Category: Move-Up Buyers

Daydreaming About Your Perfect Home? Know What You WANT vs. What You NEED

Feb

05

2017

In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search.

If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale through rose-colored glasses.

Do you really need that farmhouse sink in the kitchen in order to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the ‘man cave’ of your dreams be a future renovation project instead of a make-or-break right now?

The first step in your home buying process should be to get pre-approved for your mortgage. This allows you to know your budget before you fall in love with a home that is way outside of it.

The next step is to list all the features of a home that you would like, and to qualify them as follows:

- ‘Must Haves’ – if this property does not have these items, then it shouldn’t even be considered. (ex: distance from work or family, number of bedrooms/bathrooms)

- ‘Should Haves’ – if the property hits all of the ‘must haves’ and some of the ‘should haves,’ it stays in contention but does not need to have all of these features.

- ‘Absolute Wish List’ – if we find a property in our budget that has all of the ‘must haves,’ most of the ‘should haves,’ and ANY of these, it’s the winner!

Bottom Line

Having this list fleshed out before starting your search will save you time and frustration, while also letting your agent know what features are most important to you before starting to show you houses in your desired area.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

5 Reasons Homeowners Throw Better Super Bowl Parties! [INFOGRAPHIC]

Feb

03

2017

![5 Reasons Homeowners Throw Better Super Bowl Parties! [INFOGRAPHIC] | Simplifying The Market](http://d2d6tznlfad433.cloudfront.net/wp-content/uploads/2017/02/Super-Bowl-STM.jpg)

Highlights:

- Watching the Big Game at home with your friends & family offers many advantages.

- There’s more room to entertain a large crowd, and you don’t have to worry about complaints to your landlord if you cheer too loudly!

- The kitchen is big enough to make as many appetizers as you want, and if some of your guests are only there to watch the commercials, they can do so on a different TV in another room!

Posted in First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

Thinking of Making an Offer? 4 Tips for Success

Jan

31

2017

So you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market that you want to make sure you make a good offer so that you can guarantee your dream of making this house yours comes true!

Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the 4 Tips they covered along with some additional information for your consideration:

1. Understand How Much You Can Afford

“While it’s not nearly as fun as house hunting, fully understanding your finances is critical in making an offer.”

This ‘tip’ or ‘step’ really should take place before you start your home search process.

As we’ve mentioned before, getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and will allow you to make your offer with the confidence of knowing that you have already been approved for a mortgage for that amount. You will also need to know if you are prepared to make any repairs that may need to be made to the house (ex: new roof, new furnace).

2. Act Fast

“Even though there are fewer investors, the inventory of homes for sale is also low and competition for housing continues to heat up in many parts of the country.”

According to the latest Existing Home Sales Report, the inventory of homes for sale is currently at a 3.6-month supply; This is well below the 6-month supply that is needed for a ‘normal’ market. Buyer demand has continued to outpace the supply of homes for sale, causing buyers to compete with each other for their dream homes.

Make sure that as soon as you decide that you want to make an offer, you work with your agent to present it as soon as possible.

3. Make a Solid Offer

Freddie Mac offers this advice to help make your offer the strongest it can be:

“Your strongest offer will be comparable with other sales and listings in the neighborhood. A licensed real estate agent active in the neighborhoods you are considering will be instrumental in helping you put in a solid offer based on their experience and other key considerations such as recent sales of similar homes, the condition of the house and what you can afford.”

Consider ways of making your offer stand out! Many buyers write a personal letter to the seller letting them know how much they would love to be the new homeowners. Your agent will be able to help you figure out if there are any other ways your offer could stand out above the rest.

4. Be Prepared to Negotiate

“It’s likely that you’ll get at least one counteroffer from the sellers so be prepared. The two things most likely to be negotiated are the selling price and closing date. Given that, you’ll be glad you did your homework first to understand how much you can afford.

Your agent will also be key in the negotiation process, giving you guidance on the counteroffer and making sure that the agreed-to contract terms are met.”

If your offer is approved, Freddie Mac urges you to “always get an independent home inspection, so you know the true condition of the home.” If the inspection uncovers undisclosed problems or issues, you can discuss any repairs that may need to be made, with the seller, or cancel the contract.

Bottom Line

Whether buying your first home or your fifth, having a local professional on your side who is an expert in their market is your best bet to make sure the process goes smoothly. Happy House Hunting!

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

2 Myths That May Be Holding Back Buyers

Jan

30

2017

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.”

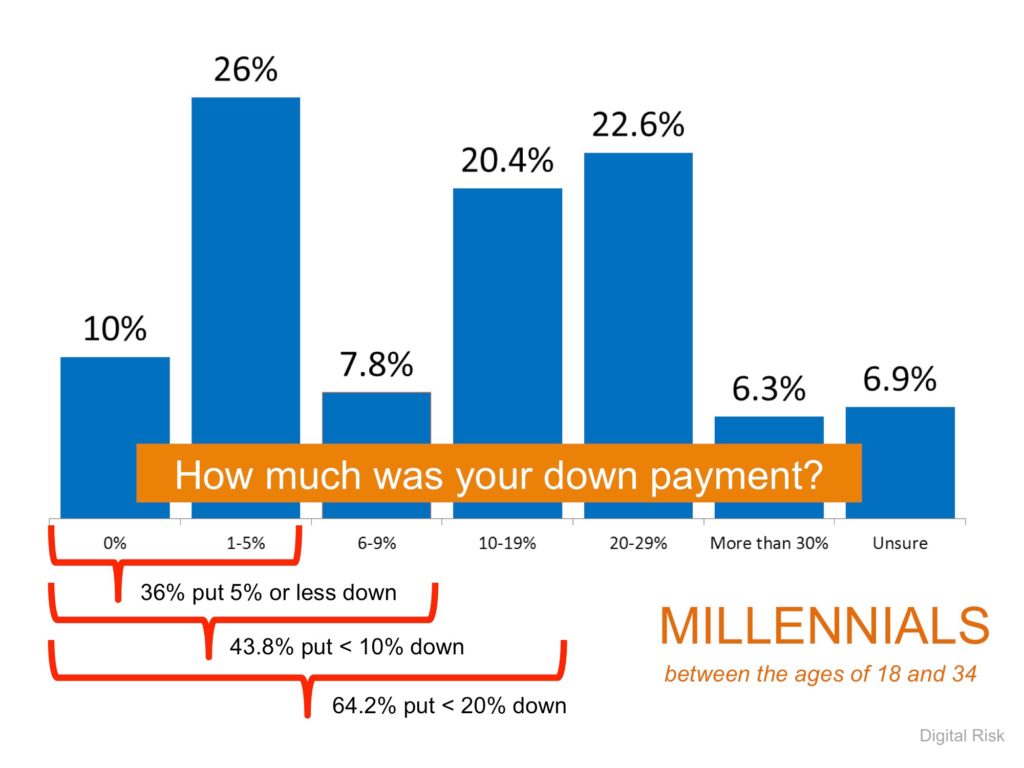

Myth #1: “I Need a 20% Down Payment”

Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required.

Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%.

Below are the results of a Digital Risk survey of Millennials who recently purchased a home.

As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%!

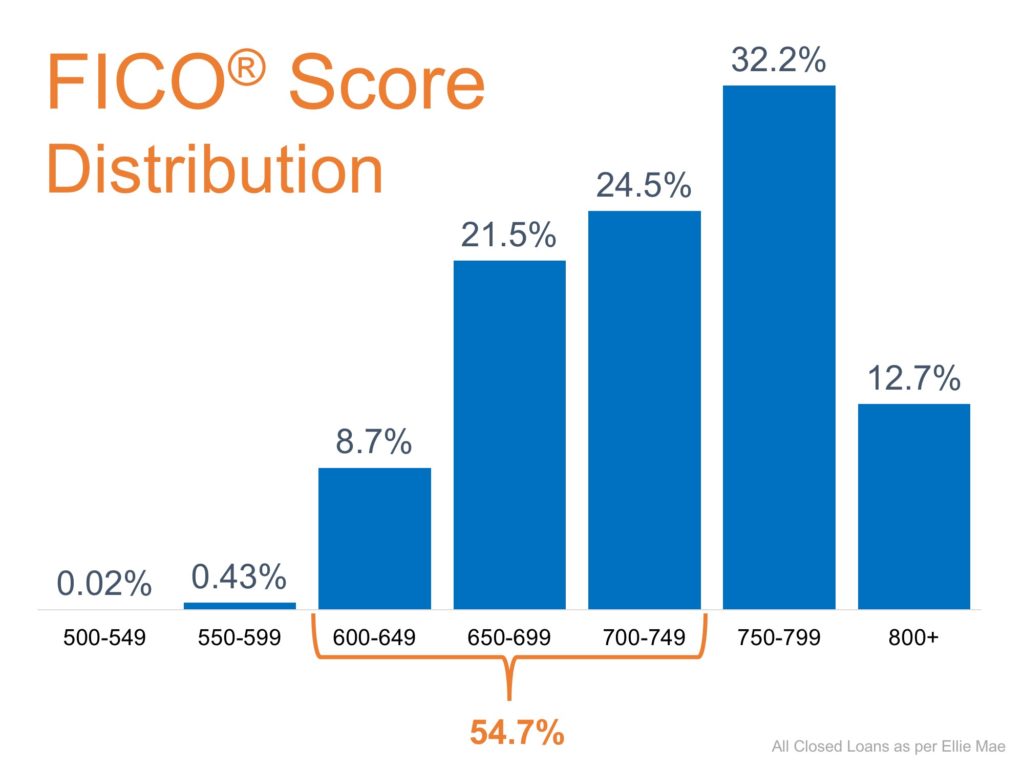

Myth #2: “I need a 780 FICO Score or Higher to Buy”

The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.7% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Posted in Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

What to Expect From Your Home Inspection

Jan

29

2017

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection.

This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.

How to Choose an Inspector

Your agent will most likely have a short list of inspectors that they have worked with in the past that they can recommend to you. Realtor.com suggests that you consider the following 5 areas when choosing the right home inspector for you:

- Qualifications – find out what’s included in your inspection & if the age or location of your home may warrant specific certifications or specialties.

- Sample Reports – ask for a sample inspection report so you can review how thoroughly they will be inspecting your dream home. The more detailed the report, the better in most cases.

- References – do your homework – ask for phone numbers and names of past clients that you can call to ask about their experience.

- Memberships – Not all inspectors belong to a national or state association of home inspectors, and membership in one of these groups should not be the only way to evaluate your choice. Membership in one of these organizations often means that there is continued training and education provided.

- Errors & Omission Insurance – Find out what the liability of the inspector or inspection company is once the inspection is over. The inspector is only human after all, and it is possible that they might miss something they should have seen.

Ask your inspector if it’s ok for you to tag along during the inspection, that way they can point out anything that should be addressed or fixed.

Don’t be surprised to see your inspector climbing on the roof, crawling around in the attic, and on the floors. The job of the inspector is to protect your investment and find any issues with the home, including but not limited to: the roof, plumbing, electrical components, appliances, heating & air conditioning systems, ventilation, windows, the fireplace & chimney, the foundation and so much more!

Bottom Line

They say ‘ignorance is bliss,’ but not when investing your hard-earned money in a home of your own. Work with a professional you can trust to give you the most information possible about your new home so that you can make the most educated decision about your purchase.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Sales at Highest Pace in 10 Years! [INFOGRAPHIC]

Jan

27

2017

Highlights:

- 5.45 million existing homes were sold in 2016! This is the highest mark set since 2006.

- Inventory of existing homes for sale dropped to a 3.6-month supply, the lowest level since NAR began tracking in 1999.

- The median price of homes sold in December was $232,200. This is the 58th consecutive month of year-over-year price gains.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Buying a Home is More Affordable Than Renting in 66% of US Counties

Jan

25

2017

According to ATTOM Data Solutions’ 2017 Rental Affordability Report, buying a home is more affordable than renting in 354 of the 540 U.S. counties they analyzed.

The report found that “making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on a three-bedroom property in 354 of the 540 counties analyzed in the report (66 percent).”

For the report, ATTOM Data Solutions compared recently released fair market rent data from the Department of Housing and Urban Development with reported income amounts from the Department of Labor and Statistics to determine the percentage of income that a family would have to spend on their monthly housing cost (rent or mortgage payments).

Rents have been surging faster than home prices in about 37% of the markets measured. Daren Blomquist, Senior Vice President of ATTOM Data Solutions warns that rising interest rates could be the tipping point of affordability:

“While buying continues to be more affordable than renting in the majority of U.S. markets, that equation could change quickly if mortgage rates keep rising in 2017. In that scenario, renters who have not yet made the leap to homeownership will find it even more difficult to make that leap this year.”

Bottom Line

Rents will continue to rise and mortgage interest rates are still at historic lows. Before you sign or renew your next lease, meet with a local professional who can help you determine if you are able to buy a home of your own and lock in your monthly housing expense.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

How Low Interest Rates Increase Your Purchasing Power

Jan

24

2017

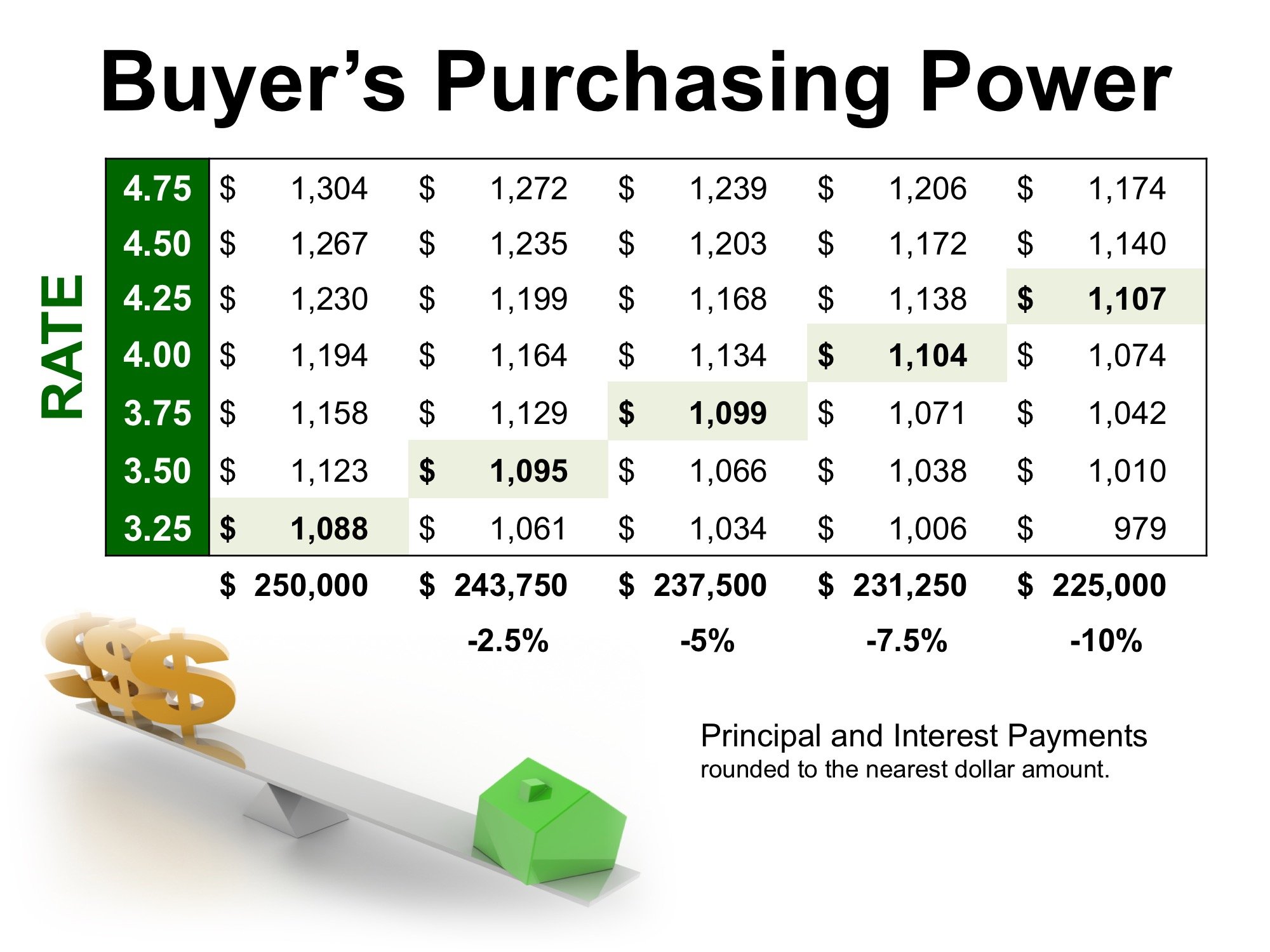

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history!

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain monthly housing budget.

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the national median price range, and planned to keep your principal and interest payments at or about $1,100 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5%, (in this example, $6,250). Experts predict that mortgage rates will be closer to 5% by this time next year.

Act now to get the most house for your hard-earned money.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

Have You Saved Enough for Closing Costs?

Jan

23

2017

There are many potential homebuyers, and even sellers, who believe that they need at least a 20% down payment in order to buy a home or move on to their next home. Time after time, we have dispelled this myth by showing that many loan programs allow you to put down as little as 3% (or 0% with a VA loan).

If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs.

Freddie Mac defines closing costs as:

“Closing costs, also called settlement fees, will need to be paid when you obtain a mortgage. These are fees charged by people representing your purchase, including your lender, real estate agent, and other third parties involved in the transaction. Closing costs are typically between 2 and 5% of your purchase price.”

We’ve recently heard from many first-time homebuyers that they wished that someone had let them know that closing costs could be so high. If you think about it, with a low down payment program, your closing costs could equal the amount that you saved for your down payment.

Here is a list of just some of the fees/costs that may be included in your closing costs, depending on where the home you wish to purchase is located:

- Government recording costs

- Appraisal fees

- Credit report fees

- Lender origination fees

- Title services (insurance, search fees)

- Tax service fees

- Survey fees

- Attorney fees

- Underwriting fees

Is there any way to avoid paying closing costs?

Work with your lender and real estate agent to see if there are any ways to decrease or defer your closing costs. There are no-closing mortgages available, but they end up costing you more in the end with a higher interest rate, or by wrapping the closing costs into the total cost of the mortgage (meaning you’ll end up paying interest on your closing costs).

Home buyers can also negotiate with the seller over who pays these fees. Sometimes the seller will agree to assume the buyer’s closing fees to get the deal finalized, which is known in the industry as ‘seller’s concession.’

Bottom Line

Speak with your lender and agent early and often to determine how much you’ll be responsible for at closing. Finding out you’ll need to come up with thousands of dollars right before closing is not a surprise anyone is ever looking forward to.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

Will Housing Affordability Be a Challenge in 2017?

Jan

19

2017

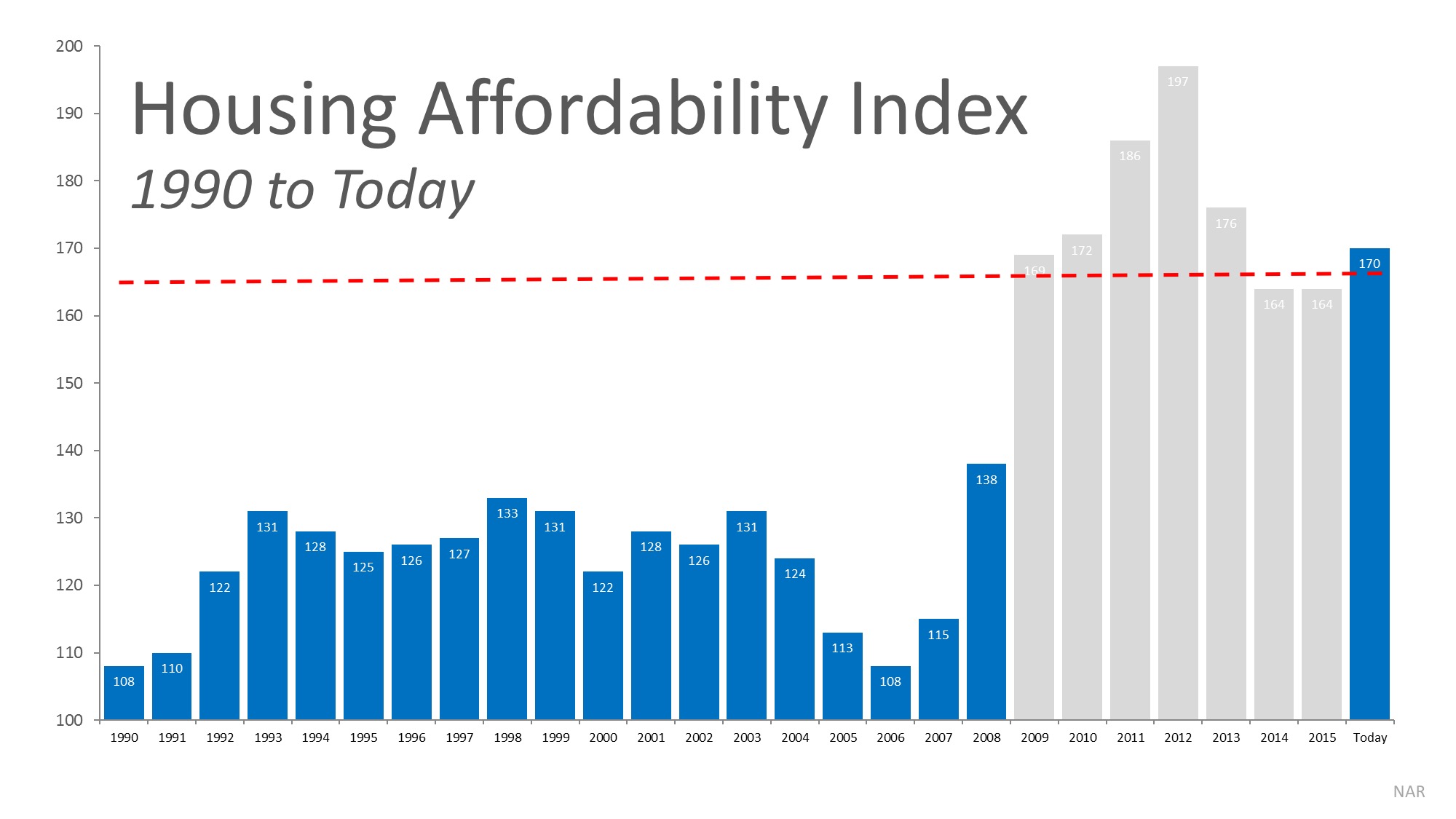

Some industry experts are saying that the housing market may be heading for a slowdown in 2017 based on rising home prices and a jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).

Here is how NAR defines the index:

“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”

Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median-priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify.

The higher the index, the easier it is to afford a home.

Why the concern?

The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market.

But, wait a minute…

Though the index skyrocketed from 2009 through 2013, we must realize during that time the housing crisis left the market with an overabundance of housing inventory with as many as one out of three listings being a distressed property (foreclosure or short sale). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock.

The market is recovering, and values are coming back nicely. That has caused the index to fall.

However, let’s remove the crisis years and look at the current index as compared to the index from 1990 – 2008:

We can see that, even though prices have increased, mortgage rates are still lower than historical averages and have put the index in a better position than every year for the nineteen years before the crash.

Bottom Line

The Housing Affordability Index is in great shape and should not be seen as a challenge to the real estate market’s continued recovery.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

![Sales at Highest Pace in 10 Years! [INFOGRAPHIC]](http://marketinfo.southbaylifestylehomes.com/wp-content/uploads/2017/01/20170127-Highest-Sales-STM-791x1024.jpg)