Category: For Buyers

January 30th, 2018 by Lum Hugh

Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership,” which revealed that “eighty percent of consumers either are unaware of how much lenders require for a down payment or believe all lenders require a down payment above 5 percent.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the down payment funds needed to qualify for a home loan. According to the same report:

“Consumers are often unaware of the option to take out low-down-payment mortgages. Only 19% of consumers believe lenders would make loans with a down payment of 5% or less… While 15% believe lenders require a 20% down payment, and 30% believe lenders expect a 20% down payment.”

These numbers do not differ much between non-owners and homeowners; 39% of non-owners believe they need more than 20% for a down payment and 30% of homeowners believe they need more than 20% for a down payment.

While many believe that they need at least 20% down to buy their dream home, they do not realize that programs are available that allow them to put down as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined with programs that have emerged allowing less cash out of pocket.

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Similar to the down payment, many either don’t know or are misinformed about what FICO® score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As you can see in the chart above, 53.5% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

January 26th, 2018 by Lum Hugh

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day when they will be able to paint the walls whatever color they’d like, or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials

January 23rd, 2018 by Lum Hugh

Many people wonder whether they should hire a real estate professional to assist them in buying their dream homes or if they should first try to go through the buying process on their own. In today’s market: you need an experienced professional!

You Need an Expert Guide If You Are Traveling a Dangerous Path

The field of real estate is loaded with landmines; you need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and is ready for you to move into can be tricky. An agent listens to your wants and needs, and can sift through the homes that do not fit within the parameters of your “dream home.”

A great agent will also have relationships with mortgage professionals and other experts that you will need in order to secure your dream home.

You Need a Skilled Negotiator

In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands, of dollars. Each step of the way – from the original offer to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

Realize that when an agent is negotiating his or her commission with you, they are negotiating their own salary; the salary that keeps a roof over their family’s head; the salary that puts food on their family’s table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family?

If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal.

Bottom Line

Famous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money…not cost you money.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

January 22nd, 2018 by Lum Hugh

According to ATTOM Data Solutions’ 2018 Rental Affordability Report, “buying a median-priced home is more affordable than renting a three-bedroom property in 240 of 447 [or 54% of] U.S. counties analyzed for the report.”

For the report, ATTOM Data Solutions compared recently released fair market rent data from the Department of Housing and Urban Development with reported income amounts from the Department of Labor and Statistics to determine the percentage of income that a family would have to spend on their monthly housing cost (rent or mortgage payments).

Daren Blomquist, Senior Vice President of ATTOM Data Solutions had this to say:

“Although buying is still more affordable than renting in the majority of U.S. housing markets, the majority is shrinking as home price appreciation continues to outpace rental growth in most areas.”

However, the report also shows that the average fair market rent rose faster than average weekly wages in 60% of the counties analyzed in the report (266 of 447 counties). With rents rising, many renters should consider buying a home soon.

Bottom Line

Rents will continue to rise, and mortgage interest rates are still at historic lows. Before you sign or renew your next lease, let’s get together to help you determine if you are able to buy a home of your own and lock in your monthly housing expense.

Posted in First Time Home Buyers, For Buyers, Rent vs. Buy

January 19th, 2018 by Lum Hugh

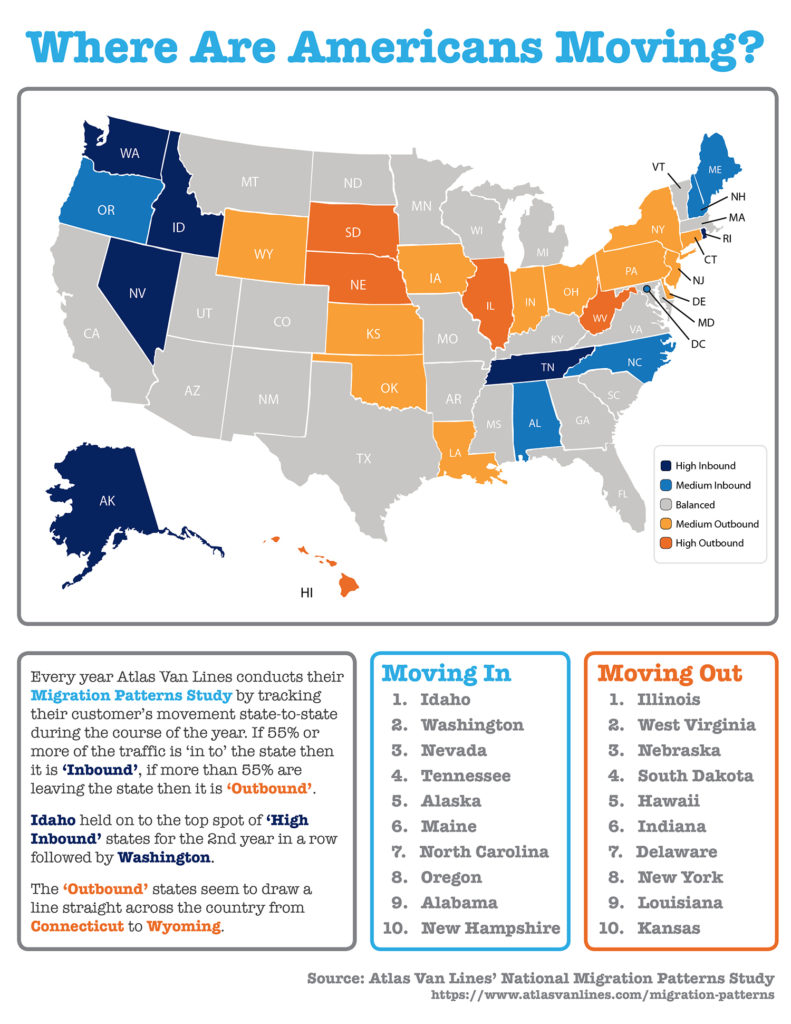

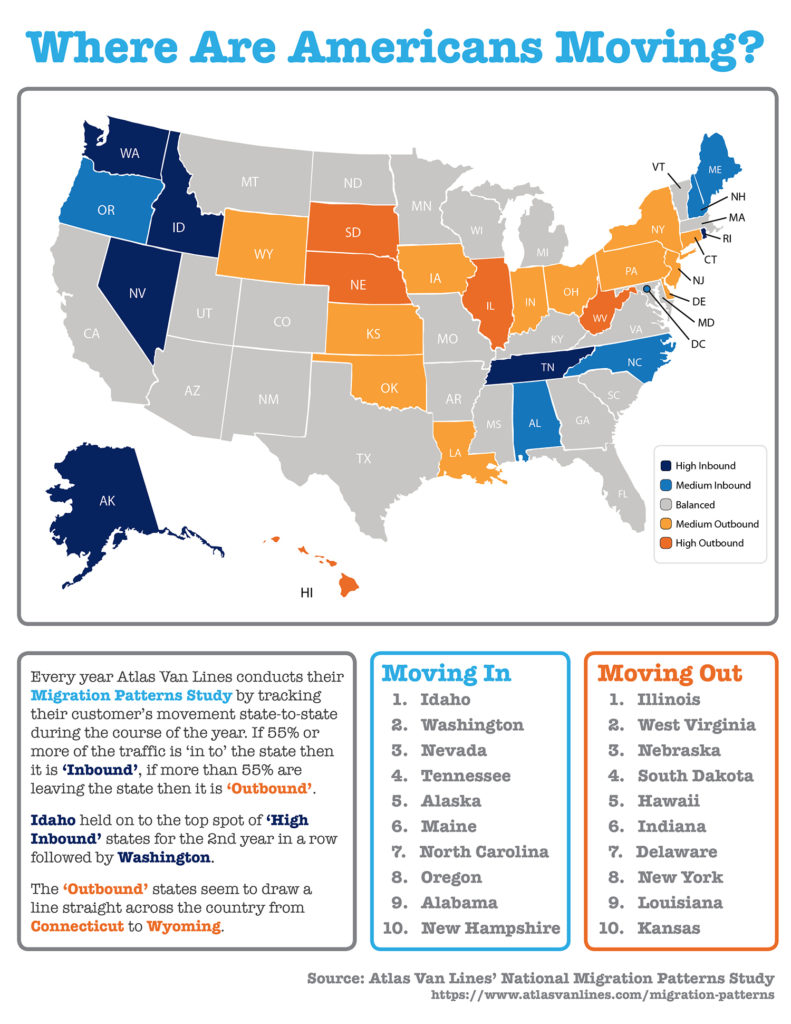

![Where Did Americans Move in 2017? [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/09171302/20180119-STM-Share.jpg)

Some Highlights:

- Atlas Van Lines recently released the results of their annual Migration Patterns Survey in which they tracked their customer’s movement from state-to-state over the course of 2017.

- Idaho held on to the top spot of ‘high inbound’ states for the 2nd year in a row followed by Washington.

- The ‘outbound’ states seem to draw a line straight across the country from Connecticut to Wyoming.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

January 18th, 2018 by Lum Hugh

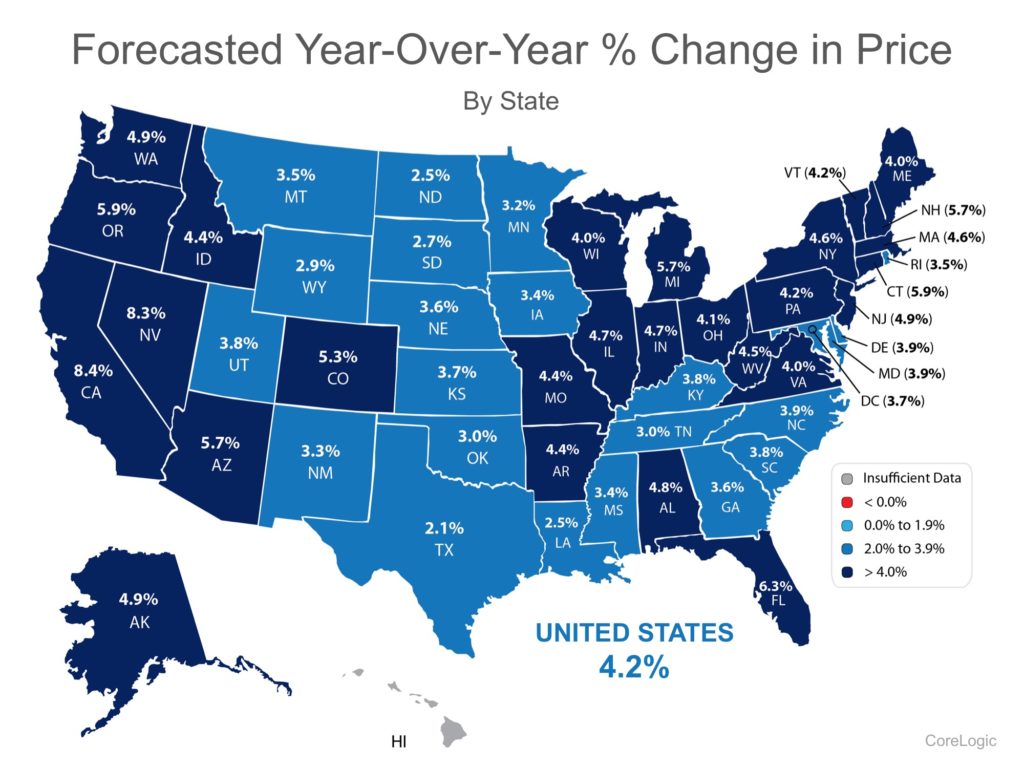

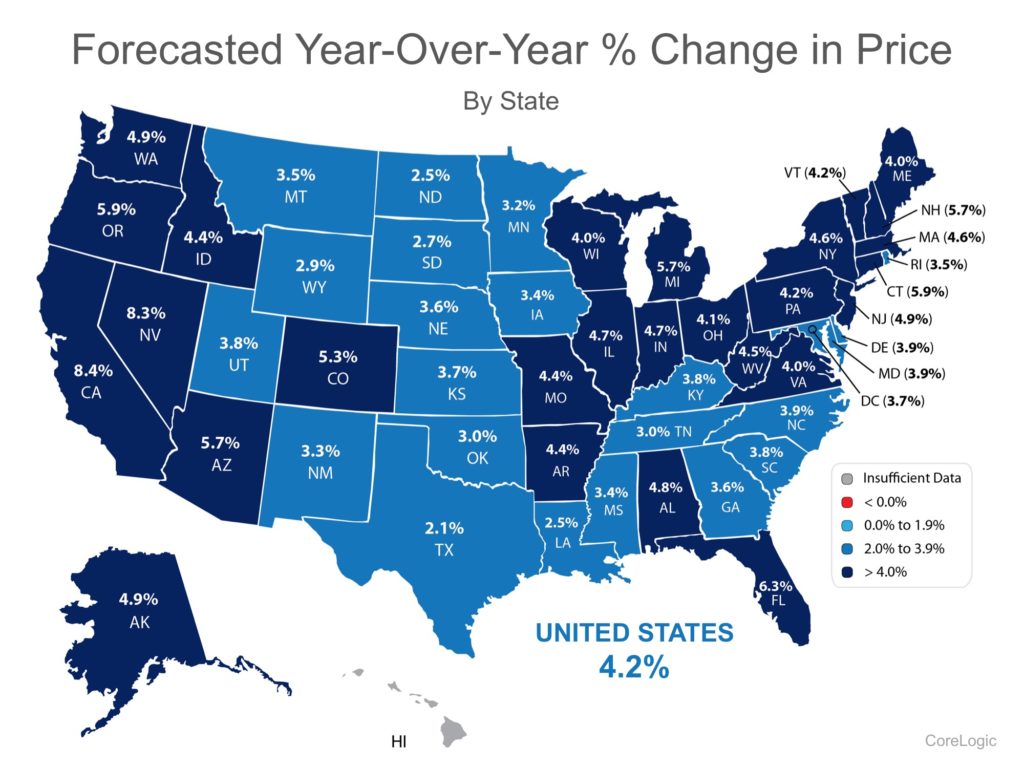

Every month, CoreLogic releases its Home Price Insights Report. In that report, they forecast where they believe residential real estate prices will be in twelve months.

Below is a map, broken down by state, reflecting how home values are forecasted to change by the end of 2018 using data from the most recent report.

As we can see, CoreLogic projects an increase in home values in 49 of 50 states, and Washington, DC (there was insufficient data for HI). Nationwide, they see home prices increasing by 4.2%.

How might the new tax code impact these numbers?

Recently, the National Association of Realtors (NAR) conducted their own analysis to determine the impact the new tax code may have on home values. NAR’s analysis:

“…estimated how home prices will change in the upcoming year for each state, considering the impact of the new tax law and the momentum of jobs and housing inventory.”

Here is a map based on NAR’s analysis:

Bottom Line

According to NAR, the new tax code will have an impact on home values across the country. However, the effect will be much less significant than what some originally thought.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, Pricing

January 17th, 2018 by Lum Hugh

According to the National Association of Realtors’ latest Realtors Confidence Index, 61% of first-time homebuyers purchased their homes with down payments below 6% from October 2016 through November 2017.

Many potential homebuyers believe that a 20% down payment is necessary to buy a home and have disqualified themselves without even trying. The median down payment for all buyers in 2017 was just 10% and that percentage drops to 6% for first-time buyers.

Zillow Senior Economist Aaron Terrazas’ recent comments shed light on why buyer demand has remained strong,

“Looking into 2018, rent is expected to continue gaining. More widespread rent growth could mean home buying demands stay high, as renters who can afford it move away from the unpredictability of rising rents toward the relative stability of a monthly mortgage payment instead.”

It’s no surprise that with rents rising, more and more first-time buyers are taking advantage of low-down-payment mortgage options to secure their monthly housing costs and finally attain their dream homes.

Bottom Line

If you are one of the many first-time buyers who is not sure if you would qualify for a low-down payment mortgage, let’s get together and set you on your path to homeownership!

Posted in Down Payments, First Time Home Buyers, For Buyers

January 16th, 2018 by Lum Hugh

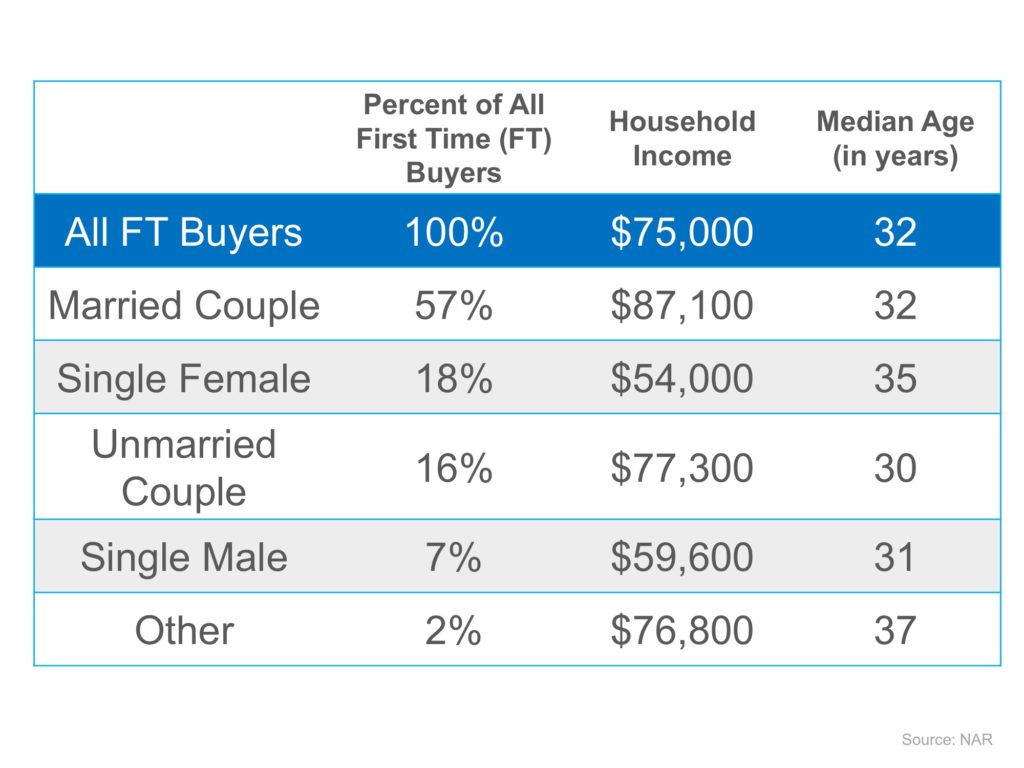

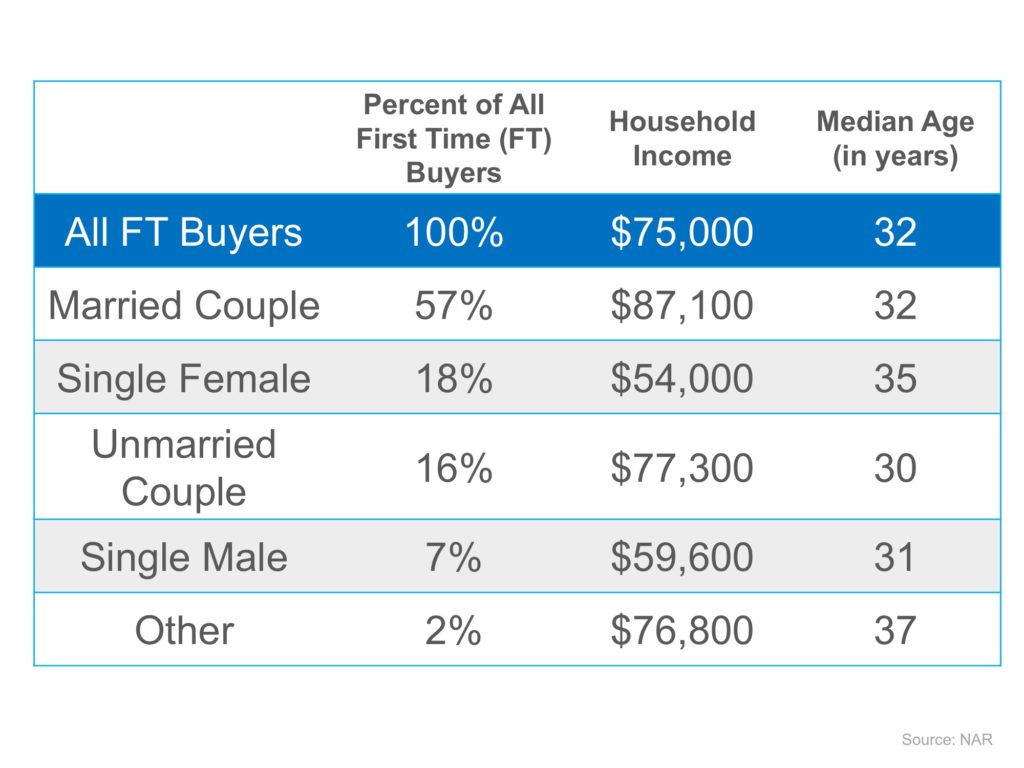

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family, others might think they are too young, and still, others might think their current income would never enable them to qualify for a mortgage.

We want to share what the typical first-time homebuyer actually looks like based on the National Association of REALTORS most recent Profile of Home Buyers & Sellers. Here are some interesting revelations on the first-time buyer:

Bottom Line

You may not be much different than many people who have already purchased their first homes. Let’s meet to determine if your dream home is within your grasp.

Posted in Demographics, First Time Home Buyers, For Buyers

January 12th, 2018 by LHugh

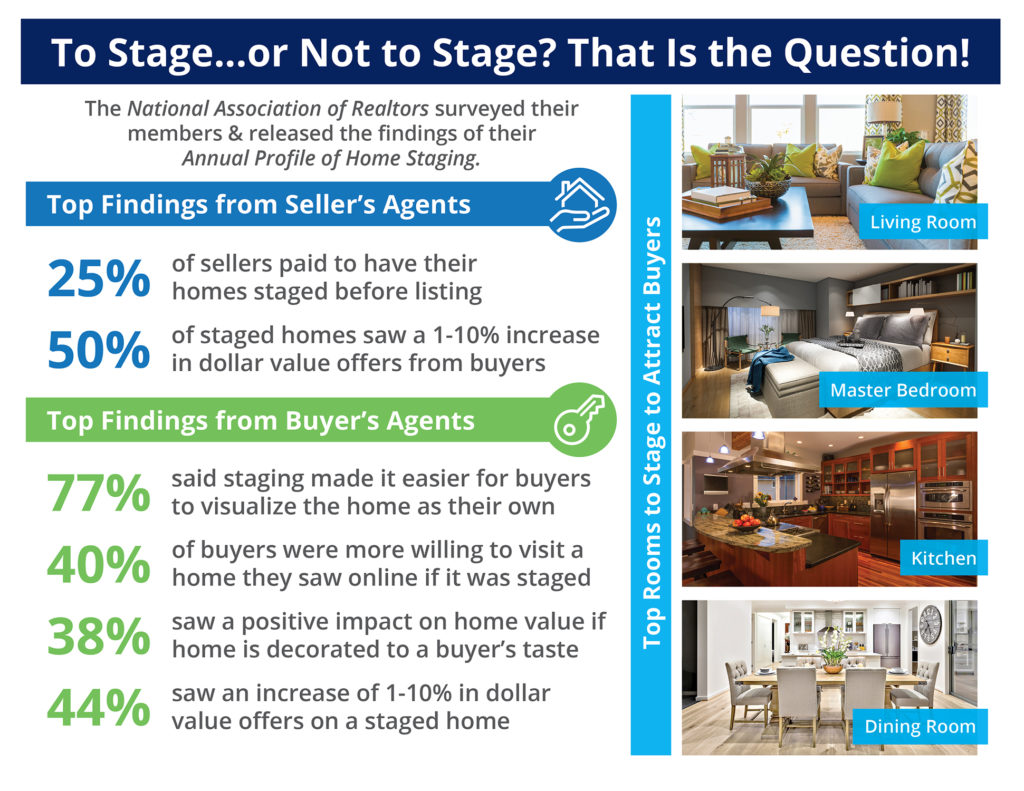

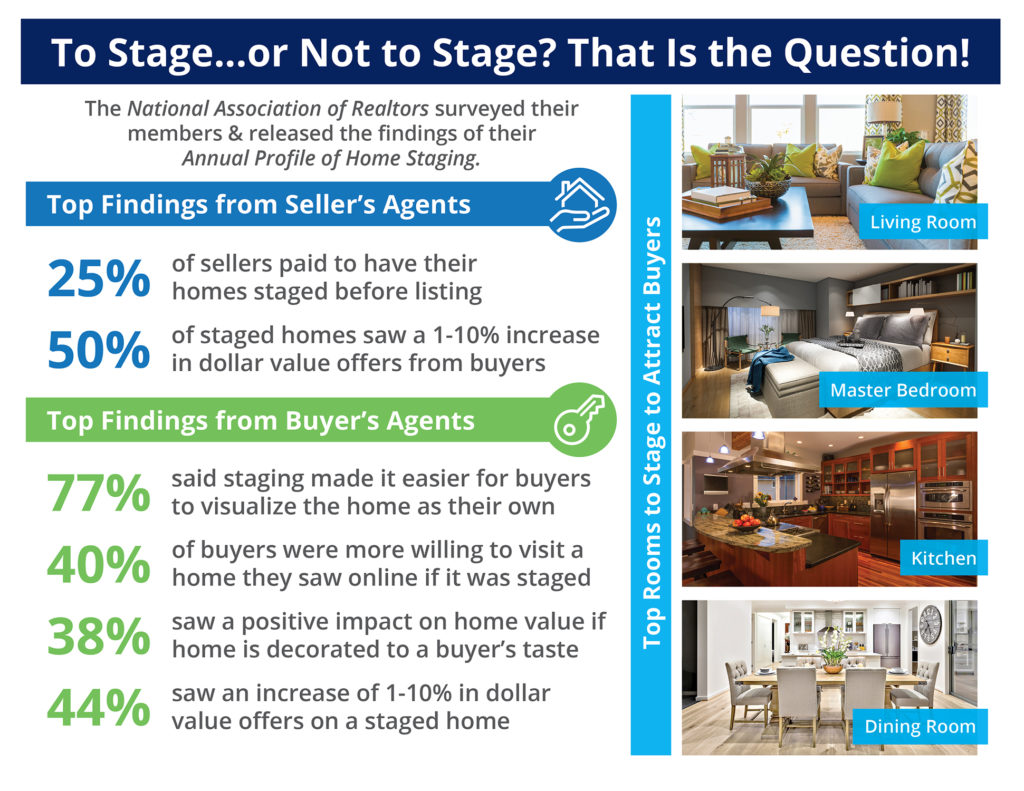

Some Highlights:

- The National Association of Realtors surveyed their members & released the findings of their Annual Profile of Home Staging.

- 50% of staged homes saw a 1-10% increase in dollar value offers from buyers.

- 77% of buyer’s agents said staging made it easier for buyers to visualize the home as their own.

- The top rooms to stage in order to attract more buyers are the living room, master bedroom, kitchen, and dining room.

Posted in For Buyers, Infographics, Move-Up Buyers

January 11th, 2018 by LHugh

Americans continue to believe that homeownership is important in achieving the American Dream. A recent survey by NeighborWorks America reported that:

“Owning a home remains a core element of the American Dream.”

When asked “How important a part of the American dream is owning a home?”

- 18% of those surveyed said it was the most important part

- 53% of those surveyed said it was very important

- 22% of those surveyed said it was somewhat important

Homeownership and Financial Stability

The survey also revealed that 81% of Americans believe that owning a home leads to a family being more financially stable. This feeling was reiterated by Zillow Senior Economist Aaron Terrazas who, in a recent press release, explained:

“After about a two-year slowdown, rent growth is starting to pick back up across the nation…Looking into 2018, rent is expected to continue gaining.

More widespread rent growth could mean home buying demands stay high, as renters who can afford it move away from the unpredictability of rising rents toward the relative stability of a monthly mortgage payment instead.” (emphasis added)

Bottom Line

Owning a home always has been, and always will be, a crucial part of attaining the American Dream.

Posted in First Time Home Buyers, For Buyers

![Where Did Americans Move in 2017? [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/09171302/20180119-STM-Share.jpg)