Category: Move-Up Buyers

Careful…Don’t Get Caught in the Rental Trap!

Apr

11

2017

There are many benefits to homeownership. One of the top benefits is being able to protect yourself from rising rents by locking in your housing cost for the life of your mortgage.

Don’t Become Trapped

Jonathan Smoke, Chief Economist at realtor.com, reported on what he calls a “Rental Affordability Crisis.” He warns that,

“Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price appreciation in the year ahead.”

In the Joint Center for Housing Studies at Harvard University’s 2016 State of the Nation’s Housing Report, they revealed that “The number of cost-burdened households rose to 21.3 million. Even more troubling, the number with severe burdens (paying more than 50% of income for housing) jumped to a record 11.4 million.” These households struggle to save for a rainy day and pay other bills, such as food and healthcare.

It’s Cheaper to Buy Than Rent

In Smoke’s article, he went on to say,

“Housing is central to the health and well-being of our country and our local communities. In addition, this (rental affordability) crisis threatens the future value of owned housing, as the burdensome level of rents will trap more aspiring owners into a vicious financial cycle in which they cannot save and build a solid credit record to eventually buy a home.”

“While more than 85% of markets have burdensome rents today, it’s perplexing that in more than 75% of the counties across the country, it is actually cheaper to buy than rent a home. So why aren’t those unhappy renters choosing to buy?”

Know Your Options

Perhaps you have already saved enough to buy your first home. HousingWire reported that analysts at Nomura believe:

“It’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment.

It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added)

Many first-time homebuyers who believe that they need a large down payment may be holding themselves back from their dream home. As we have reported before, in many areas of the country, a first-time home buyer can save for a 3% down payment in less than two years. You may have already saved enough!

Bottom Line

Don’t get caught in the trap so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Let’s get together to determine if you can qualify for a mortgage now!

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

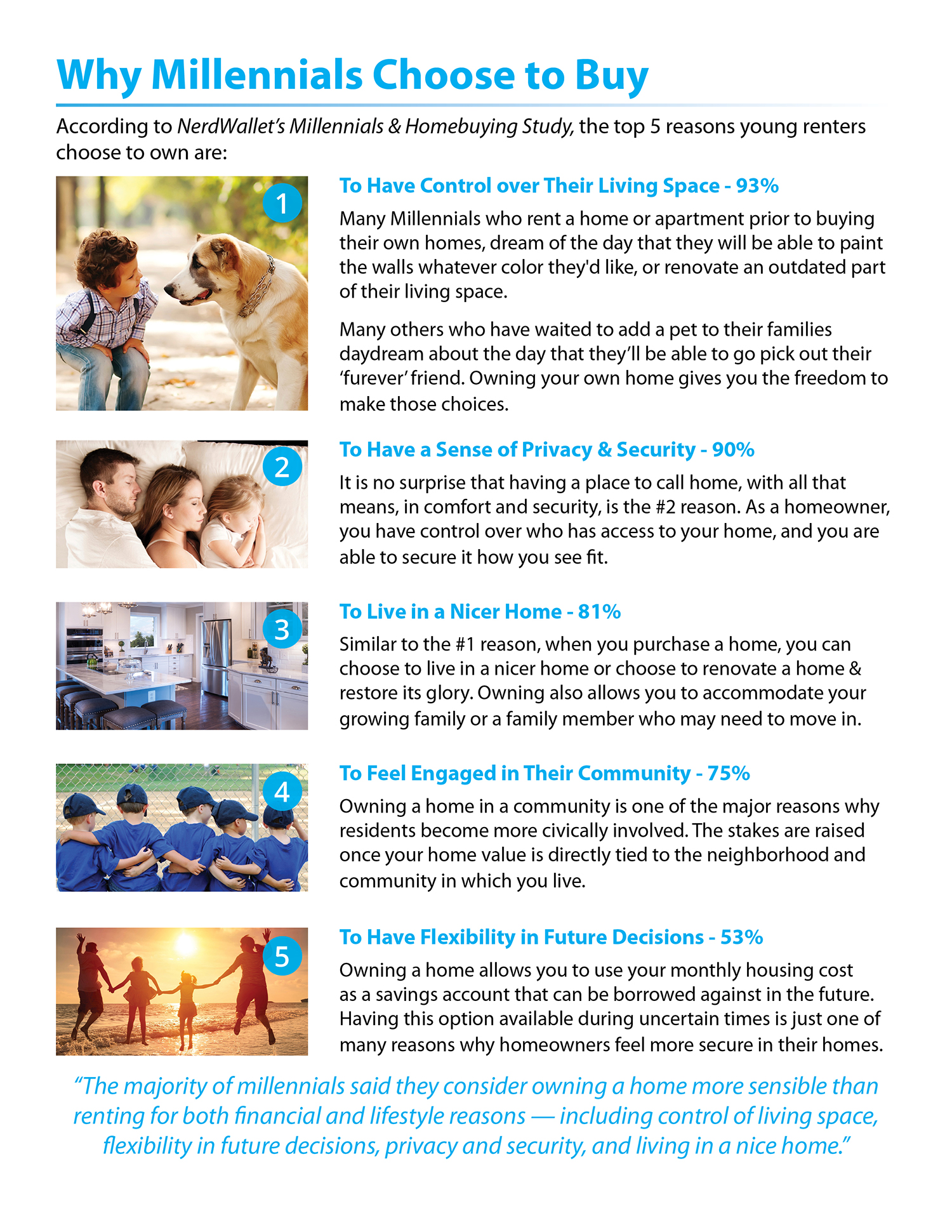

Why Millennials Choose to Buy [INFOGRAPHIC]

Apr

07

2017

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- At 93%, the top reason Millennials choose to buy is to have control over their living space.

- Many Millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls whatever color they’d like, or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials, Move-Up Buyers

The ‘REAL’ News about Housing Affordability

Apr

06

2017

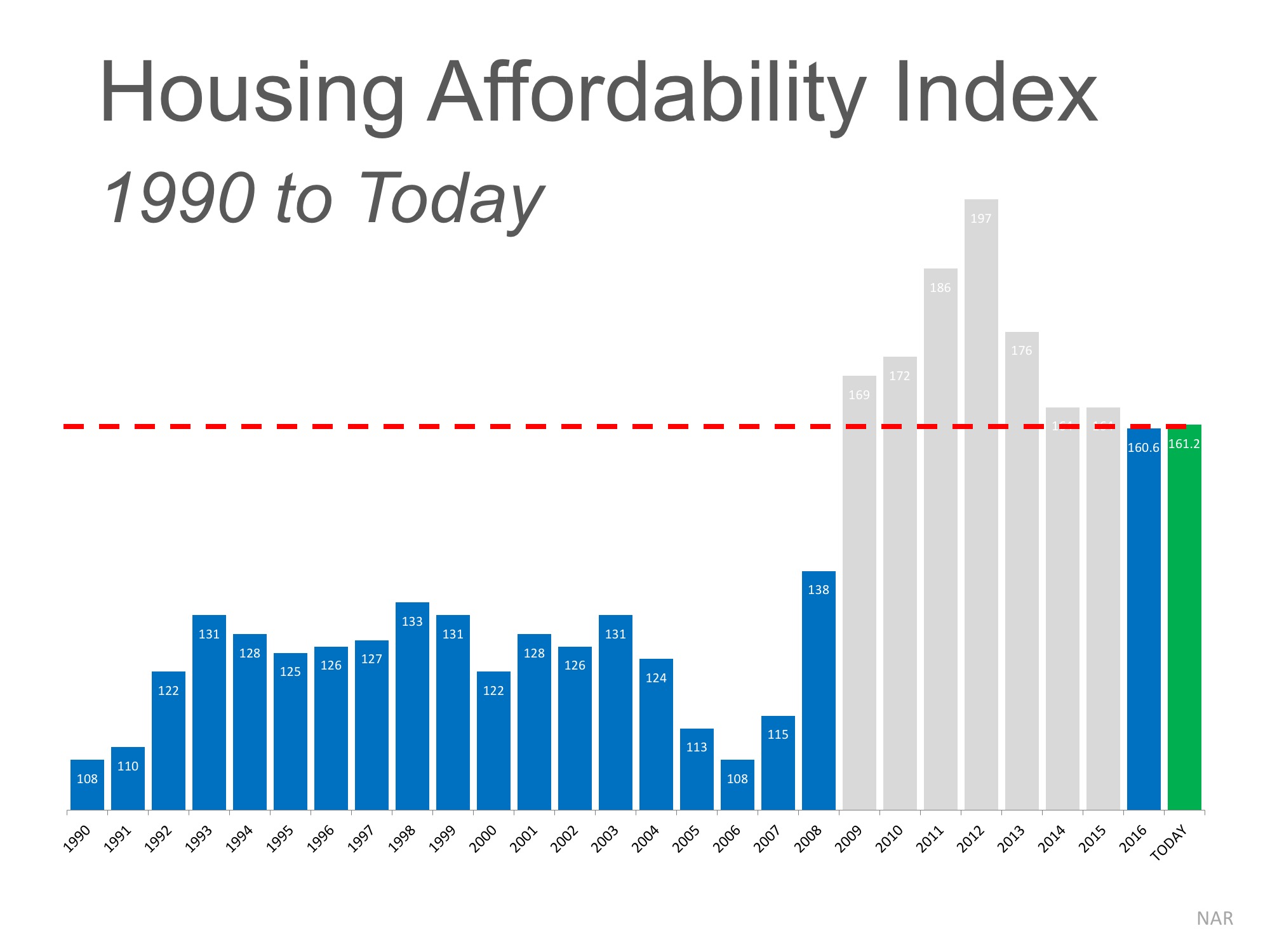

Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).

Here is how NAR defines the index:

“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”

Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median-priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify.

The higher the index, the easier it is to afford a home.

Why the concern?

The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market.

But, wait a minute…

Though the index skyrocketed from 2009 through 2013, we must realize that during that time, the housing crisis left the market with an overabundance of distressed properties (foreclosures and short sales). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock.

The market is recovering, and values are coming back nicely. That has caused the index to fall.

However, let’s remove the crisis years (shaded in gray) and look at the current index as compared to the index from 1990 – 2008:

Though prices and rates appear to be increasing, we must realize that affordability is composed of three ingredients: home prices, interest rates, and income. And, incomes are finally rising.

ATTOM Data Solutions recently released their Q1 2017 U.S. Home Affordability Index. The report explained:

“Stronger wage growth is the silver lining in this report, outpacing home price growth in more than half of the markets for the first time since Q1 2012, when median home prices were still falling nationwide. If that pattern continues, it will help turn the tide in the eroding home affordability trend.”

Bottom Line

Compared to historic norms, it is still a great time to buy from an affordability standpoint.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Buying this Spring? Be Prepared for Bidding Wars

Apr

05

2017

Traditionally, spring is the busiest season for real estate. Buyers come out in force and homeowners list their houses for sale hoping to capitalize on buyer activity. This year will be no different!

Buyers have already been out in force looking for their dream homes and more are on their way, but the challenge is that the inventory of homes for sale has not kept up with demand, which has lead to A LOT of competition for the homes that are available.

A recent Bloomberg article touched on the current market conditions:

“It’s the 2017 U.S. spring home-selling season, and listings are scarcer than they’ve ever been. Bidding wars common in perennially hot markets like the San Francisco Bay area, Denver and Boston are now also prevalent in the once slow-and-steady heartland, sending prices higher and sparking desperation among buyers across the country.”

Sam Khater, Deputy Chief Economist at CoreLogic went on to explain why buyers are flocking to the market in big numbers:

“In today’s market, many buyers think the trough in [interest] rates is over. If you don’t get in now, it’s just going to be worse later. Rates will be higher, prices will be higher, and maybe inventory selection will be lower.”

In some markets, “thirty-five percent of properties are selling within the first week or two of hitting the market.” Homes are selling at a rapid clip in places like:

- Denver, CO

- Seattle, WA

- Oakland, CA

- Grand Rapids, MI

- Boise, ID

- Madison, WI

- Omaha, NE

Bottom Line

Let’s get together to discuss your exact market conditions and help you create a strategy to secure your new home in this competitive atmosphere!

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Again… You Do Not Need 20% Down to Buy NOW!

Apr

03

2017

A survey by Ipsos found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. There are two major misconceptions that we want to address today.

1. Down Payment

The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 40% of consumers think a 20% down payment is always required. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

The survey also revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in February had a credit score of 752, while FHA mortgages closed with a score of 686. The average across all loans closed in February was 720. The chart below shows the distribution of FICO® Scores for all loans approved in February.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

Posted in Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

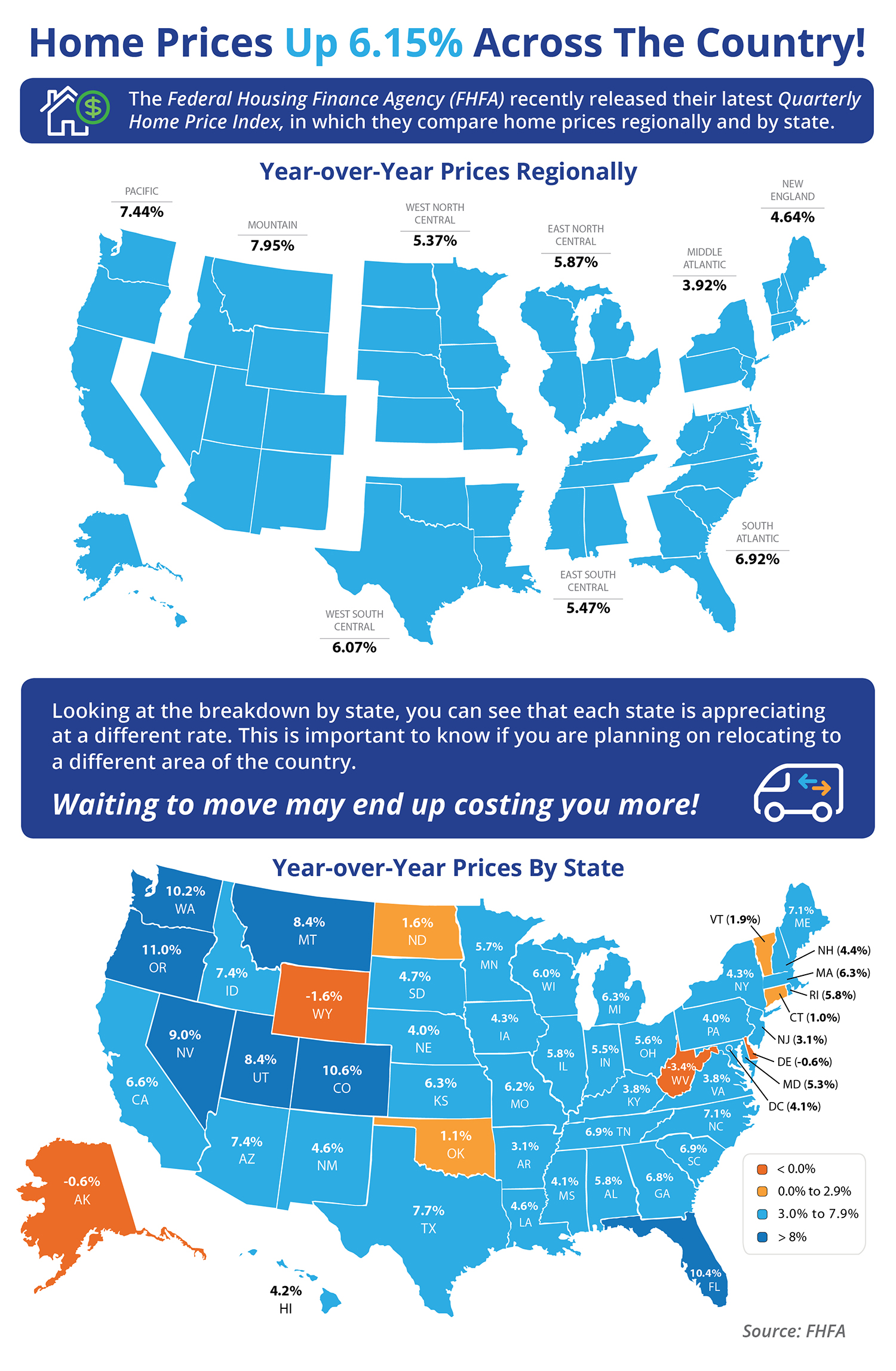

Home Prices Up 6.15% Across the Country! [INFOGRAPHIC]

Mar

31

2017

Some Highlights:

- The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report.

- In the report, home prices are compared both regionally and by state.

- Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more!

- Alaska, Delaware, West Virginia & Wyoming were the only states where home prices are lower than they were last year.

Posted in First Time Home Buyers, For Buyers, For Sellers, Infographics, Move-Up Buyers, Pricing

Looking to Move-Up to a Luxury Home? Now’s the Time!

Mar

29

2017

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! We recently shared data from Trulia’s Market Mismatch Study which showed that in today’s premium home market, buyers are in control.

The inventory of homes for sale in the luxury market far exceeds those searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer, or can be found at a discount.

Those who have a starter or trade-up home to sell will find buyers competing, and often entering bidding wars, to be able to call your house their new home.

The sale of your starter or trade-up house will aid in coming up with a larger down payment for your new luxury home. Even a 5% down payment on a million-dollar home is $50,000.

But not all who are buying luxury properties have a home to sell first.

In a recent Washington post article, Daryl Judy, an associate broker with Washington Fine Properties, gave some insight into what many millennials are choosing to do:

“Some high-earning millennials save money until they are in their early 30s to buy a place and just skip over that starter-home phase. They’ll stay in an apartment until they can afford to pay for the place they want.”

Bottom Line

The best time to sell anything is when demand is high and supply is low. If you are currently in a starter or trade-up house that no longer fits your needs, and are looking to step into a luxury home… Now’s the time to list your house for sale and make your dreams come true.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Millionaire to Millennials: Buy Now!

Mar

28

2017

Self-made millionaire David Bach was quoted in a CNBC article explaining that “the single biggest mistake millennials are making” is not purchasing a home because buying real estate is “an escalator to wealth.”

Bach went on to explain:

“If millennials don’t buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter.”

In his bestselling book, “The Automatic Millionaire,” Bach does the math:

“As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing. Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!”

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.

He has been a contributor to NBC’s Today Show appearing more than 100 times, has been a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS, and has been profiled in many major publications, including The New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, The Washington Post, The Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Renting or Buying… Either Way You’re Paying a Mortgage

Mar

27

2017

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained this month in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person with that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.23% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

What Are the Experts Saying about Mortgage Rates?

Mar

22

2017

Mortgage interest rates have risen over the last few months and projections are that they will continue their upswing throughout 2017. What impact will this have on the housing market? Here is what the experts are saying:

Laurie Goodman, Co-director of the Urban Institute’s Housing Finance Policy Center:

“In 1984, 1994, 2000, and 2013, every time we have rate increases, we have increases in nominal home prices. We expect this to be more pronounced, as there is a big demand-and-supply gap at the present time.”

Scott Anderson, Chief Economist for Bank of the West:

“The tightening labor market, rising wage growth, high levels of consumer confidence and a millennial generation with a pent-up demand for housing should allow the housing market to weather the storm of gradually rising interest rates.”

Ivy Zelman in her latest “Z” Report:

“Although we strongly believe that the housing supply-demand imbalance for single-family homes will continue to drive above-average home price appreciation, just as falling mortgage rates aided pricing power on the margin in recent months, we expect the opposite effect to become evident in the coming months. As such, we project year-end home price inflation of 4.8% for 2017 and 4.1% for 2018.”

Bob Walters, President & COO of retail mortgage lender Quicken Loans:

“A modest increase in mortgage rates won’t have much of an effect on home purchases. A buyer may need to slightly re-evaluate which homes they can afford, but it’s not likely to make an impact on qualifying, in most cases.”

First American Chief Economist Mark Fleming:

“Our survey data shows that mortgage rates would have to be significantly higher to have any meaningful impact. The house buying power that borrowers have, even with rates below five percent, still remains historically strong.”

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers