Category: Move-Up Buyers

Why are Existing Home Sales Down?

Aug

30

2018

The latest Existing Home Sales Report issued by the National Association of Realtors (NAR) revealed that home sales have decreased for four consecutive months and are at their slowest pace in over two years. This has some industry leaders puzzled considering the fact that the economy is strengthening, unemployment is down, and wages are beginning to rise. This begs the question: “Where are the buyers?”

Actually, agents in the field of most communities are still seeing strong desire from prospective purchasers. They have a list of potential buyers ready to go if the right houses come on the market and they claim it is not a shortage of demand, but is instead a shortage of inventory that is causing the market to soften.

Why is there a shortage of inventory?

You only need to look at the graph below to understand:

New construction sales over the last ten years are far below historic numbers from 1995-2002.

A recent industry report looked at building permits and concluded:

“If construction over the past decade matched historic norms, accounting for population change, the country would have had 2.3 million more single-family home permits.”

That decade of not building enough homes is the primary reason for the concerns about today’s market.

Wait, weren’t we talking about ‘existing’ home sales?

Some may argue that NAR’s sales report deals with existing home sales and not new construction, and they would be correct. However, reports have shown that one of the main reasons why existing homeowners are not selling is because they can’t find homes that meet the needs of their current lifestyles. Historically, the upgrades in a newly constructed home were the answers to those needs.

Over the last decade, however, there were fewer homes built to satisfy this move-up seller. Consequently, there are many homeowners who stayed in their homes for a longer tenure, instead of putting their homes up for sale.

Bottom Line

As more new homes are being built, there will be more housing inventory to satisfy current demand which will cause prices to moderate and sales volumes to increase.

Posted in For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, Pricing

Top 3 Myths About Today’s Real Estate Market

Aug

29

2018

There are many conflicting headlines when it comes to describing today’s real estate market. Some are making comparisons to the market we experienced 10 years ago and are starting to believe that we may be doomed to repeat ourselves. Others are just plain wrong when it comes to what it takes to qualify for a mortgage.

Today, we want to try and clear the air by shedding some light on what’s causing some of these headlines, as well as what’s truly going on.

Myth #1: We Are Headed for Another Housing Bubble

Home prices have appreciated year-over-year for the last 76 straight months. Many areas of the country are at or near their peak prices achieved before the last housing bubble burst. This has many worried that we are headed towards another housing bubble.

Reality: The biggest challenge facing today’s real estate market is a lack of homes for sale! Demand is strong, as many renters have come off the fence and are searching for their dream homes.

Historically, a normal market requires a 6-month supply of inventory in order for prices to rise with the rate of inflation. According to the National Association of Realtors (NAR) there is currently a 4.3-month supply of inventory.

The US housing market hasn’t had 6-months inventory since August 2012! The concept of supply and demand is what is driving home prices up!

Myth #2: The Rumored Recession Will Lead to Another Housing Market Crash

Economists and analysts know that the country has experienced economic growth for almost a decade. When this happens, they also know that a recession can’t be too far off. But what is a recession?

Merriam-Webster defines a recession as “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two consecutive quarters.”

Reality: Recession DOES NOT equal housing crisis. Many people associate these two terms with one another because the last time we had a recession it was caused by a housing crisis. According to the Federal Reserve, over the last 40 years, there have been six recessions. In each of the previous five recessions, home values appreciated.

Myth #3: There is an Affordability Crisis Looming

Rising home prices have many concerned that the average family will no longer be able to afford the most precious piece of the American Dream – their own home.

There are many different affordability indexes supported by different organizations that all measure different data. For this reason, there is a lot of confusion about what “affordable” actually means.

The monthly cost of a home is determined by the home’s price and the interest rate on the mortgage used to purchase it. According to Freddie Mac, interest rates have risen from 3.95% in January to 4.59% just last week.

Reality: As we mentioned earlier, home prices have appreciated year-over-year for the last 76 months, largely driven by high demand and low supply.

According to a recent study by Zillow, the percentage of median income necessary to buy a home in today’s market (17.1%) is well below the mark reached in 1985 – 2000 (21%), as well as the mark reached in 2006 (25.4)! Interest rates would have to increase to 6% before buying a home would be less affordable than historical norms.

The starter-home market has appreciated at higher levels (9.4% year-over-year) than any other market. One reason for this is the fact that many of the first-time buyers who have flocked to the starter-home market are being met with high competition. For some hopeful buyers, it may take more than a good offer to stand out from the crowd!

Bottom Line

There is a lot of confusion in today’s real estate market. If your future plans include buying or selling, make sure you have a trusted advisor and market expert by your side to help guide you to the best decision for you and your family.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Rent or Buy: Either Way You’re Paying A Mortgage!

Aug

27

2018

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

With home prices rising, many renters are concerned about their house-buying power. Mark Fleming, Chief Economist at First American, explained:

“Over the last three years, renter house-buying power has increased fast enough to keep pace with house price appreciation, so the share of homes that a renter can afford to buy has remained the same since 2015.

Although mortgage rates are expected to rise, they are still low by historic standards, and real household incomes are the highest they have ever been. Assuming this trend continues, our measure of affordability, which takes into account income, interest rates, and house prices, indicates that homeownership is still within reach for renters.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.51% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers, Rent vs. Buy

Having Trouble Saving Enough for Your Down Payment? Crowdfund It!

Aug

22

2018

You read that right! First-time buyers across the country are getting creative when it comes to saving the necessary down payment to buy a home.

Many couples are asking their wedding guests to contribute to their “Down Payment Fund” rather than fulfilling a traditional registry. This is fueled by the fact that many couples live together prior to marriage and already have the necessary items to make a house a home…they just need the house!

The average wedding in the United States has 120 guests who give wedding gifts valued, on average, at $186. This means that couples could walk away from their nuptials with over $22,000 towards their down payment!

Services like HomeFundMe allow friends, family members, and almost anyone else in a buyer’s network to contribute funds toward the buyer’s down payment. Contributors can determine, at the time of their donation, if their gifts are ‘conditional’ or ‘non-conditional’ on the beneficiary buying a home.

According to a recent Wall Street Journal article, “about 400 borrowers have used HomeFundMe to help buy homes since the program launched in October and on average, they raise about $2,500.” The article went on to explain that most borrowers use these funds in combination with their personal savings to shorten the time needed to achieve their goal of homeownership.

There are more and more programs surfacing from lenders that allow buyers to put down as little as 3% to buy their dream home. Fannie Mae and Freddie Mac loan programs require 3% down payments, while FHA programs require as little as 3.5%, and VA Loans are often approved with 0% down!

Bottom Line

Gone are the days of 20% down or no loan! If your dreams include buying a home of your own in the next year, you can get creative with your down payment savings to make it happen!

Posted in Down Payments, First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

The #1 Reason to Put Your House on The Market TODAY!

Jul

30

2018

The National Association of Realtors (NAR) released the results of their latest Existing Home Sales Report which revealed that home sales declined 0.6% to a seasonally adjusted annual rate of 5.38 million in June from 5.41 million in May, and are 2.2% below a year ago. Some may look at these numbers and think that now is a bad time to sell their house, but in fact, the opposite is true.

The national slowdown in sales is directly tied to a lack of inventory available for the buyers who are out in the market looking for their dream homes! In fact, the inventory of homes for sale had fallen year-over-year for 36 consecutive months before posting a modest 0.5% gain last month and has had an upward impact on home prices.

NAR’s Chief Economist Lawrence Yun had this to say,

“It’s important to note that despite the modest year-over-year rise in inventory, the current level is far from what’s needed to satisfy demand levels. Furthermore, it remains to be seen if this modest increase will stick, given the fact that the robust economy is bringing more interested buyers into the market, and new home construction is failing to keep up.”

The few houses that are on the market are selling fast! According to NAR’s Realtors Confidence Index, properties were typically on the market for 26 days.

Bottom Line

If you are one of the many homeowners who is debating listing your house for sale this year, the time is now! Let’s get together to discuss the specifics of our market!

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

Americans Rank Real Estate Best Investment for 5 Years Running! [INFOGRAPHIC]

Jul

27

2018

![Americans Rank Real Estate Best Investment for 5 Years Running! [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/18142501/20180727-Share-STM.jpg)

Some Highlights:

- Real estate has outranked stocks/mutual funds, gold, savings accounts/CDs, and bonds as the best long-term investment among Americans for the last 5 years!

- The generations agree! Real estate is the best investment!

- Generation X leads the way with 37% believing in real estate as the top investment.

Posted in Baby Boomers, First Time Home Buyers, For Buyers, Generation X, Infographics, Millennials, Move-Up Buyers, Rent vs. Buy

Lack of Listings Slowing Down the Market

Jul

23

2018

As the real estate market continues to move down the road to a complete recovery, we see home values and home sales increasing while distressed sales (foreclosures and short sales) continue to fall to their lowest points in years. There is no doubt that the housing market will continue to strengthen throughout 2018.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory!

Here’s what a few industry experts have to say about the current inventory crisis:

Lawrence Yun, Chief Economist for the National Association of Realtors

“Inventory coming onto the market during this year’s spring buying season…was not even close to being enough to satisfy demand, that is why home prices keep outpacing incomes and listings are going under contract in less than a month – and much faster – in many parts of the country.”

Sam Khater, Chief Economist for Freddie Mac

“While this spring’s sudden rise in mortgage rates [took] up a good chunk of the conversation, it’s the stubbornly low inventory levels in much of the country that are preventing sales from really taking off like they should… Most markets simply need a lot more new and existing supply to cool price growth and give buyers enough choices.”

Alexandra Lee, Housing Data Analyst for Trulia

“This seasonal inventory jump wasn’t enough to offset the historical year-over-year downward trend that has continued over 14 consecutive quarters…Despite the second-quarter gain, inventory was down 5.3% from a year ago. Still, this represents an easing of the double-digit drops we’ve been seeing since the second quarter of 2017.”

Bottom Line

If you are thinking about selling, now may be the time. Demand for your house will be strongest while there is still very little competition which could lead to a quick sale for a great price.

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

What You Need to Know About the Mortgage Process [INFOGRAPHIC]

Jul

20

2018

![What You Need to Know About the Mortgage Process [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/17145720/20180720-Share-STM.jpg)

Some Highlights:

- Many buyers are purchasing a home with a down payment as little as 3%.

- You may already qualify for a loan, even if you don’t have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

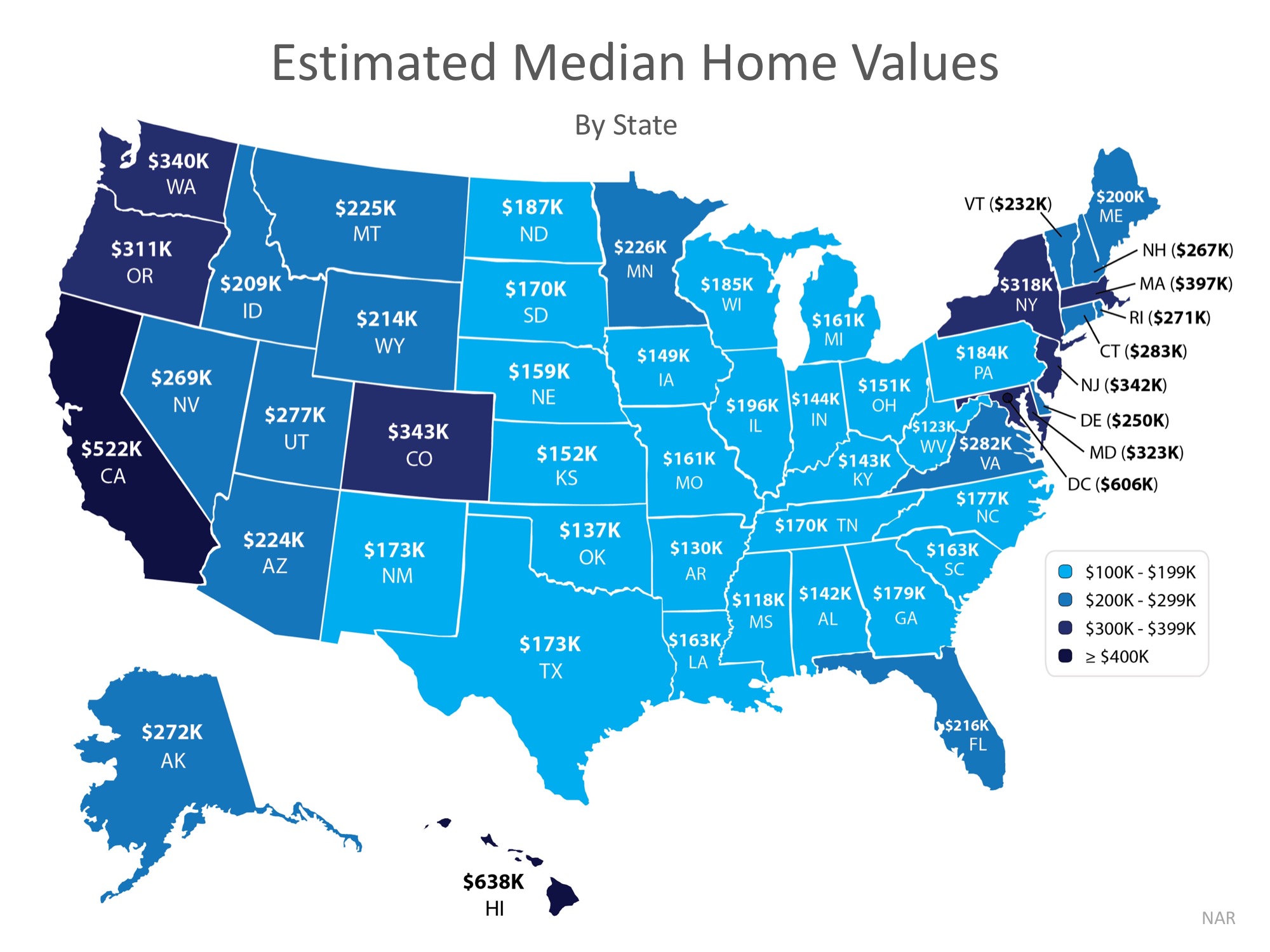

What’s the Median Home Value in Your State?

Jun

27

2018

If you’ve entered the real estate market as a buyer or a seller, you’ve inevitably heard the mantra “location, location, location” in reference to identical homes increasing or decreasing in value based on where they’re located.

In today’s housing market where home prices are appreciating quickly, it’s important to know that not every home appreciates at the same rate. The map below demonstrates that point on a state-by-state basis using data from the National Association of Realtors.

Demand often dictates value, even for houses in the same area of the country! High demand for starter and trade-up homes have driven prices up in these categories by nearly 10% over the past year, while those in the premium markets have appreciated at closer to 6%.

Bottom Line

If you are debating whether or not to buy and/or sell a home this year, let’s get together to help you figure out exactly what’s going on in our market.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Pricing

4 Reasons to Sell This Summer [INFOGRAPHIC]

Jun

22

2018

Some Highlights:

- Buyer demand continues to outpace the supply of homes for sale which means that buyers are often competing with one another for the few listings that are available!

- Housing inventory is still under the 6-month supply needed to sustain a normal housing market.

- Perhaps the time has come for you and your family to move on and start living the life you desire.

Posted in For Sellers, Infographics, Move-Up Buyers