Category: Move-Up Buyers

Why Working with a Local Real Estate Professional Makes All the Difference

May

31

2017

If you’ve entered the real estate market, as a buyer or a seller, you’ve inevitably heard the real estate mantra, “location, location, location” in reference to how identical homes can increase or decrease in value due to where they’re located. Well, a new survey shows that when it comes to choosing a real estate agent, the millennial generation’s mantra is, “local, local, local.”

CentSai, a financial wellness online community, recently surveyed over 2,000 millennials (ages 18-34) and found that 75% of respondents would use a local real estate agent over an online agent, and 71% would choose a local lender.

Survey respondents cited many reasons for their choice to go local, “including personal touch & handholding, longstanding relationships, local knowledge, and amount of hassle.”

Doria Lavagnino, Cofounder & President of CentSai had this to say:

“We were surprised to learn that online providers are not yet as big a disruptor in this sector as we first thought, despite purported cost savings. We found that millennials place a high value on the personal touch and knowledge of a local agent. Buying a home for the first time is daunting, and working with a local agent—particularly an agent referred by a parent or friend—could provide peace of mind.”

The findings of the CentSai survey are consistent with the Consumer Housing Trends Study, which found that millennials prefer a more hands-on approach to their real estate experience:

“While older generations rely on real estate agents for information and expertise, Millennials expect real estate agents to become trusted advisers and strategic partners.”

When it comes to choosing an agent, millennials and other generations share their top priority: the sense that an agent is trustworthy and responsive to their needs.

That said, technology still plays a huge role in the real estate process. According to the National Association of Realtors, 95% of home buyers look for prospective homes and neighborhoods online, and 91% also said they would use an online site or mobile app to research homes they might consider purchasing.

Bottom Line

Many wondered if this tech-savvy generation would prefer to work with an online agent or lender, but more and more studies show that when it comes to real estate, millennials want someone they can trust, someone who knows the neighborhood they want to move into, leading them through the entire experience.

Posted in First Time Home Buyers, For Buyers, For Sellers, Millennials, Move-Up Buyers

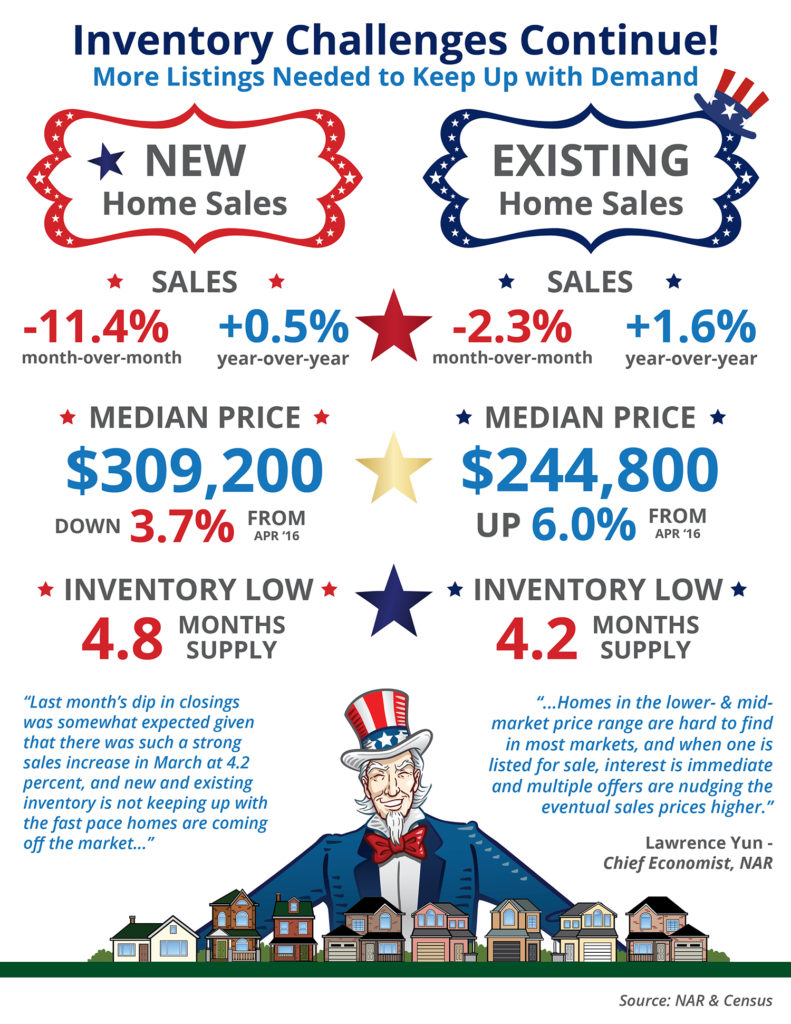

Inventory Challenges Continue! [INFOGRAPHIC]

May

26

2017

Some Highlights:

- After a surge in March, existing home sales and new home sales slowed due to a drop in inventory available for sale in the start-up and trade-up categories.

- Median existing home prices surged for the 62nd straight month, up 6.0% over last year to $244,800.

- New home prices slowed as builders have started to turn their focus toward single family, smaller homes.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

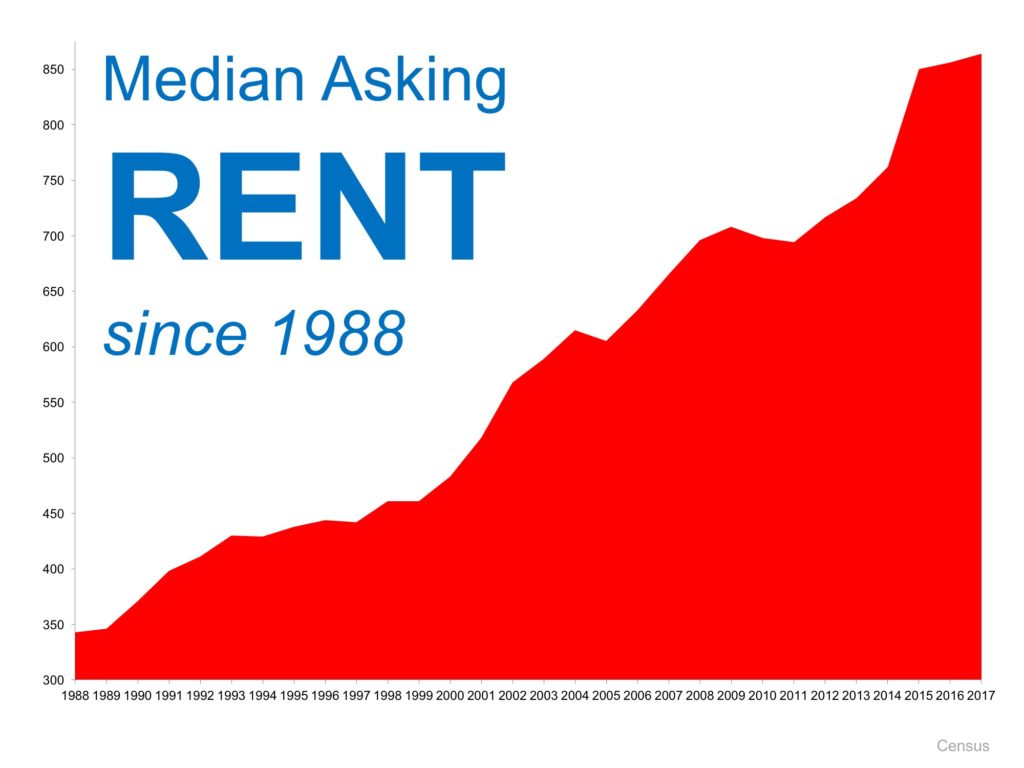

Is Now a Good Time to Rent?

May

23

2017

People often ask if now is a good time to buy a home, but nobody ever asks when a good time to rent is. Regardless, we want to make certain that everyone understands that today is NOT a good time to rent.

The Census Bureau recently released their 2017 first quarter median rent numbers. Here is a graph showing rent increases from 1988 until today:

As you can see, rents have steadily increased and are showing no signs of slowing down. If you are faced with making the decision of whether or not you should renew your lease, you might be pleasantly surprised at your ability to buy a home of your own instead.

Bottom Line

One way to protect yourself from rising rents is to lock in your housing expense by buying a home. If you are ready and willing to buy, let’s meet to determine if you are able to today!

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

5 Reasons to Hire a Real Estate Professional When Buying or Selling!

May

22

2017

Whether you are buying or selling a home it can be quite an adventurous journey, which is why you need an experienced real estate professional to guide you on the path to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.

The 5 reasons you NEED a real estate professional in your corner haven’t changed, but have rather been strengthened by the projections of higher mortgage interest rates & home prices as the market continues to pick up steam.

1. What do you do with all this paperwork?

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true real estate professional is an expert in his or her market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what?

There are over 180 possible steps that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to make sure that you achieve your dream?

3. Are you a good negotiator?

So maybe you’re not convinced that you need an agent to sell your home. After looking at the list of parties that you will need to be prepared to negotiate with, you’ll soon realize the value in selecting a real estate professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people who you will need to be knowledgeable of, and answer to, during the process.

4. What is the home you’re buying/selling really worth?

It is important for your home to be priced correctly from the start to attract the right buyers and shorten the amount of time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to the National Association of REALTORS, “the typical FSBO home sold for $185,000 compared to $245,000 among agent-assisted home sales.”

Get the most out of your transaction by hiring a professional.

5. Do you know what’s really going on in the market?

There is so much information out there on the news and the internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively, and correctly, price your home at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has his or her finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

You wouldn’t replace the engine in your car without a trusted mechanic. Why would you make one of the most important financial decisions of your life without hiring a real estate professional?

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers

#1 Answer to the Housing Shortage: New Construction

May

18

2017

The biggest challenge to today’s housing market is the shortage of housing inventory for sale. A normal market would see a six-month supply of homes for sale. Currently, that number is below four months. This is the major reason home prices have continued to appreciate at higher levels than historic averages.

The good news is that builders are now starting to build more homes in lower price ranges.

Builder Confidence is Up

The Housing Market Index from the National Association of Home Builders (NAHB) reveals that builder confidence increased last month. HousingWire quoted NAHB Chief Economist Robert Dietz about the reason for the increase in confidence amongst builders.

“The HMI measure of future sales conditions reached its highest level since June 2005, a sign of growing consumer confidence in the new home market. Especially as existing home inventory remains tight, we can expect increased demand for new construction moving forward.”

Builders are Meeting the Needs of Today’s Purchaser

Builders are not only jumping into the market – they are doing a better job of matching current demand. The Wall Street Journal recently reported:

“In a shift, new households are overwhelmingly choosing to buy rather than rent. Some 854,000 new-owner households were formed during the first three months of the year, more than double the 365,000 new-renter households formed during the period, according to Census Bureau data.”

The WSJ article went on to say:

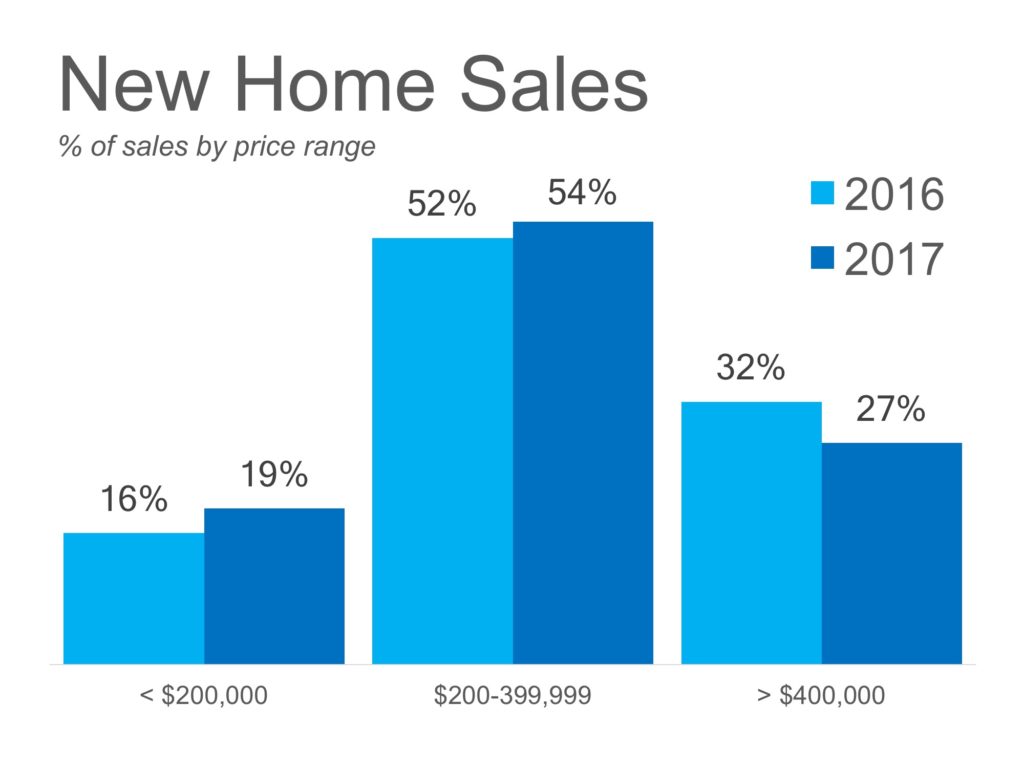

“Home builders are beginning to shift their focus away from luxury homes and toward homes at lower price points to cater to this burgeoning millennial clientele.”

The graph below compares 2016 to 2017 new construction sales by price point. As we can see, builders are slowly beginning to shift to prices more favorable to the first-time and non-luxury buyer.

Bottom Line

There is a drastic need for a larger supply of home inventory to meet the skyrocketing demand. Builders are finally doing their part to help rectify this situation.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers, New Construction

4 Tips for Effectively Making an Offer

May

16

2017

So, you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market, you want to make sure that you make a good offer so that you can guarantee that your dream of making this house yours comes true!

Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the 4 tips they covered along with some additional information for your consideration:

1. Understand How Much You Can Afford

“While it’s not nearly as fun as house hunting, fully understanding your finances is critical in making an offer.”

This ‘tip’ or ‘step’ should really take place before you start your home search process.

As we’ve mentioned before, getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and will allow you to make your offer with the confidence of knowing that you have already been approved for a mortgage for that amount. You will also need to know if you are prepared to make any repairs that may need to be made to the house (ex: new roof, new furnace).

2. Act Fast

“Even though there are fewer investors, the inventory of homes for sale is also low and competition for housing continues to heat up in many parts of the country.”

According to the latest Existing Home Sales Report, the inventory of homes for sale is currently at a 3.7-month supply; this is well below the 6-month supply that is needed for a ‘normal’ market. Buyer demand has continued to outpace the supply of homes for sale, causing buyers to compete with each other for their dream homes.

Make sure that as soon as you decide that you want to make an offer, you work with your agent to present it as soon as possible.

3. Make a Solid Offer

Freddie Mac offers this advice to help make your offer the strongest it can be:

“Your strongest offer will be comparable with other sales and listings in the neighborhood. A licensed real estate agent active in the neighborhoods you are considering will be instrumental in helping you put in a solid offer based on their experience and other key considerations such as recent sales of similar homes, the condition of the house and what you can afford.”

Talk with your agent to find out if there are any ways that you can make your offer stand out in this competitive market!

4. Be Prepared to Negotiate

“It’s likely that you’ll get at least one counteroffer from the sellers so be prepared. The two things most likely to be negotiated are the selling price and closing date. Given that, you’ll be glad you did your homework first to understand how much you can afford.

Your agent will also be key in the negotiation process, giving you guidance on the counteroffer and making sure that the agreed-to contract terms are met.”

If your offer is approved, Freddie Mac urges you to “always get an independent home inspection, so you know the true condition of the home.” If the inspector uncovers undisclosed problems or issues, you can discuss any repairs that may need to be made with the seller, or cancel the contract.

Bottom Line

Whether you’re buying your first home or your fifth, having a local professional on your side who is an expert in their market is your best bet in making sure the process goes smoothly. Happy House Hunting!

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Do You Know the Cost of NOT Owning Your Home?

May

15

2017

Owning a home has great financial benefits, yet many continue renting! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.

Zillow recently reported that:

“With Rents continuing to climb and interest rates staying low, many renters find themselves gazing over the homeownership fence and wondering if the grass really is greener. Leaving aside, for the moment, the difficulties of saving for a down payment, let’s focus on the monthly expenses of owning a home: it turns out that renters currently paying the median rent in many markets could afford to buy a higher-quality property than the typical (read: median-valued) home without increasing their monthly expenses.”

What proof exists that owning is financially better than renting?

1. The latest Rent Vs. Buy Report from Trulia pointed out the top 5 financial benefits of homeownership:

- Mortgage payments can be fixed while rents go up.

- Equity in your home can be a financial resource later.

- You can build wealth without paying capital gain.

- A mortgage can act as a forced savings account

- Overall, homeowners can enjoy greater wealth growth than renters.

2. Studies have shown that a homeowner’s net worth is 45x greater than that of a renter.

3. Just a few months ago, we explained that a family buying an average priced home at the beginning of 2017 could build more than $42,000 in family wealth over the next five years.

4. Some argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into the rent payment –along with a profit margin!!

Bottom Line

Owning a home has always been, and will always be, better from a financial standpoint than renting.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

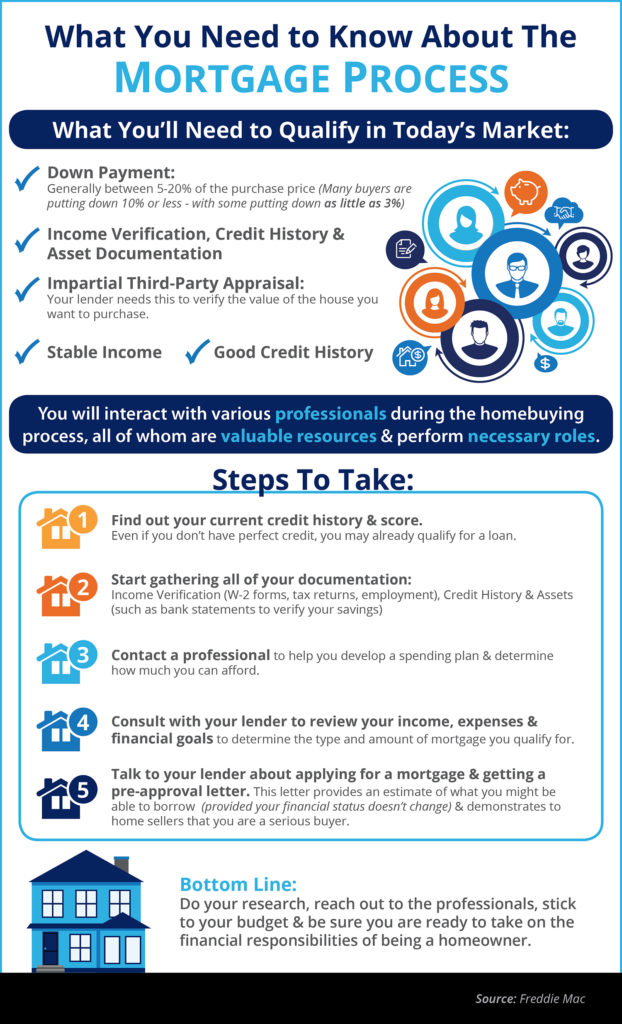

What You Need to Know About Qualifying for a Mortgage [INFOGRAPHIC]

May

12

2017

Some Highlights:

- Many buyers are purchasing a home with a down payment as little as 3%.

- You may already qualify for a loan, even if you don’t have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

Posted in First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

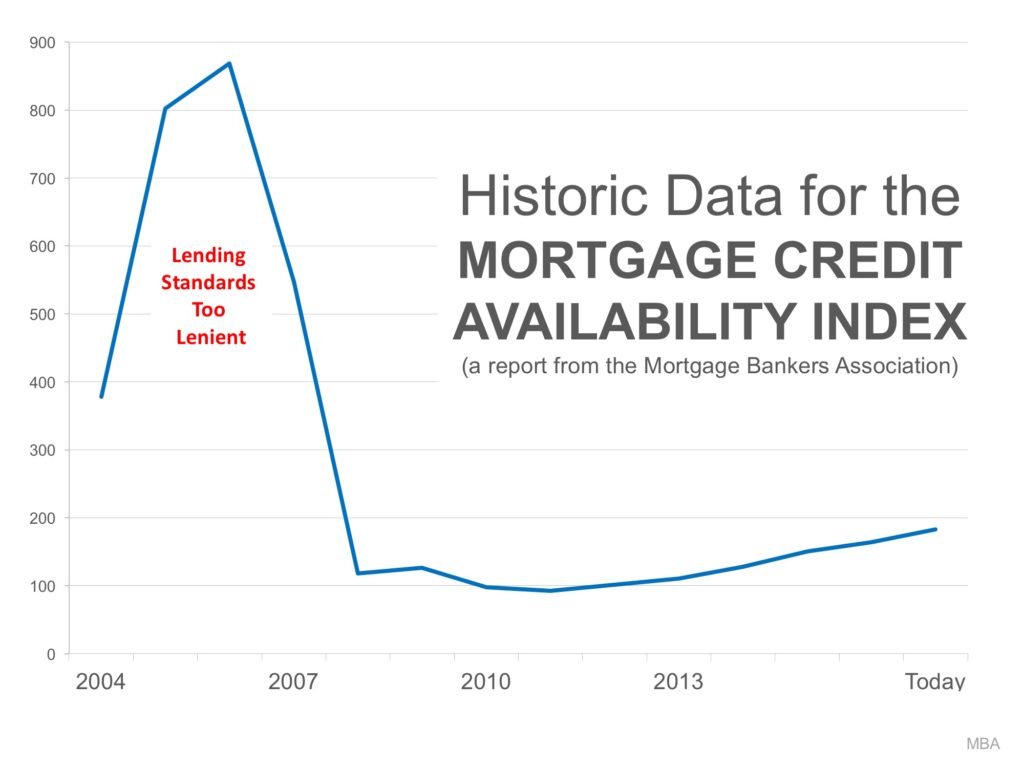

3 Reasons the Housing Market is NOT in a Bubble

May

11

2017

With housing prices appreciating at levels that far exceed historical norms, some are fearful that the market is heading for another bubble. To alleviate that fear, we just need to look back at the reasons that caused the bubble ten years ago.

Last decade, demand for housing was artificially propped up because mortgage lending standards were way too lenient. People that were not qualified to purchase were able to attain a mortgage anyway. Prices began to skyrocket. This increase in demand caused homebuilders in many markets to overbuild.

Eventually, the excess in new construction and the flooding of the market with distressed properties (foreclosures & short sales), caused by the lack of appropriate lending standards, led to the housing crash.

Where we are today…

1. If we look at lending standards based on the Mortgage Credit Availability Index released monthly by the Mortgage Bankers Association, we can see that, though standards have become more reasonable over the last few years, they are nowhere near where they were in the early 2000s.

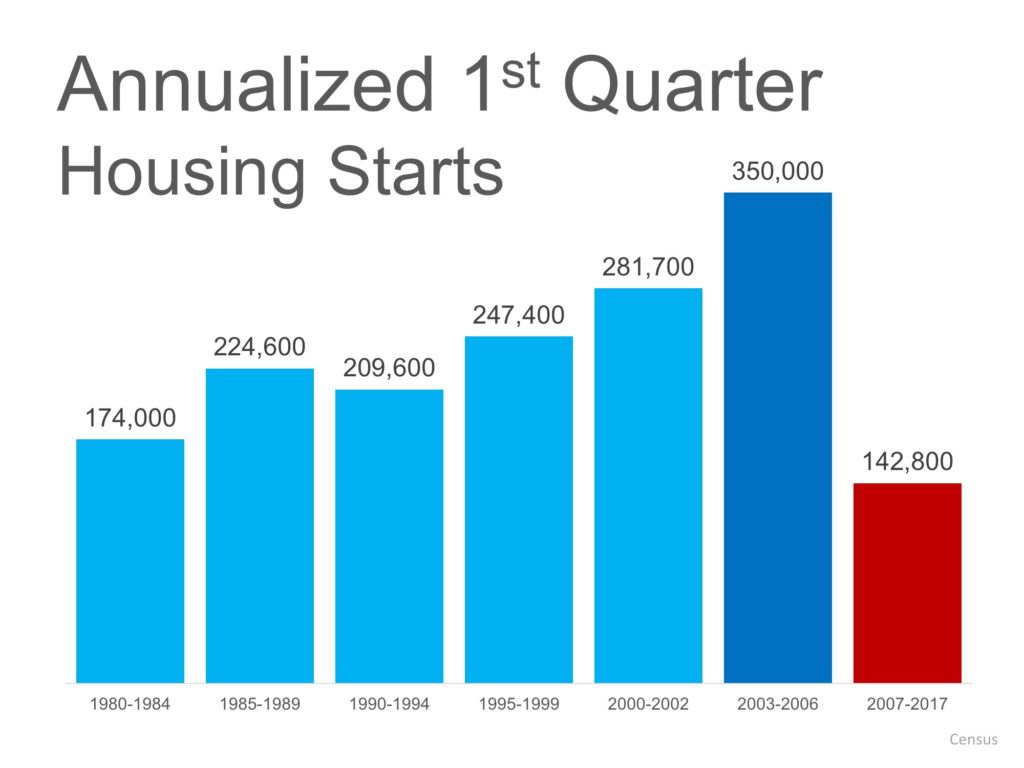

2. If we look at new construction, we can see that builders are not “over building.” Average annual housing starts in the first quarter of this year were not just below numbers recorded in 2002-2006, they are below starts going all the way back to 1980.

3. If we look at home prices, most homes haven’t even returned to prices seen a decade ago. Trulia just released a report that explained:

“When it comes to the value of individual homes, the U.S. housing market has yet to recover. In fact, just 34.2% of homes nationally have seen their value surpass their pre-recession peak.”

Bottom Line

Mortgage lending standards are appropriate, new construction is below what is necessary and home prices haven’t even recovered. It appears fears of a housing bubble are over-exaggerated.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Gallup: Real Estate is Best Long-Term Investment 4 Years Running

May

10

2017

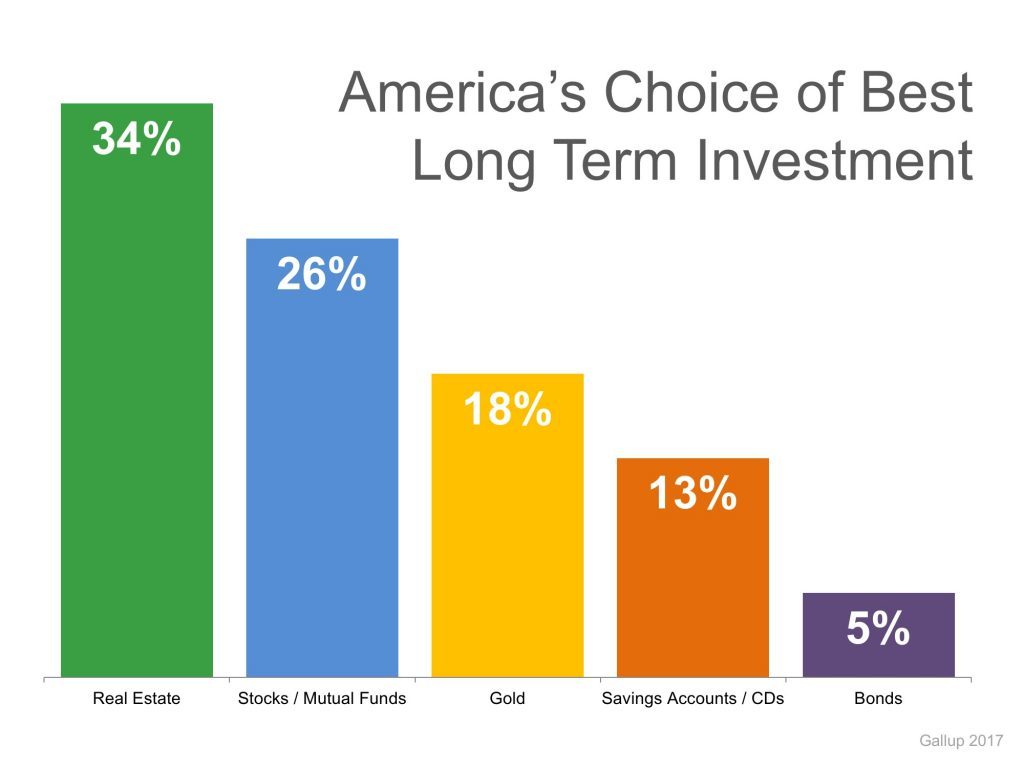

Every year, Gallup surveys Americans to determine their choice for the best long-term investment. Respondents are given a choice between real estate, stocks/mutual funds, gold, savings accounts/CDs, or bonds.

For the fourth year in a row, Real Estate has come out on top as the best long-term investment! This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26%. The full results are shown in the chart below.

The study makes it a point to draw attention to the contrast of the sentiment over the last four years compared to that of 2011-2012, when gold took the top slot with 34% of the votes. Real estate and stocks took second and third place, respectively, while still in recovery from the Great Recession.

Bottom Line

As the real estate market has recovered, so has the belief of the American people in the stability of housing as a long-term investment.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers