Category: Move-Up Buyers

Where Are Home Prices Heading in The Next 5 Years?

Aug

29

2017

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

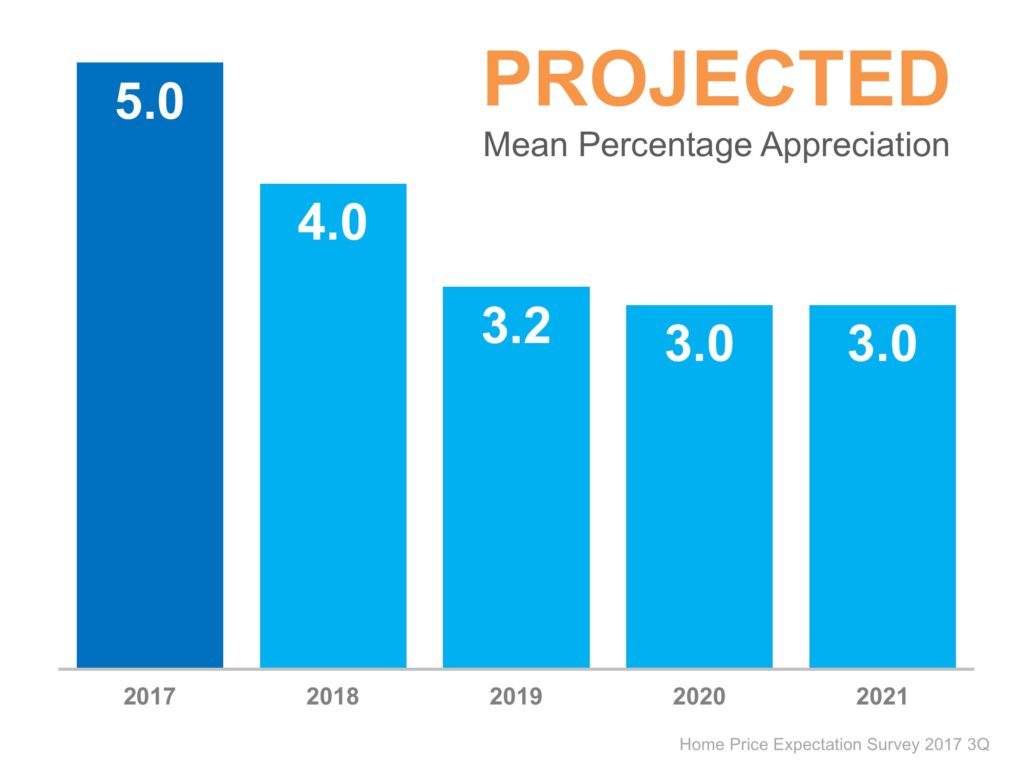

The results of their latest survey:

Home values will appreciate by 5.0% over the course of 2017, 4.0% in 2018, 3.2% in 2019, 3.0% in 2020, and 3.0% in 2021. That means the average annual appreciation will be 3.64% over the next 5 years.

The prediction for cumulative appreciation increased from 17.8% to 18.4% by 2021. The experts making up the most bearish quartile of the survey are projecting a cumulative appreciation of 6.7%.

Bottom Line

Individual opinions make headlines. We believe this survey is a fairer depiction of future values.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, Pricing

Don’t Disqualify Yourself… 52% of Approved Loans Have A FICO® Score Under 750

Aug

28

2017

The results of countless studies have shown that potential home buyers, and even current homeowners, have an inflated view of what is really required to qualify for a mortgage in today’s market.

One such study by the Wharton School of Business at the University of Pennsylvania revealed that many millennials have not yet considered purchasing homes simply because they don’t believe they can qualify for a mortgage.

A recent article about millennials by Realtor.com explained that:

“About 72% of aspiring millennial buyers said they’re waiting because they can’t afford to buy…”

The article also explained that 29% of millennials believe their credit scores are too low to buy.The problem here is the fact that they think they will be denied a mortgage is keeping them from even attempting to apply.

Ellie Mae’s Vice President Jonas Moe encouraged buyers to know their options before assuming that they won’t qualify for a mortgage:

“Many potential home buyers are ‘disqualifying’ themselves. You don’t need a 750 FICO® Score and a 20% down payment to buy.”

So, what credit score is necessary?

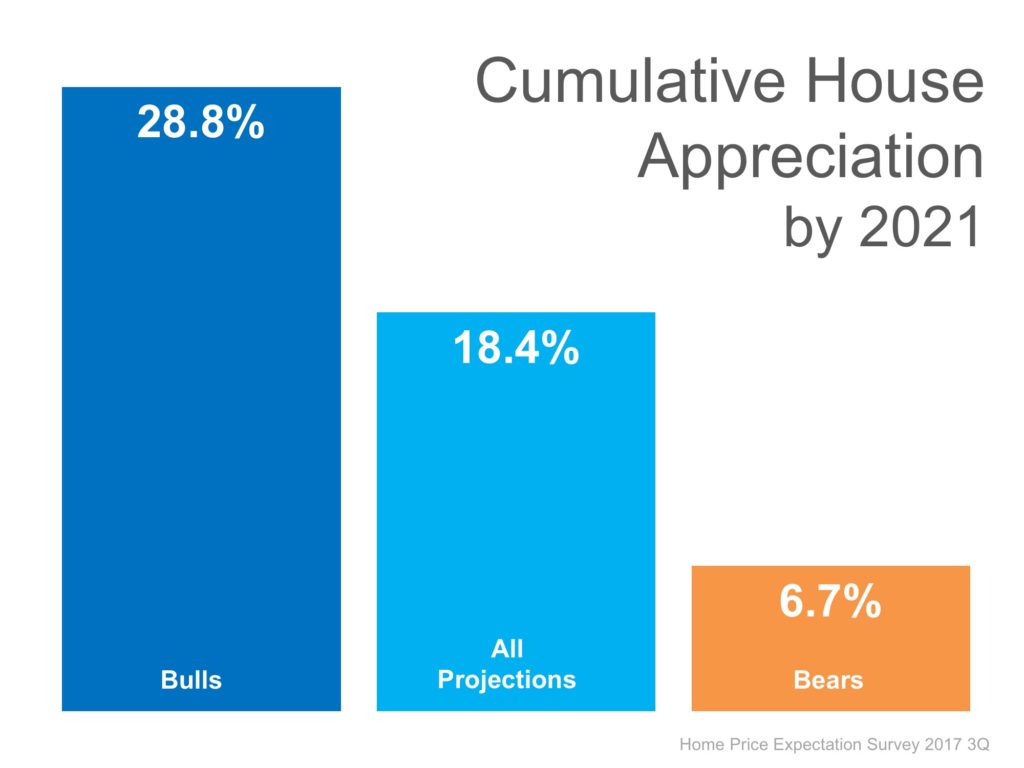

Below is a breakdown of the FICO® Score distribution of all closed (approved) loans in July from Ellie Mae’s latest Origination Report.

Over 52% of all approved loans had a FICO® Score under 750. Many potential home buyers believe that they need a score over 780 to qualify.

Bottom Line

If owning a home of your own has always been your dream and you are ready and willing to buy, or if you are a homeowner who wants to move up, find out if you are able to! Let’s get together to determine if your dreams can become a reality sooner than you thought!

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Home Prices Up 6.64% Across the Country! [INFOGRAPHIC]

Aug

25

2017

![Home Prices Up 6.64% Across the Country! [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/24140034/20170825-Share-STM.jpg)

Some Highlights:

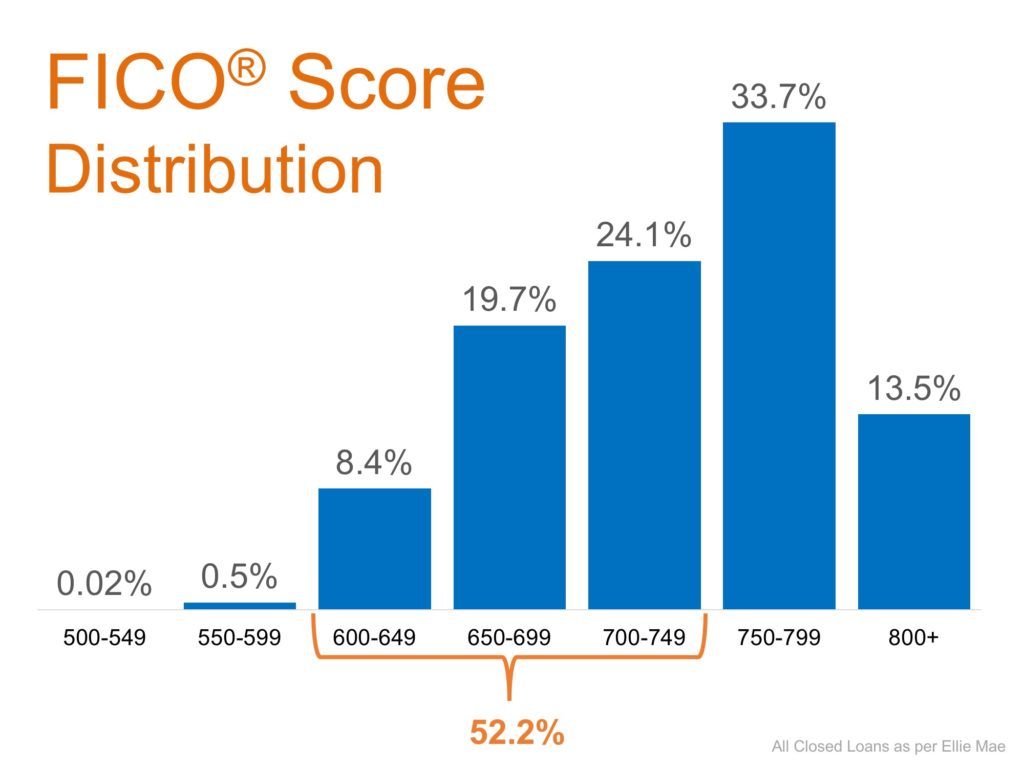

- The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report.

- In the report, home prices are compared both regionally and by state.

- Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more!

- Alaska & West Virginia were the only states where home prices are lower than they were last year.

Posted in For Buyers, For Sellers, Infographics, Move-Up Buyers, Pricing

Want to Keep up with the Joneses? Now’s the Time

Aug

23

2017

Does your current house fit your needs? Does it seem like everyone else is moving up and moving on to more luxurious surroundings? Are you wondering what it would take to start living your dream life?

Market conditions around the country have presented an opportunity like no other for those who are looking to make the jump to a premium or luxury home.

The National Association of Realtors reports that national inventory levels are now at a 4.3-month supply. A normal market, where prices appreciate with inflation, has 6-7-months inventory. The national market has echoed the conditions felt in the starter and trade-up markets as inventory has declined year-over-year for 25 consecutive months.

The chart below shows the relationship between the inventory of homes for sale and prices.

According to Trulia’s latest Inventory Report, the inventory of homes for sale in the two lower priced markets has dropped by double digit percentages over the last 12 months (16% for starter and 13% for trade-up homes). While the inventory of homes in the premium home category has dropped by only 4%.

This has created a seller’s market in the lower-priced markets, as 54% of homes were on the market for less than a month in the last Realtors Confidence Index, and a buyer’s market in the luxury market, where homes were on the market for an average of 160 days according to the Institute for Luxury Home Marketing.

Bottom Line

If you are even thinking of listing your home and moving up to a luxury home, let’s get together to evaluate your ability to do so. Homeowners across the country are upgrading their homes, why can’t you? Your dream home is waiting!

Posted in For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

58% of Homeowners See a Drop in Home Values Coming

Aug

17

2017

According to the recently released Modern Homebuyer Survey from ValueInsured, 58 percent of homeowners think there will be a “housing bubble and price correction” within the next 2 years.

After what transpired just ten years ago, we can understand the concern Americans have about the current increase in home prices. However, this market has very little in common with what happened last decade.

The two major causes of the housing crash were:

- A vast oversupply of housing inventory caused by home builders building at a pace that far exceeded historical norms.

- Lending standards that were so relaxed that unqualified buyers could easily obtain financing thus enabling them to purchase a home.

Today, housing inventory is at a 20-year low with new construction starts well below historic norms and financing a home is anything but simple in the current mortgage environment. The elements that precipitated the housing crash a decade ago do not exist in today’s real estate market.

The current increase in home prices is the result of a standard economic equation: when demand is high and supply is low, prices rise.

If you are one of the 58% of homeowners who are concerned about home values depreciating over the next two years and are hesitant to move up to the home of your dreams, take comfort in the latest Home Price Expectation Survey.

Once a quarter, a nationwide panel of over one hundred economists, real estate experts and investment & market strategists are surveyed and asked to project home values over the next five years. The experts predicted that houses would continue to appreciate through the balance of this year and in 2018, 2019, 2020 and 2021. They do expect lower levels of appreciation during these years than we have experienced over the last five years but do not call for a decrease in values (depreciation) in any of the years mentioned.

Bottom Line

If you currently own a home and are thinking of moving-up to the home your family dreams about, don’t let the fear of another housing bubble get in the way as this housing market in no way resembles the market of a decade ago.

Posted in For Buyers, Housing Market Updates, Move-Up Buyers

Sellers: Your Home is an Oasis in an Inventory Desert

Aug

16

2017

First-time homebuyers are flocking to the real estate market by the thousands to find their dream homes in order to make their dreams of homeownership a reality. Unfortunately for many, the inventory of starter and trade-up homes in the US has struggled to keep up with demand!

According to the National Association of Realtors (NAR), the inventory of homes for sale dropped 7.1% year-over-year to a 4.3-month supply and is down for the 25th consecutive month.

Some homeowners may be hesitant to list their homes for sale because they are worried that they will also have a problem finding a home to buy and move in to. This is a legitimate concern; no one wants to sell their home quickly and not have anywhere to live.

But there is good news! If you are thinking of moving up to a luxury or premium home, there is more inventory available in these markets and you may even get a great deal on a home that has been on the market for a while.

If you are the owner of a starter home and you are looking to move into a trade-up home, or if you are just looking to relocate to a new area in a home of the same size, there is still hope!

In many markets, homeowners are building contingency plans into their contracts. This means that the homeowner builds in extra time before they close in order to find their dream home and they are upfront about the contingency with any buyers who come to see the house.

Your home is an oasis to buyers who are searching for homes in today’s market. The right buyers will sympathize and wait for you and your family to find your next home.

Bottom Line

Don’t let the fear of not finding a home to move in to stop you from moving on with your life. Let’s get together to discuss ways to set expectations with potential buyers from the start.

Posted in For Sellers, Move-Up Buyers

Homes Are Selling Quickly Nationwide

Aug

15

2017

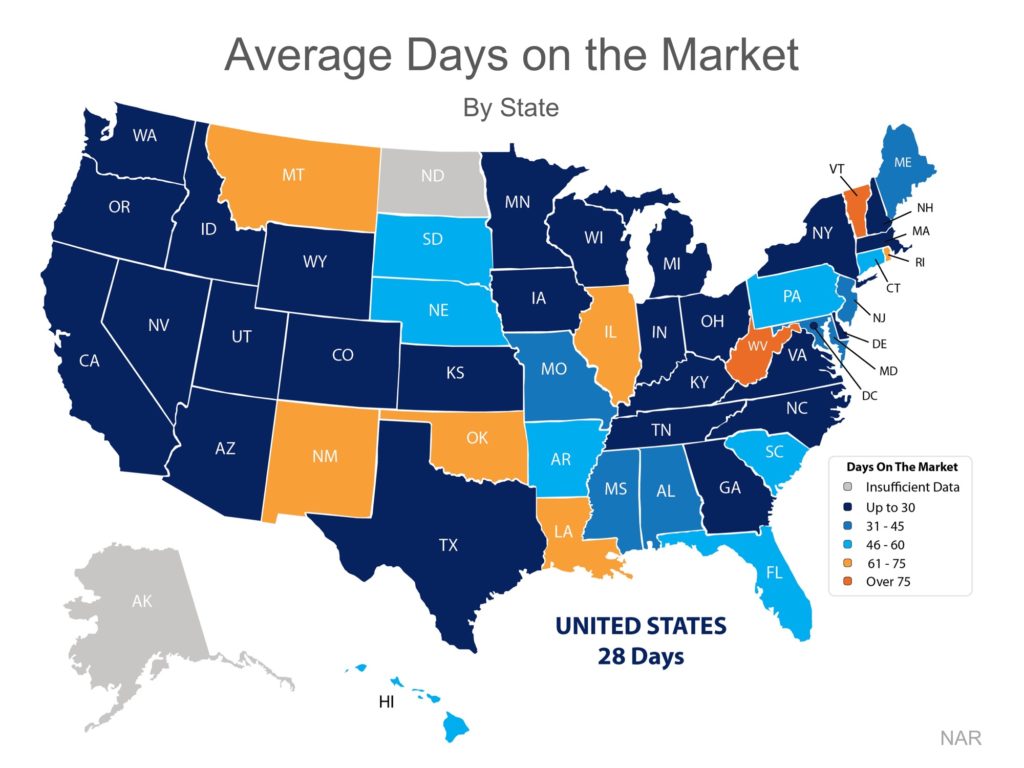

The National Association of Realtors (NAR) recently released their latest Existing Home Sales Report, which revealed that homes were on the market for an average of 28 days in June. This is a slight increase from the 27 days reported in May, but down from 34 days reported a year ago.

54% of homes across the country were on the market for less than a month in June!

Among the 27 states with homes selling in 30 days or less are Washington, Utah, California, and Colorado. The map below was created using results from NAR’s Monthly Realtors Confidence Index Survey.

Bottom Line

Buyer demand is increasing as the inventory of homes available for sale remains low. If you are thinking about listing your home for sale this year, let’s meet up so I can help you take advantage of current market conditions!

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

Homeowner’s Net Worth Is Still Greater Than a Renter’s

Aug

14

2017

Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400).

The latest survey data, covering 2014-2016 will be released later this year. In the meantime, Lawrence Yun, the National Association of Realtors’ Chief Economist estimates that the gap has widened even further, to 45 times greater ($225,000 vs. $5,000)!

Put Your Housing Cost to Work for You

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth. Every time you pay your rent, you are contributing to your landlord’s net worth.

The latest National Housing Pulse Survey from NAR reveals that 84% of consumers believe that purchasing a home is a good financial decision. William E. Brown comments:

“Despite the growing concern over affordable housing, this survey makes it clear that a strong majority still believe in homeownership and aspire to own a home of their own. Building equity, wanting a stable and safe environment, and having the freedom to choose their neighborhood remain the top reasons to own a home.”

Bottom Line

If you are interested in finding out if you could put your housing cost to work for you by purchasing a home, let’s get together and evaluate your ability to buy today!

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Hey, Millennial Homeowners!! It May Be Time to Sell

Aug

10

2017

Contrary to what many believe, Millennials are not the ‘renter’ generation. Millennials purchased a larger percentage (34%) of homes in the U.S. than any other age group in 2017 and the most recent Census Bureau report shows that the homeownership rate among Millennials is finally on the rise.

Many Millennials took advantage of post housing crash prices and the First-Time Homebuyers’ Tax Credit and jumped into homeownership in 2010. If you are one of these buyers, now may be the time to sell for many reasons. Here are a few:

1. Equity Build-Up

Home prices have been on the rise since the beginning of 2012 and your house may have appreciated by more than you think. ATTOM Data Solutions, in their Q2 2017 U.S. Home Sales Report revealed that:

“…homeowners who sold in the second quarter realized an average price gain of $51,000 since purchase — the highest average price gain for home sellers since Q2 2007, when it was $57,000.

The average home seller price gain of $51,000 in Q2 2017 represented an average return of 26 percent on the previous purchase price of the home, the highest average home seller return since Q3 2007, when it was 27 percent.”

2. Projected Home Price Increases

If you just got married or just found out you are about to become a parent, you may have plans to move up a bigger home or perhaps move to a different area. Waiting to buy a more expensive home in this market probably doesn’t make sense. The experts contacted for the Home Price Expectation Survey are projecting home prices to increase by nearly 5% over the next year. Yes, your house’s price will increase but not as much as a home currently valued higher than yours.

3. Projected Interest Rate Increases

The Mortgage Bankers’ Association, Freddie Mac, Fannie Mae and the National Association of Realtors are each projecting mortgage rates to increase over the next year.

Higher PRICES + Higher INTEREST RATES = LARGER MORTGAGE PAYMENTS.

Bottom Line

If you are lucky enough to be one of those Millennials who purchased a house in 2010 (or even later), now might be the perfect time to move up to the home of your dreams!

Posted in For Sellers, Millennials, Move-Up Buyers

93.9% Of Homes in The US Have Positive Equity

Aug

08

2017

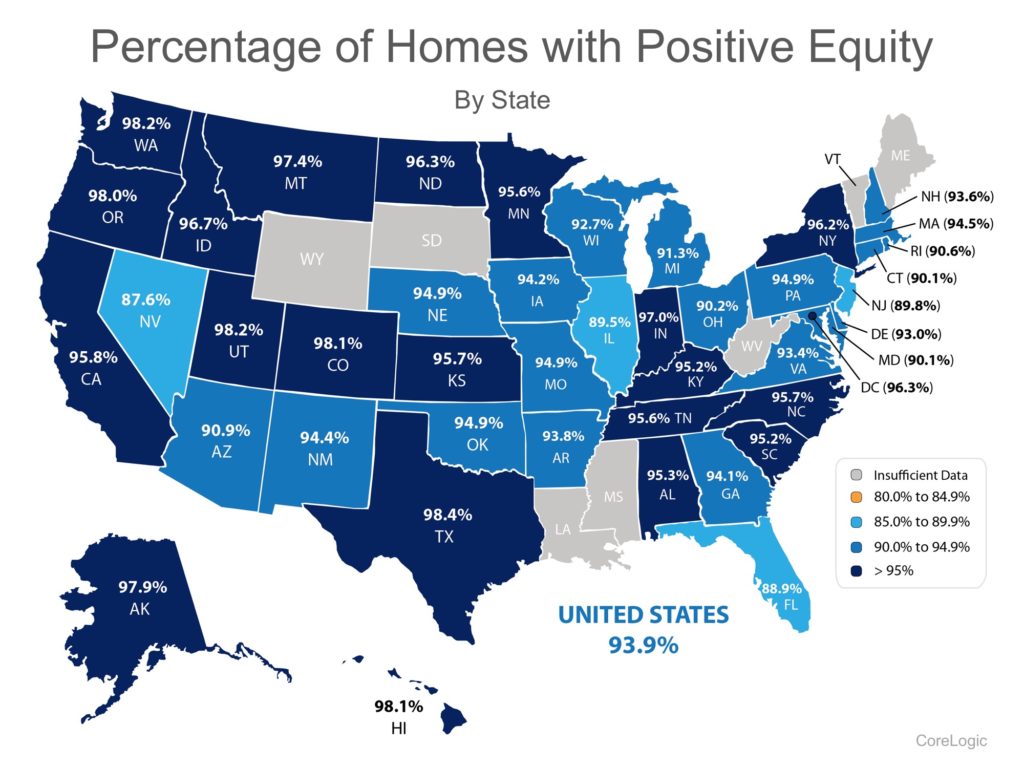

CoreLogic’s latest Equity Report revealed that ninety-one thousand residential properties regained equity in Q1 2017. The outlook for 2017 remains positive as well, as an additional 600 thousand properties will regain equity if home prices rise another 5% this year.

The study also revealed that:

- Roughly 63% of all homeowners have seen their equity increase since Q1 2016

- The average homeowner gained about $14,000 in equity between Q1 2016 and Q1 2017

- Only 1.6% of residential properties are near-negative equity

Below is a map showing the percentage of homes with a mortgage, in each state, that have positive equity. (The states in gray have insufficient data to report.)

Significant Equity Is On The Rise

Frank Martell, President & CEO of CoreLogic, believes this is great news for the “long-term health of the U.S. economy.” He went on to say:

“Homeowner equity increased by $766 billion over the last year, the largest increase since Q2 2014. The rising cushion of home equity is one of the main drivers of improved mortgage performance. Since home equity is the largest source of homeowner wealth, the increase in home equity also supports consumer balance sheets, spending and the broader economy.”

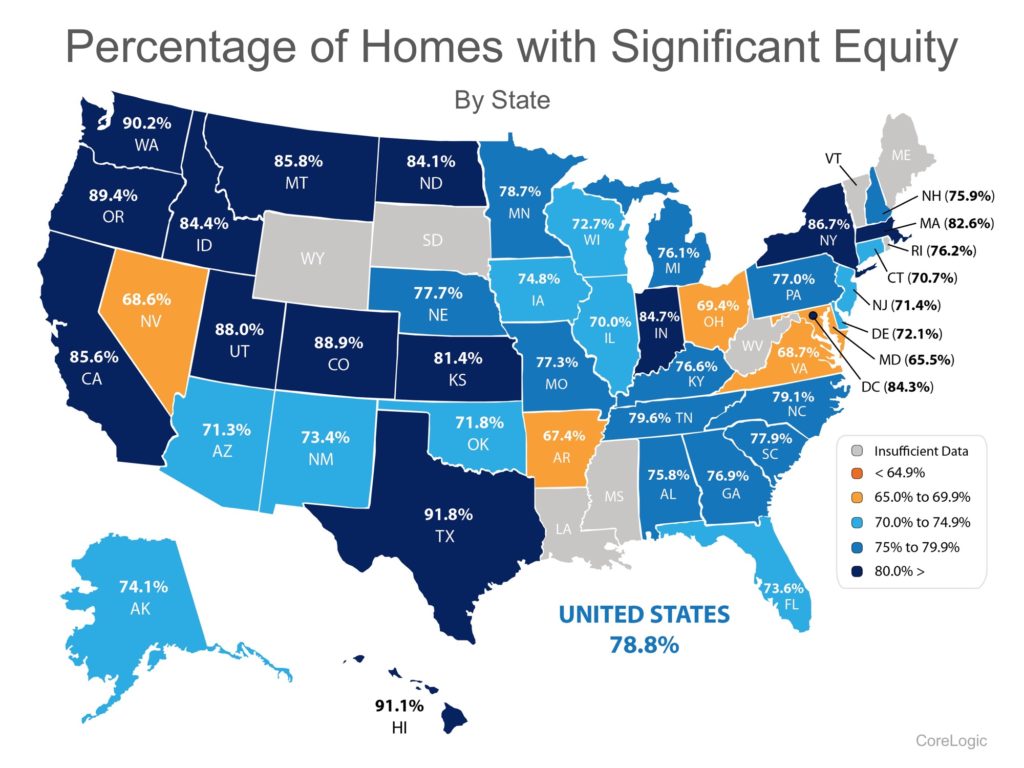

Of the 93.9% of homeowners with positive equity in the US, 78.8% have significant equity (defined as more than 20%). This means that nearly three out of four homeowners with a mortgage could use the equity in their current home to purchase a new home, now.

The map below shows the percentage of homes with a mortgage, in each state, that have significant equity. (The states in gray have insufficient data to report.)

Bottom Line

If you are one of the many homeowners who are unsure of how much equity they have in their homes and are curious about their ability to move, let’s meet up to evaluate your situation.

Posted in For Sellers, Move-Up Buyers