Category: For Buyers

January 10th, 2018 by LHugh

According to Ellie Mae’s latest Origination Report, the average FICO® Score on all closed loans dropped to 722 which is its lowest mark since April. The average includes all approved refinance and purchase loans.

FHA and VA loans showed the most opportunity for millennials looking to enter the market with low down payments and even lower FICO® Score requirements.

Ellie Mae’s Millennial Tracker revealed that those who purchased homes in December with an FHA Loan were able to do so with an average down payment of 4% and a FICO® Score of only 684.

Joe Tyrell, EVP of Corporate Strategy at Ellie Mae commented on the opportunity this brings to buyers,

“With the average credit score dipping, lenders are extending credit to borrowers who may have had no previous access to the housing market.”

Bottom Line

More and more potential buyers are able to qualify for a mortgage loan now! If you are debating a home purchase, let’s get together and evaluate your ability to buy today!

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

January 9th, 2018 by LHugh

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up, home sales are up, and distressed sales (foreclosures and short sales) have fallen to their lowest points in years. It seems that the market will continue to strengthen in 2018.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the winter, supply is not keeping up.

Here are the thoughts of a few industry experts on the subject:

National Association of Realtors

“Total housing inventory at the end of November dropped 7.2 percent to 1.67 million existing homes available for sale, and is now 9.7 percent lower than a year ago (1.85 million) and has fallen year-over-year for 30 consecutive months. Unsold inventory is at a 3.4-month supply at the current sales pace, which is down from 4.0 months a year ago.”

Joseph Kirchner, Senior Economist for Realtor.com

“The increases in single-family permits and starts show that builders are planning and starting new construction projects, that’s a good thing because it will help to relieve the shortage of homes on the market.”

Sam Khater, Deputy Chief Economist at CoreLogic

“Inventory is tighter than it appears. It’s much lower for entry-level buyers.”

Bottom Line

If you are thinking of selling, now may be the time. Demand for your house will be strong at a time when there is very little competition. That could lead to a quick sale for a really good price.

Posted in For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

January 5th, 2018 by LHugh

Some Highlights:

- Buyer demand continues to outpace the supply of homes for sale which means that buyers are often competing with one another for the few listings that are available!

- Housing inventory is still under the 6-month supply needed to sustain a normal housing market.

- Perhaps the time has come for you and your family to move on and start living the life you desire.

Posted in For Buyers, For Sellers, Infographics, Move-Up Buyers

January 4th, 2018 by LHugh

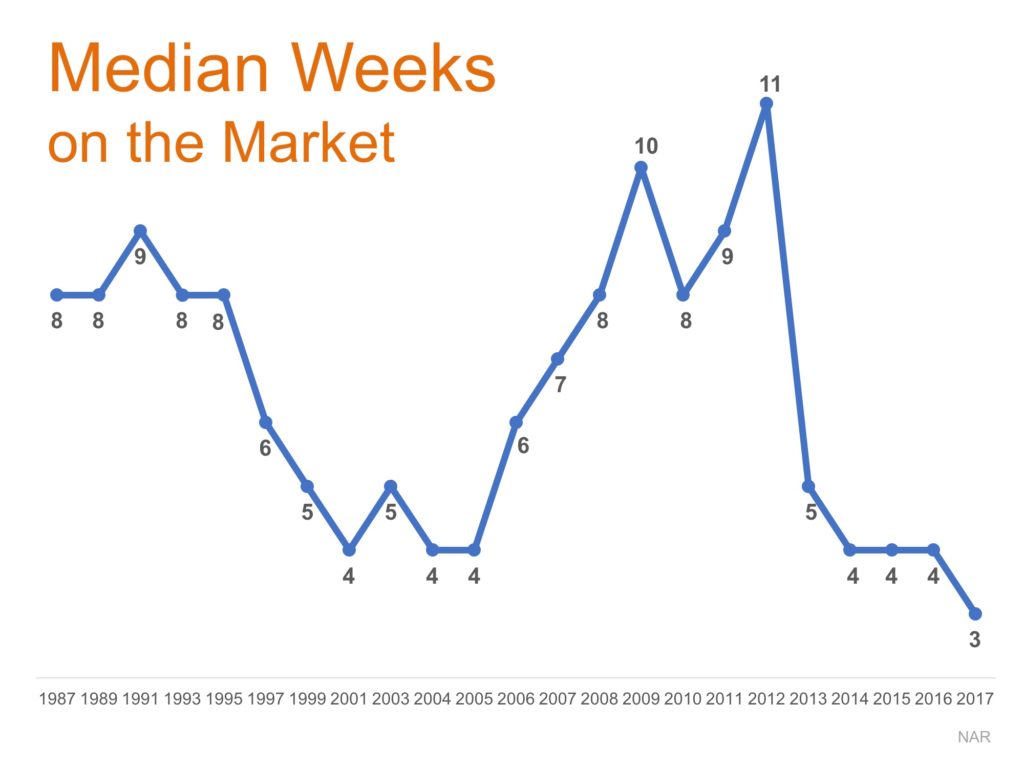

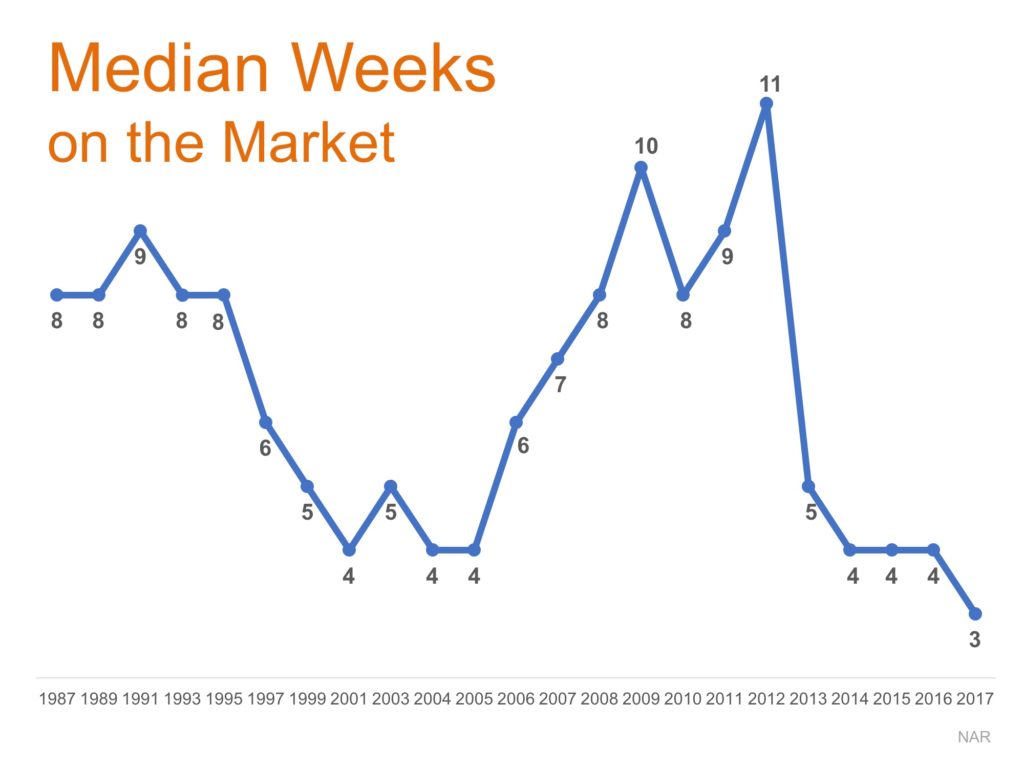

According to recently released data from the National Association of Realtors (NAR), the median amount of time a home spent on the market hit an all-time low of only three weeks in 2017.

Strong buyer demand, a good economy, and a low inventory of new and existing homes for sale created the perfect storm to accelerate the time between listing and signing a contract. The time needed to sell a home has dropped substantially since its highest mark of 11 weeks in 2012.

The chart below shows the median weeks on the market from 1987 to today.

Bottom Line

If you are a homeowner who is debating whether or not to list your home for sale, know that national market conditions are primed for a quick turnaround! Let’s get together to discuss exactly what’s going on in our area, today!

Posted in For Buyers, For Sellers, Move-Up Buyers

January 3rd, 2018 by LHugh

Homeownership is a major part of the American Dream. As evidence of that, 91% of Americans believe that owning a home is either essential (43%) or important (48%) to achieving that “dream.” In a market where some people may be unsure about the benefits and possibilities of buying a home, it is important that we remember this.

Homeownership is NOT just about the money. In fact, some of the major benefits are non-financial. Here are a few of those benefits as per the National Association of Realtors:

- Consistent findings show that homeownership does make a significant positive impact on educational achievement.

- Several researchers have found that homeowners tend to be more involved in their communities than renters.

- Early studies of homeownership and health outcomes found that homeowners and children of homeowners are generally happier and healthier than non-owners, even after controlling for factors such as income and education levels that are also associated with positive health outcomes and positively correlated with homeownership.

Bottom Line

Homeownership means something more to people and their families than just the financial considerations.

Posted in First Time Home Buyers, For Buyers, Rent vs. Buy

January 2nd, 2018 by LHugh

Over the next five years, home prices are expected to appreciate on average by 3.35% per year and to grow by 24.34% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

As an example, let’s assume a young couple purchases and closes on a $250,000 home this month (January). If we only look at the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Since the experts predict that home prices will increase by 4.2% in 2018, the young homeowners will have gained $10,500 in equity in just one year.

Over a five-year period, their equity will increase by nearly $45,000! This figure does not even take into account their monthly principal mortgage payments. In many cases, home equity is one of the largest portions of a family’s overall net worth.

Bottom Line

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, find out if you are able to today!

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers

December 29th, 2017 by Lum Hugh

![Buying or Selling in 2018? 5 Reasons to Resolve to Hire a Pro [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2017/12/19171354/20171229-Share-STM.jpg)

Some Highlights:

- As we usher in the new year, one thing is for certain… if you plan to buy or sell a house this year, you need a real estate professional on your team!

- There are many benefits to using a local professional!

- Pick a professional who knows your local market and can help you achieve your dreams!

Posted in First Time Home Buyers, For Buyers, For Sellers, Infographics, Move-Up Buyers

December 28th, 2017 by Lum Hugh

What truly causes a housing bubble and the inevitable crash? For the best explanation, let’s go to a person who correctly called the last housing bubble – a year before it happened.

“A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation…Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the ‘bubble’ bursts.

I have taken to calling the housing market a ‘bubble’.”

– Bill McBride of Calculated Risk calling the bubble back in April 2005

Where do we stand today regarding speculation?

There are two measurements that are used to determine the speculation in a housing market:

- The number of homes purchased by an investor and

- The number of homes being flipped (resold within a twelve-month period)

As compared to 2005, investor purchases are down dramatically (from 23% to 13%) and so is flipping (from 8.2% to 5.7%). McBride explains:

“There is currently some flipping activity, but this is more the normal type of flipping (buy, improve and then sell). Back in 2005, people were just buying homes and letting them sit vacant – and then selling without significant improvements. Classic speculation.”

What are the experts saying about speculation in today’s market?

DSNews recently ran an article which asked two economists to compare the speculation in today’s market to that in 2005-2007. Here is what they said:

Dr. Eddie Seiler, Chief Housing Economist at Summit Consulting:

“The speculative ‘flipping mania’ of 2006 is absent from most metro areas.”

Tian Liu, Chief Economist of Genworth Mortgage Insurance:

“The nature of housing demand is different as well, with more potential homeowners and far fewer speculators in the housing market compared to the 2005-2007 period.”

And what does McBride, who called the last housing bubble, think about today’s real estate market?

Sixty days ago, he explained:

“In 2005, people were just buying homes and letting them sit vacant – and then selling without significant improvements. Classic speculation. And even more dangerous during the bubble was the excessive use of leverage (all those poor-quality loans). Currently lending standards are decent, and loan quality is excellent…

I wouldn’t call house prices a bubble – and I don’t expect house prices to decline nationally like during the bust.”

Bottom Line

Speculation is a major element of the housing bubble formula. Right now, there are not elevated percentages of investors and house flippers. Therefore, there is not an elevated rate of speculation.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

December 27th, 2017 by Lum Hugh

We often talk about the financial reasons why buying a home makes sense. But, more often than not, the emotional reasons are the more powerful or compelling reasons.

No matter what shape or size your living space is, the concept and feeling of home can mean different things to different people. Whether it’s a certain scent or a favorite chair, the emotional reasons why we choose to buy our own homes are typically more important to us than the financial ones.

1. Owning your home offers stability to start and raise a family

From the best neighborhoods to the best school districts, even those without children at the time of purchase may have this in the back of their minds as a major reason for choosing the location of the home that they purchase.

2. There’s no place like home

Owning your own home offers you not only safety and security, but also a comfortable place that allows you to relax after a long day!

3. You have more space for you and your family

Whether your family is expanding, an older family member is moving in, or you need to have a large backyard for your pets, you can take this all into consideration when buying your dream home!

4. You have control over renovations, updates, and style

Looking to actually try one of those complicated wall treatments that you saw on Pinterest? Tired of paying an additional pet deposit for your apartment building? Or maybe you want to finally adopt that puppy or kitten you’ve seen online 100 times? Who’s to say that you can’t in your own home?

Bottom Line

Whether you are a first-time homebuyer or a move-up buyer who wants to start a new chapter in your life, now is a great time to reflect on the intangible factors that make a house a home.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Rent vs. Buy

December 22nd, 2017 by Lum Hugh

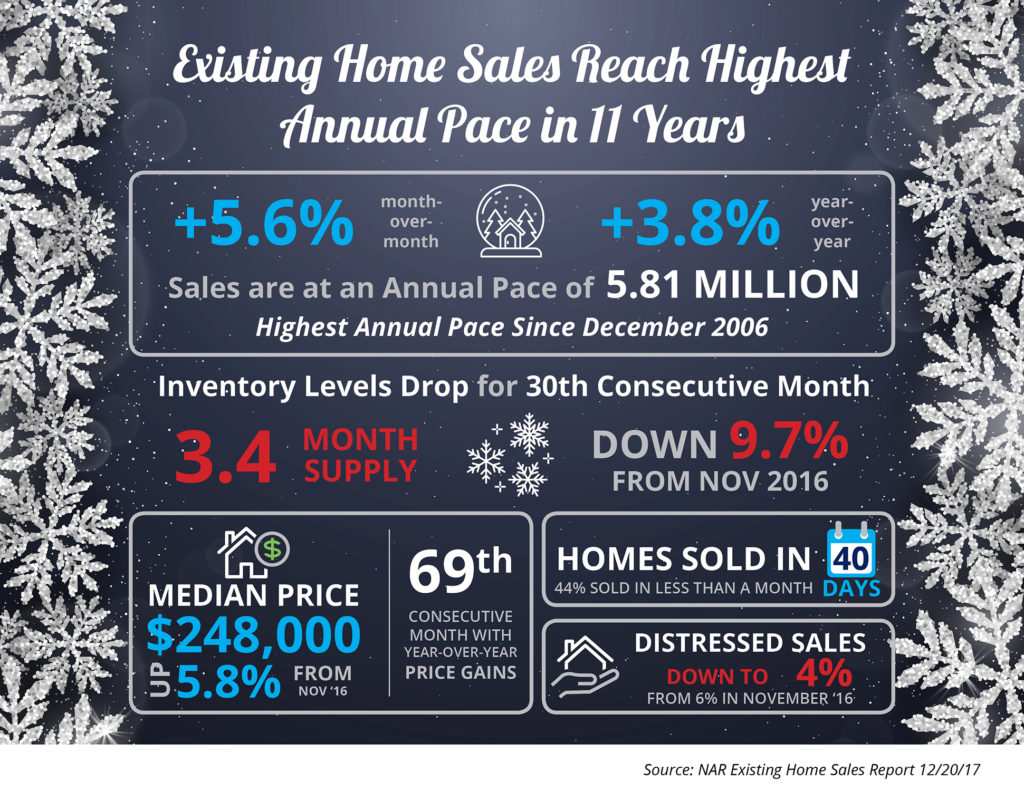

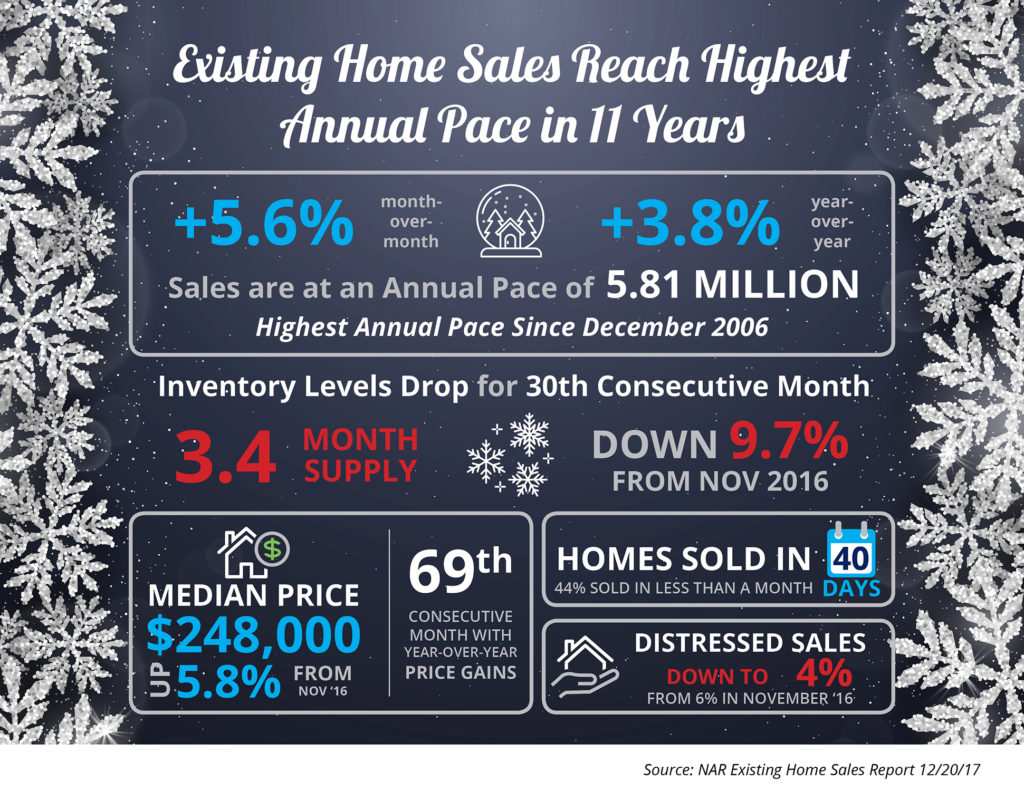

Some Highlights:

- Existing home sales are currently at an annual pace of 5.81 million, the highest pace since December 2006.

- The inventory of existing homes for sale has dropped year-over-year for the last 30 consecutive months and is now at a 3.4-month supply.

- NAR’s Chief Economist Lawrence Yun had this to say: “Faster economic growth in recent quarters, the booming stock market and continuous job gains are fueling substantial demand for buying a home as 2017 comes to an end.”

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

![Buying or Selling in 2018? 5 Reasons to Resolve to Hire a Pro [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2017/12/19171354/20171229-Share-STM.jpg)