Category: Move-Up Buyers

A Tale of Two Markets: A 6-Month Update

Oct

04

2017

Six months ago, we reported that the mismatch between the type of inventory of homes for sale and the demand of buyers in the US was causing the formation of two markets.

In the starter and trade-up home categories, there were significantly more buyers than there were homes for sale, causing a seller’s market. In the premium, or luxury, home categories, the opposite was true as there was a surplus of these homes compared to the buyers that were out searching for their dream homes, which created a buyer’s market.

According to the National Association of Realtors latest Existing Home Sales Report, the inventory of existing homes for sale in today’s market is at a 4.2-month supply. Inventory is now 6.5% lower than this time last year, marking the 27th consecutive month of year-over-year decreases.

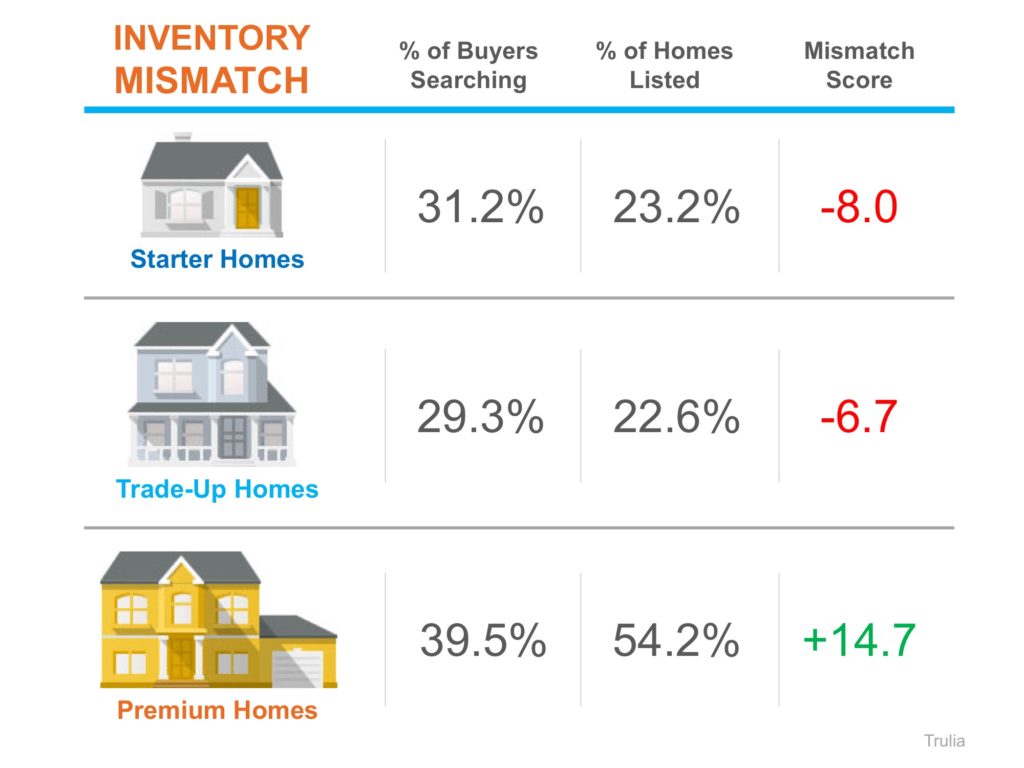

Looking at the latest report from Trulia, we can see that not much has changed, and in fact, recent natural disasters across the country have made inventory conditions even more dire.

Trulia’s market mismatch score measures the search interest of buyers against the category of homes that are available on the market. For example: “if 60% of buyers are searching for starter homes but only 40% of listings are starter homes, [the] market mismatch score for starter homes would be 20.”

The results of their latest analysis are detailed in the chart below.

Nationally, buyers are searching for starter and trade-up homes and are coming up short with the listings available, which is leading to a highly competitive seller’s market in these categories.

Premium homebuyers, on the other hand, have the best chance of less competition and more inventory of listings in their price range with a 14.7-point surplus, which is creating more of a buyer’s market.

Bottom Line

Real estate is local. If you are thinking about buying OR selling this fall, let’s get together to discuss the exact market conditions in your area.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Which Homes Have Increased in Value the Most?

Oct

02

2017

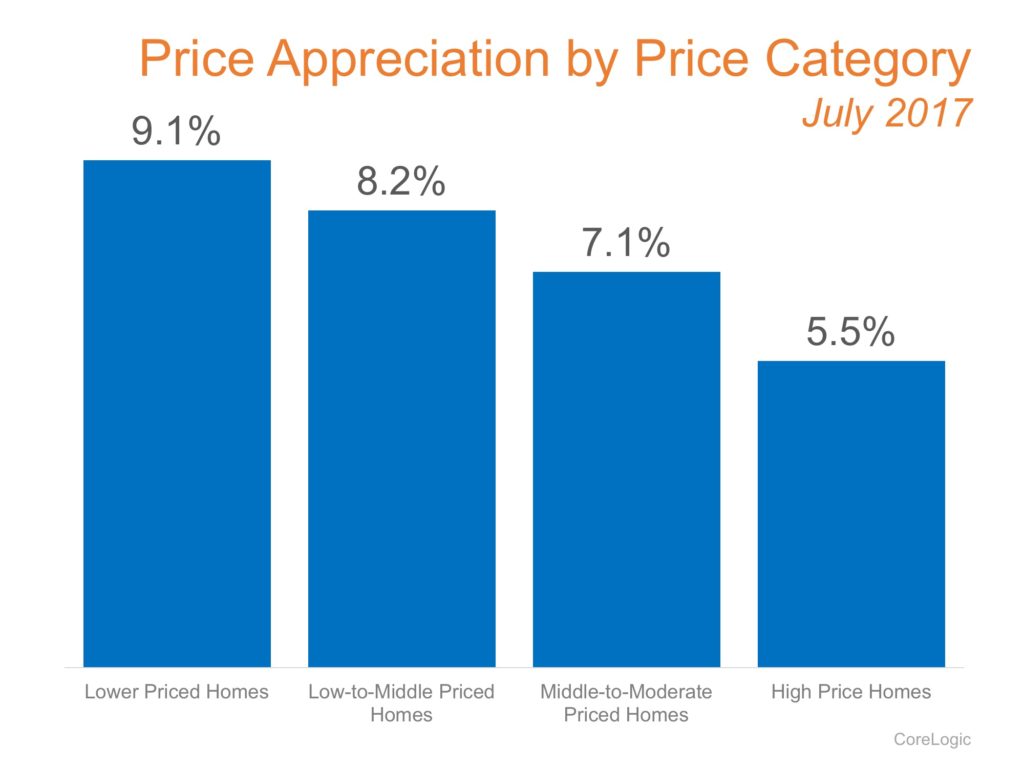

Home values have risen dramatically over the last twelve months. The latest Existing Home Sales Report from the National Association of Realtors puts the annual increase in the median existing-home price at 5.6%. CoreLogic, in their most recent Home Price Index Report, revealed that national home prices have increased by 6.7% year-over-year.

CoreLogic broke appreciation down ever further into four price ranges which gives a more detailed view than simply looking at the year-over-year increases of the national median home price.

The chart below shows the four tiers and each one’s growth from July 2016 to July 2017 (the latest data available).

It is important to pay attention to how prices are changing in your local market. The location of your home is not the only factor in determining how much it has appreciated over the course of the last year. Lower priced homes have appreciated at greater rates than homes at the upper ends of the spectrum, due to demand from first-time home buyers and baby boomers looking to downsize.

Bottom Line

If you are planning on listing your home for sale in today’s market, let’s get together to go over exactly what’s going on in your area and your price range.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Should I Buy a Home Now? Or Wait Until Next Year? [INFOGRAPHIC]

Sep

29

2017

![Should I Buy a Home Now? Or Wait Until Next Year? [INFOGRAPHIC]| Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/09/28125015/20170929-Share-STM.jpg)

Some Highlights:

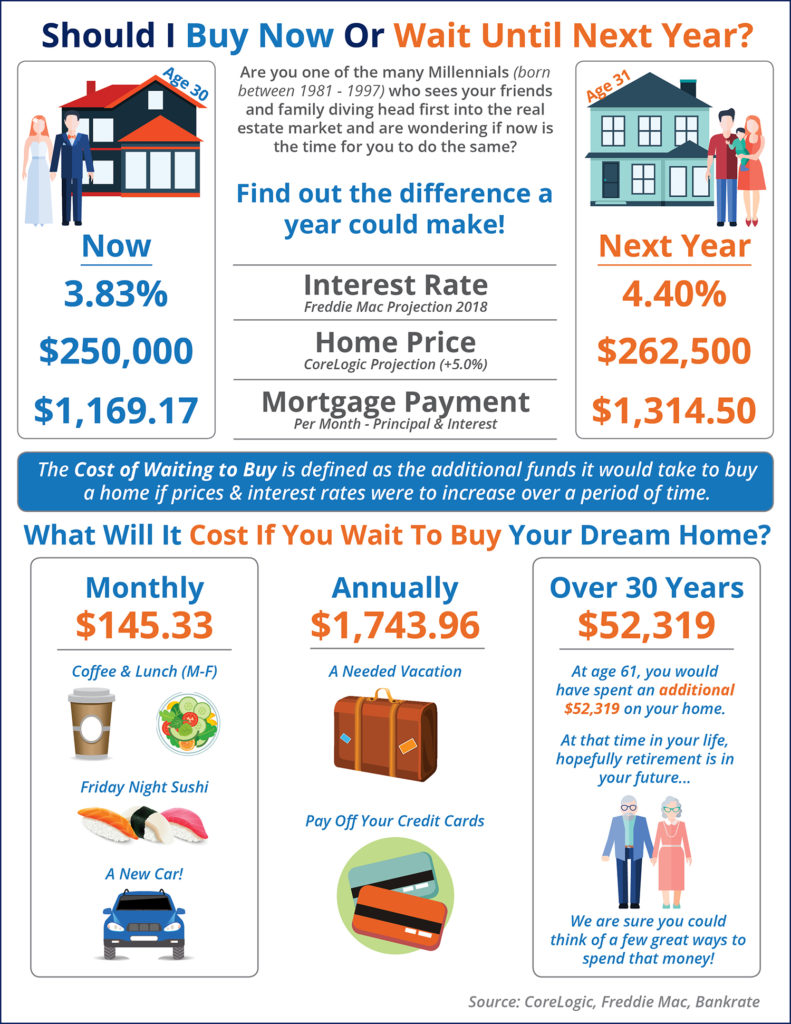

- The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac predicts interest rates to rise to 4.4% by next year.

- CoreLogic predicts home prices to appreciate by 5.0% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Millennials, Move-Up Buyers, Pricing

Thinking of Selling your Home? Competition is Coming

Sep

28

2017

The number of building permits issued for single-family homes is the best indicator of how many newly built homes will rise over the next few months. According to the latest U.S. Census Bureau and U.S. Department of Housing & Urban Development Residential Sales Report, the number of these permits were up 7.7% over last year.

How will this impact buyers?

More inventory means more options. Danielle Hale, Realtor.com’s Chief Economist, explained this is good news for the housing market – especially for those looking to buy:

“It’s not spectacular construction growth, but it’s slow and steady in the right direction. Eventually, the pickup in single-family home construction will mean [buyers] will have more options. Especially with the limited number of sales right now, more options are really needed.”

How will this impact sellers?

More inventory means more competition. Today, because of the tremendous lack of inventory, a seller can expect:

- A great price on their home as buyers outbid each other for it

- A quick sale as buyers have so little to choose from

- Fewer hassles as buyers don’t want to “rock the boat” on the deal

With an increase in competition, the seller may not enjoy these same benefits. As Hale said:

“As new construction continues to increase, home shoppers will eventually have more [choices] and a bit more time to make purchase decisions compared to today’s quick-moving housing market.”

Bottom Line

If you are considering the sale of your home, it might make sense to beat this new construction competition to the market.

Posted in For Sellers, Move-Up Buyers

What to Look for in Your Real Estate Team

Sep

27

2017

How do you select the members of your team who are going to help you make your dream of owning a home a reality? What should you be looking for? How do you know if you’ve found the right agent or lender?

The most important characteristic that you should be looking for in your agent is someone who is going to take the time to really educate you on the choices available to you and your ability to buy in today’s market.

As Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Do your research. Ask your friends and family for recommendations of professionals whom they have used in the past and have had good experiences with.

Look for members of your team who will be honest and trustworthy; after all, you will be trusting them with helping you make one of the biggest financial decisions of your life.

Whether this is your first or fifth time buying a home, you want to make sure that you have an agent who is going to have the tough conversations with you, not just the easy ones. If your offer isn’t accepted by the seller, or they think that there may be something wrong with the home that you’ve fallen in love with, you would rather know what they think than make a costly mistake.

According to a Consumer Housing Trends Study, millennials have already started to prefer a more hands-on approach to their real estate experience:

“While older generations rely on real estate agents for information and expertise, millennials expect real estate agents to become trusted advisers and strategic partners.”

Look for someone to invest in your family’s future with you. You want an agent who isn’t focused on the transaction but is instead focused on helping you understand the process while helping you find your dream home.

Bottom Line

In this world of Google searches, where it seems like all the answers are just a mouse-click away, you need an agent who is going to educate you and share the information that you need to know before you even know you need it.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

More Than Half of All Buyers Are Surprised by Closing Costs

Sep

26

2017

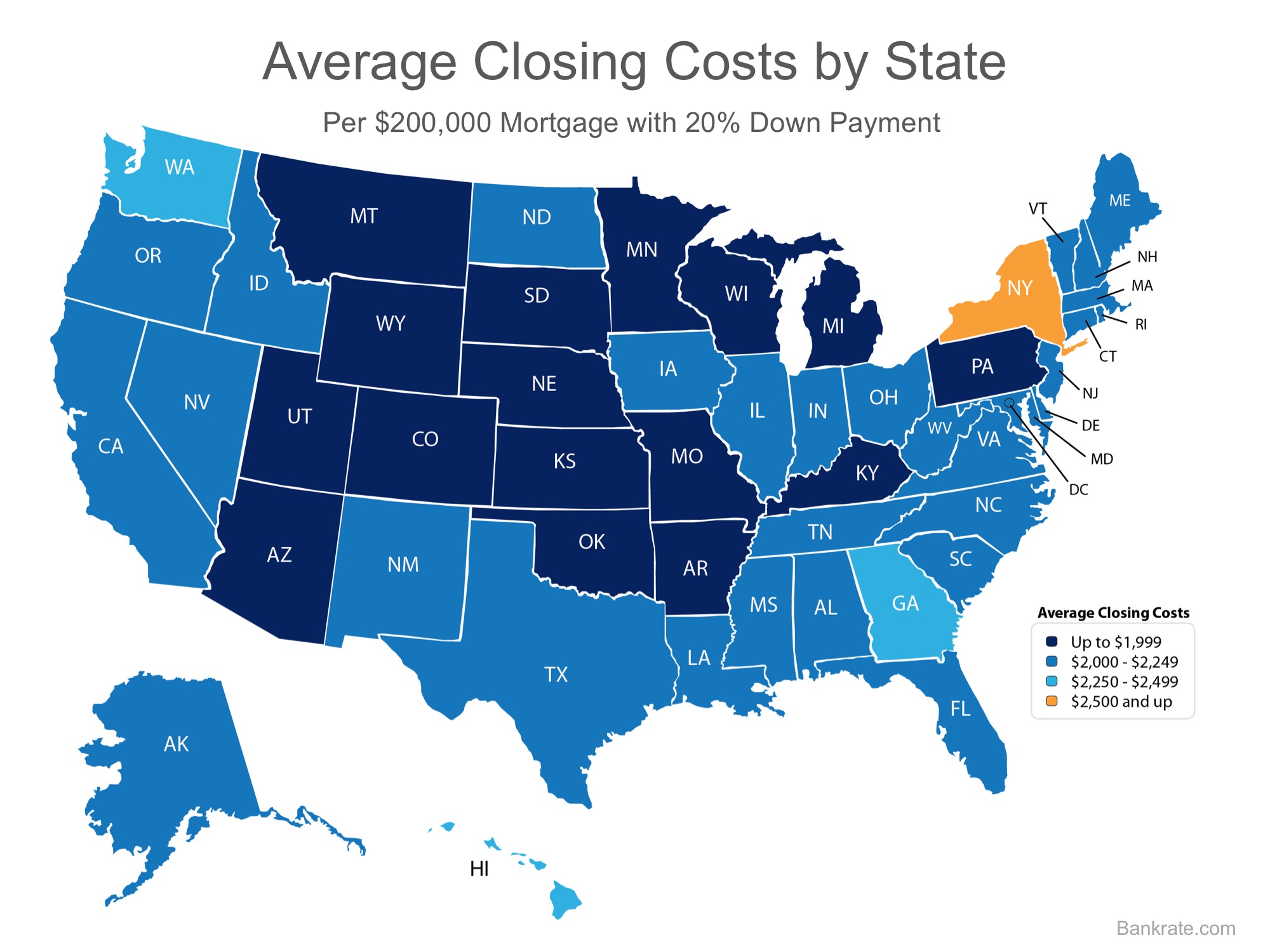

According to a survey conducted by ClosingCorp, over half of all homebuyers are surprised by the closing costs required to obtain their mortgage.

After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all, while another 35% were stunned by how much higher the fees were than expected.

“Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance and appraisal fees.”

Bankrate.com gathered closing cost data from lenders in every state and Washington, D.C. in order to share the average costs in each state. The map below was created using the closing costs on a $200,000 mortgage with a 20% down payment.

Keep in mind that if you are in the market for a home above this price range, your costs could be significantly greater. According to Freddie Mac,

“Closing costs are typically between 2 and 5% of your purchase price.”

Bottom Line

Speak with your lender and agent early and often to determine how much you’ll be responsible for at closing. Finding out that you’ll need to come up with thousands of dollars right before closing is not a surprise anyone is ever looking forward to.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Lack of Existing Home Inventory Slows Sales Heading into Fall [INFOGRAPHIC]

Sep

22

2017

Some Highlights:

- The National Association of Realtors (NAR) recently released their latest Existing Home Sales Report.

- First-time homebuyers made up 31% of all sales in August.

- Homes are selling quickly with 51% of homes on the market for less than a month.

- A limited supply continues to drive up prices for the 66th consecutive month.

Posted in For Buyers, For Sellers, Infographics, Move-Up Buyers, Pricing

Why Are So Few Homes for Sale?

Sep

21

2017

There is no doubt that the largest challenge in today’s housing market is a lack of housing inventory for sale. This challenge has been defined as an “overwhelming lack of supply,” and even a “straight up inventory crisis.”

First American just released the results of a survey which sheds light on the reasons for the current lack of supply.

The survey asked title agents and real estate professionals to identify what they believe are the top reasons for this lack of inventory in their markets. Here are the results of the survey:

- 47% – existing homeowners are worried that they will not be able to find a home to buy

- 26.5% – first-time buyer demand is absorbing a large share of available homes

- 11.3% – existing homeowners’ mortgage rates are lower than the current rates

- 10.6% – insufficient or negative equity in the home

- 4.6% – foreign buyer demand is absorbing a large share of available homes

As the survey revealed, there is a shortage of current homeowners willing to put their homes on the market for one of three reasons (see numbers 1, 3 and 4 above).

Is this an opportunity for some homeowners?

The report on the survey explains:

“The crowd has spoken, and it seems in many markets home buyers and sellers alike are ‘imprisoned’ by the lack of housing inventory.”

That leaves a tremendous opportunity for every homeowner not facing these concerns. If you can put your home on the market today, you are subject to far less competition than at any time in recent history. That will result in your home selling quickly and for the highest possible price.

Bottom Line

While many homeowners are feeling imprisoned for multiple reasons, those who are not handcuffed by these concerns have a once in a lifetime opportunity to sell their houses at a peak selling time.

Posted in For Buyers, For Sellers, Move-Up Buyers

More Americans Say Now is a Good Time to Sell!

Sep

20

2017

Recently released data from Fannie Mae’s National Housing Survey revealed that rising home prices were the catalyst behind an eight-point jump in the net percentage of respondents who say now is a good time to sell. The index is now 21 points higher than it was this time last year.

Overall, 62% of Americans surveyed said that now is a good time to sell (up from 58%), while 26% of respondents said that now is not a good time to sell (down from 30%). The net score is the difference between the two percentages, or 36%.

According to CoreLogic, home prices are now up 6.7% over last year and 78.8% of homeowners with a mortgage in the US now have significant equity (defined as 20% or more).

As home prices have increased, more and more homeowners have realized that now is a good time to sell their homes in order to take advantage of the extra equity they now have.

At the same time, however, rising prices have had the exact opposite impact on the good-time-to-buy scale as many buyers are nervous that they will not be able to afford a home; the net score dropped 5 points to 18%.

Doug Duncan, Vice President & Chief Economist at Fannie Mae, had this to say,

“In the early stages of the economic expansion, home selling sentiment trailed home buying sentiment by a significant margin. The reverse is true today.

The net good time to sell share is now double the net good time to buy share, with record high percentages of consumers citing home prices as the primary reason for both perceptions. Such a sizable gap between selling and buying sentiment, if it persists, could weigh on the housing market through the rest of the year.”

Buyer demand continues to outpace the supply of homes for sale, which has driven prices up across the country. Until the supply starts to better match demand, there will be a gap between the sentiments surrounding buying and selling.

Bottom Line

If you are considering listing your home for sale this year, now is the time!

Posted in For Buyers, For Sellers, Move-Up Buyers, Pricing

Home Sales Expected to Increase Nicely in 2018

Sep

19

2017

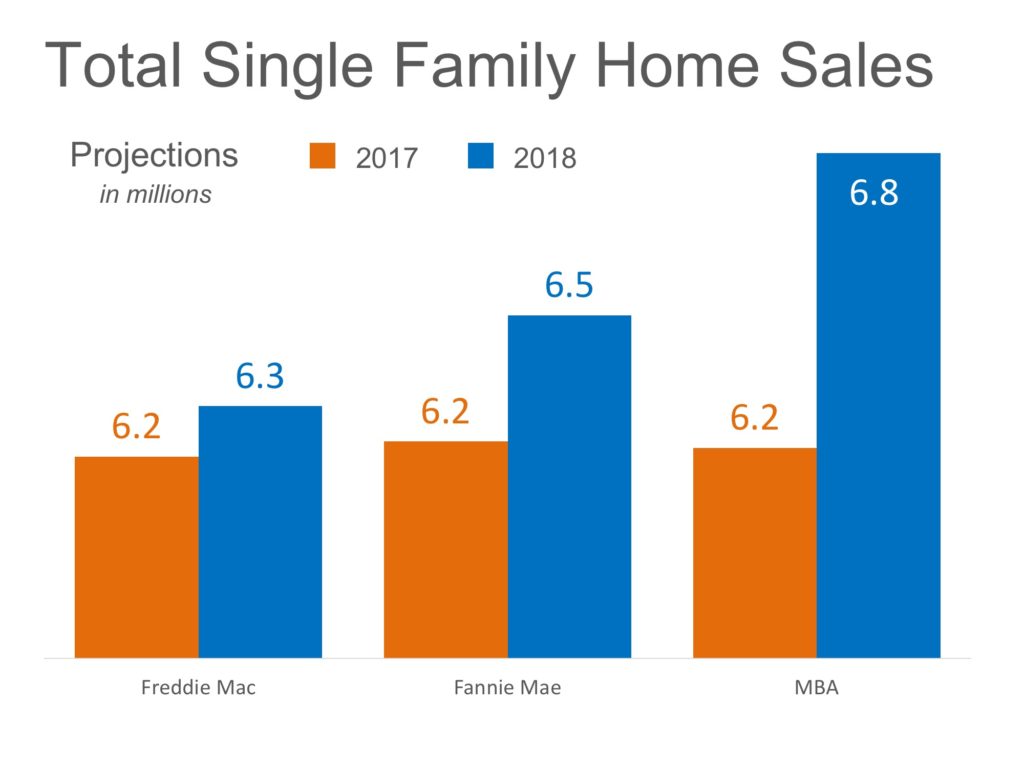

Freddie Mac, Fannie Mae, and The Mortgage Bankers Association are all projecting that home sales will increase in 2018. Here is a chart showing what each entity is projecting in sales for the remainder of this year and the next.

As we can see, each entity is projecting sizable increases in home sales next year. If you have considered selling your house recently, now may be the time to put it on the market.

Posted in For Sellers, Move-Up Buyers