Category: Infographics

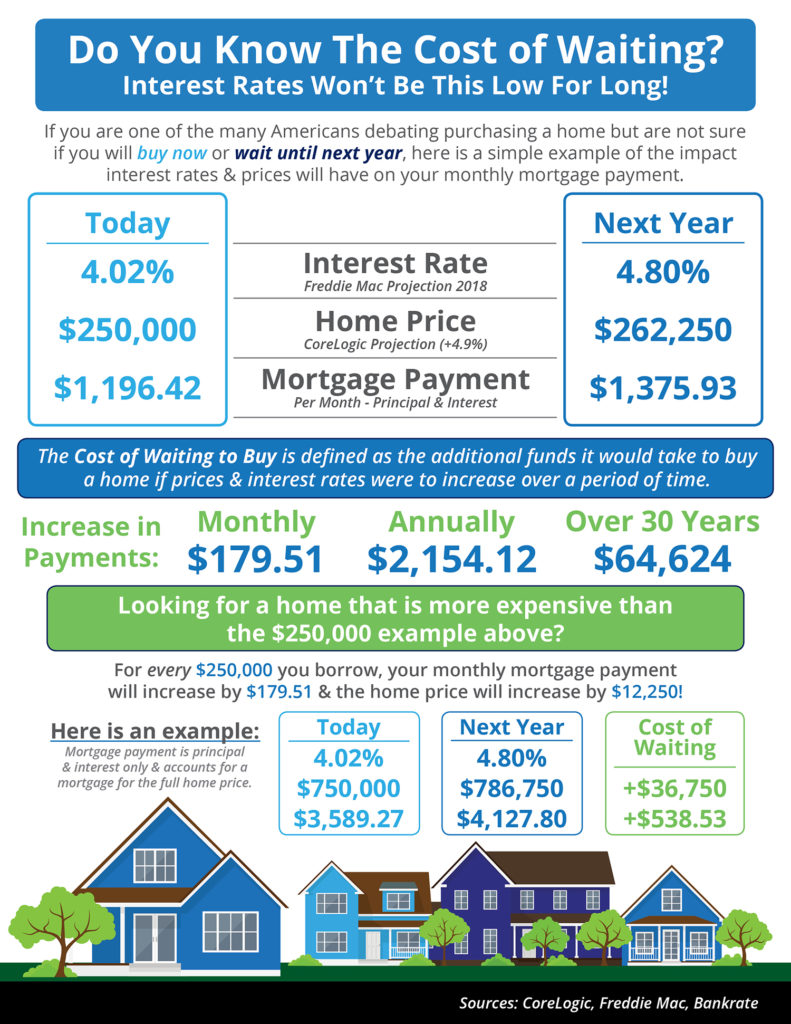

Do You Know the Cost of Waiting? [INFOGRAPHIC]

May

05

2017

![Do You Know the Cost of Waiting? [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/04/19155321/20170505-Share-STM.jpg)

Some Highlights:

- The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

- Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.9% according to CoreLogic.

- Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Pricing

Homes are Selling Fast Across the Country [INFOGRAPHIC]

Apr

28

2017

![Homes are Selling Fast Across the Country [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/04/25170909/20170428-Share-STM1.jpg)

Some Highlights:

- The National Association of REALTORS® surveyed their members for their monthly Confidence Index.

- The REALTORS® Confidence Index is a key indicator of housing market strength based on a monthly survey sent to over 50,000 real estate practitioners. Practitioners are asked about their expectations for home sales, prices and market conditions.

- Homes sold in 60 days or less in 36 out of 50 states, and Washington D.C.

- Homes typically went under contract in 34 days in March!

Posted in For Sellers, Housing Market Updates, Infographics

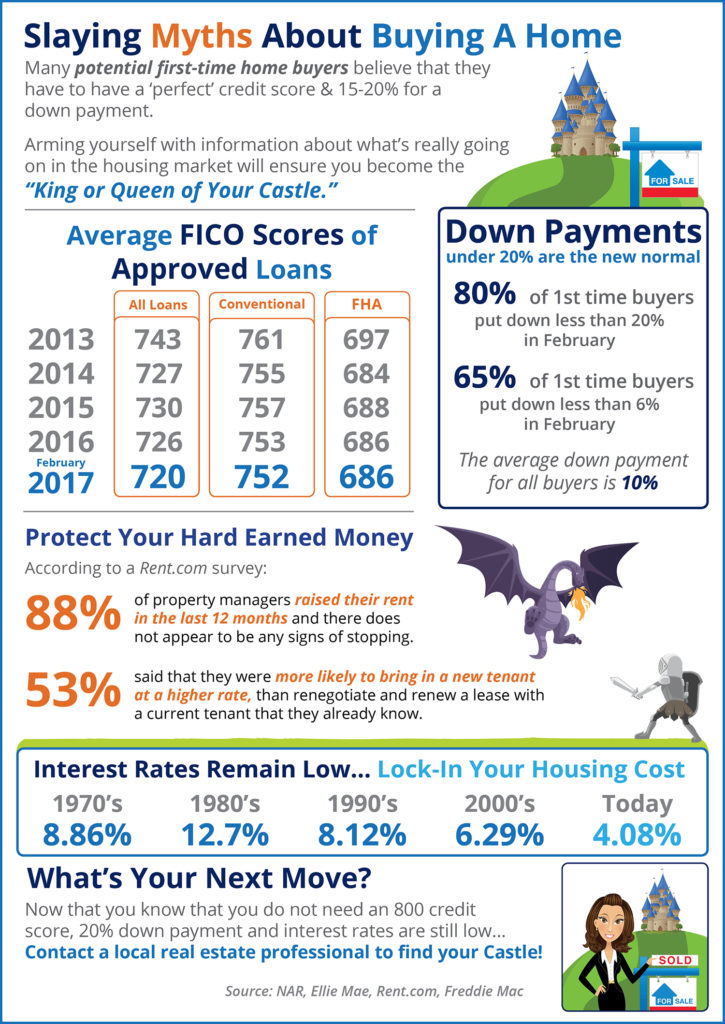

Slaying Home Buying Myths [INFOGRAPHIC]

Apr

21

2017

Some Highlights:

- Interest rates are still below historic numbers.

- 88% of property managers raised their rent in the last 12 months!

- The credit score requirements for mortgage approval continue to fall.

Posted in Down Payments, First Time Home Buyers, For Buyers, Infographics, Interest Rates

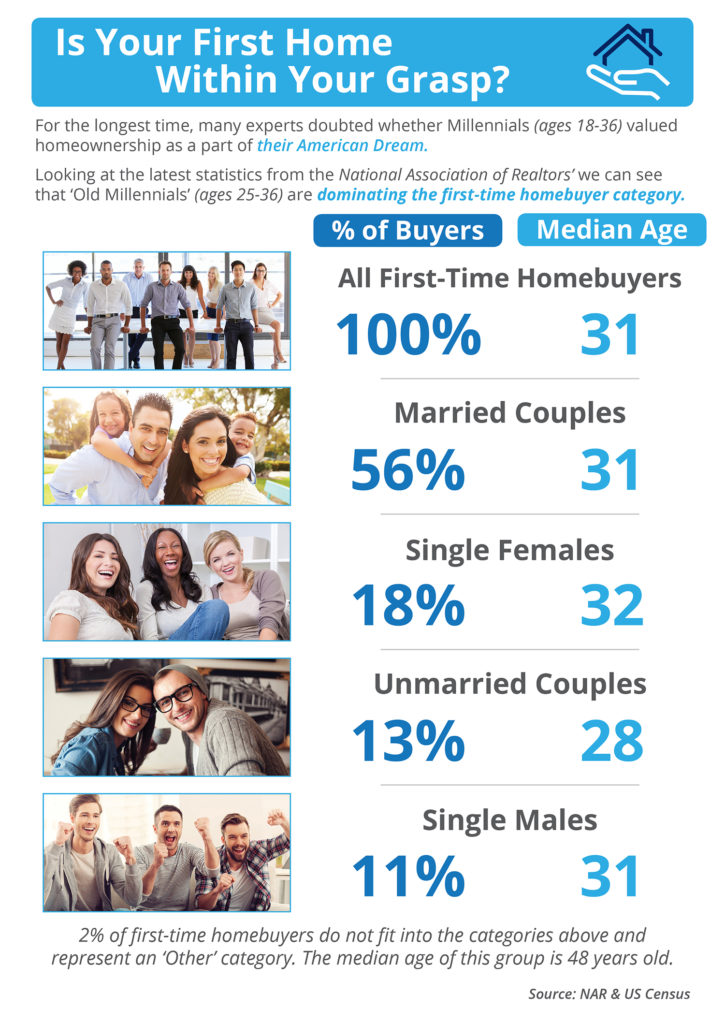

Is Your First Home Within Your Grasp? [INFOGRAPHIC]

Apr

14

2017

Some Highlights:

- ‘Millennials’ are defined as 18-36 year olds according to the US Census Bureau.

- According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 31 years old.

- More and more ‘Old Millennials’ (25-36 year olds) are realizing that homeownership is within their reach now!

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials, Move-Up Buyers

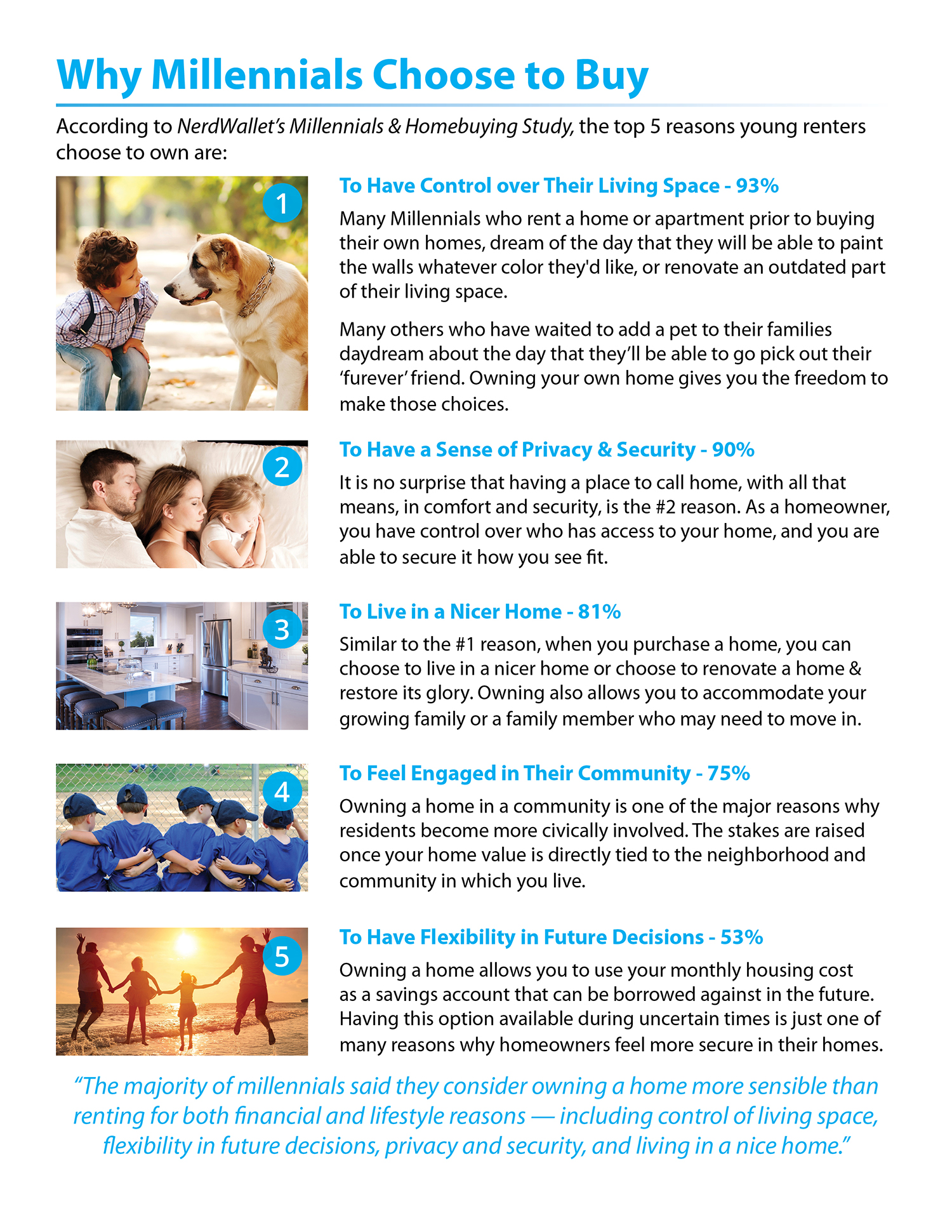

Why Millennials Choose to Buy [INFOGRAPHIC]

Apr

07

2017

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- At 93%, the top reason Millennials choose to buy is to have control over their living space.

- Many Millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls whatever color they’d like, or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials, Move-Up Buyers

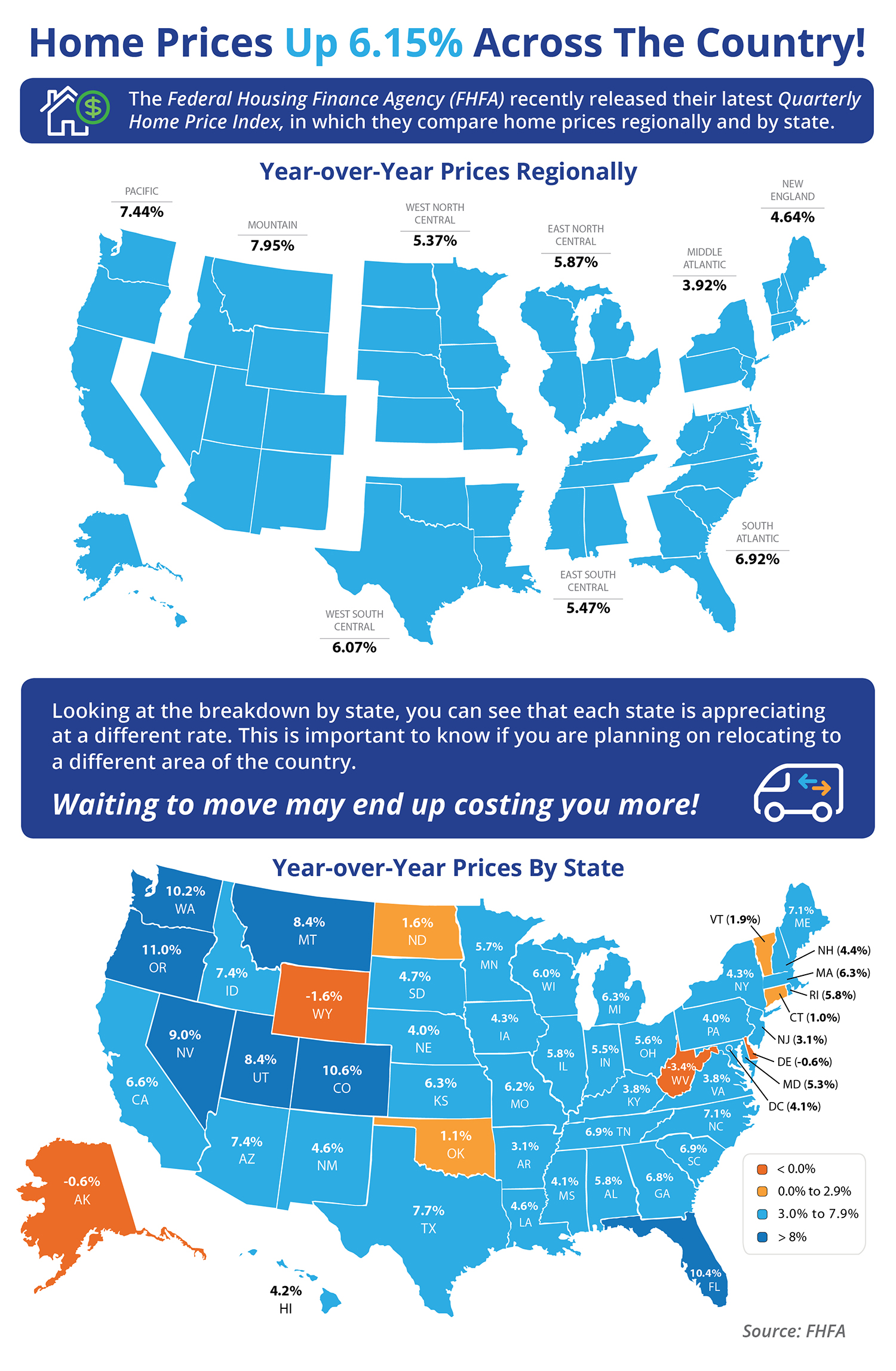

Home Prices Up 6.15% Across the Country! [INFOGRAPHIC]

Mar

31

2017

Some Highlights:

- The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report.

- In the report, home prices are compared both regionally and by state.

- Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more!

- Alaska, Delaware, West Virginia & Wyoming were the only states where home prices are lower than they were last year.

Posted in First Time Home Buyers, For Buyers, For Sellers, Infographics, Move-Up Buyers, Pricing

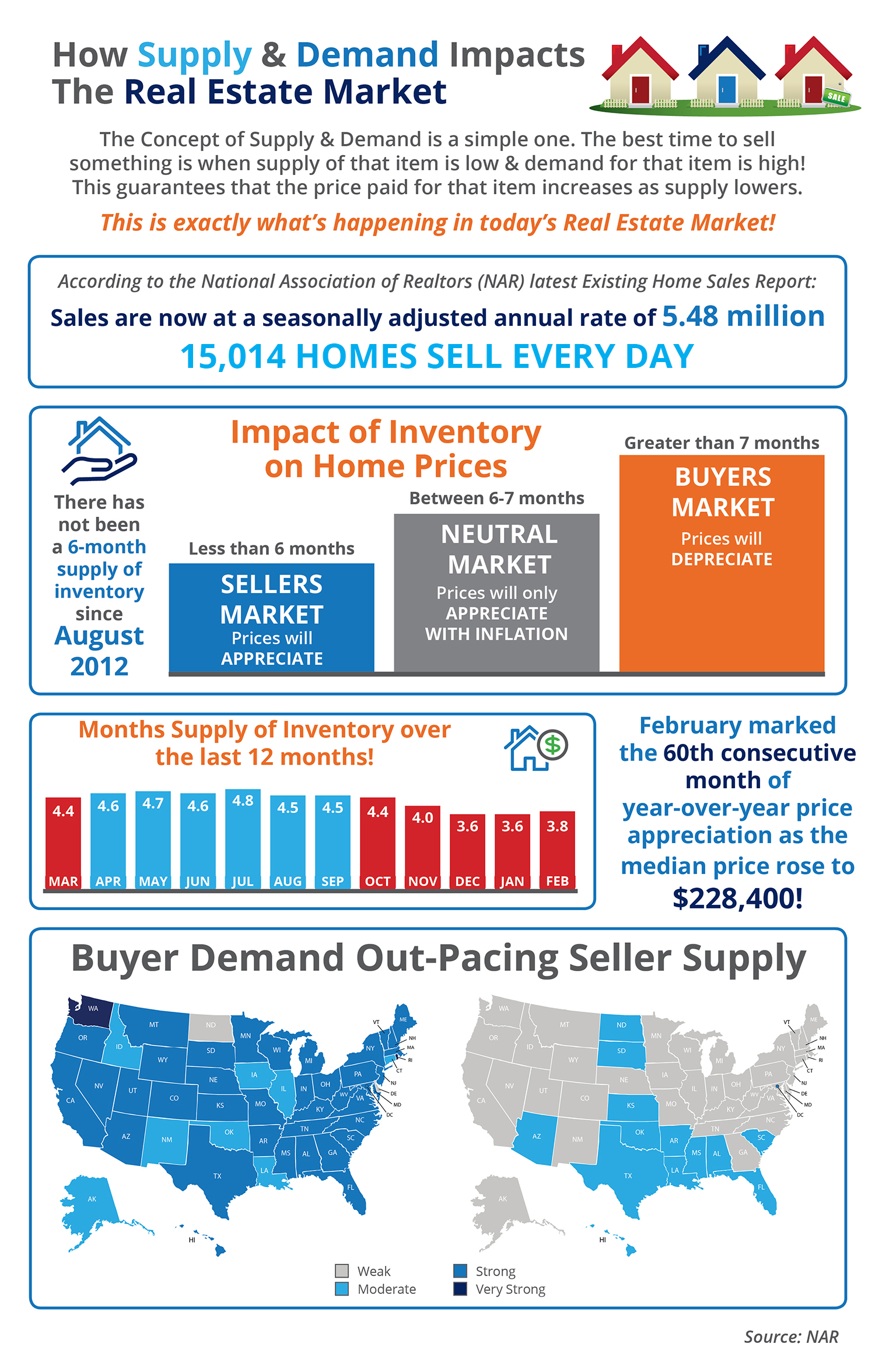

How Low Supply & High Demand Impacts the Real Estate Market [INFOGRAPHIC]

Mar

24

2017

Some Highlights:

- The concept of Supply & Demand is a simple one. The best time to sell something is when the supply of that item is low & the demand for that item is high!

- Anything under a 6-month supply is a Seller’s Market!

- There has not been a 6-months inventory supply since August 2012!

- Buyer Demand continues to outpace Seller Supply!

Posted in For Buyers, For Sellers, Housing Market Updates, Infographics

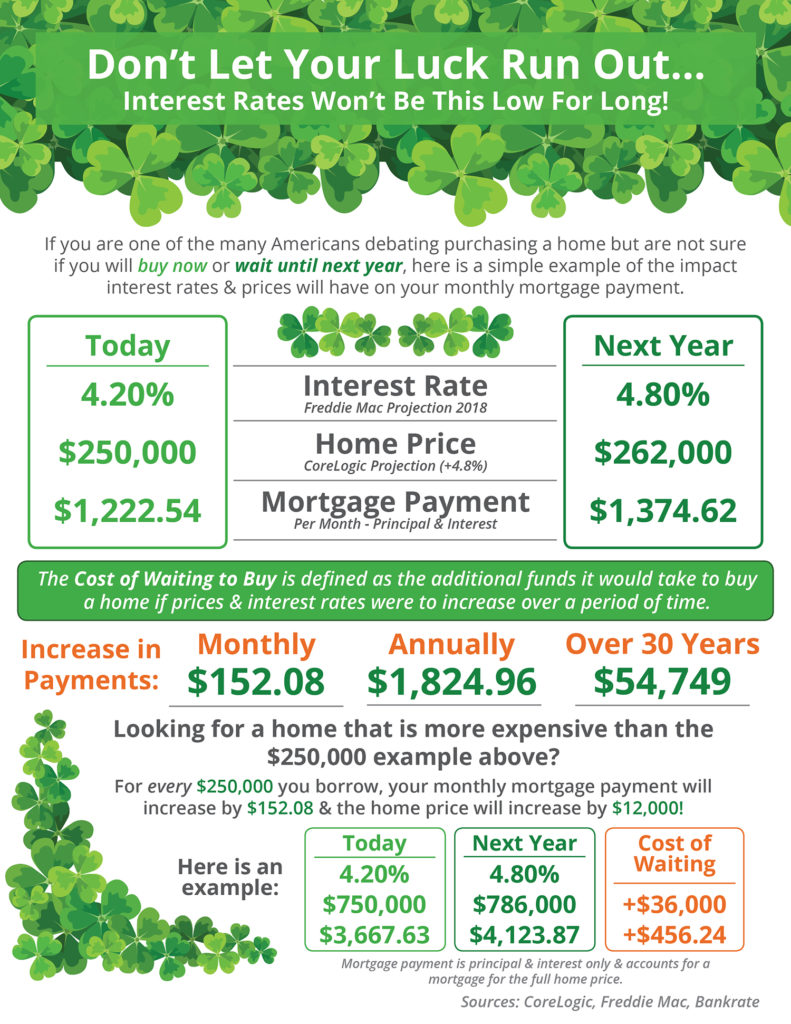

Don’t Let Your Luck Run Out [INFOGRAPHIC]

Mar

17

2017

Some Highlights:

- The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

- Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.8% according to CoreLogic.

- Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Move-Up Buyers, Pricing

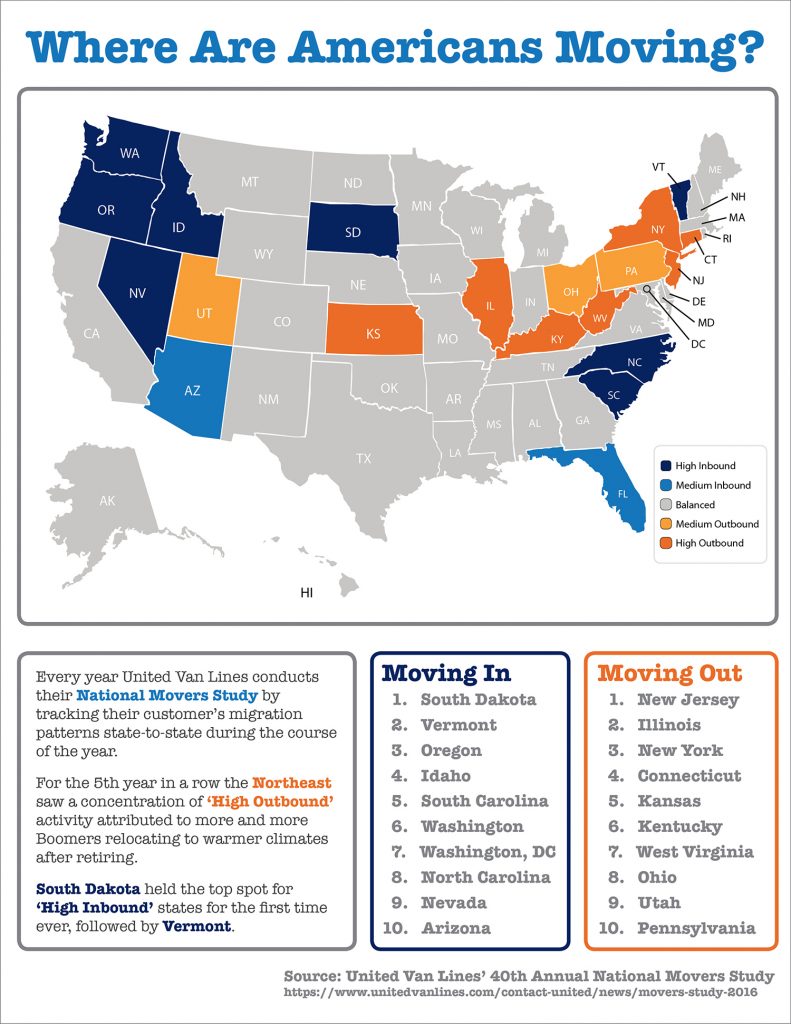

Where Did Americans Move in 2016?

Mar

03

2017

Some Highlights:

- For the 5th year in a row, the Northeast saw a concentration of “High Outbound” activity.

- For the first time ever, South Dakota held the top spot for “High Inbound” states.

- Much of America’s outbound activity can be attributed to Boomers relocating to warmer climates after retiring.

Posted in For Buyers, For Sellers, Infographics

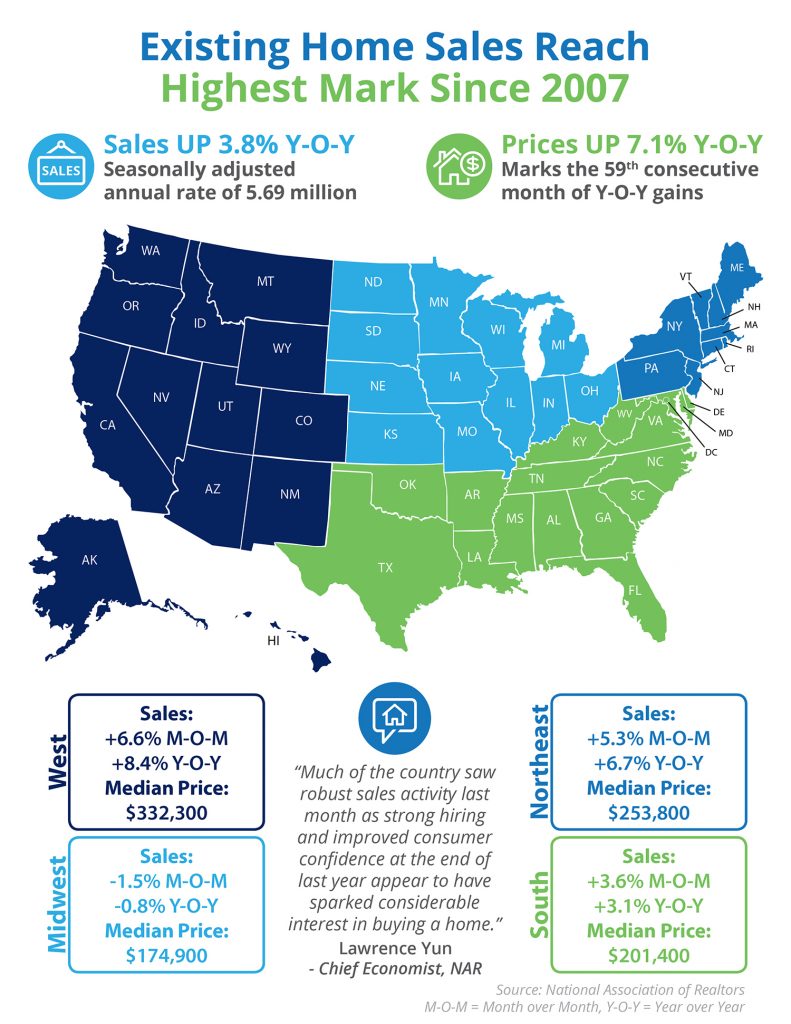

Existing Home Sales Reach Highest Mark Since 2007 [INFOGRAPHIC]

Feb

24

2017

Highlights:

- Sales of existing homes reached the highest pace in a decade at a seasonally adjusted annual rate of 5.69 million.

- January marked the 59th consecutive month of year-over-year price gains as the median home price rose 7.1% to $228,900.

- NAR’s Chief Economist, Lawrence Yun had this to say, “Much of the country saw robust sales activity last month as strong hiring and improved consumer confidence at the end of last year appear to have sparked considerable interest in buying a home.”

Posted in For Buyers, For Sellers, Housing Market Updates, Infographics