Category: For Buyers

Do You Know How Much Equity You Have in Your Home?

Jun

20

2017

CoreLogic’s latest Equity Report revealed that 91,000 properties regained equity in the first quarter of 2017. This is great news for the country, as 48.2 million of all mortgaged properties are now in a positive equity situation.

Price Appreciation = Good News for Homeowners

Frank Nothaft, CoreLogic’s Chief Economist, explains:

“One million borrowers achieved positive equity over the last year, which means risk continues to steadily decline as a result of increasing home prices.”

Frank Martell, President and CEO of CoreLogic, believes this is a great sign for the market in 2017 as well, as he had this to say:

“Homeowner equity increased by $766 billion over the last year, the largest increase since Q2 2014. The rising cushion of home equity is one of the main drivers of improved mortgage performance. Since home equity is the largest source of homeowner wealth, the increase in home equity also supports consumer balance sheets, spending and the broader economy.”

This is great news for homeowners! But, do they realize that their equity position has changed?

According to the Fannie Mae’s Home Purchase Sentiment Index (HPSI), more homeowners are beginning to realize that they may have more equity than they first thought.

“This is only the second time in the survey’s history that the net share of those saying it’s a good time to sell surpassed the net share of those saying it’s a good time to buy.”

78.8% of homeowners have significant equity (more than 20%) in their homes today!

This means that many Americans with a mortgage have an opportunity to take advantage of today’s seller’s market. With a sizeable equity position, many homeowners could easily move into a housing situation that better meets their current needs (moving to a larger home or downsizing).

Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae spoke out on this issue:

“High home prices have led many consumers to give us the first clear indication we’ve seen in the National Housing Survey’s seven-year history that they think it’s now a seller’s market. However, we continue to see a lack of housing supply as many potential sellers are unwilling or unable to put their homes on the market…”

Bottom Line

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2017! Let’s get together to evaluate your situation!

Posted in For Buyers, For Sellers, Move-Up Buyers

Buying Is Now 33.1% Cheaper Than Renting in the US

Jun

19

2017

The results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers actually show that the range is an average of 3.5% less expensive in San Jose (CA), all the way up to 50.1% less expensive in Baton Rouge (LA), and 33.1% nationwide!

Other interesting findings in the report include:

- Interest rates have remained low and, even though home prices have appreciated around the country, they haven’t greatly outpaced rental appreciation.

- With rents & home values moving in tandem, shifts in the ‘rent vs. buy’ decision are largely driven by changes in mortgage interest rates.

- Nationally, rates would have to reach 9.1%, a 128% increase over today’s average of 4.0%, for renting to be cheaper than buying. Rates haven’t been that high since January of 1995, according to Freddie Mac.

Bottom Line

Buying a home makes sense socially and financially. If you are one of the many renters out there who would like to evaluate your ability to buy this year, let’s get together to find your dream home.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates

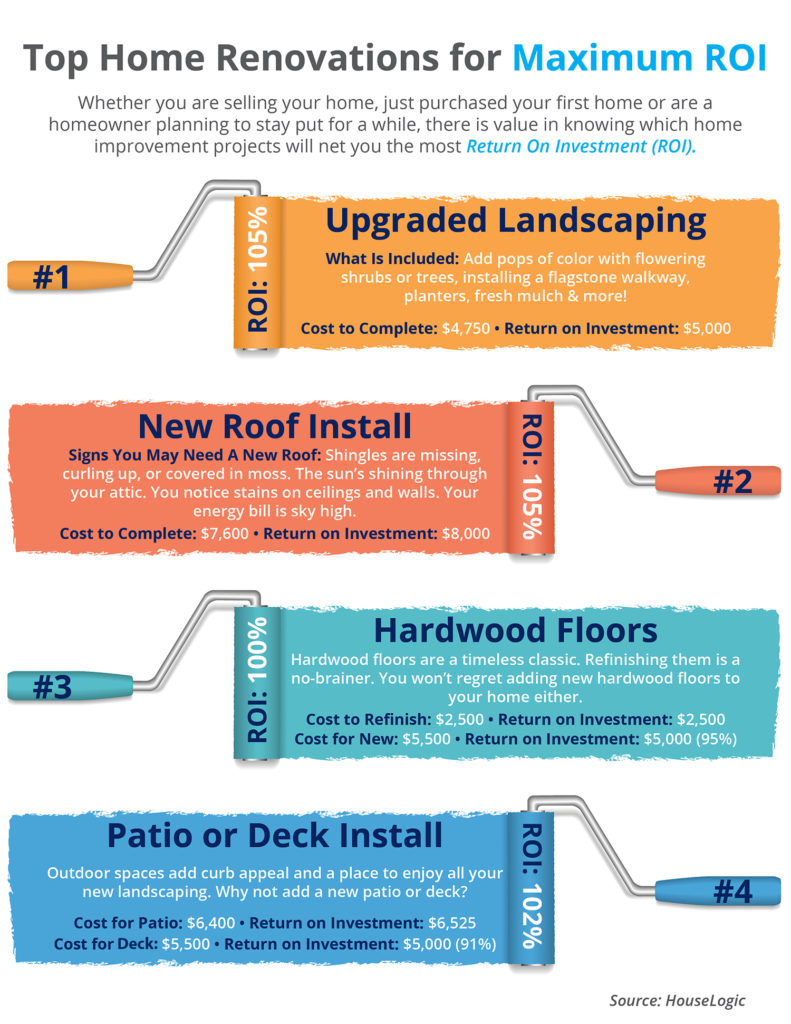

Top Home Renovations for Maximum ROI [INFOGRAPHIC]

Jun

16

2017

Some Highlights:

- Whether you are selling your home, just purchased your first home, or are a homeowner planning to stay put for a while, there is value in knowing which home improvement projects will net you the most Return On Investment (ROI).

- While big projects like adding a bathroom or a complete kitchen remodel are popular ways to increase a home’s value, something as simple as updating landscaping and curb appeal can have a quick impact on a home’s value.

- For more information about top renovation projects that net you the most ROI, you can check out the complete list here.

Posted in First Time Home Buyers, For Buyers, For Sellers, Infographics, Move-Up Buyers

Are Home Prices Approaching Bubble Territory?

Jun

15

2017

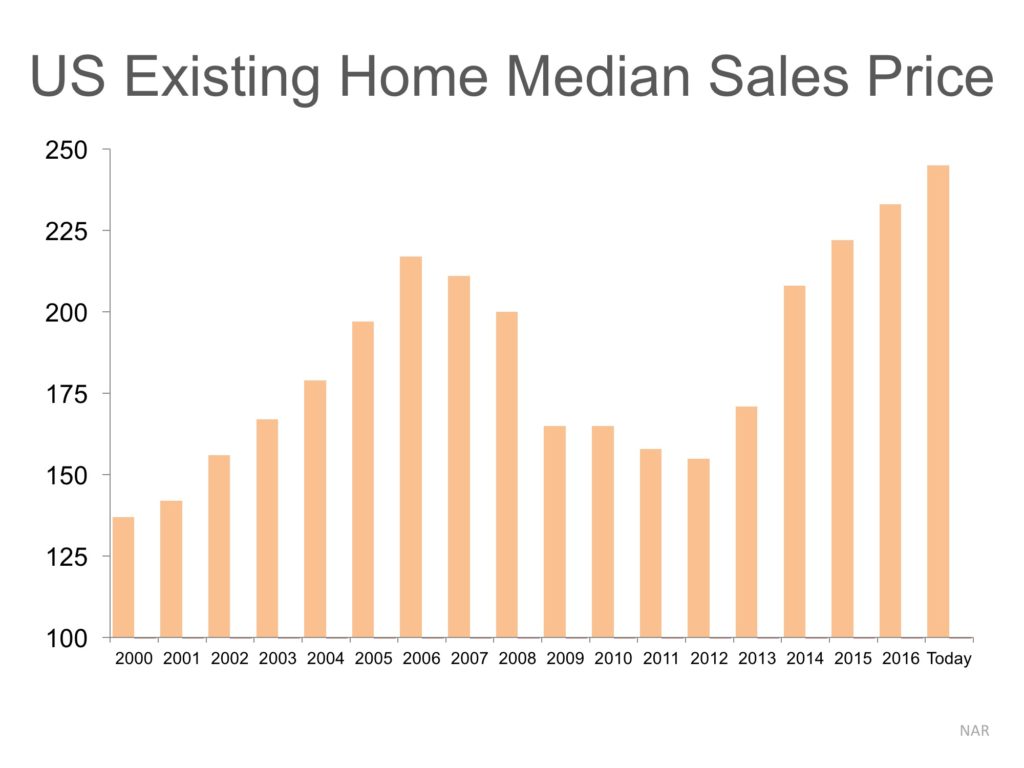

As home values continue to rise, some are questioning whether we are approaching another housing bubble. Zillow just reported that:

“National home values have surpassed the peak hit during the housing bubble and are at their highest value in more than a decade.”

Though that statement is correct, we must realize that just catching prices of a decade ago does not mean we are at bubble numbers. Here is a graph of median prices as reported by the National Association of Realtors (NAR).

We can see that prices rose during the early 2000s, fell during the crash and have risen since 2013.

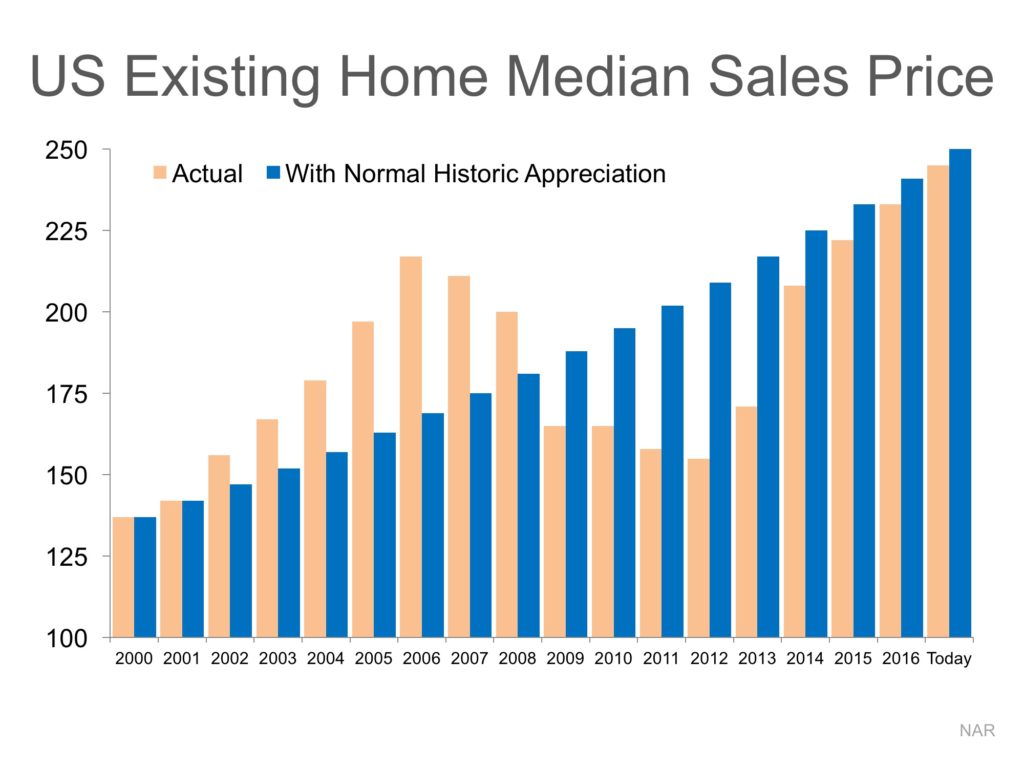

However, let’s assume there was no housing bubble and crash and that home prices appreciated at normal historic levels (3.6% annually) over the last ten years.

Here is a graph comparing actual price appreciation (tan bars) with what prices would have been with normal appreciation (blue bars).

Bottom Line

As we can see, had there not been a boom and bust, home values would essentially be where they are right now.

Posted in For Buyers, For Sellers, Housing Market Updates, Pricing

The TRUTH Behind the RENT vs. BUY Debate

Jun

14

2017

In a blog post published last Friday, CNBC’s Diana Olnick reported on the latest results of the FAU Buy vs. Rent Index. The index examines the entire US housing market and then isolates 23 major markets for comparison. The researchers at FAU use a “‘horse race’ comparison between an individual that is buying a home and an individual that rents a similar-quality home and reinvests all monies otherwise invested in homeownership.”

Having read both the index and the blog post, we would like to clear up any confusion that may exist. There are three major points that we would like to counter:

1. The Title

The CNBC blog post was titled, “Don’t put your money in a house, says a new report.” The title of the press release about the report on FAU’s website was “FAU Buy vs. Rent Index Shows Rising Prices and Mortgage Rates Moving Housing Markets in the Direction of Renting.”

Now, we all know headlines can attract readers and the stronger the headline the more readership you can attract, but after dissecting the report, this headline may have gone too far. The FAU report notes that rising home prices and the threat of increasing mortgage rates could make the decision of whether to rent or to buy a harder one in three metros, but does not say not to buy a home.

2. Mortgage Interest Rates are Rising

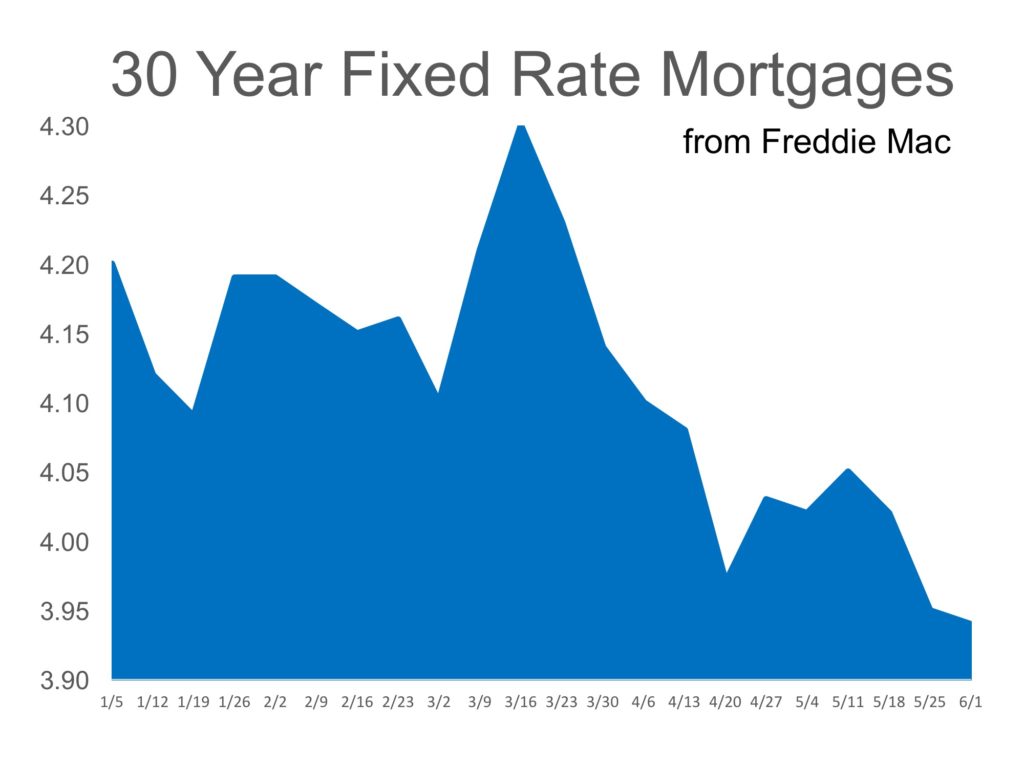

According to Freddie Mac, mortgage interest rates reached their lowest mark of 2017 last week at 3.89%. Interest rates have hovered around 4% for the majority of 2017, giving many buyers relief from rising home prices and helping with affordability.

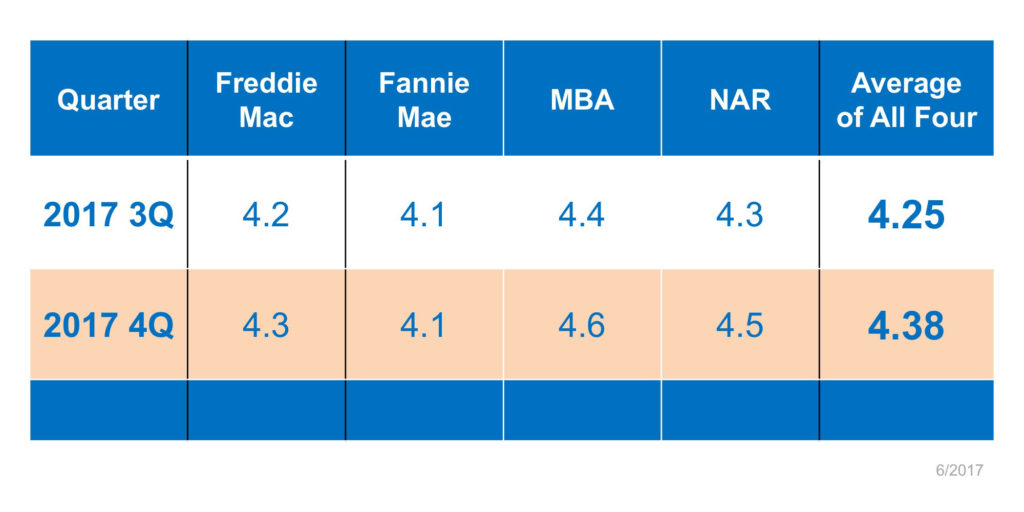

While experts predict that rates will increase by the end of 2017, the latest projections have softened, with Freddie Mac predicting that rates will rise to 4.3% in Q4.

3. “Renting may be a better option than buying, according to the report.”

Of the 23 metros that the study reports on, 11 of them are firmly in buy territory, including New York, Boston, Chicago, Cleveland, and more. This means that in nearly half of all the major cities in the US, it makes more financial sense to buy a home than to continue renting one.

In 9 of the remaining metros, the decision as to whether to rent or buy is closer to a toss-up right now. This means that all things being equal, the cost to rent or buy is nearly the same. That leaves the decision up to the individual or family as to whether they want to renew their lease or buy a home of their own.

The 3 remaining metros Dallas, Denver and Houston, have experienced high levels of price appreciation and have been reported to be in rent territory for well over a year now, so that’s not news…

Beer & Cookies

One of the three authors of the study, Dr. Ken Johnson has long reported on homeownership and the decision between renting and buying a home. The methodology behind the report goes on to explain that even in a market where a renter would be able to spend less on housing, they would have to be disciplined enough to reinvest their remaining income in stocks/bonds/other investments for renting a home to be a more attractive alternative to buying.

Johnson himself has said:

“However, in perhaps a more realistic setting where renters can spend on consumption (beer, cookies, education, healthcare, etc.), ownership is the clear winner in wealth accumulation. Said another way, homeownership is a self-imposed savings plan on the part of those that choose to own.”

Bottom Line

In the end, you and your family are the only ones who can decide if homeownership is the right path to go down. Real estate is local and every market is different. Let’s get together to discuss what’s really going on in your area and how we can help you make the best, most informed decision for you and your family.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates

Homeownership Is a Good Financial Investment!

Jun

13

2017

According to a recent report by Trulia, “buying is cheaper than renting in 100 of the largest metro areas by an average of 33.1%.” The report may have some people thinking about buying a home instead of signing another lease extension, but does that make sense from a financial perspective?

Ralph McLaughlin, Trulia’s Chief Economist explains:

“Owning a home is one of the most common ways households build long-term wealth, as it acts like a forced savings account. Instead of paying your landlord, you can pay yourself in the long run through paying down a mortgage on a house.”

The article listed five reasons why owning a home makes financial sense:

- Mortgage payments can be fixed while rents go up.

- Equity in your home can be a financial resource later.

- You can build wealth without paying capital gains.

- A mortgage can act as a forced savings account.

- Overall, homeowners can enjoy greater wealth growth than renters.

Bottom Line

Before you sign another lease, let’s get together and discuss all your options.

Posted in First Time Home Buyers, For Buyers

4 Reasons to Buy This Summer!

Jun

12

2017

Here are four great reasons to consider buying a home today, instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 7.1% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.9% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have remained around 4%. Most experts predict that they will begin to rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison, projecting that rates will increase by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You are Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

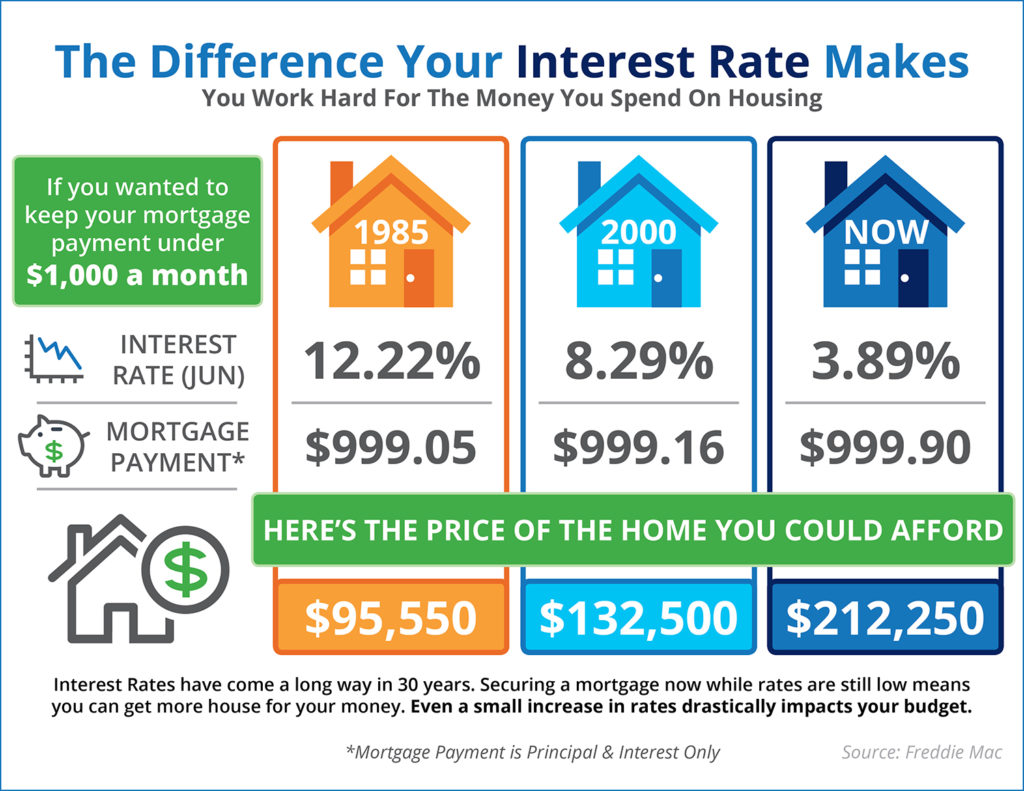

The Impact Your Interest Rate Makes [INFOGRAPHIC]

Jun

09

2017

![The Impact Your Interest Rate Makes [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/06/08171202/20170609-Share-STM.jpg)

Some Highlights:

- Interest rates have come a long way in the last 30 years.

- The interest rate you secure directly impacts your monthly payment and the amount of house that you can afford if you plan to stay within a certain budget.

- Interest rates are at their lowest in years… RIGHT NOW!

- If buying your first home, or moving up to the home of your dreams is in your future, now may be the time to act!

Posted in First Time Home Buyers, For Buyers, For Sellers, Infographics, Interest Rates, Move-Up Buyers

Mortgage Interest Rates Reverse Course in 2017

Jun

08

2017

To start the year, housing experts all agreed on one thing: 2017 was going to be the year we would see mortgage interest rates begin to rise. After years of historically low rates, and an improving economy, the question wasn’t if they would increase but instead how much they would increase. Some thought we could see rates hit 5-5.5% by the end of the year.

However, the exact opposite has happened. Instead of higher rates as we head into the middle of 2017, we now have the lowest rates of the year (as reported by Freddie Mac). Here is a graph of mortgage rate movement since the beginning of the year:

Projections still call for an increase…

Four major entities (Freddie Mac, Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors) are still projecting that rates will increase by the fourth quarter of the year.

Bottom Line

No one knows for sure where interest rates will be in six months. However, if you are thinking about buying your first house or trading up to the home of your dreams, you can still get a mortgage at historically low rates RIGHT NOW.

Posted in First Time Home Buyers, For Buyers, For Sellers, Interest Rates, Move-Up Buyers

69% of Buyers are Wrong About Down Payment Needs

Jun

07

2017

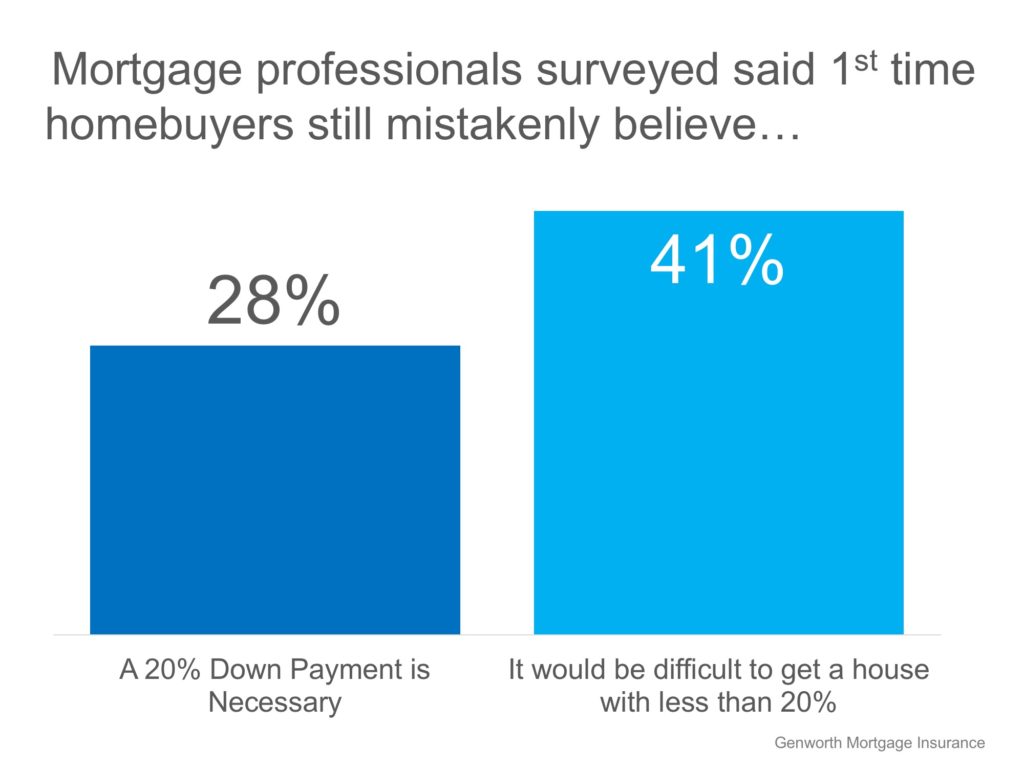

According to a recent survey conducted by Genworth Financial Inc. at the Annual Mortgage Bankers’ Association Secondary Market Conference, mortgage professionals say that first-time buyers still believe a 20% down payment is necessary to buy in today’s market.

Nearly 40% of mortgage industry professionals surveyed believe that a lack of knowledge about the home-buying process is keeping potential buyers on the sidelines. Saving for a down payment is often cited as a huge barrier for first-time homebuyers to make the leap into homeownership.

If homeowners believe that they need a 20% down payment to enter the market, they also believe that they will have to wait years (in some markets) to come up with the necessary funds to buy their dream homes.

The greatest source of confusion cited in the survey results centered around down payments. The results are broken down in the chart below:

Rohit Gupta, CEO of Genworth Mortgage Insurance had this to say,

“While first-time homebuyers continue to drive the purchase market, we believe many are staying on the sidelines due to the misconception that a 20 percent down payment is required to secure a mortgage.

There are various low down payment options available today that allow prospective homebuyers to reach their dreams of homeownership sooner. It is crucial that, as an industry, we proactively educate eligible borrowers about solutions that will enable them to buy a home when they’re ready.”

Bottom Line

Don’t let a lack of understanding of the home-buying process keep you and your family out of the housing market. Let’s get together to discuss your options!

Posted in Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers