Category: For Buyers

Millionaire to Millennials: Buy Now!

Mar

28

2017

Self-made millionaire David Bach was quoted in a CNBC article explaining that “the single biggest mistake millennials are making” is not purchasing a home because buying real estate is “an escalator to wealth.”

Bach went on to explain:

“If millennials don’t buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter.”

In his bestselling book, “The Automatic Millionaire,” Bach does the math:

“As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing. Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!”

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.

He has been a contributor to NBC’s Today Show appearing more than 100 times, has been a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS, and has been profiled in many major publications, including The New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, The Washington Post, The Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Renting or Buying… Either Way You’re Paying a Mortgage

Mar

27

2017

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained this month in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person with that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.23% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

How Low Supply & High Demand Impacts the Real Estate Market [INFOGRAPHIC]

Mar

24

2017

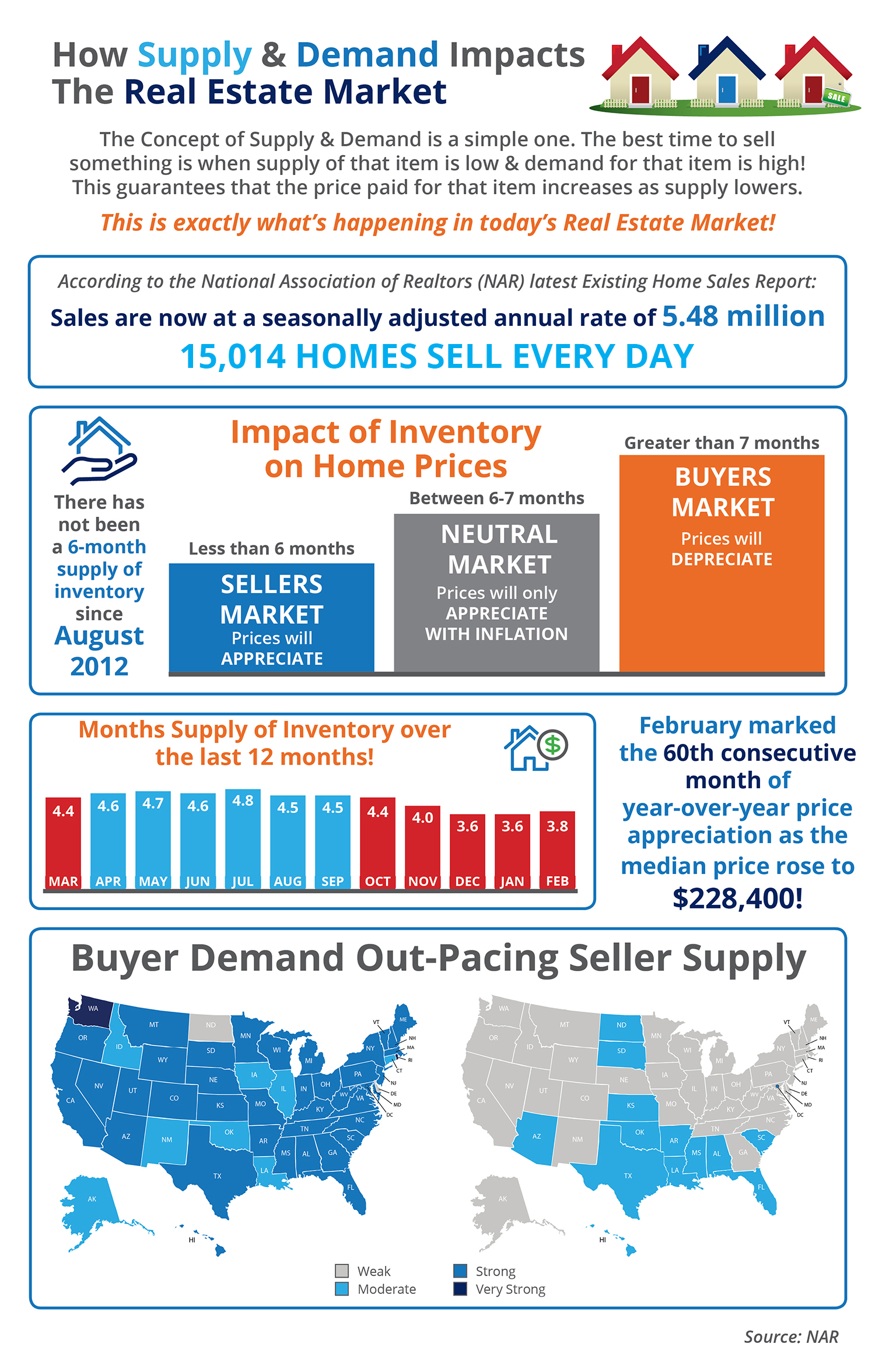

Some Highlights:

- The concept of Supply & Demand is a simple one. The best time to sell something is when the supply of that item is low & the demand for that item is high!

- Anything under a 6-month supply is a Seller’s Market!

- There has not been a 6-months inventory supply since August 2012!

- Buyer Demand continues to outpace Seller Supply!

Posted in For Buyers, For Sellers, Housing Market Updates, Infographics

The Foreclosure Crisis: 10 Years Later

Mar

23

2017

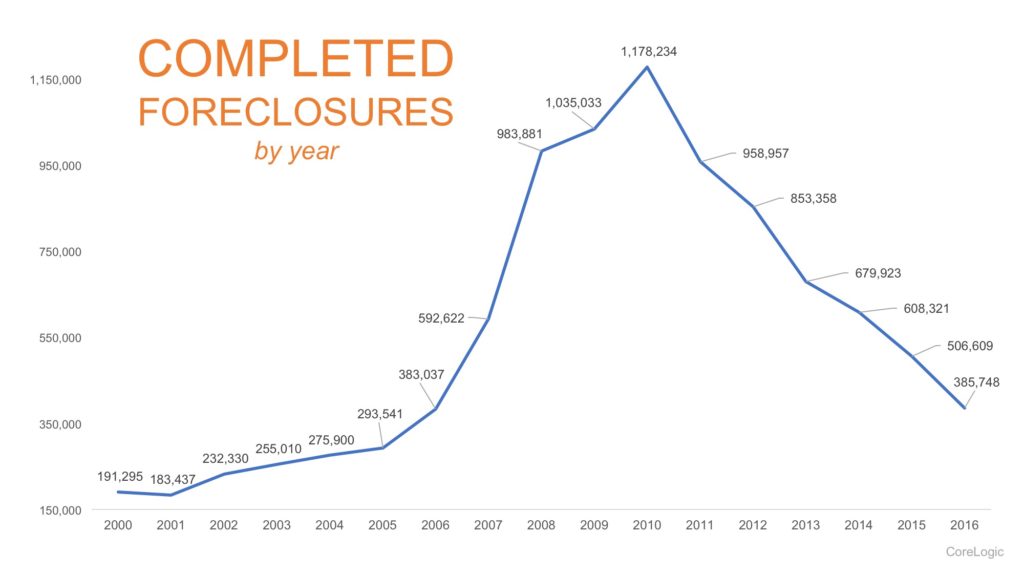

CoreLogic recently released a report entitled, United States Residential Foreclosure Crisis: 10 Years Later, in which they examined the years leading up to the crisis all the way through to present day.

With a peak in 2010 when nearly 1.2 million homes were foreclosed on, over 7.7 million families lost their homes throughout the entire foreclosure crisis.

Dr. Frank Nothaft, Chief Economist for CoreLogic, had this to say,

“The country experienced a wild ride in the mortgage market between 2008 and 2012, with the foreclosure peak occurring in 2010. As we look back over 10 years of the foreclosure crisis, we cannot ignore the connection between jobs and homeownership. A healthy economy is driven by jobs coupled with consumer confidence that usually leads to homeownership.”

Since the peak, foreclosures have been steadily on the decline by nearly 100,000 per year all the way through the end of 2016, as seen in the chart below.

If this trend continues, the country will be back to 2005 levels by the end of 2017.

Bottom Line

As the economy continues to improve, and employment numbers increase, the number of completed foreclosures should continue to decrease.

Posted in Distressed Properties, For Buyers, For Sellers, Foreclosures, Housing Market Updates

What Are the Experts Saying about Mortgage Rates?

Mar

22

2017

Mortgage interest rates have risen over the last few months and projections are that they will continue their upswing throughout 2017. What impact will this have on the housing market? Here is what the experts are saying:

Laurie Goodman, Co-director of the Urban Institute’s Housing Finance Policy Center:

“In 1984, 1994, 2000, and 2013, every time we have rate increases, we have increases in nominal home prices. We expect this to be more pronounced, as there is a big demand-and-supply gap at the present time.”

Scott Anderson, Chief Economist for Bank of the West:

“The tightening labor market, rising wage growth, high levels of consumer confidence and a millennial generation with a pent-up demand for housing should allow the housing market to weather the storm of gradually rising interest rates.”

Ivy Zelman in her latest “Z” Report:

“Although we strongly believe that the housing supply-demand imbalance for single-family homes will continue to drive above-average home price appreciation, just as falling mortgage rates aided pricing power on the margin in recent months, we expect the opposite effect to become evident in the coming months. As such, we project year-end home price inflation of 4.8% for 2017 and 4.1% for 2018.”

Bob Walters, President & COO of retail mortgage lender Quicken Loans:

“A modest increase in mortgage rates won’t have much of an effect on home purchases. A buyer may need to slightly re-evaluate which homes they can afford, but it’s not likely to make an impact on qualifying, in most cases.”

First American Chief Economist Mark Fleming:

“Our survey data shows that mortgage rates would have to be significantly higher to have any meaningful impact. The house buying power that borrowers have, even with rates below five percent, still remains historically strong.”

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers

4 Great Reasons to Buy This Spring!

Mar

20

2017

Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.9% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.8% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have remained around 4% over the last couple months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison, projecting that rates will increase by at least a half a percentage point this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You are Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Don’t Let Your Luck Run Out [INFOGRAPHIC]

Mar

17

2017

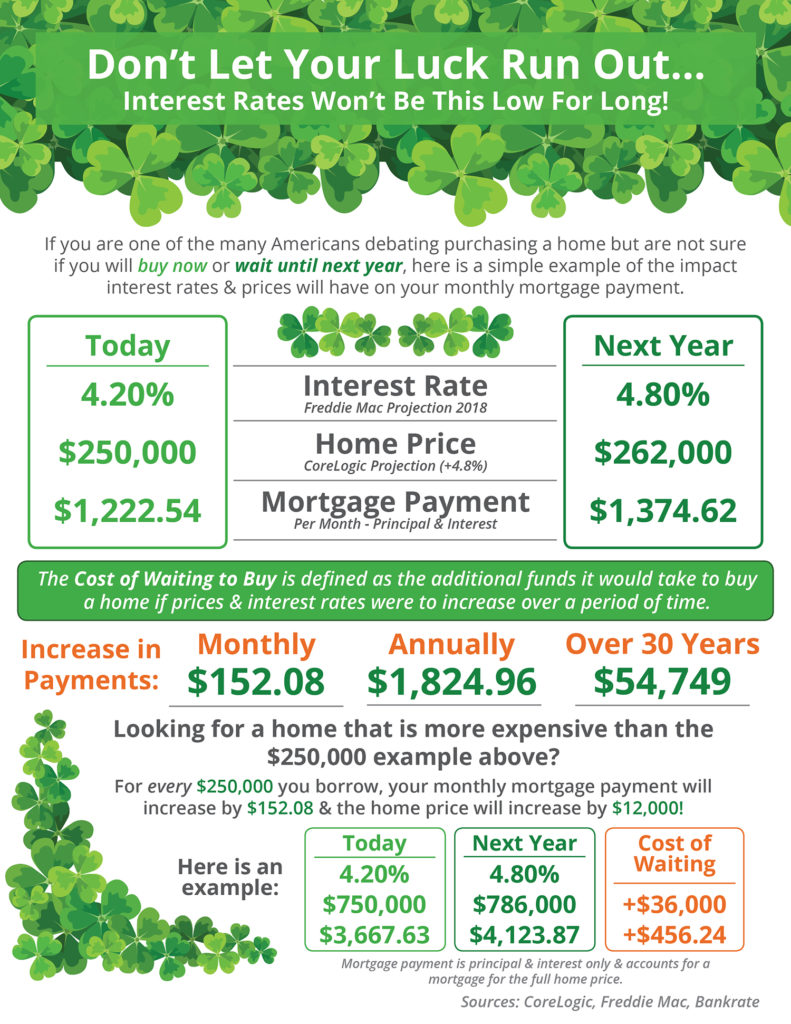

Some Highlights:

- The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

- Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.8% according to CoreLogic.

- Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Move-Up Buyers, Pricing

Which Homes Have Appreciated the Most?

Mar

16

2017

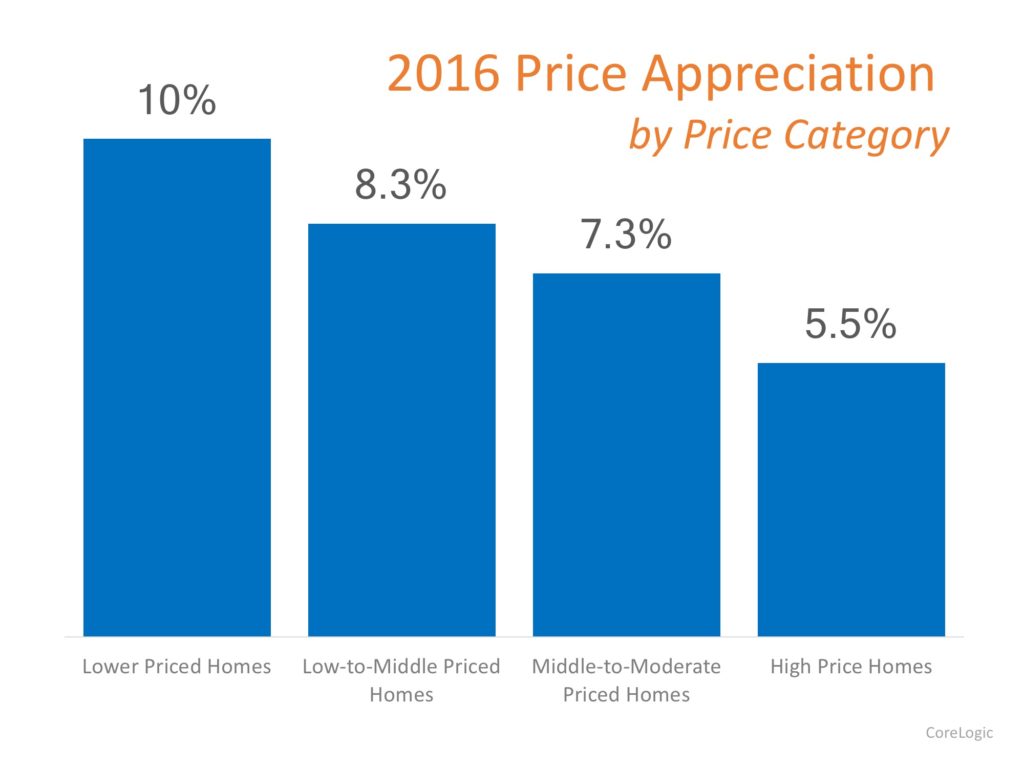

Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 7.1%. CoreLogic, in their most recent Home Price Insights Report, reveals that national home prices have increased by 6.9% year-over-year.

The CoreLogic report broke down appreciation even further into four different price categories:

- Lower Priced Homes: priced at 75% or less of the median

- Low-to-Middle Priced Homes: priced between 75-100% of the median

- Middle-to-Moderate Priced Homes: priced between 100-125% of the median

- High Price Homes: priced greater than 125% of the median

Here is how each category did in 2016:

Bottom Line

The lower priced homes (which are more in demand) appreciated at greater rates than the homes at the upper ends of the spectrum.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

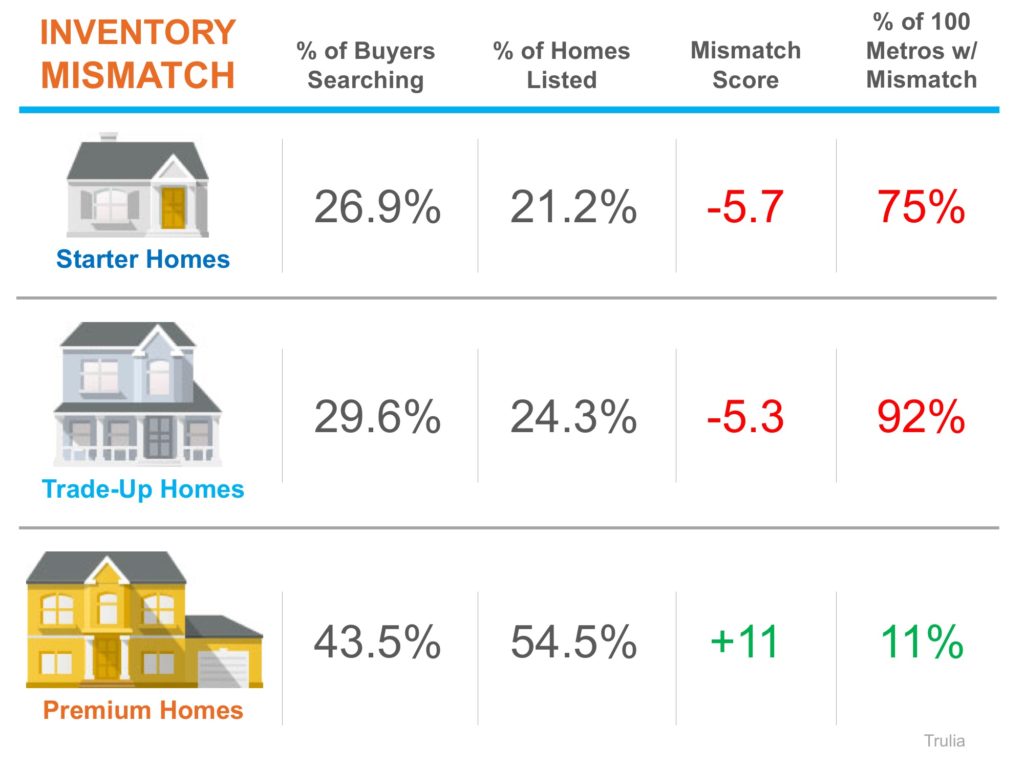

A Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture

Mar

15

2017

The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the National Association of Realtors latest Existing Home Sales Report. Inventory is now 7.1% lower than this time last year, marking the 20th consecutive month of year-over-year drops.

Historically, inventory must reach a 6-month supply for a normal market where home prices appreciate with inflation. Anything less than a 6-month supply is a sellers’ market, where the demand for houses outpaces supply and prices go up.

As you can see from the chart below, the United States has been in a sellers’ market since August 2012, but last month’s numbers reached a new low.

Recently Trulia revealed that not only is there a shortage of homes on the market in general, but the homes that are available for sale are not meeting the needs of the buyers that are searching.

Homes are generally bucketed into three groups by price range: starter, trade-up, and premium.

Trulia’s market mismatch score measures the search interest of buyers against the category of homes that are available on the market. For example: “if 60% of buyers are searching for starter homes but only 40% of listings are starter homes, [the] market mismatch score for starter homes would be 20.”

The results of their latest analysis are detailed in the chart below.

Nationally, buyers are searching for starter and trade-up homes and are coming up short with the listings available, leading to a highly competitive seller’s market in these categories. Ninety-two of the top 100 metros have a shortage in trade-up inventory.

Premium homebuyers have the best chance of less competition and a surplus of listings in their price range with an 11-point surplus, leading to more of a buyer’s market.

“It leaves Americans who are in the market for a home increasingly chasing too fewer options in lower price ranges, and sellers of premium homes more likely to be left waiting longer for a buyer.”

Lawrence Yun, NAR’s Chief Economist doesn’t see an end to this coming any time soon:

“Competition is likely to heat up even more heading into the spring for house hunters looking for homes in the lower- and mid-market price range.”

Bottom Line

Real estate is local. If you are thinking about buying OR selling this spring, let’s get together to discuss the exact market conditions in your area.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

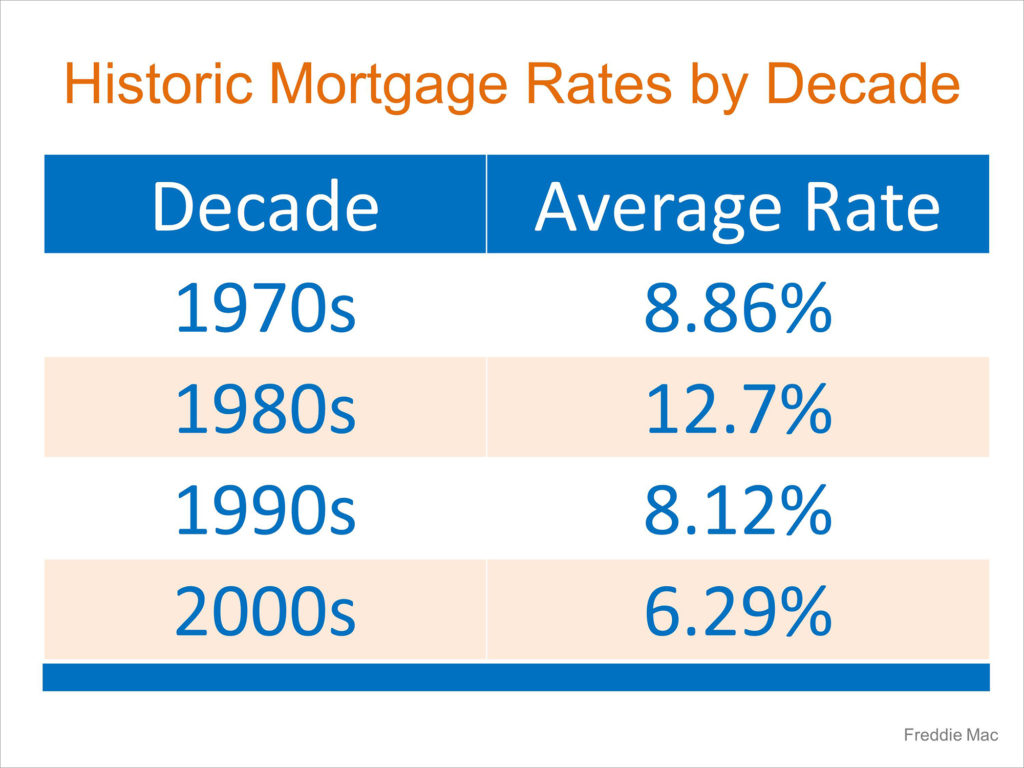

Mortgage Interest Rates Went Up Again… Should I Wait to Buy?

Mar

14

2017

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.

This has caused some purchasers to lament the fact they may no longer be able to get a rate below 4%. However, we must realize that current rates are still at historic lows.

Here is a chart showing the average mortgage interest rate over the last several decades.

Bottom Line

Though you may have missed getting the lowest mortgage rate ever offered, you can still get a better interest rate than your older brother or sister did ten years ago, a lower rate than your parents did twenty years ago, and a better rate than your grandparents did forty years ago.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers