Category: Move-Up Buyers

Dreaming of a Luxury Home? Now’s the Time!

Mar

19

2018

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! Recently, the Institute for Luxury Home Marketing released its Luxury Market Report which showed that in today’s premium home market, buyers are in control.

The inventory of homes for sale in the luxury market far exceeds the number of people searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer or can be found at a discount.

Those who have a starter or trade-up home to sell will find buyers competing, and often entering bidding wars, to be able to call their house their new home.

The sale of your starter or trade-up house will help you come up with a larger down payment for your new luxury home. Even a 5% down payment on a million-dollar home is $50,000.

But not all who are buying luxury properties have a home to sell first.

A recent Bloomberg article gave some insight into what many millennials are choosing to do:

“A new generation of affluent homebuyers powered by a surge in inherited wealth is driving the luxury-home market, demanding larger spaces and fancier finishes, according to a report heralding ‘the rise of the new aristocracy.’”

Bottom Line

The best time to sell anything is when demand is high, and supply is low. If you are currently in a starter or trade-up house that no longer fits your needs and you are looking to step into a luxury home, now’s the time to list your house for sale and make your dreams come true.

Posted in First Time Home Buyers, For Buyers, Luxury Market, Millennials, Move-Up Buyers

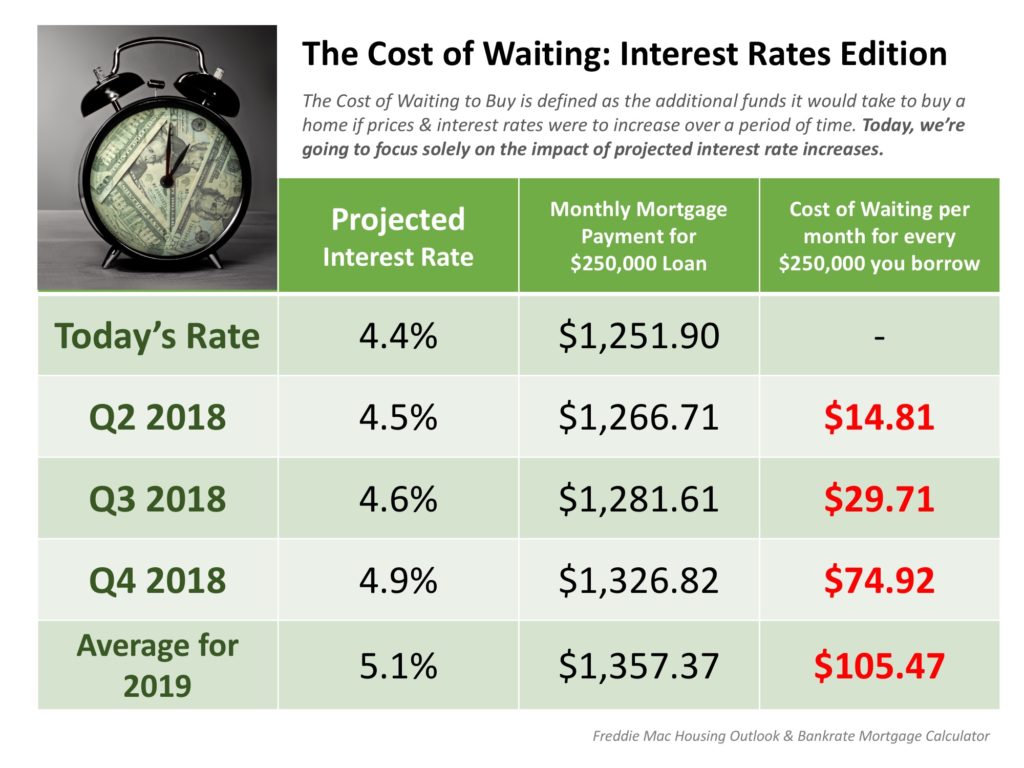

The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC]

Mar

16

2018

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/03/09132142/20180316-Share-STM.jpg)

Some Highlights:

- Interest rates are projected to increase steadily heading into 2019.

- The higher your interest rate, the more money you end up paying for your home and the higher your monthly payment will be.

- Rates are still low right now. Don’t wait until rates hit 5% to start searching for your dream home!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Move-Up Buyers

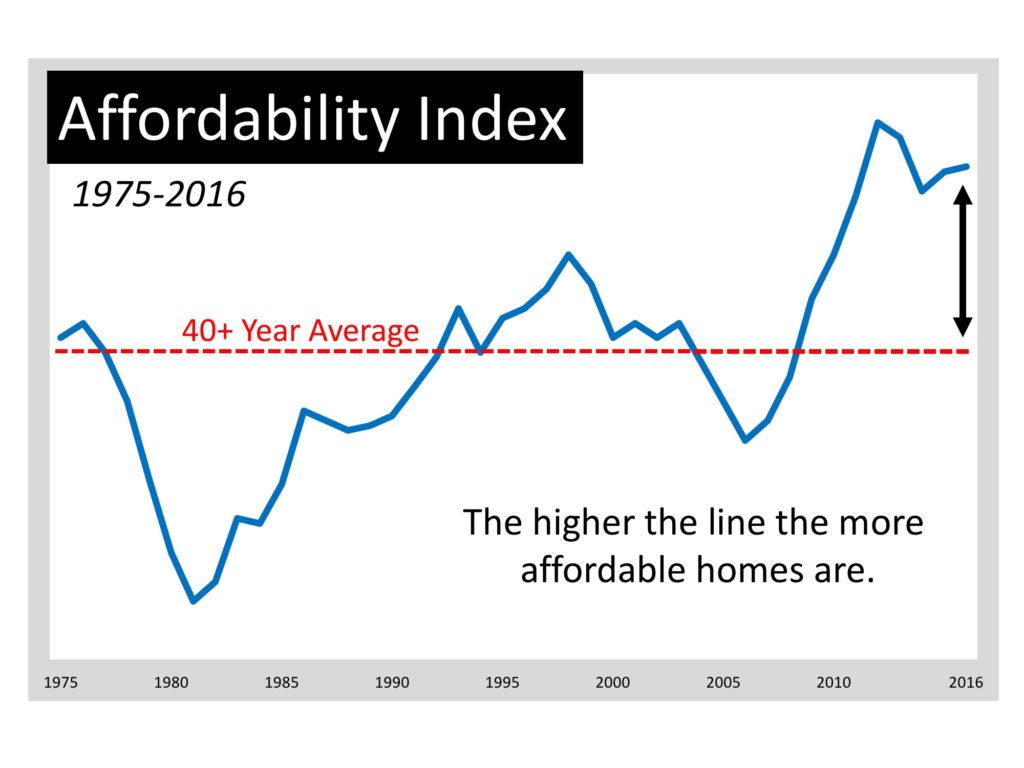

Moving up Is MORE Affordable Now Than Almost Any Other Time in 40 Years

Mar

15

2018

If you are considering selling your current home, to either move up to a larger home or into a home in an area that better suits your current family needs, great news was just revealed.

Last week, Trulia posted a blog, Not Your Father’s Housing Market, which examined home affordability over the last 40+ years (1975-2016). Their research revealed that:

“Nationally, homes are just about the most affordable they’ve been in the last 40 years… the median household could afford a home 1.5 times more expensive than the median home price. In 1980, the median household could only afford about 3/4 of the median home price.

Despite relatively stagnant incomes, affordability has grown due to the sharp drop in mortgage rates over the last 30 years – from a high of over 16% in the 1980s to under 4% by 2016.

Of the nation’s 100 largest metros, only Miami became unaffordable between 1990 and 2016. Meanwhile, 22 metros have flipped from being unaffordable to becoming affordable in that same time frame.”

Here is a graph showing the Affordability Index compared to the 40-year average:

The graph shows that housing affordability is better now than at any other time in the last forty years, except during the housing crash last decade.

(Remember that during the crash you could purchase distressed properties – foreclosures and short sales – at 20-50% discounts.)

There is no doubt that with home prices and mortgage rates on the rise, the affordability index will continue to fall. That is why if you are thinking of moving up, you probably shouldn’t wait.

Bottom Line

If you have held off on moving up to your family’s dream home because you were hoping to time the market, that time has come.

Posted in For Buyers, For Sellers, Move-Up Buyers

7 Factors to Consider When Choosing A Home to Retire In

Mar

14

2018

As more and more baby boomers enter retirement age, the question of whether or not to sell their homes and move will become a hot topic. In today’s housing market climate, with low available inventory in the starter and trade-up home categories, it makes sense to evaluate your home’s ability to adapt to your needs in retirement.

According to the National Association of Exclusive Buyers Agents (NAEBA), there are 7 factors that you should consider when choosing your retirement home.

1. Affordability

“It may be easy enough to purchase your home today but think long-term about your monthly costs. Account for property taxes, insurance, HOA fees, utilities – all the things that will be due whether or not you have a mortgage on the property.”

Would moving to a complex with homeowner association fees actually be cheaper than having to hire all the contractors you would need to maintain your home, lawn, etc.? Would your taxes go down significantly if you relocated? What is your monthly income going to be like in retirement?

2. Equity

“If you have equity in your current home, you may be able to apply it to the purchase of your next home. Maintaining a healthy amount of home equity gives you a source of emergency funds to tap, via a home equity loan or reverse mortgage.”

The equity you have in your current home may be enough to purchase your retirement home with little to no mortgage. Homeowners in the US gained an average of over $14,000 in equity last year.

3. Maintenance

“As we age, our tolerance for cleaning gutters, raking leaves and shoveling snow can go right out the window. A condominium with low-maintenance needs can be a literal lifesaver, if your health or physical abilities decline.”

As we mentioned earlier, would a condo with an HOA fee be worth the added peace of mind of not having to do the maintenance work yourself?

4. Security

“Elderly homeowners can be targets for scams or break-ins. Living in a home with security features, such as a manned gate house, resident-only access and a security system can bring peace of mind.”

As scary as that thought may be, any additional security and an extra set of eyes looking out for you always adds to peace of mind.

5. Pets

“Renting won’t do if the dog can’t come too! The companionship of pets can provide emotional and physical benefits.”

Evaluate all of your options when it comes to bringing your ‘furever’ friend with you to a new home. Will there be necessary additional deposits if you are renting or in a condo? Is the backyard fenced in? How far are you from your favorite veterinarian?

6. Mobility

“No one wants to picture themselves in a wheelchair or a walker, but the home layout must be able to accommodate limited mobility.”

Sixty is the new 40, right? People are living longer and are more active in retirement, but that doesn’t mean that down the road you won’t need your home to be more accessible. Installing handrails and making sure your hallways and doorways are wide enough may be a good reason to look for a home that was built to accommodate these needs.

7. Convenience

“Is the new home close to the golf course, or to shopping and dining? Do you have amenities within easy walking distance? This can add to home value!”

How close are you to your children and grandchildren? Would relocating to a new area make visits with family easier or more frequent? Beyond being close to your favorite stores and restaurants, there are a lot of factors to consider.

Bottom Line

When it comes to your forever home, evaluating your current house for its ability to adapt with you as you age can be the first step to guaranteeing your comfort in retirement. If after considering all these factors you find yourself curious about your options, let’s get together to evaluate your ability to sell your house in today’s market and get you into your dream retirement home!

Posted in Baby Boomers, For Buyers, For Sellers, Move-Up Buyers

4 Reasons Spring is a Great Time to Buy a Home!

Mar

12

2018

Here are four great reasons to consider buying a home today instead of waiting.

Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.6% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.3% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage hovered close to 4.0% in 2017. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison, projecting that rates will increase by nearly a full percentage point by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

Either Way, You Are Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

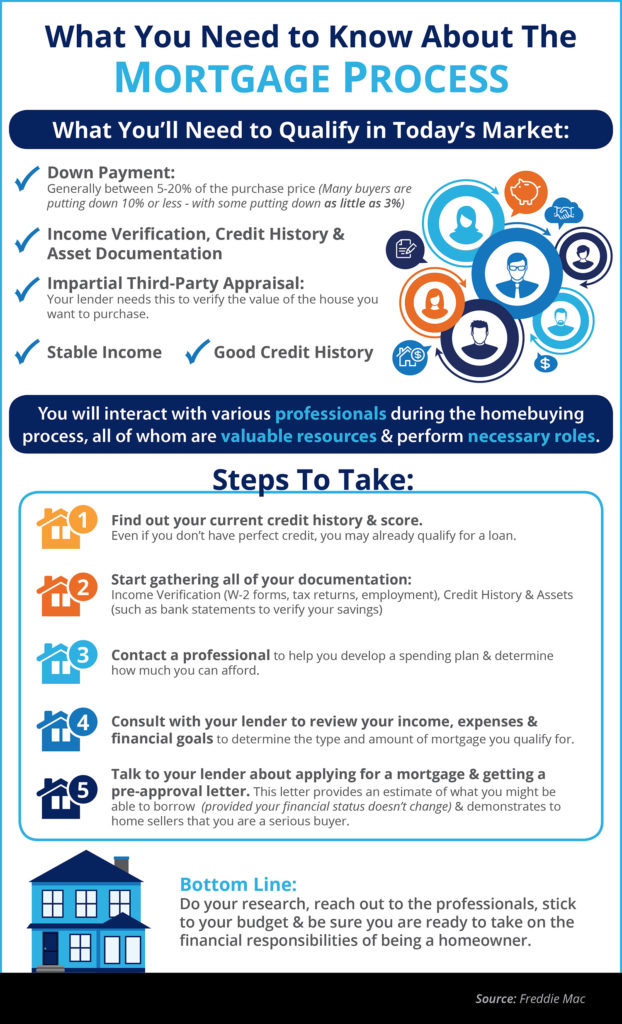

The Mortgage Process: What You Need to Know [INFOGRAPHIC]

Feb

23

2018

![The Mortgage Process: What You Need to Know [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/02/15072558/20180223-Share-STM.jpg)

Some Highlights:

- Many buyers are purchasing a home with a down payment as little as 3%.

- You may already qualify for a loan, even if you don’t have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

Posted in Buying Myths, First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

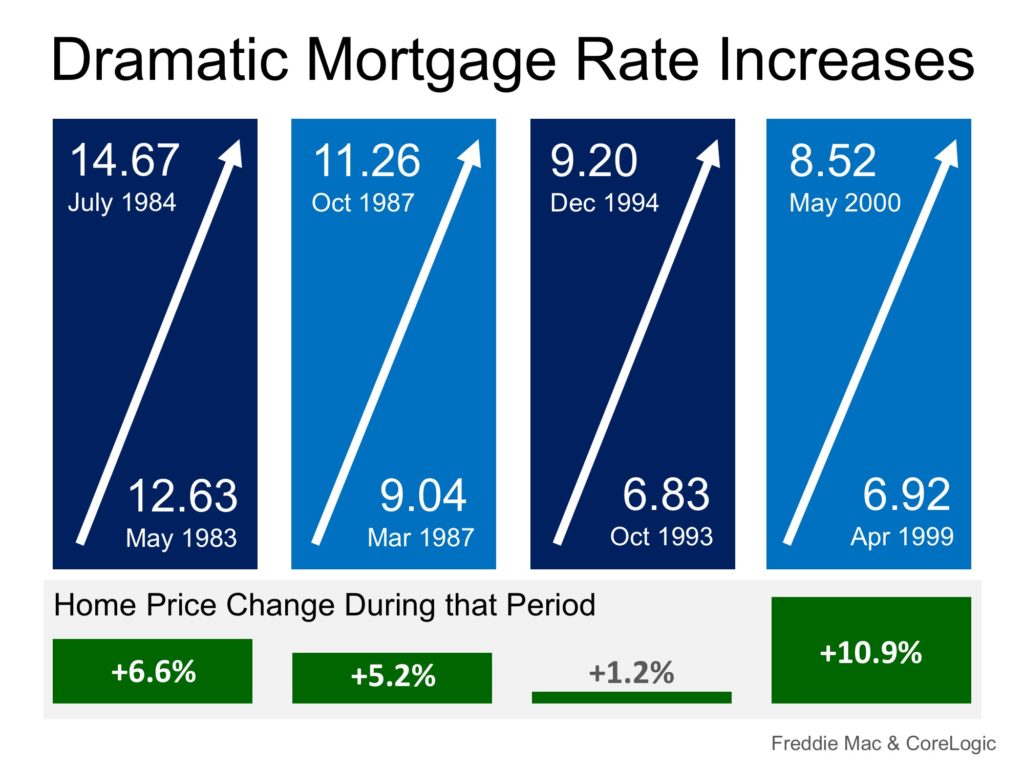

Mortgage Rates on FIRE! Home Prices Up in Smoke?

Feb

22

2018

Mortgage interest rates have already risen by over a quarter of a percentage point in 2018. Many are projecting that rates could increase to 5% by the end of the year.

What impact will rising rates have on house values?

Many quickly jump to the conclusion that an increase in mortgage rates will have a detrimental impact on real estate prices as fewer buyers will be able to qualify for a loan. This seems logical; if there is less demand for housing then prices will drop.

However, in a good economy, rising mortgage rates increase demand as many prospective purchasers immediately jump off the fence to guarantee they get the lower rate.

Let’s look at home prices the last four times mortgage rates increased dramatically.

In each case, home prices APPRECIATED and did not depreciate. No one is projecting as dramatic an increase in rates as the examples above. Most are projecting an increase of approximately 1% by the end of the year.

The last time mortgage rates increased by 1% over a twelve-month period was January 2013 (3.41%) to January 2014 (4.43%). What happened to house prices during that span? They appreciated by 9.8%.

Just two weeks ago, Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting explained:

“Mortgage rates have risen 1% or more ten times in the last 43 years, with little impact on home sales and prices when the economy was also strong…Historically, rising confidence, solid job growth, and higher wages have more than offset reduced demand for housing resulting from higher mortgage rates.”

Bottom Line

When mortgage rates increase, history has shown that prices appreciate (and do not depreciate) during that same time span.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Interest Rates, Move-Up Buyers, Pricing

2 Ways to Get the Most Money from The Sale of Your Home

Feb

20

2018

Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive the maximum value for your house?

Here are two keys to ensure that you get the highest price possible.

1. Price it a LITTLE LOW

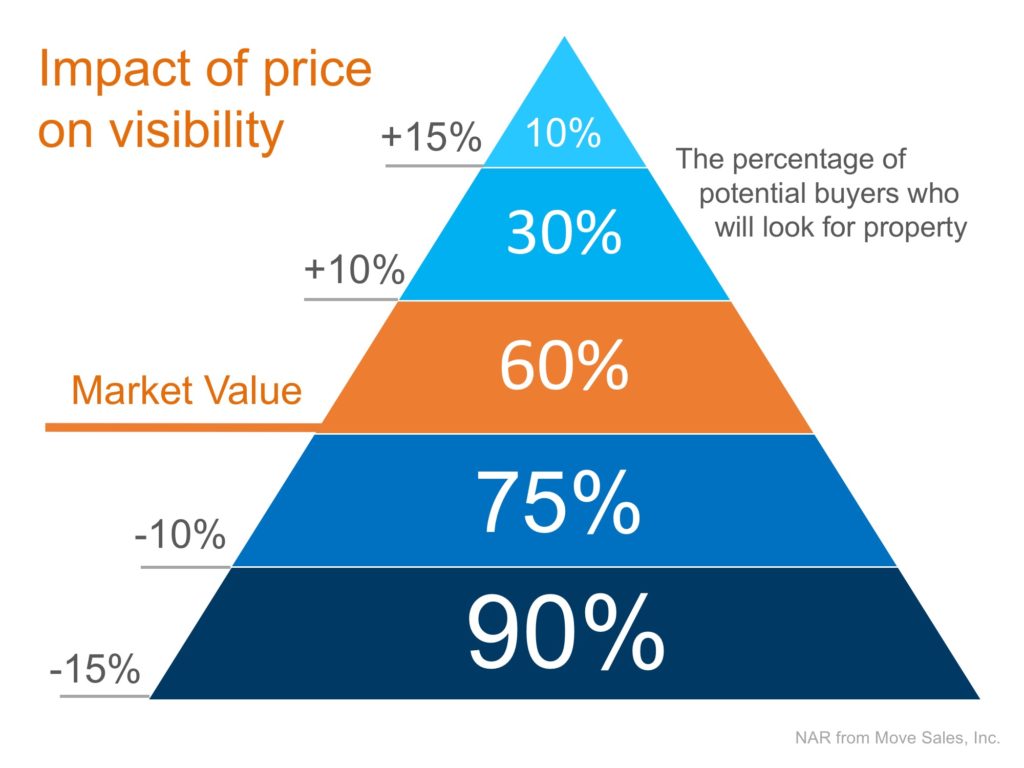

This may seem counterintuitive, but let’s look at this concept for a moment. Many homeowners think that pricing their homes a little OVER market value will leave them with room for negotiation. In actuality, this just dramatically lessens the demand for your house (see chart below).

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. By doing this, the seller will not be fighting with a buyer over the price but will instead have multiple buyers fighting with each other over the house.

Realtor.com gives this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

2. Use a Real Estate Professional

This, too, may seem counterintuitive. The seller may think they would make more money if they didn’t have to pay a real estate commission. With this being said, studies have shown that homes typically sell for more money when handled by a real estate professional.

A study by Collateral Analytics, reveals that FSBOs don’t actually save any money, and in some cases may be costing themselves more, by not listing with an agent.

In the study, they analyzed home sales in a variety of markets in 2016 and the first half of 2017. The data showed that:

“FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.”

The results of the study showed that the differential in selling prices for FSBOs when compared to MLS sales of similar properties is about 5.5%. Sales in 2017 suggest the average price was near 6% lower for FSBO sales of similar properties.

Bottom Line

Price your house at or slightly below the current market value and hire a professional. This will guarantee that you maximize the price you get for your house.

Posted in For Sellers, FSBOs, Move-Up Buyers, Pricing, Selling Myths

Top 5 Reasons to Hire a Real Estate Professional When Buying or Selling!

Feb

19

2018

Whether you are buying or selling a home it can be quite the adventure, which is why you need an experienced real estate professional to guide you on the path to achieving your ultimate goal. But in this world of instant gratification and internet searches, many sellers think that they can ‘For Sale by Owner’ or ‘FSBO.’

The 5 reasons you NEED a real estate professional in your corner haven’t changed but have rather been strengthened by the projections of higher mortgage interest rates & home prices as the market continues to pick up steam.

1. What do you do with all this paperwork?

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true real estate professional is an expert in his or her market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what?

There are over 180 possible steps that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to make sure that you achieve your dream?

3. Are you a good negotiator?

So maybe you’re not convinced that you need an agent to sell your home. After looking at the list of parties that you will need to be prepared to negotiate with, you’ll soon realize the value in selecting a real estate professional. From the buyers (who want the best deals possible), to the home inspection companies, all the way to the appraisers, there are at least 11 different people who you will need to be knowledgeable of, and answer to, during the process.

4. What is the home you’re buying/selling really worth?

It is important for your home to be priced correctly from the start to attract the right buyers and shorten the amount of time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to a study by Collateral Analytics, FSBOs achieve prices significantly lower than those from similar properties sold by real estate agents:

“FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.”

Get the most out of your transaction by hiring a professional.

5. Do you know what’s really going on in the market?

There is so much information out there on the news and on the internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has his or her finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

You wouldn’t replace the engine in your car without a trusted mechanic, so why would you make one of the most important financial decisions of your life without hiring a real estate professional?

Posted in First Time Home Buyers, For Buyers, For Sellers, FSBOs, Move-Up Buyers

Should I Wait Until Next Year to Buy? Or Buy Now? [INFOGRAPHIC]

Feb

16

2018

Some Highlights:

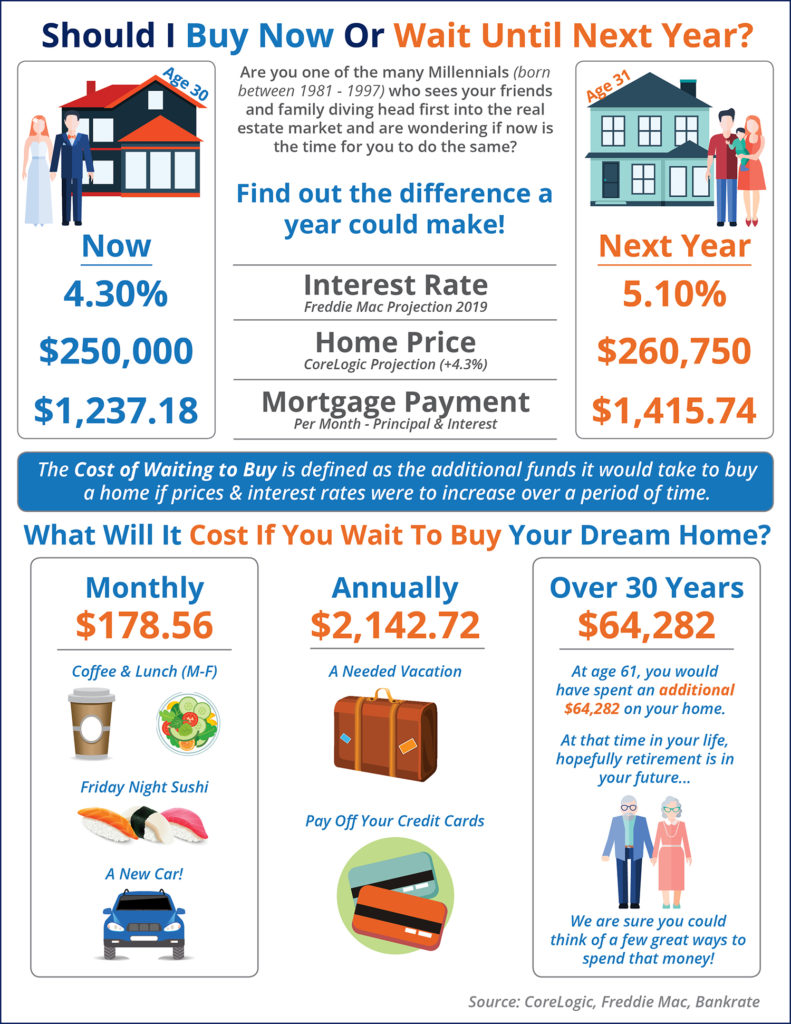

- The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac predicts interest rates to rise to 5.1% by 2019.

- CoreLogic predicts home prices to appreciate by 4.3% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Millennials, Move-Up Buyers, Pricing