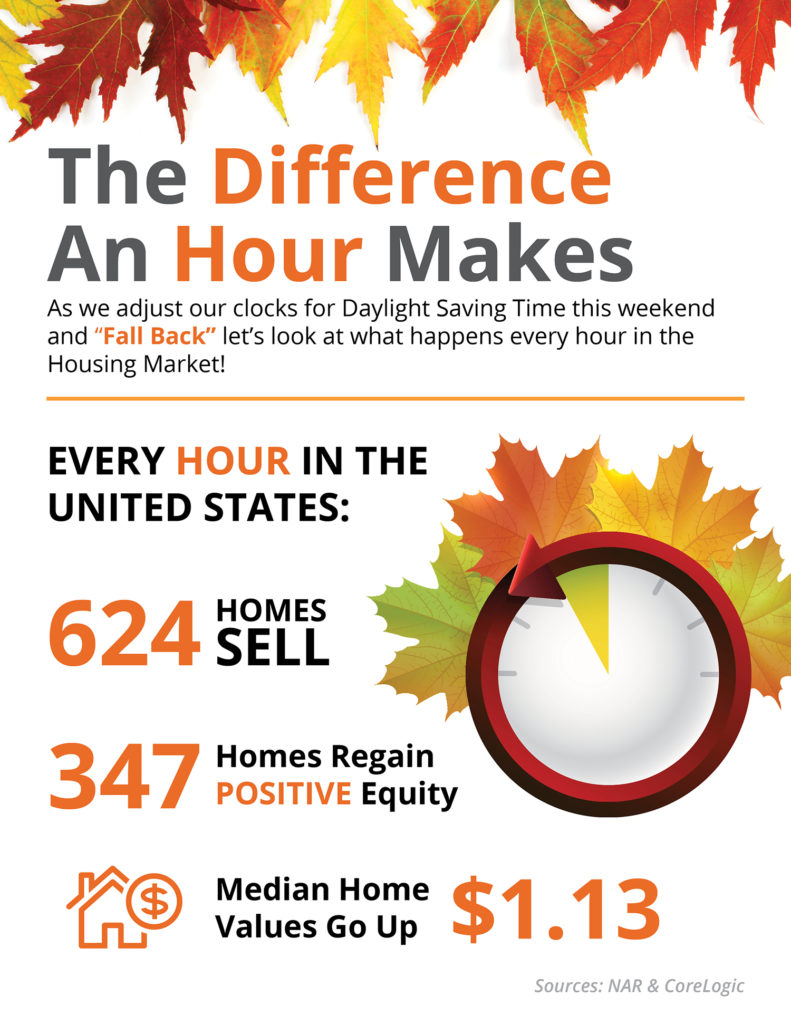

The Difference an Hour Makes in Real Estate [INFOGRAPHIC]

Nov

03

2017

Every Hour in the US Housing Market:

- 624 Homes Sell

- 347 Homes Regain Positive Equity

- Median Home Values Go Up $1.13

Posted in For Buyers, For Sellers, Infographics

Thinking About Buying? Know Your Credit Score

Nov

01

2017

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

- Make payments, including rent, credit cards, and car loans, on time.

- Keep your spending to no more than 30% of your limit on credit cards.

- Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

- Check for errors on your credit report and work toward fixing them.

- Shop for mortgage rates within a 30-day period — too many spread-out inquiries can lower your score.

- Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Don’t Let Fear Stop You from Applying for a Mortgage

Oct

31

2017

A considerable number of potential buyers shy away from jumping into the real estate market due to their uncertainty about the buying process. A specific cause for concern tends to be mortgage qualification.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need to have saved for a down payment (73% of all buyers made a down payment of less than 20%, with many buyers putting down 3% or less), a stable income and good credit history.

Throughout the entire home buying process, you will interact with many different professionals, all of whom perform necessary roles. These professionals are also valuable resources for you.

Once you’re ready to apply, here are 5 easy steps that Freddie Mac suggests you follow:

- Find out your current credit history & score – even if you don’t have perfect credit, you may already qualify for a loan. The average FICO® Score of all closed loans in September was 724, according to Ellie Mae.

- Start gathering all your documentation – income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional – your real estate agent will be able to recommend a loan officer that can help you develop a spending plan, as well as determine how much home you can afford.

- Consult with your lender – he or she will review your income, expenses, and financial goals to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval – a pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change), and demonstrates to home sellers that you are serious about buying!

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure that you are ready to take on the financial responsibilities of becoming a homeowner.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Renting or Buying…Either Way, You’re Paying Someone’s Mortgage

Oct

30

2017

There are some people who have not purchased homes yet because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich,”

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person with that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 3.94% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers, Rent vs. Buy

Buying a Home Can Be Scary… Unless You Know the Facts [INFOGRAPHIC]

Oct

27

2017

Some Highlights:

Many potential homebuyers believe that they need a 20% down payment and a 780 FICO® score to qualify to buy a home, which stops many of them from even trying! Here are some facts:

- 40% of millennials who purchased homes this year have put down less than 10%.

- 76.4% of loan applications were approved last month.

- The average credit score of approved loans was 724 in September.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Infographics, Millennials

How to Save on a Mortgage Payment Whether Buying or Selling

Oct

26

2017

In Trulia’s recent report, Rent vs. Buy: Roommate Edition, they examined the impact that renting with a roommate has in determining whether it is more expensive to rent or buy. The study explains:

“Since we started keeping track in 2012, it’s been a better deal to buy than rent in America’s largest housing markets – and for much of that time it hasn’t been close.”

It then goes on to ask the question:

“But does the equation change for renters who share their rent with a roommate?”

The report reveals:

“While the standard rent vs. buy analysis reveals buying is cheaper than renting in all of the nation’s 100 largest metros, this doesn’t hold true for those choosing between renting with a roommate and buying a starter home.”

It seems obvious that sharing the cost of renting your living space by taking in a roommate dramatically decreases your housing expense (which is exactly what the report concluded), but it got us thinking.

What if you purchased a home and took in that same roommate?

The savings you would gain by adding a roommate would also occur if you purchased a home. This presents an opportunity for a list of possible purchasers. Here are two examples:

- The first-time buyer: As the report explains, many young adults already live with a roommate. If they purchased a new home, perhaps that roommate (or someone else) would be willing to rent a room in their new house. The rent could help offset the mortgage payment.

- The empty-nester seller looking to move: Their home may no longer fit their current lifestyle. They may now be looking for something a little smaller with all the bedrooms on the ground level. These families may be able to open a bedroom to an older family member (parents, aunts & uncles, etc.). This would kill two birds with one stone.

A smaller, move-down home is almost impossible to find in the current housing market. If the seller-turned-buyer takes on a tenant, they could buy a more expensive home knowing that the additional monies needed to pay the mortgage would be offset with the additional monies they receive in rent. Secondly, the older couple (ex. parents) could get a housing option that probably far surpasses anything else available to them in the current market.

Bottom Line

Considering the concept of renting a portion of your house to be able to purchase the perfect home may make sense to many families. You will need to decide if it is right for you.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Rent vs. Buy