Category: For Buyers

Get All the Facts about PMI

May

02

2017

When it comes to buying a home, whether it is your first time or your fifth, it is always important to know all the facts. With the large number of mortgage programs available that allow buyers to purchase a home with a down payment below 20%, you can never have too much information about Private Mortgage Insurance (PMI).

What is PMI?

Freddie Mac defines PMI as:

“An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.

Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. Freddie Mac goes on to explain that:

“The cost of PMI varies based on your loan-to-value ratio – the amount you owe on your mortgage compared to its value – and credit score, but you can expect to pay between $30 and $70 per month for every $100,000 borrowed.”

According to the National Association of Realtors, the average down payment for all buyers last year was 10%. For first-time buyers, that number dropped to 6%, while repeat buyers put down 14% (no doubt aided by the sale of their home). This just goes to show that for a large number of buyers last year, PMI did not stop them from buying their dream homes.

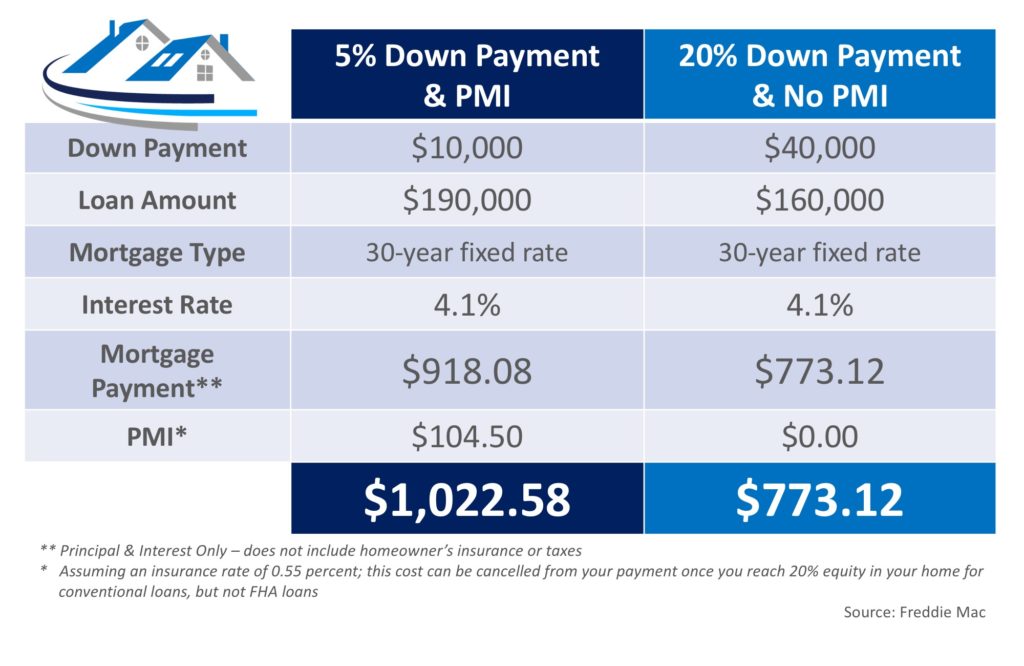

Here’s an example of the cost of a mortgage on a $200,000 home with a 5% down payment & PMI, compared to a 20% down payment without PMI:

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.”

Bottom Line

If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, let’s get together to discuss our market’s conditions and to help you make the best decision for you and your family.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Is the Current Pace of Home Sales Maintainable?

May

01

2017

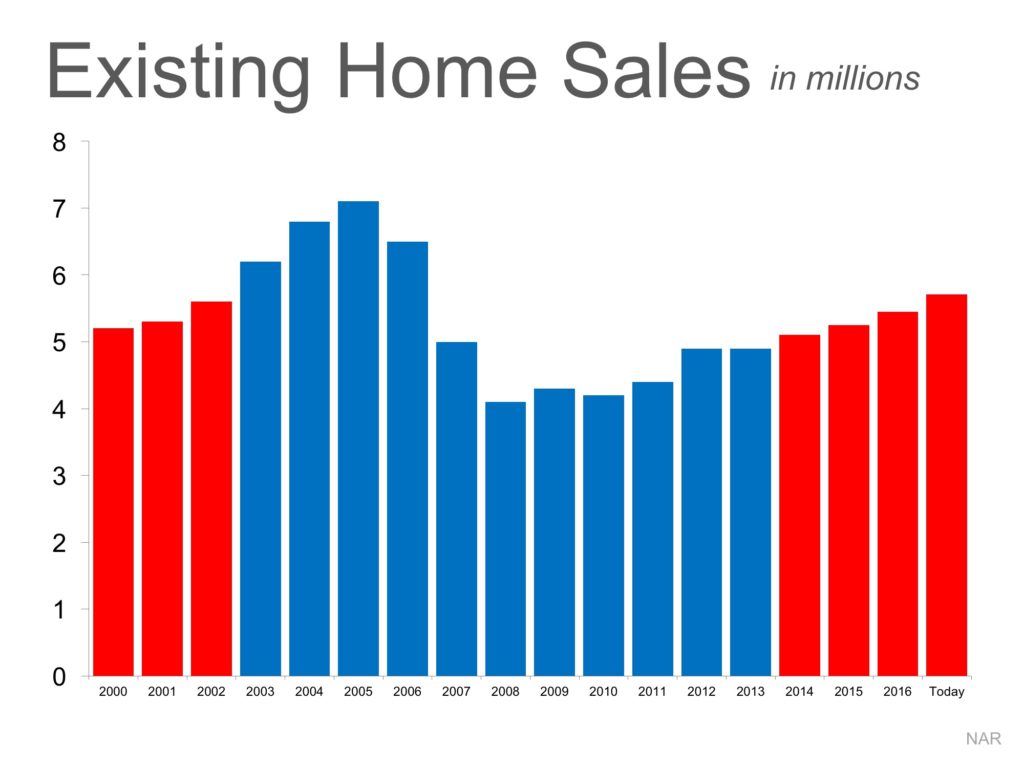

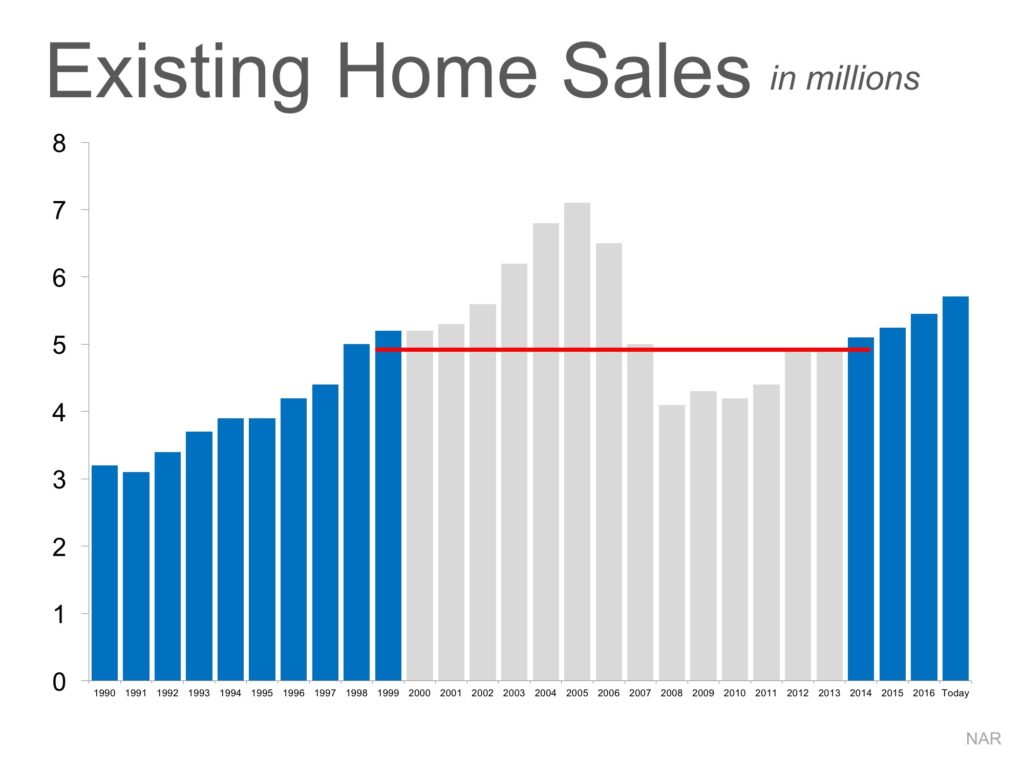

There are some experts questioning whether the current pace of residential home sales is maintainable. Are too many people buying homes like in 2004-2006? Are we headed for another housing crisis? Actually, if we look closely at the numbers, we can see that we are looking at a very healthy real estate market.

Why the concern?

Some are looking at the last four years of home sales and comparing them to the three years just prior to the housing bubble. Looking at the graph below, we can understand that thinking.

However, if we go further back in history, we can see the real picture. After taking out the “boom & bust” years, the pace of sales is growing at quite a natural pace.

And new home sales are way below historic numbers. Dave Liniger, Re/Max CEO explains:

“We expect a seasonal uptick in sales this time of year and March certainly met and somewhat exceeded that expectation. We don’t anticipate the tightening inventory to ease up in most markets until new home construction can catch up to its pre-recession pace. Until then, sellers will enjoy a fast-paced market and buyers will need to work with their agents to get in the right home.”

Bottom Line

The current pace of residential home sales definitely seems maintainable.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Your Tax Return: Bring it Home

Apr

27

2017

This time of year, many people eagerly check their mailboxes looking for their tax return check from the IRS. But, what do most people plan to do with the money? GO Banking Rates recently surveyed Americans and asked the question – “What do you plan on doing with your tax refund?”

The results of the survey were interesting. Here is what they plan to do with their money:

- 41% – Put it into savings

- 38% – Pay off debt

- 11% – Go on a vacation

- 5% – Make a major purchase (car, home, etc.)

- 5% – Splurge on a purchase

Upon seeing the research, The National Association of Realtors (NAR) wondered if this could help with a constant challenge cited by many people who wish to purchase a home – saving for the down payment.

In a recent post in NAR’s Economists’ Outlook Blog, they explained:

“With a sizable tax refund, the average American would have a decent down payment depending on which region or market you live in.”

They went on to add:

“[A]pproximately 5 percent of all respondents indicated they would make a major purchase which does not seem like a lot. However, there is a bigger group 41 percent who see saving the tax return is best and that group could be potential homebuyers if they are not already.”

In other words, putting that money toward purchasing a home is a form of savings.

Bottom Line

When one considers that first-time home buyers in 2016 had an average down payment of 6%, a decent tax return could go a long way toward the necessary funds needed for a down payment on a house. Or perhaps, the down payment needed by a son or daughter to make their homeownership dream a reality. How are you going to spend your return?

Posted in Down Payments, First Time Home Buyers, For Buyers

Real Estate Mogul: Here’s Why You Should Buy

Apr

26

2017

Real Estate mogul, Sean Conlon, host of The Deed: Chicago on CNBC, was recently asked the question, should you buy? Or should you rent a house?

Conlon responded:

“I am a true believer that you save every penny and you buy your first house… and that is still the fastest path to wealth in this country.”

Conlon went on to suggest that first-time buyers put down 10-20% “if they can make it work,” and to remain in their home at least 4-5 years to see a return on their investment.

Who is Sean Conlon, and why should you listen to his advice?

Within a few years of working in the real estate industry, Conlon had established himself as one of the leading agents in the United States and has founded 3 billion-dollar brokerages dealing in residential, commercial and investment sales. Since immigrating to America from the United Kingdom in 1990, he believes very strongly in the American Dream and the role that homeownership plays in achieving it. Conlon is quoted on his website as saying:

“I treat people the way I would like to be treated if I went in to buy a house and I work harder than anybody I know. I think if you do that in America, you will always succeed.”

Bottom Line

Homeownership is an investment you can leverage against in the future that not only provides shelter and safety but also helps you build your family’s wealth. If you are debating whether or not to purchase a home this year, let’s get together to discuss the opportunities available in today’s market!

Posted in First Time Home Buyers, For Buyers

How Fast Can You Save for a Down Payment?

Apr

24

2017

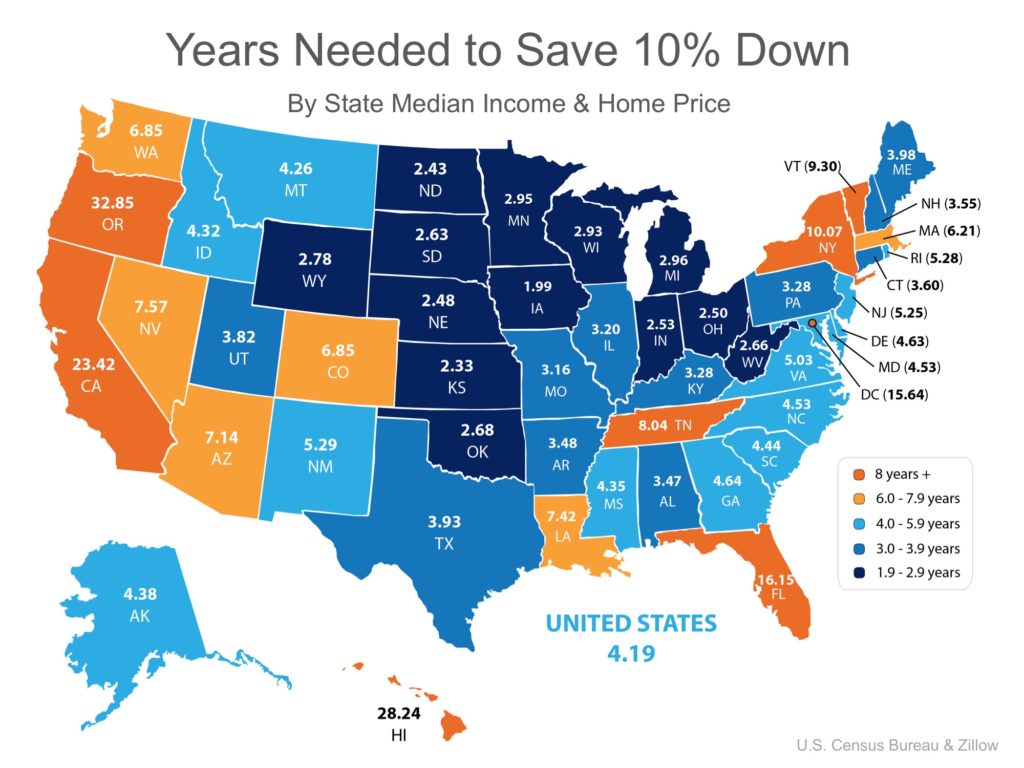

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state?

Using data from the United States Census Bureau and Zillow, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting a 2-bedroom apartment in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Iowa can save for a down payment the quickest in just under 2 years (1.99). Below is a map created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3% down programs? Suddenly, saving for a down payment no longer takes 5 or 10 years, but becomes attainable in a year or two in many states as shown in the map below.

Bottom Line

Whether you have just started to save for a down payment, or have been saving for years, you may be closer to your dream home than you think! Let’s meet up so I can help you evaluate your ability to buy today.

Posted in Down Payments, First Time Home Buyers, For Buyers

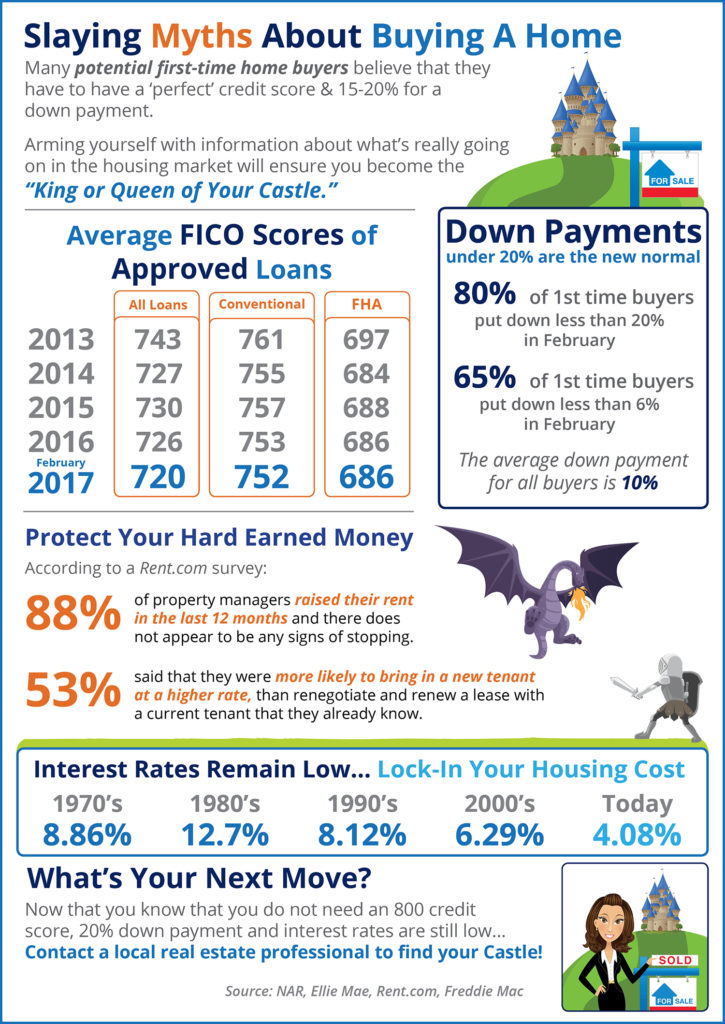

Slaying Home Buying Myths [INFOGRAPHIC]

Apr

21

2017

Some Highlights:

- Interest rates are still below historic numbers.

- 88% of property managers raised their rent in the last 12 months!

- The credit score requirements for mortgage approval continue to fall.

Posted in Down Payments, First Time Home Buyers, For Buyers, Infographics, Interest Rates

Tax Return Depressing? Owning a Home Could Help

Apr

20

2017

Many Americans got some depressing news last week; either their tax return was not as large as they had hoped or, in some cases, they were told they owed additional money to either the Federal or State government or both. One way to save on taxes is to own your own home.

According to the Tax Policy Center’s Briefing Book -“A citizen’s guide to the fascinating (though often complex) elements of the federal Tax System” – there are several tax advantages to homeownership.

Here are four items, and a quote on each, from the Briefing Book:

1. Mortgage Interest Deduction

“Homeowners who itemize deductions may reduce their taxable income by deducting any interest paid on a home mortgage. The deduction is limited to interest paid on up to $1 million of debt incurred to purchase or substantially rehabilitate a home. Homeowners also may deduct interest paid on up to $100,000 of home equity debt, regardless of how they use the borrowed funds. Taxpayers who do not own their home have no comparable ability to deduct interest paid on debt incurred to purchase goods and services.”

2. Property Tax Deduction

“Homeowners who itemize deductions may also reduce their taxable income by deducting property taxes they pay on their homes.”

3. Imputed Rent

“Buying a home is an investment, part of the returns from which is the opportunity to live in the home rent-free. Unlike returns from other investments, the return on homeownership—what economists call “imputed rent”—is excluded from taxable income. In contrast, landlords must count as income the rent they receive, and renters may not deduct the rent they pay. A homeowner is effectively both landlord and renter, but the tax code treats homeowners the same as renters while ignoring their simultaneous role as their own landlords.”

4. Profits from Home Sales

“Taxpayers who sell assets must generally pay capital gains tax on any profits made on the sale. But homeowners may exclude from taxable income up to $250,000 ($500,000 for joint filers) of capital gains on the sale of their home if they satisfy certain criteria: they must have maintained the home as their principal residence in two out of the preceding five years, and they generally may not have claimed the capital gains exclusion for the sale of another home during the previous two years.”

Bottom Line

We are not suggesting that you purchase a house just to save on your taxes. However, if you have been on the fence as to whether 2017 is the year you should become a homeowner, this information might help with that decision.

Disclaimer: Always check with your accountant to find out what tax advantages apply to you in your area.

Posted in First Time Home Buyers, For Buyers

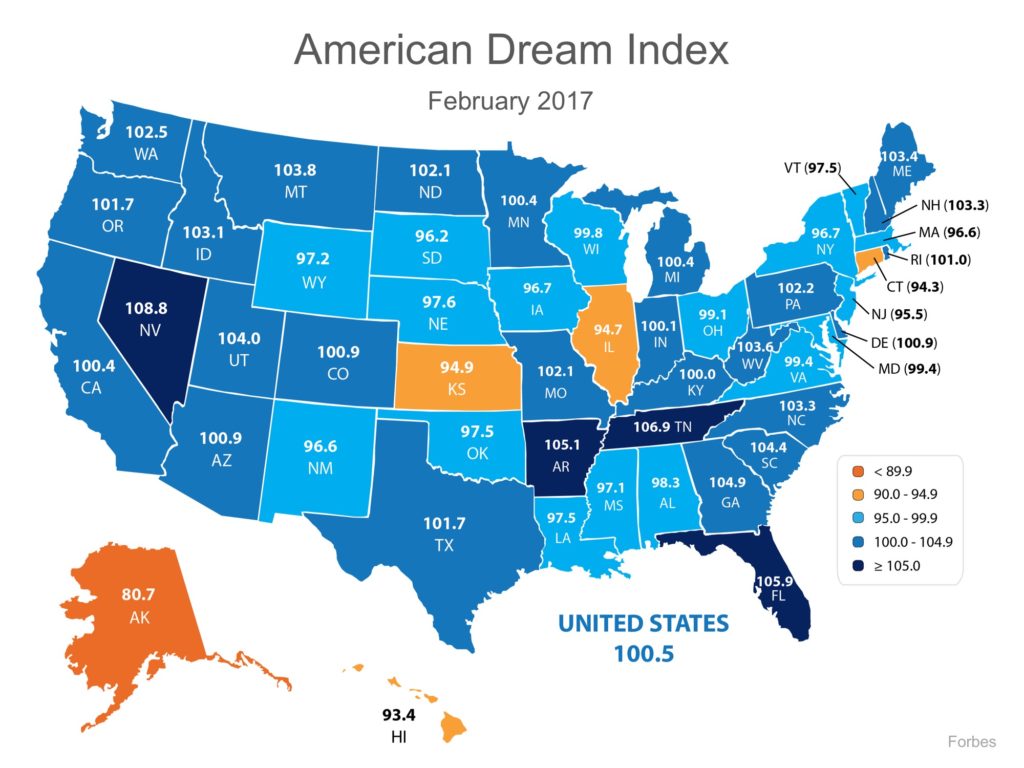

Measuring Your Ability to Achieve the American Dream

Apr

19

2017

Forbes.com recently released the results of their new American Dream Index, in which they measure “the prosperity of the middle class, and…examine which states best support the American Dream.”

The monthly index measures several different economic factors, including goods-producing employment, personal and commercial bankruptcies, building permits, startup activity, unemployment insurance claims, labor force participation, and layoffs.

The national index score was rounded out to 100 in January and saw a modest jump to 100.5 in February.

Alaska represented the lowest score on the index at 80.7, due mostly to the recent collapse in oil prices. Nevada came in with the highest score at 108.8, boosted by big gains in goods-producing jobs and new construction activity. The full results can be seen in the map below.

Forbes Senior Editor Kurt Badenhausen explained why many states saw a boost in the index last month:

“[B]usinesses are hiring in part in anticipation of tax cuts and less regulation… Many areas of the country have experienced strong upticks in employment and construction, as well as declines in unemployment claims since the start of the year.”

Bottom Line

The American Dream, for many, includes being able to own a home of his or her own. With the economy improving in many areas of the country, that dream can finally become a reality.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

US Housing Market Continues the Move into ‘Buy Territory’!

Apr

18

2017

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment.

The BH&J Index is a quarterly report that attempts to answer the question:

In today’s housing market, is it better to rent or buy a home?

The index examines the entire US housing market and then isolates 23 major cities for comparison. The researchers “measure the relationship between purchasing property and building wealth through a buildup in equity versus renting a comparable property and investing in a portfolio of stocks and bonds.”

While most of the metropolitan markets examined moved further into buy territory (15 of the 23), markets like Dallas, Denver, and Houston are currently deep into rent territory. In these three markets, it is estimated that renting will top homeownership 7 out of 10 times.

Due to a lack of inventory, the home prices in the Dallas, Denver, and Houston, areas have increased by 13%, 11.4%, and 7.3% respectively. Home prices in these areas will begin to return to more normal levels once residents realize that renting is not the best option, therefore bringing home affordability back as well.

Bottom Line

The majority of the country is strongly in buy territory. Buying a home makes sense socially and financially, as rents are predicted to increase substantially in the next year. Protect yourself from rising rents by locking in your housing cost with a mortgage payment now.

To Find Out More About the Study: The BH&J Index and other FAU real estate activities are sponsored by Investments Limited of Boca Raton. The BH&J Index is published quarterly and is available online at http://business.fau.edu/buyvsrent.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

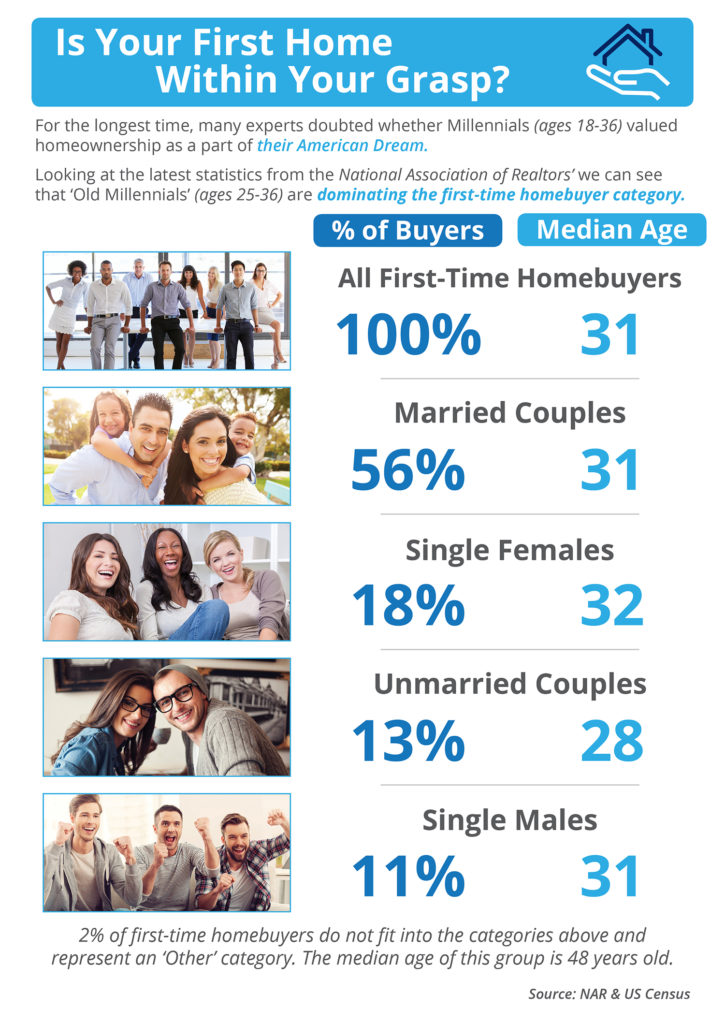

Is Your First Home Within Your Grasp? [INFOGRAPHIC]

Apr

14

2017

Some Highlights:

- ‘Millennials’ are defined as 18-36 year olds according to the US Census Bureau.

- According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 31 years old.

- More and more ‘Old Millennials’ (25-36 year olds) are realizing that homeownership is within their reach now!

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials, Move-Up Buyers