Category: Housing Market Updates

Existing Home Sales Reach Highest Annual Pace in 11 Years [INFOGRAPHIC]

Dec

22

2017

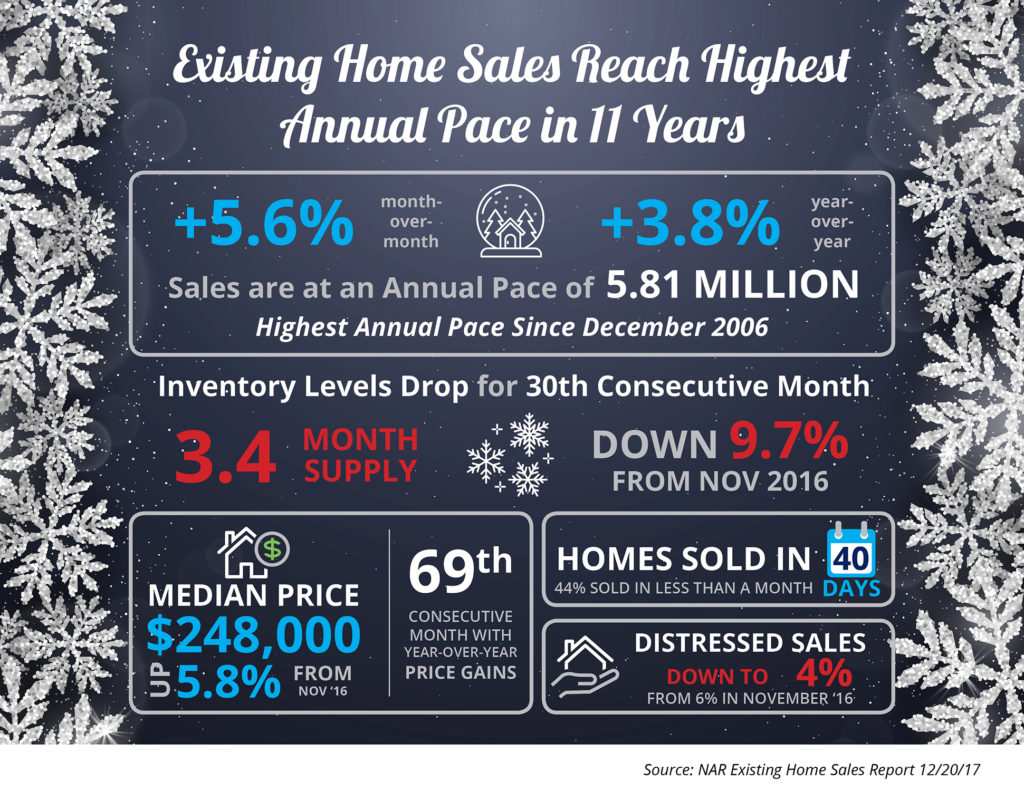

Some Highlights:

- Existing home sales are currently at an annual pace of 5.81 million, the highest pace since December 2006.

- The inventory of existing homes for sale has dropped year-over-year for the last 30 consecutive months and is now at a 3.4-month supply.

- NAR’s Chief Economist Lawrence Yun had this to say: “Faster economic growth in recent quarters, the booming stock market and continuous job gains are fueling substantial demand for buying a home as 2017 comes to an end.”

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

Housing Prices are NOT Heading for Another Crash

Dec

21

2017

As home values continue to increase at levels greater than historic norms, some are concerned that we are heading for another crash like the one we experienced ten years ago. We recently explained that the lenient lending standards of the previous decade (which created false demand) no longer exist. But what about prices?

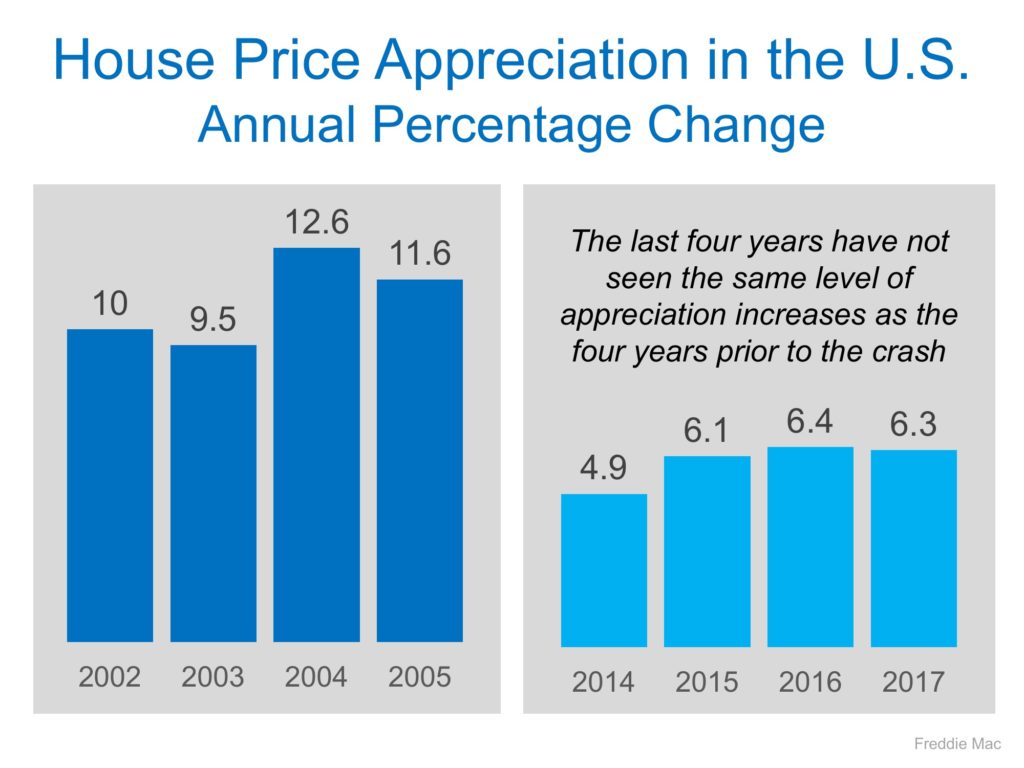

Are prices appreciating at the same rate that they were prior to the crash of 2006-2008? Let’s look at the numbers as reported by Freddie Mac:

The levels of appreciation we have experienced over the last four years aren’t anywhere near the levels that were reached in the four years prior to last decade’s crash.

We must also realize that, to a degree, the current run-up in prices is the market trying to catch up after a crash that dramatically dropped prices for five years.

Bottom Line

Prices are appreciating at levels greater than historic norms. However, we are not at the levels that led to the housing bubble and bust.

Posted in For Buyers, For Sellers, Housing Market Updates, Pricing

The Real Reason Home Prices are Increasing

Nov

30

2017

There are many unsubstantiated theories as to why home values are continuing to increase. From those who are worried that lending standards are again becoming too lenient (data shows this is untrue), to those who are concerned that prices are again approaching boom peaks because of “irrational exuberance” (this is also untrue as prices are not at peak levels when they are adjusted for inflation), there seems to be no shortage of opinion.

However, the increase in prices is easily explained by the theory of supply & demand. Whenever there is a limited supply of an item that is in high demand, prices increase.

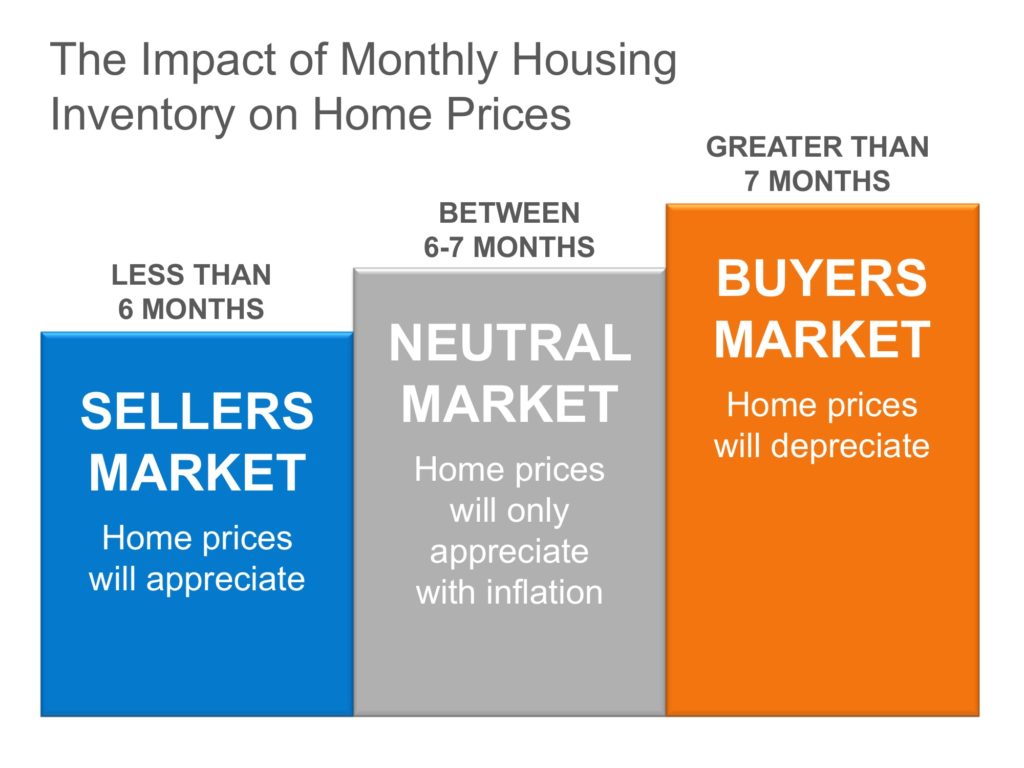

It is that simple. In real estate, it takes a six-month supply of existing salable inventory to maintain pricing stability. In most housing markets, anything less than six months will cause home values to appreciate and anything more than seven months will cause prices to depreciate (see chart 1).

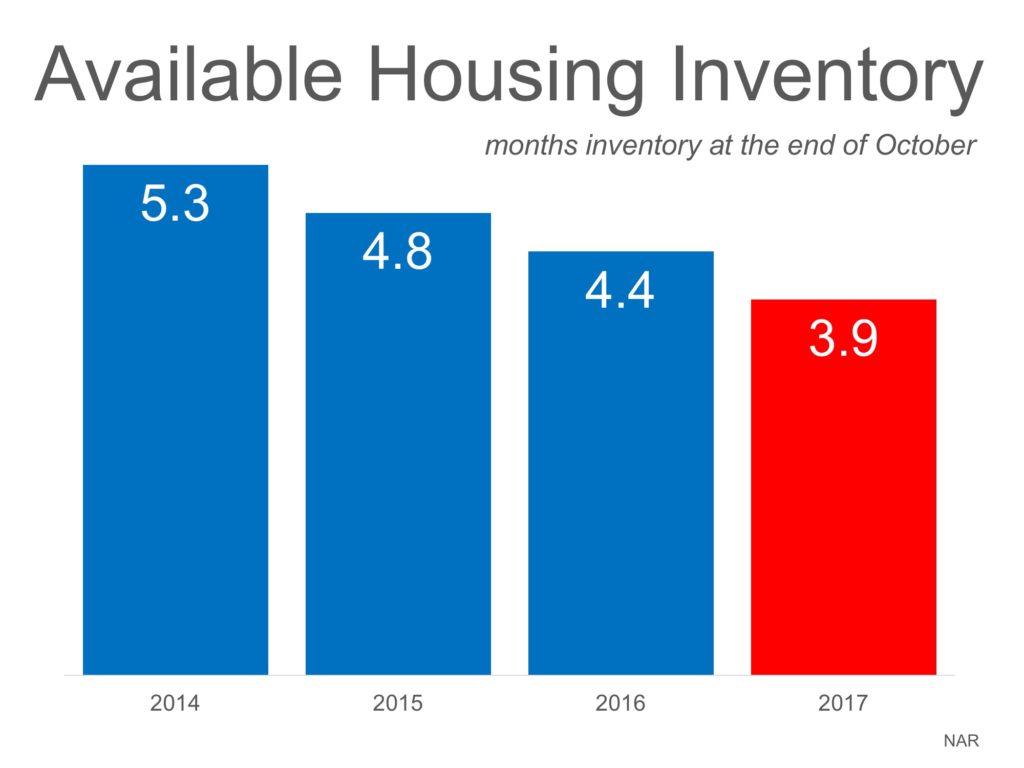

According to the Existing Home Sales Report from the National Association of Realtors (NAR), the monthly inventory of homes has been below six months for the last four years (see chart 2).

Bottom Line

If buyer demand outpaces the current supply of existing homes for sale, prices will continue to appreciate. Nothing nefarious is taking place. It is simply the theory of supply & demand working as it should.

Posted in Buying Myths, First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, Pricing

Existing Home Sales Slowed by a Lack of Listings [INFOGRAPHIC]

Nov

24

2017

Some Highlights:

- The inventory of existing homes for sale has dropped year-over-year for the last 29 consecutive months and is now at a 3.9-month supply.

- Existing home sales are currently at an annual pace of 5.48 million, the highest pace since June of this year, but down 0.9% from October 2016.

- NAR’s Chief Economist, Lawrence Yun, had this to say: “While the housing market gained a little more momentum last month, sales are still below year ago levels because low inventory is limiting choices for prospective buyers and keeping price growth elevated.”

Posted in For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

Nov

22

2017

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in just the last year:

- More buyers are putting less than 20% down to purchase a home

- The average credit score on closed mortgages is lower

- More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

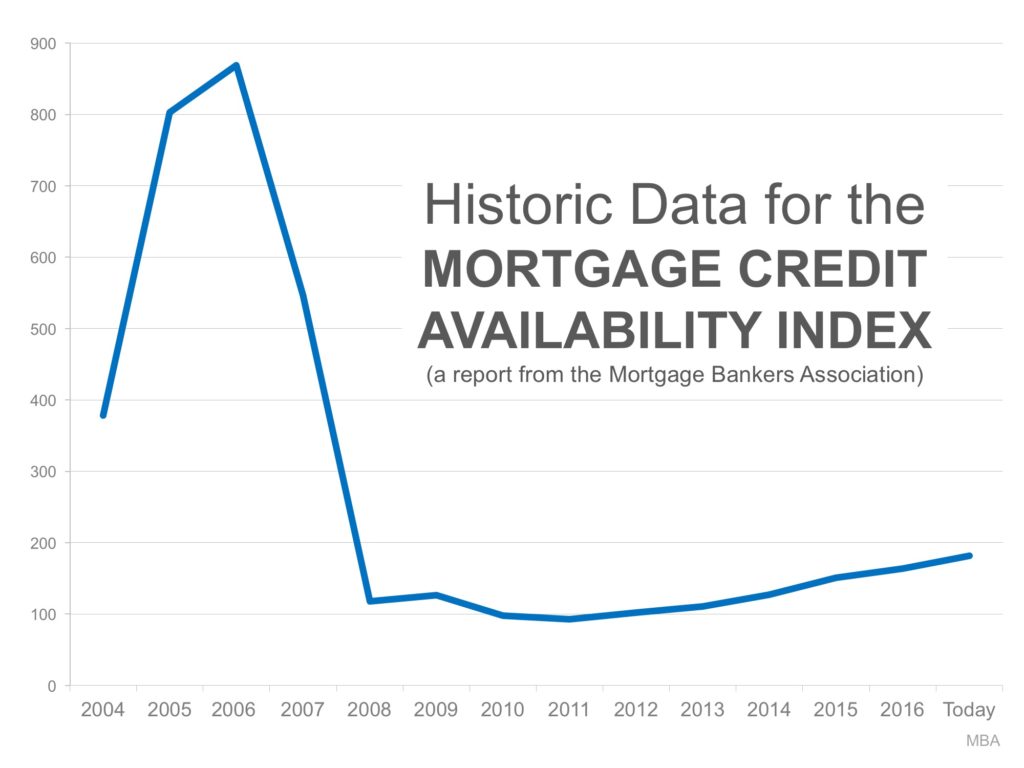

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

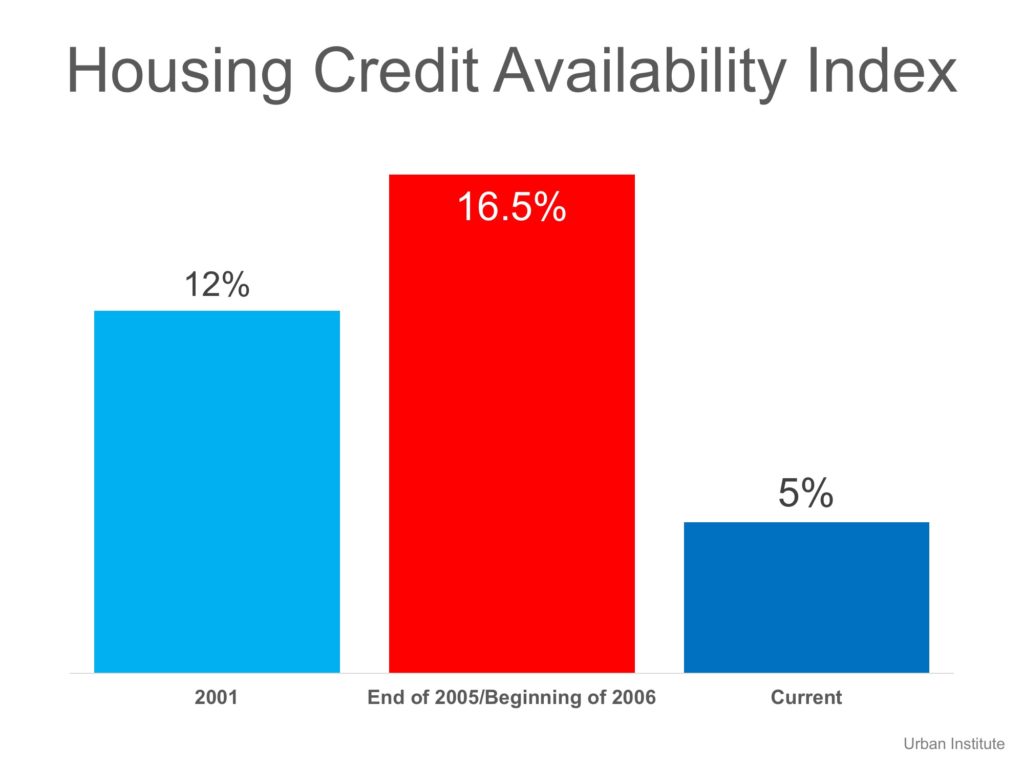

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the Institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates … it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

Posted in Buying Myths, First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

A Housing Bubble? Industry Experts Say NO!

Nov

09

2017

With residential home prices continuing to appreciate at levels above historic norms, some are questioning if we are heading toward another housing bubble (and subsequent burst) like the one we experienced in 2006-2008.

Recently, five housing experts weighed in on the question.

Rick Sharga, Executive VP at Ten-X:

“We’re definitely not in a bubble.”

“We have a handful of markets that are frothy and probably have hit an affordability wall of sorts but…while prices nominally have surpassed the 2006 peak, we’re not talking about 2006 dollars.”

Christopher Thornberg, Partner at Beacon Economics:

“There is no direct or indirect sign of any kind of bubble.”

“Steady as she goes. Prices continue to rise. Sales roughly flat.…Overall this market is in an almost boring place.”

Bill McBride, Calculated Risk:

“I wouldn’t call house prices a bubble.”

“So prices may be a little overvalued, but there is little speculation and I don’t expect house prices to decline nationally like during the bust.”

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices:

“Housing is not repeating the bubble period of 2000-2006.”

“…price increases vary unlike the earlier period when rising prices were almost universal; the number of homes sold annually is 20% less today than in the earlier period and the months’ supply is declining, not surging.”

Bing Bai & Edward Golding, Urban Institute:

“We are not in a bubble and nowhere near the situation preceding the 2008 housing crisis.”

“Despite recent increases, house prices remain affordable by historical standards, suggesting that home prices are tracking a broader economic expansion.”

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, Pricing

Why Sell Now Instead of Later? The Buyers are Out Now

Nov

02

2017

Each year, most homeowners wait until the spring to sell their houses because they believe that they can get a better deal during the normal spring buyer’s market. However, recently released data suggests that a seller’s best deal may be available right now. The concept of ‘supply & demand’ reveals that the best price for an item will be realized when the supply of that item is low and the demand for that item is high. Let’s see how this applies to the current residential real estate market.

SUPPLY

It is no secret that the supply of homes for sale has been far below the number needed for over a year. A normal market requires six months of housing inventory to meet the demand. The latest report from the National Association of Realtors (NAR) revealed that there is currently only a 4.2-month supply.

Supply is currently very low!!

DEMAND

A report that was just released tells us that demand is very strong. The most recent Foot Traffic Report (which sheds light on the number of buyers out looking at homes) disclosed that there are more buyers right now than at any other time in the last twelve months. This includes more buyers looking at homes right now than at any time during last year’s spring market.

Demand is currently very high!!

Bottom Line

Waiting until the spring to list your house for sale made sense in the past. This year is different. The best deal is probably available right now.

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

Thinking of Selling? You Should Do It TODAY!!

Oct

16

2017

That headline might be a little aggressive; however, as August 2017’s housing market data begins to roll in, we can definitely say one thing: If you are considering selling, IT IS TIME TO LIST YOUR HOME TODAY!

In a recent article by CBS News, they explained that the number of existing home sales is shrinking, and Lawrence Yun, Chief Economist for the National Association of Realtors, said:

“There should be 3 million homes on the market right now…Yet, there are only 1.9 million.”

And this situation will be affected greatly by recent natural disasters. Yun continued by saying:

“Before the hurricanes I would have predicted 1.35 million in new-home construction in 2018…I’ll have to scale that down now.”

NAR, in their August 2017 Realtors® Confidence Index, indicated that:

“Amid sustained job creation and sustained historically low mortgage rates, REALTORS® reported…that buyer demand is stronger compared to conditions one year ago… and that fifty percent of properties were on the market for less than one month when sold.”

The only challenge to today’s market is a severe lack of inventory. A balanced market would have a full six-month supply of homes for sale. Currently, there is only a 4.2-month supply of inventory, which is down from 4.5 months one year ago.

Bottom Line

With demand increasing and supply dropping, this may be the perfect time to get the best price for your home. Let’s get together and discuss the inventory levels in your neighborhood to determine your next steps.

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

A Tale of Two Markets: A 6-Month Update

Oct

04

2017

Six months ago, we reported that the mismatch between the type of inventory of homes for sale and the demand of buyers in the US was causing the formation of two markets.

In the starter and trade-up home categories, there were significantly more buyers than there were homes for sale, causing a seller’s market. In the premium, or luxury, home categories, the opposite was true as there was a surplus of these homes compared to the buyers that were out searching for their dream homes, which created a buyer’s market.

According to the National Association of Realtors latest Existing Home Sales Report, the inventory of existing homes for sale in today’s market is at a 4.2-month supply. Inventory is now 6.5% lower than this time last year, marking the 27th consecutive month of year-over-year decreases.

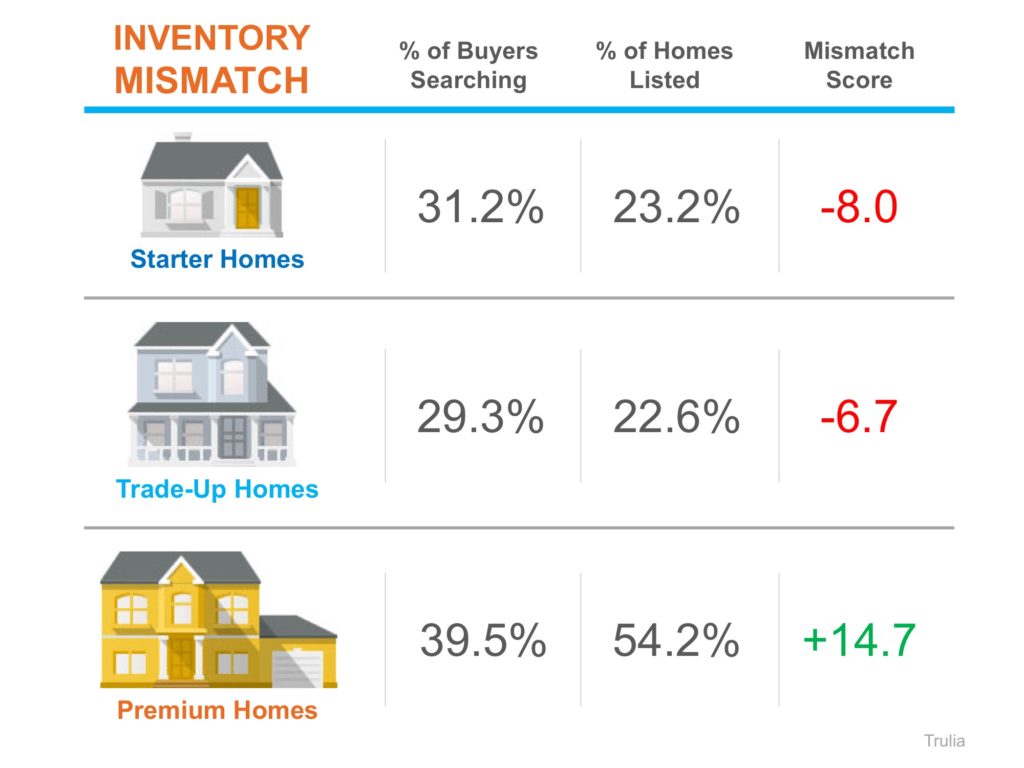

Looking at the latest report from Trulia, we can see that not much has changed, and in fact, recent natural disasters across the country have made inventory conditions even more dire.

Trulia’s market mismatch score measures the search interest of buyers against the category of homes that are available on the market. For example: “if 60% of buyers are searching for starter homes but only 40% of listings are starter homes, [the] market mismatch score for starter homes would be 20.”

The results of their latest analysis are detailed in the chart below.

Nationally, buyers are searching for starter and trade-up homes and are coming up short with the listings available, which is leading to a highly competitive seller’s market in these categories.

Premium homebuyers, on the other hand, have the best chance of less competition and more inventory of listings in their price range with a 14.7-point surplus, which is creating more of a buyer’s market.

Bottom Line

Real estate is local. If you are thinking about buying OR selling this fall, let’s get together to discuss the exact market conditions in your area.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Which Homes Have Increased in Value the Most?

Oct

02

2017

Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 5.6%. CoreLogic, in their most recent Home Price Index Report, revealed that national home prices have increased by 6.7% year-over-year.

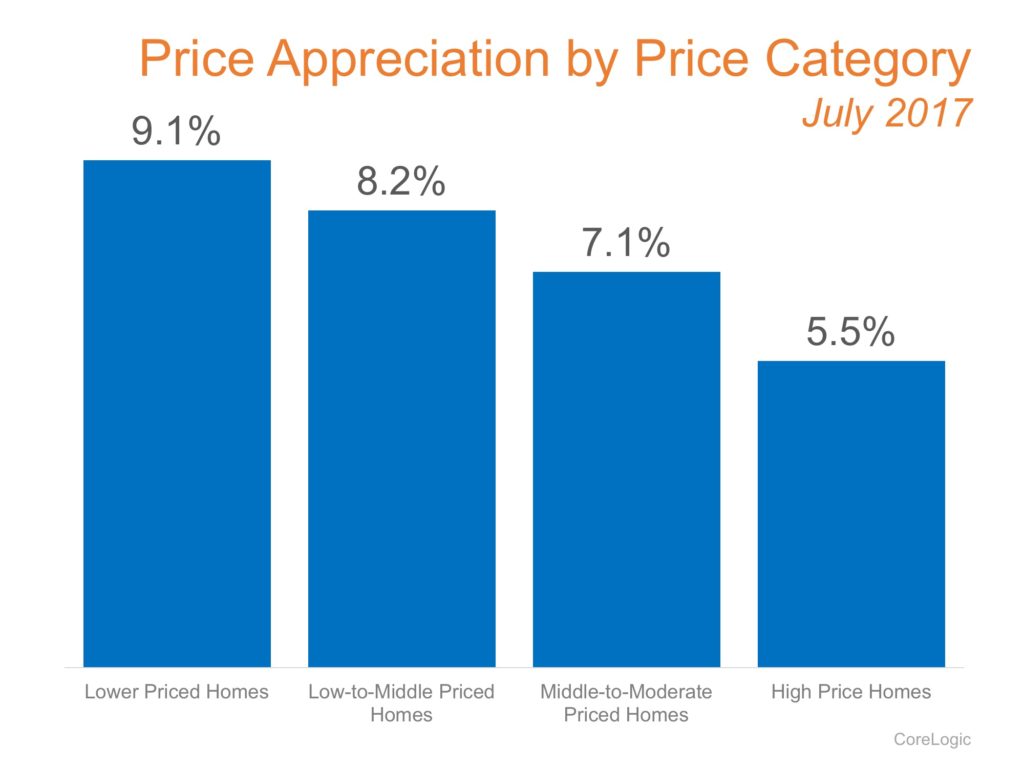

CoreLogic broke appreciation down ever further into four price ranges which gives a more detailed view than simply looking at the year-over-year increases of the national median home price.

The chart below shows the four tiers and each one’s growth from July 2016 to July 2017 (the latest data available).

It is important to pay attention to how prices are changing in your local market. The location of your home is not the only factor in determining how much it has appreciated over the course of the last year. Lower priced homes have appreciated at greater rates than homes at the upper ends of the spectrum, due to demand from first-time home buyers and baby boomers looking to downsize.

Bottom Line

If you are planning on listing your home for sale in today’s market, let’s get together to go over exactly what’s going on in your area and your price range.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers