Category: Housing Market Updates

February 22nd, 2018 by Lum Hugh

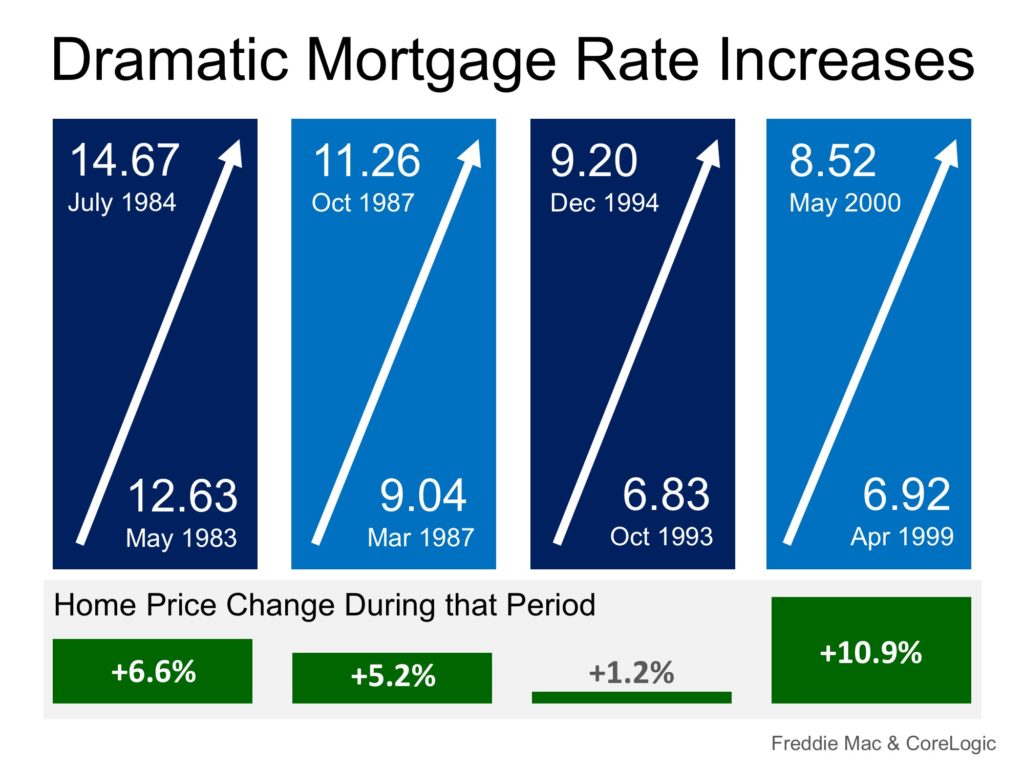

Mortgage interest rates have already risen by over a quarter of a percentage point in 2018. Many are projecting that rates could increase to 5% by the end of the year.

What impact will rising rates have on house values?

Many quickly jump to the conclusion that an increase in mortgage rates will have a detrimental impact on real estate prices as fewer buyers will be able to qualify for a loan. This seems logical; if there is less demand for housing then prices will drop.

However, in a good economy, rising mortgage rates increase demand as many prospective purchasers immediately jump off the fence to guarantee they get the lower rate.

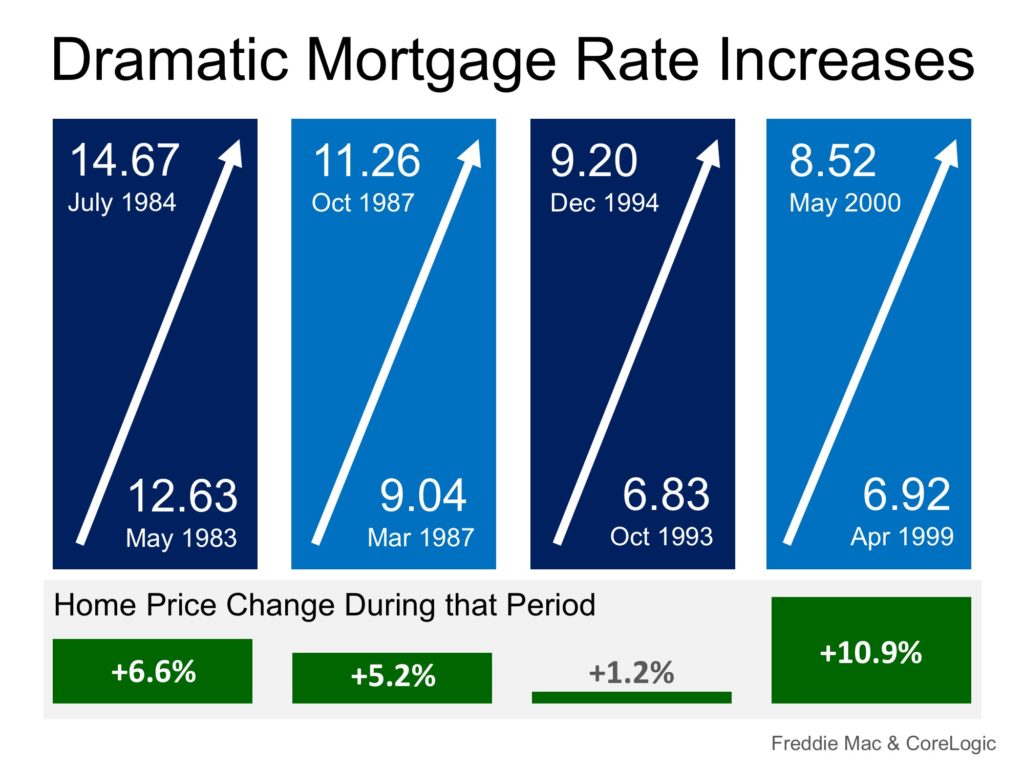

Let’s look at home prices the last four times mortgage rates increased dramatically.

In each case, home prices APPRECIATED and did not depreciate. No one is projecting as dramatic an increase in rates as the examples above. Most are projecting an increase of approximately 1% by the end of the year.

The last time mortgage rates increased by 1% over a twelve-month period was January 2013 (3.41%) to January 2014 (4.43%). What happened to house prices during that span? They appreciated by 9.8%.

Just two weeks ago, Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting explained:

“Mortgage rates have risen 1% or more ten times in the last 43 years, with little impact on home sales and prices when the economy was also strong…Historically, rising confidence, solid job growth, and higher wages have more than offset reduced demand for housing resulting from higher mortgage rates.”

Bottom Line

When mortgage rates increase, history has shown that prices appreciate (and do not depreciate) during that same time span.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Interest Rates, Move-Up Buyers, Pricing

February 15th, 2018 by Lum Hugh

There has been tremendous volatility in certain markets over the last few weeks (for example, the stock and currency markets). When this happens, some tend to lump all of their investments together and create an almost ‘Armageddon’ scenario where everything loses value quickly and dramatically. Real estate is an investment that can get caught up in this hysteria. Does the concern about the current housing market have merit?

Financial advisors have been warning us for months that the stock market was ripe for a “correction.”

Experts have been questioning the value of alternative currencies for over a year.

In contrast, here are the opinions of three major players in the residential housing market:

Ralph DeFranco, Chief Economist, Arch Capital Services Inc.

“It’s premature to worry about a housing bubble. The typical warning signs – excessive debt levels, poor quality loans, exponentially increasing home prices, rising vacancy rates and/or poor affordability compared to the past, and a high number of internet searches on house flipping – are not present.”

Liu-Down, Genworth Chief Economist

“My thoughts on many recent discussions of ‘housing bubble’ – the bar for a housing bubble is higher than just prices being above some fundamental value. There must be widespread behavior change as well such as higher levels of fraud and speculation.”

Fitch Report

“US home prices are on track for a 5% nominal gain for the 4th consecutive year, returning national prices to their highest level since 2007. The growth has been driven by historically low mortgage rates and unemployment plus solid population and personal income growth rates…a meaningful correction should only be triggered by an unexpected economic shock.”

Bottom Line

Speculation has driven certain markets over the last year. However, it has not been speculation, but instead people’s desire for homeownership, that has driven the real estate market.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

February 8th, 2018 by Lum Hugh

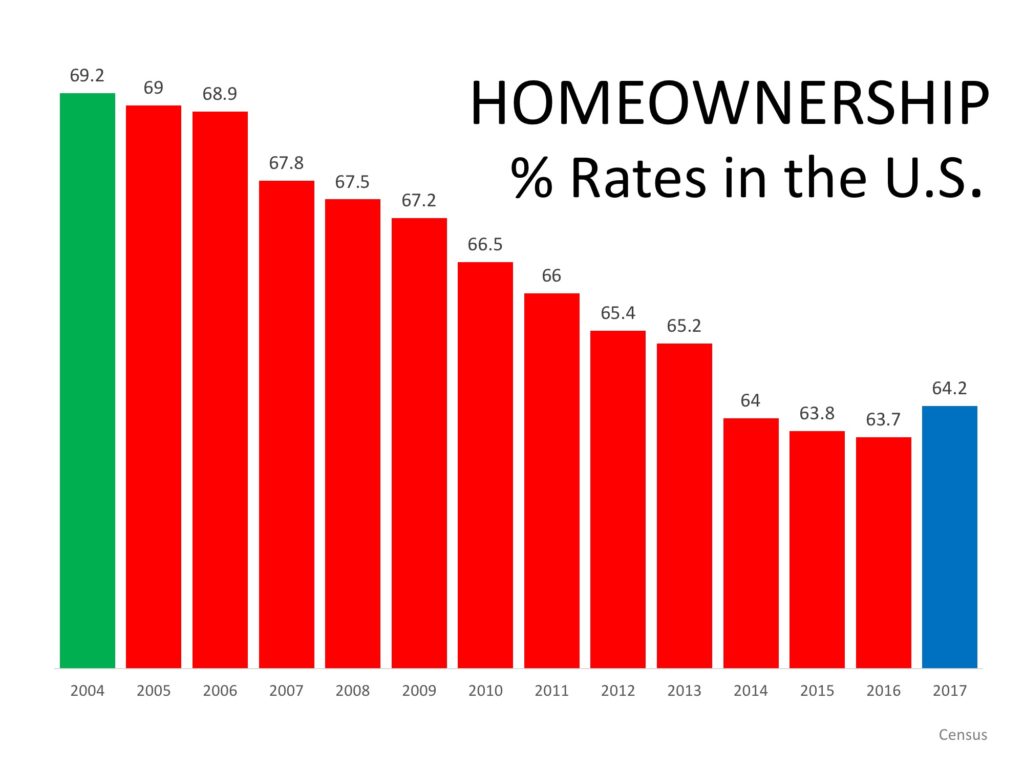

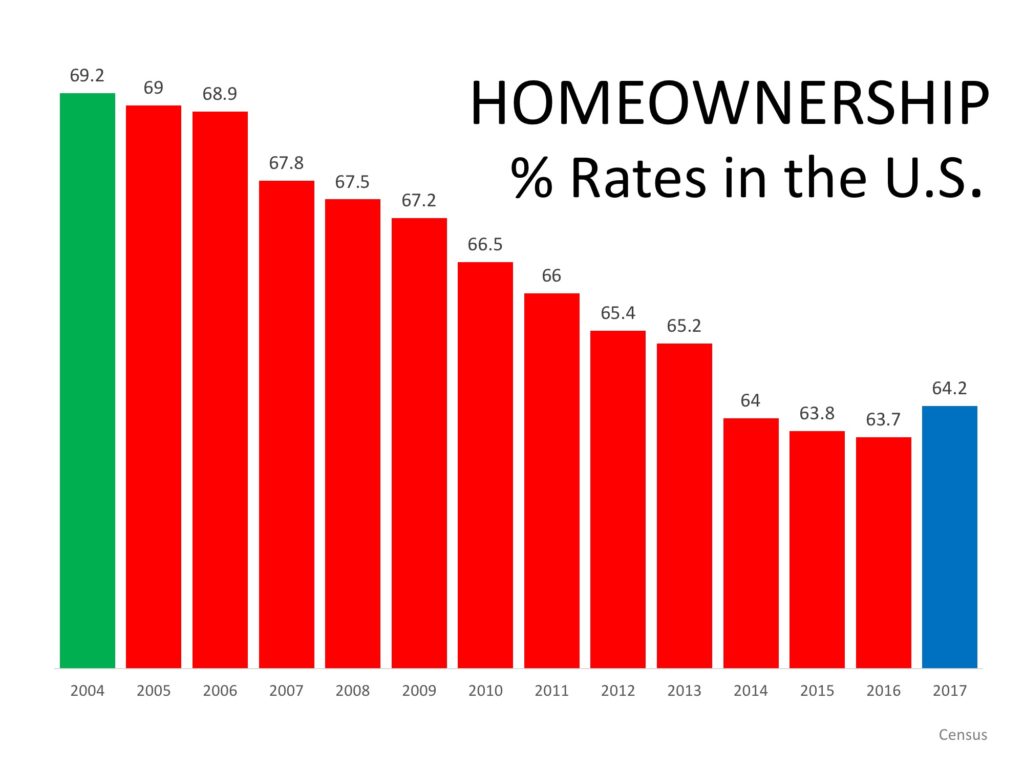

The famous quote by Mark Twain in the title of this article can be used to describe homeownership in America today. Last week, the Census revealed that the percentage of homeowners in the country increased for the first time in thirteen years.

A story in the Wall Street Journal gave these new homeownership numbers some context:

“The annual increase marks a crucial turning point because it comes after the federal government reined in bubble-era policies that encouraged banks to ease lending standards to boost homeownership. This time, what’s driving the market is a shift in favor of owning rather than renting.

‘This is market, market and market…There’s no government incentive program in sight that is having this effect,’ said Susan Wachter, a professor of real estate and finance at the Wharton School at the University of Pennsylvania, ‘This is back to basics.’”

In a separate report comparing the rental population in America to the homeowner population, RentCafé also concluded that the gap is now shrinking.

“Undoubtedly, the recession had a great impact on homeownership…However, it looks like it takes more to discourage Americans from buying a house than that.

As the years go by, it seems more and more certain that the fact that renting has seen a sudden gain in popularity is more a reaction to the economic crisis than a paradigm shift in the Americans’ attitude toward housing.”

America’s belief in homeownership was also evidenced in a recent survey by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not important

Bottom Line

Homeownership has been, is and will always be a crucial element of the American Dream.

*Pictured Above – Mark Twain’s home in Hartford, Connecticut.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

January 29th, 2018 by Lum Hugh

Every winter, families across the country decide if this will be the year that they sell their current houses and move into their dream homes.

Mortgage rates hovered around 4% for all of 2017 which forced many buyers off the fence and into the market, resulting in incredibly strong demand RIGHT NOW!

At the same time, however, inventory levels of homes for sale have dropped dramatically as compared to this time last year.

Trulia reported that “in Q4 2017, U.S. home inventory decreased by 10.5%. That is the biggest drop we’ve seen since Q2 2013.”

Here is a chart showing the decrease in inventory levels by category:

The largest drop in inventory was in the starter home category which saw a 19% dip in listings.

Bottom Line

Demand for your home is very strong right now while your competition (other homes for sale) is at a historically low level. If you are thinking of selling in 2018, now may be the perfect time.

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

January 25th, 2018 by Lum Hugh

Definitely an aggressive headline. However, as the final data on the 2017 housing market rolls in, we can definitely say one thing: If you are considering selling, IT IS TIME TO LIST YOUR HOME!

How did we finish 2017?

- New-home sales were at their highest level in a decade.

- Sales of previously owned homes were at their highest level in more than a decade.

- Starts of single-family homes were their strongest in a decade and applications to build such properties advanced to the fastest pace since August 2007.

And Bloomberg Business just reported:

“America’s housing market is gearing up for a robust year ahead. Builders are more optimistic, demand is strong and lean inventory is keeping prices elevated.”

And the National Association of Realtors revealed that buyer traffic is stronger this winter than it was during the spring buying season last year.

The only challenge to the market is a severe lack of inventory. A balanced market would have a full six-month supply of homes for sale. Currently, there is less than a four-month supply of inventory. This represents a decrease in supply of 9.7% from the same time last year.

Bottom Line

With demand increasing and supply dropping, this may be the perfect time to get the best price for your home. Let’s get together to see whether that is the case in your neighborhood.

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

January 19th, 2018 by Lum Hugh

![Where Did Americans Move in 2017? [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/09171302/20180119-STM-Share.jpg)

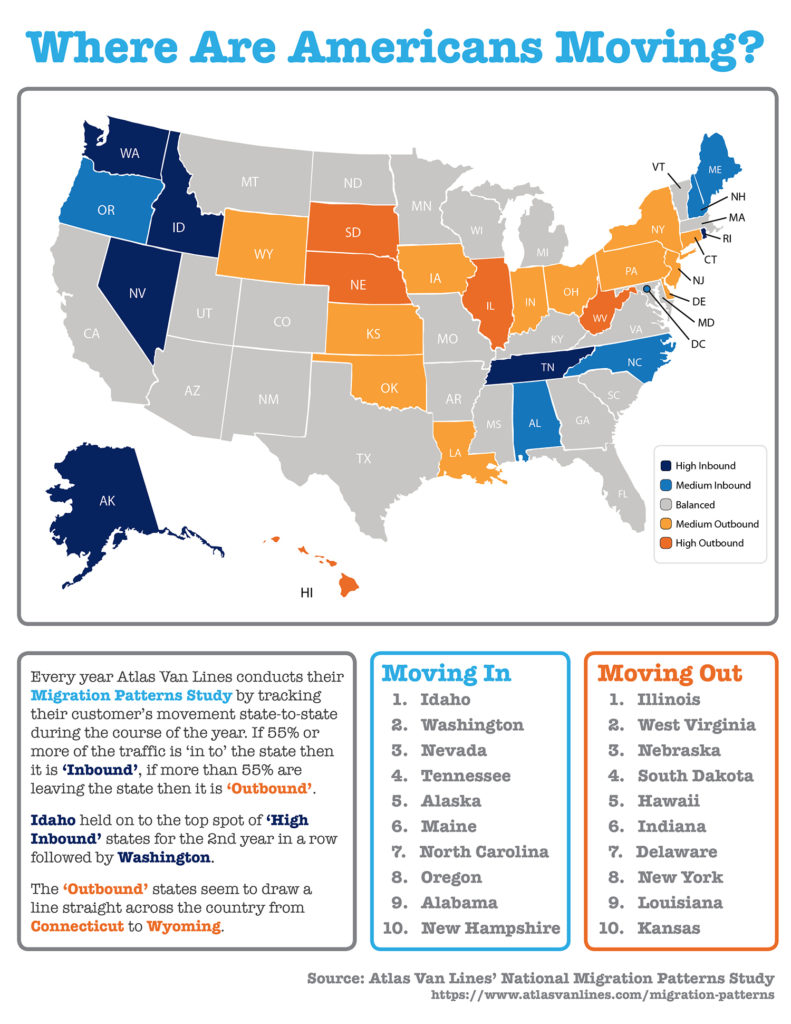

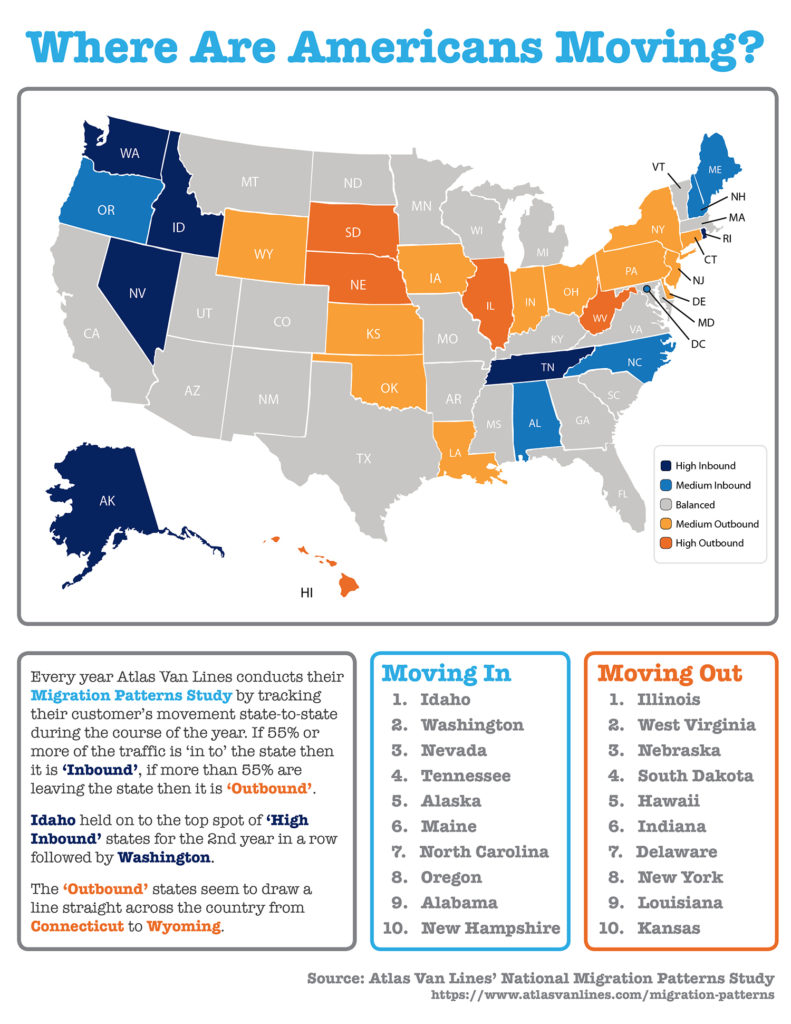

Some Highlights:

- Atlas Van Lines recently released the results of their annual Migration Patterns Survey in which they tracked their customer’s movement from state-to-state over the course of 2017.

- Idaho held on to the top spot of ‘high inbound’ states for the 2nd year in a row followed by Washington.

- The ‘outbound’ states seem to draw a line straight across the country from Connecticut to Wyoming.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

January 18th, 2018 by Lum Hugh

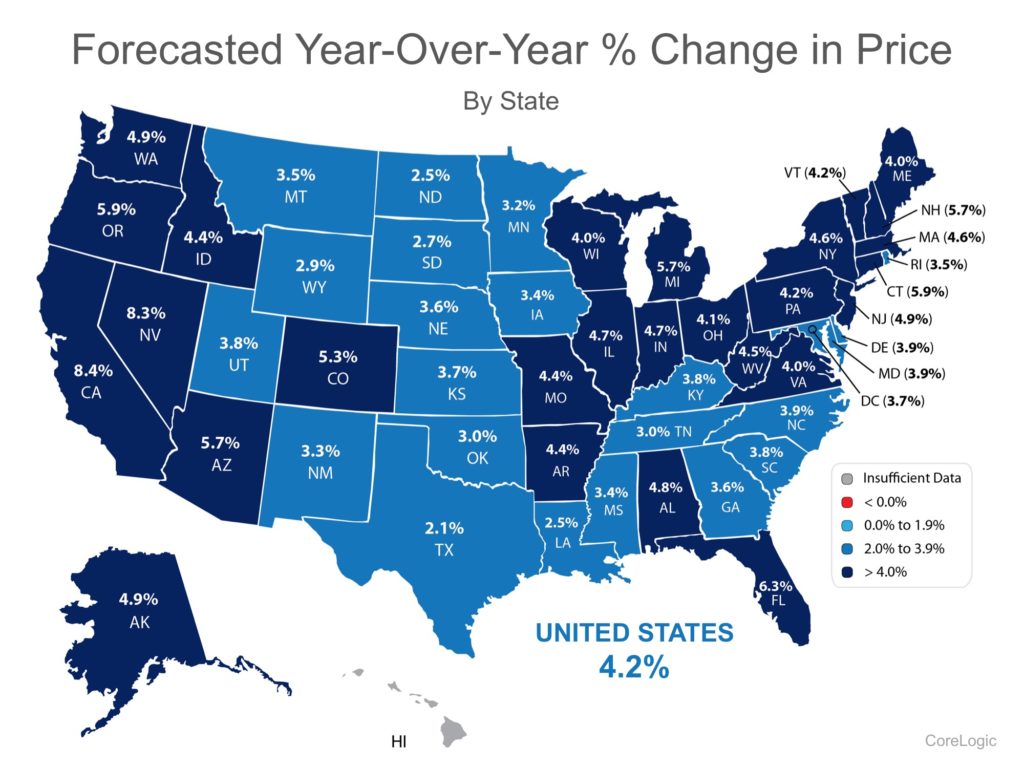

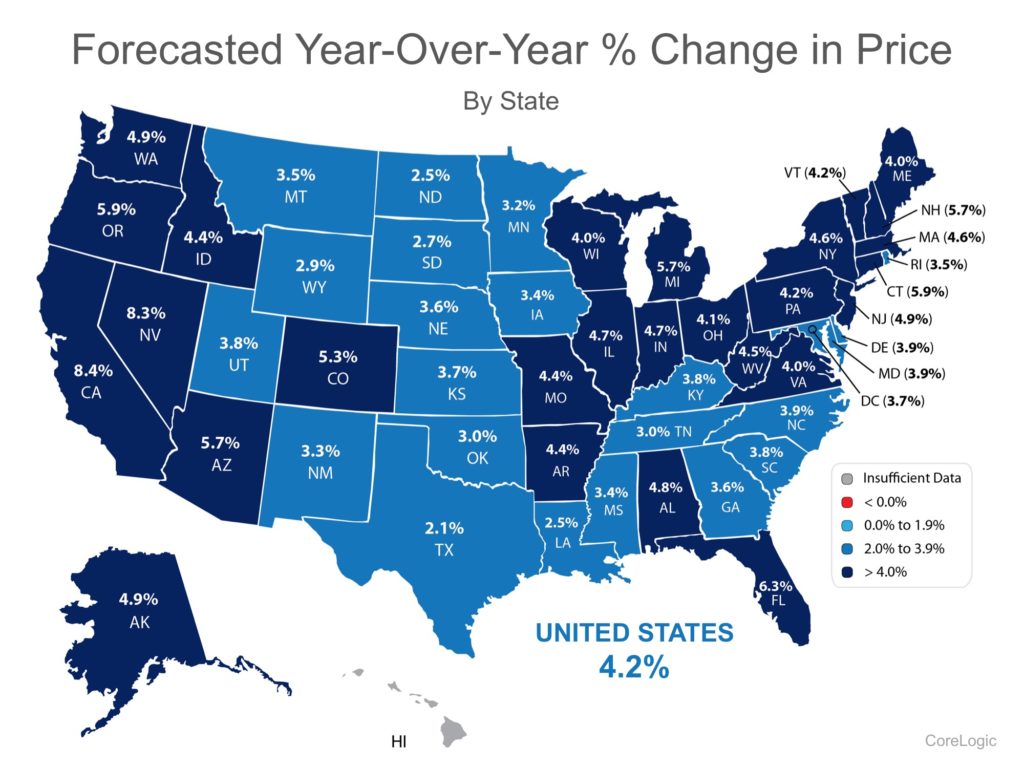

Every month, CoreLogic releases its Home Price Insights Report. In that report, they forecast where they believe residential real estate prices will be in twelve months.

Below is a map, broken down by state, reflecting how home values are forecasted to change by the end of 2018 using data from the most recent report.

As we can see, CoreLogic projects an increase in home values in 49 of 50 states, and Washington, DC (there was insufficient data for HI). Nationwide, they see home prices increasing by 4.2%.

How might the new tax code impact these numbers?

Recently, the National Association of Realtors (NAR) conducted their own analysis to determine the impact the new tax code may have on home values. NAR’s analysis:

“…estimated how home prices will change in the upcoming year for each state, considering the impact of the new tax law and the momentum of jobs and housing inventory.”

Here is a map based on NAR’s analysis:

Bottom Line

According to NAR, the new tax code will have an impact on home values across the country. However, the effect will be much less significant than what some originally thought.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, Pricing

January 9th, 2018 by LHugh

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up, home sales are up, and distressed sales (foreclosures and short sales) have fallen to their lowest points in years. It seems that the market will continue to strengthen in 2018.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the winter, supply is not keeping up.

Here are the thoughts of a few industry experts on the subject:

National Association of Realtors

“Total housing inventory at the end of November dropped 7.2 percent to 1.67 million existing homes available for sale, and is now 9.7 percent lower than a year ago (1.85 million) and has fallen year-over-year for 30 consecutive months. Unsold inventory is at a 3.4-month supply at the current sales pace, which is down from 4.0 months a year ago.”

Joseph Kirchner, Senior Economist for Realtor.com

“The increases in single-family permits and starts show that builders are planning and starting new construction projects, that’s a good thing because it will help to relieve the shortage of homes on the market.”

Sam Khater, Deputy Chief Economist at CoreLogic

“Inventory is tighter than it appears. It’s much lower for entry-level buyers.”

Bottom Line

If you are thinking of selling, now may be the time. Demand for your house will be strong at a time when there is very little competition. That could lead to a quick sale for a really good price.

Posted in For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

January 8th, 2018 by LHugh

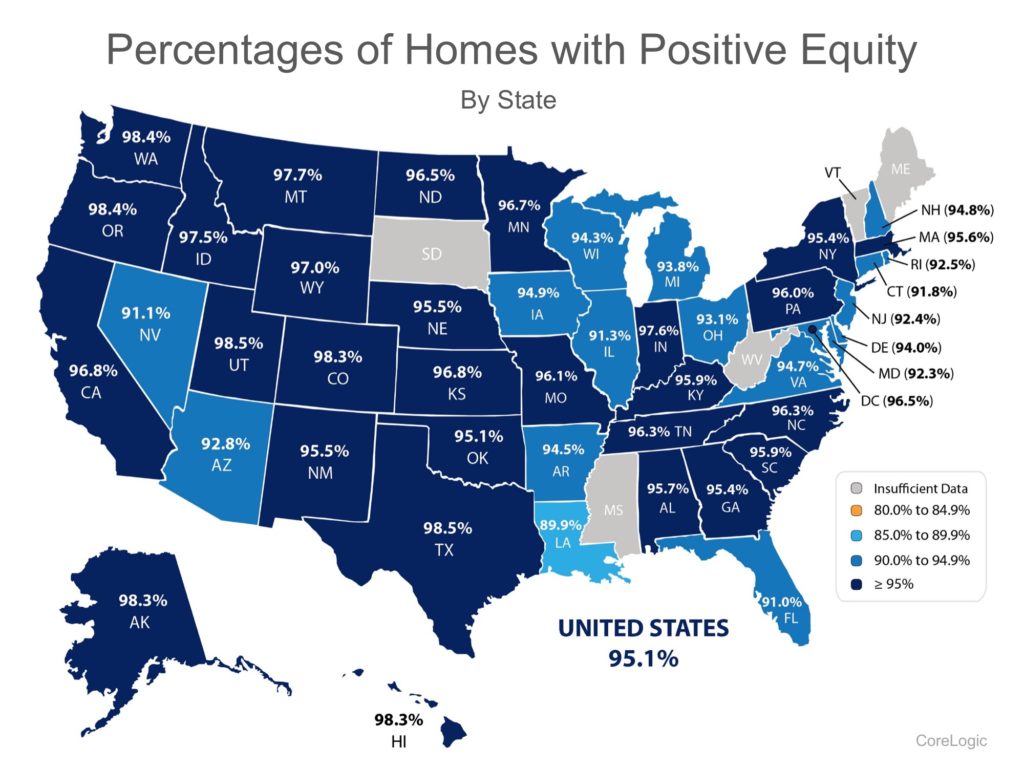

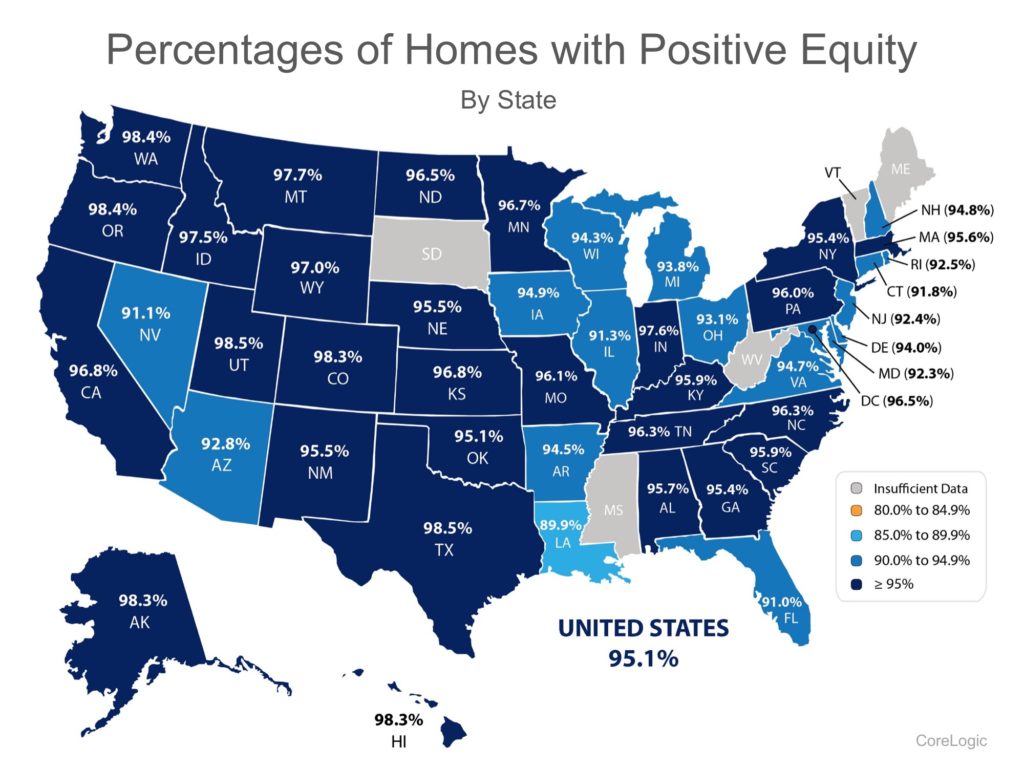

CoreLogic’s latest Equity Report revealed that “over the past 12 months, 712,000 borrowers moved into positive equity.” This is great news, as the share of homeowners with negative equity (those who owe more than their home is worth), has dropped more than 20% since the peak in Q4 of 2009 (26%) to 4.9% today.

The report also revealed:

- The average homeowner gained approximately $14,900 in equity during the past year.

- Compared to Q3 2016, negative equity decreased 22% from 3.2 million homes, or 6.3% of all mortgaged properties.

- U.S. homeowners with mortgages (roughly 63% of all homeowners) have seen their equity increase by a total of $870.6 billion since Q3 2016, an increase of 11.8%, year-over-year.

The map below shows the percentage of homes by state with a mortgage and positive equity. (The states in gray have insufficient data to report.)

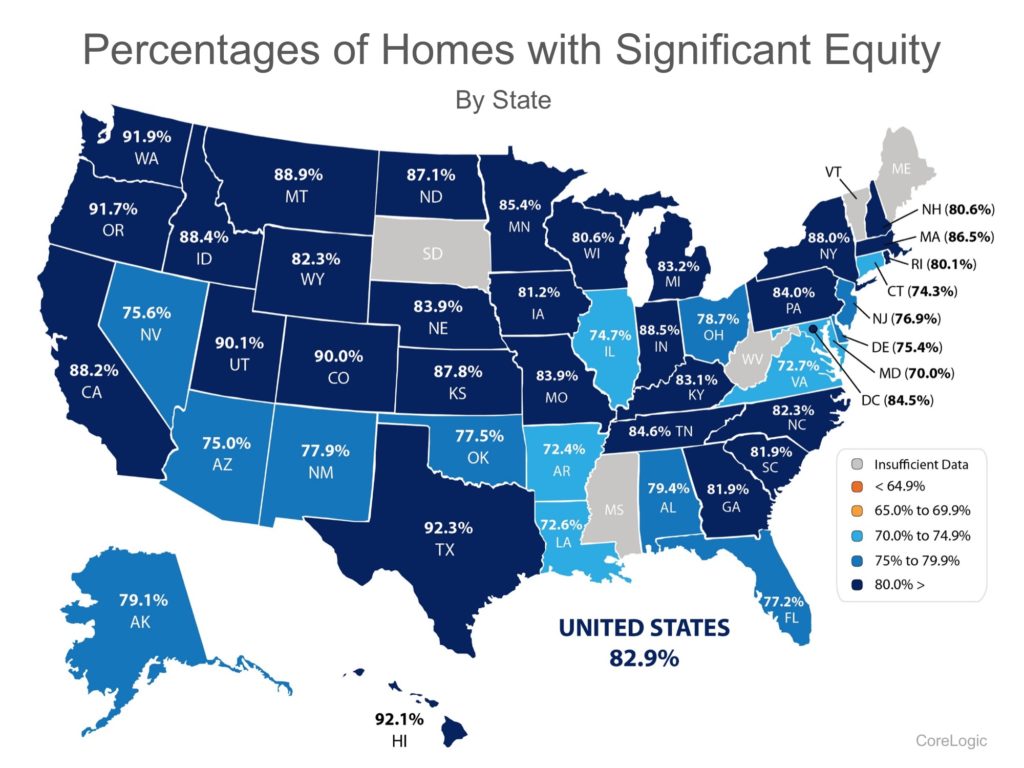

Significant Equity Is on The Rise

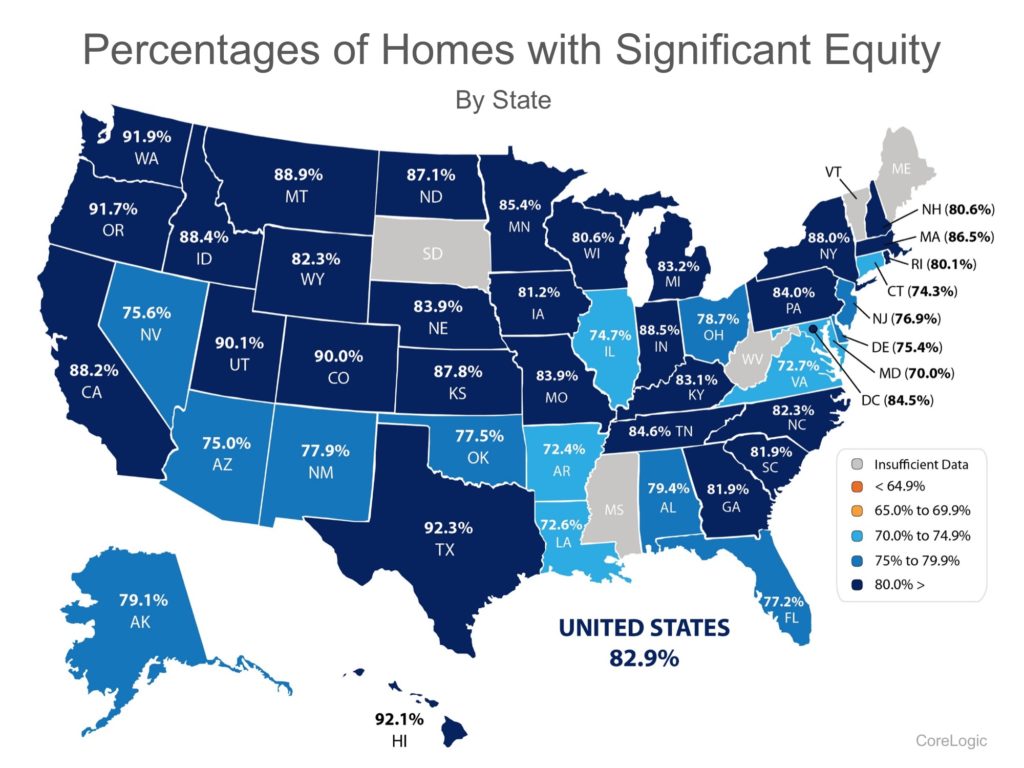

Frank Nothaft, Chief Economist at CoreLogic, believes this is great news for the “housing market.” He went on to say:

“Homeowner equity increased by almost $871 billion over the last 12 months, the largest increase in more than three years. This increase is primarily a reflection of rising home prices, which drives up home values, leading to an increase in home equity positions and supporting consumer spending.”

Of the 95.1% of homeowners with positive equity in the U.S., 82.9% have significant equity (defined as more than 20%). This means that more than three out of four homeowners with a mortgage could use the equity in their current home to purchase a new home now.

The map below shows the percentage of homes by state with a mortgage and significant equity.

Bottom Line

If you are one of the many homeowners who are unsure of how much equity you have in your home and are curious about your ability to move, let’s meet up to evaluate your situation.

Posted in For Sellers, Housing Market Updates

December 28th, 2017 by Lum Hugh

What truly causes a housing bubble and the inevitable crash? For the best explanation, let’s go to a person who correctly called the last housing bubble – a year before it happened.

“A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation…Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the ‘bubble’ bursts.

I have taken to calling the housing market a ‘bubble’.”

– Bill McBride of Calculated Risk calling the bubble back in April 2005

Where do we stand today regarding speculation?

There are two measurements that are used to determine the speculation in a housing market:

- The number of homes purchased by an investor and

- The number of homes being flipped (resold within a twelve-month period)

As compared to 2005, investor purchases are down dramatically (from 23% to 13%) and so is flipping (from 8.2% to 5.7%). McBride explains:

“There is currently some flipping activity, but this is more the normal type of flipping (buy, improve and then sell). Back in 2005, people were just buying homes and letting them sit vacant – and then selling without significant improvements. Classic speculation.”

What are the experts saying about speculation in today’s market?

DSNews recently ran an article which asked two economists to compare the speculation in today’s market to that in 2005-2007. Here is what they said:

Dr. Eddie Seiler, Chief Housing Economist at Summit Consulting:

“The speculative ‘flipping mania’ of 2006 is absent from most metro areas.”

Tian Liu, Chief Economist of Genworth Mortgage Insurance:

“The nature of housing demand is different as well, with more potential homeowners and far fewer speculators in the housing market compared to the 2005-2007 period.”

And what does McBride, who called the last housing bubble, think about today’s real estate market?

Sixty days ago, he explained:

“In 2005, people were just buying homes and letting them sit vacant – and then selling without significant improvements. Classic speculation. And even more dangerous during the bubble was the excessive use of leverage (all those poor-quality loans). Currently lending standards are decent, and loan quality is excellent…

I wouldn’t call house prices a bubble – and I don’t expect house prices to decline nationally like during the bust.”

Bottom Line

Speculation is a major element of the housing bubble formula. Right now, there are not elevated percentages of investors and house flippers. Therefore, there is not an elevated rate of speculation.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

![Where Did Americans Move in 2017? [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/09171302/20180119-STM-Share.jpg)