Category: Move-Up Buyers

January 30th, 2018 by Lum Hugh

Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership,” which revealed that “eighty percent of consumers either are unaware of how much lenders require for a down payment or believe all lenders require a down payment above 5 percent.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the down payment funds needed to qualify for a home loan. According to the same report:

“Consumers are often unaware of the option to take out low-down-payment mortgages. Only 19% of consumers believe lenders would make loans with a down payment of 5% or less… While 15% believe lenders require a 20% down payment, and 30% believe lenders expect a 20% down payment.”

These numbers do not differ much between non-owners and homeowners; 39% of non-owners believe they need more than 20% for a down payment and 30% of homeowners believe they need more than 20% for a down payment.

While many believe that they need at least 20% down to buy their dream home, they do not realize that programs are available that allow them to put down as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined with programs that have emerged allowing less cash out of pocket.

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Similar to the down payment, many either don’t know or are misinformed about what FICO® score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As you can see in the chart above, 53.5% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

January 29th, 2018 by Lum Hugh

Every winter, families across the country decide if this will be the year that they sell their current houses and move into their dream homes.

Mortgage rates hovered around 4% for all of 2017 which forced many buyers off the fence and into the market, resulting in incredibly strong demand RIGHT NOW!

At the same time, however, inventory levels of homes for sale have dropped dramatically as compared to this time last year.

Trulia reported that “in Q4 2017, U.S. home inventory decreased by 10.5%. That is the biggest drop we’ve seen since Q2 2013.”

Here is a chart showing the decrease in inventory levels by category:

The largest drop in inventory was in the starter home category which saw a 19% dip in listings.

Bottom Line

Demand for your home is very strong right now while your competition (other homes for sale) is at a historically low level. If you are thinking of selling in 2018, now may be the perfect time.

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

January 25th, 2018 by Lum Hugh

Definitely an aggressive headline. However, as the final data on the 2017 housing market rolls in, we can definitely say one thing: If you are considering selling, IT IS TIME TO LIST YOUR HOME!

How did we finish 2017?

- New-home sales were at their highest level in a decade.

- Sales of previously owned homes were at their highest level in more than a decade.

- Starts of single-family homes were their strongest in a decade and applications to build such properties advanced to the fastest pace since August 2007.

And Bloomberg Business just reported:

“America’s housing market is gearing up for a robust year ahead. Builders are more optimistic, demand is strong and lean inventory is keeping prices elevated.”

And the National Association of Realtors revealed that buyer traffic is stronger this winter than it was during the spring buying season last year.

The only challenge to the market is a severe lack of inventory. A balanced market would have a full six-month supply of homes for sale. Currently, there is less than a four-month supply of inventory. This represents a decrease in supply of 9.7% from the same time last year.

Bottom Line

With demand increasing and supply dropping, this may be the perfect time to get the best price for your home. Let’s get together to see whether that is the case in your neighborhood.

Posted in For Sellers, Housing Market Updates, Move-Up Buyers

January 24th, 2018 by Lum Hugh

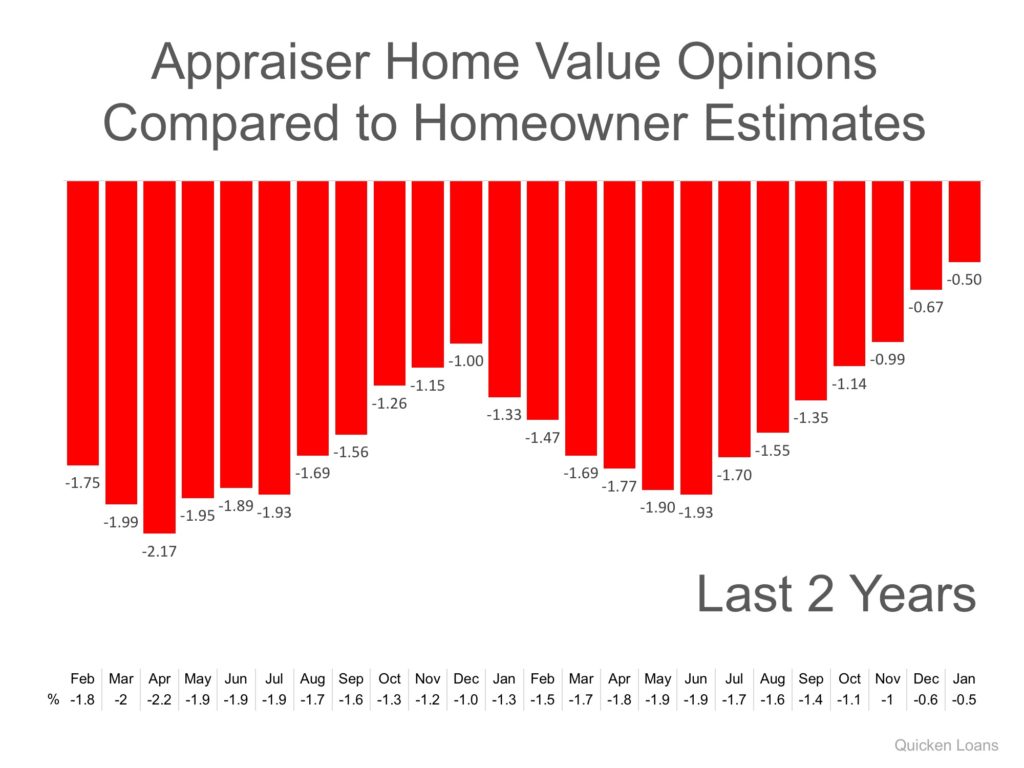

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 4% or more over the next twelve months. One major challenge in such a market is the bank appraisal.

When prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

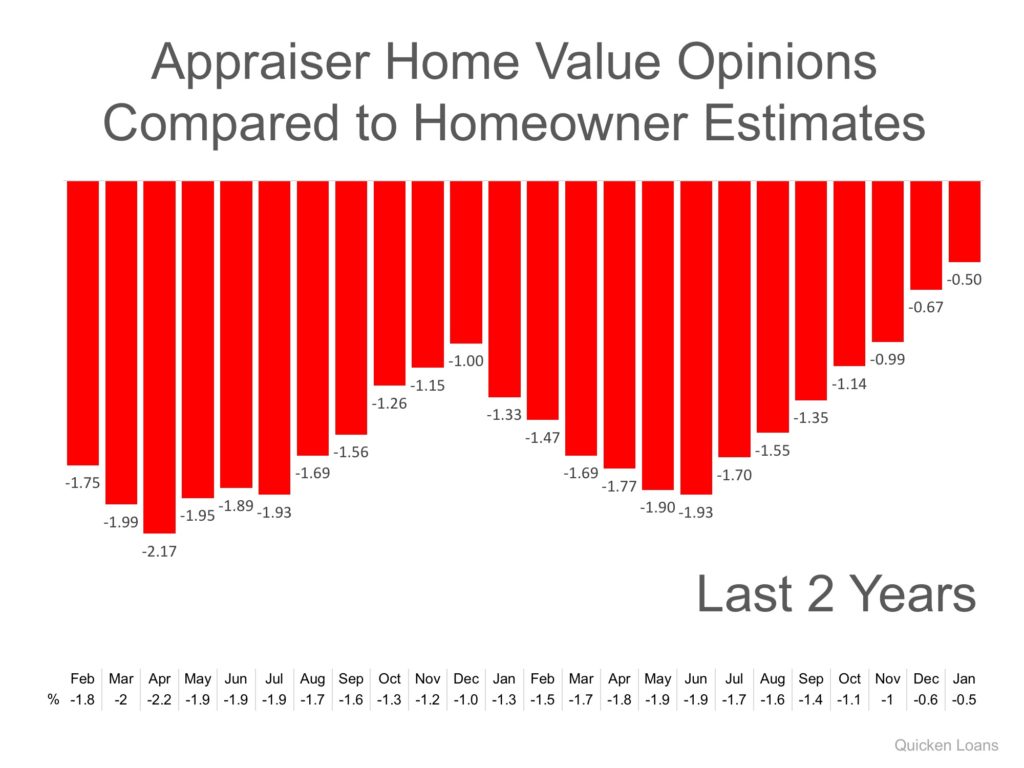

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

In the latest release, the disparity was the narrowest it has been in over two years, as the gap between appraisers and homeowners was only -0.5%. This is important for homeowners to note as even a .5% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home)

The chart below illustrates the changes in home price estimates over the last two years.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges homeowners to find out how their local markets have been impacted by supply and demand:

“Appraisers and real estate professionals evaluate their local housing markets daily. Homeowners, on the other hand, may only think about their housing market when they see ‘for sale’ signs hit front yards in the spring or when they think about accessing their equity.”

“With several years of growth, owners may have more equity than they realize. Many consumers use the tax season at the beginning of the year to reevaluate their entire financial life. It also provides a good opportunity for them to consider how best to take advantage of their equity while mortgage interest rates and borrowing costs are still near record lows.”

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

Posted in For Sellers, Move-Up Buyers, Pricing

January 23rd, 2018 by Lum Hugh

Many people wonder whether they should hire a real estate professional to assist them in buying their dream homes or if they should first try to go through the buying process on their own. In today’s market: you need an experienced professional!

You Need an Expert Guide If You Are Traveling a Dangerous Path

The field of real estate is loaded with landmines; you need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and is ready for you to move into can be tricky. An agent listens to your wants and needs, and can sift through the homes that do not fit within the parameters of your “dream home.”

A great agent will also have relationships with mortgage professionals and other experts that you will need in order to secure your dream home.

You Need a Skilled Negotiator

In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands, of dollars. Each step of the way – from the original offer to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes.

Realize that when an agent is negotiating his or her commission with you, they are negotiating their own salary; the salary that keeps a roof over their family’s head; the salary that puts food on their family’s table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family?

If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal.

Bottom Line

Famous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money…not cost you money.

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

January 19th, 2018 by Lum Hugh

![Where Did Americans Move in 2017? [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/09171302/20180119-STM-Share.jpg)

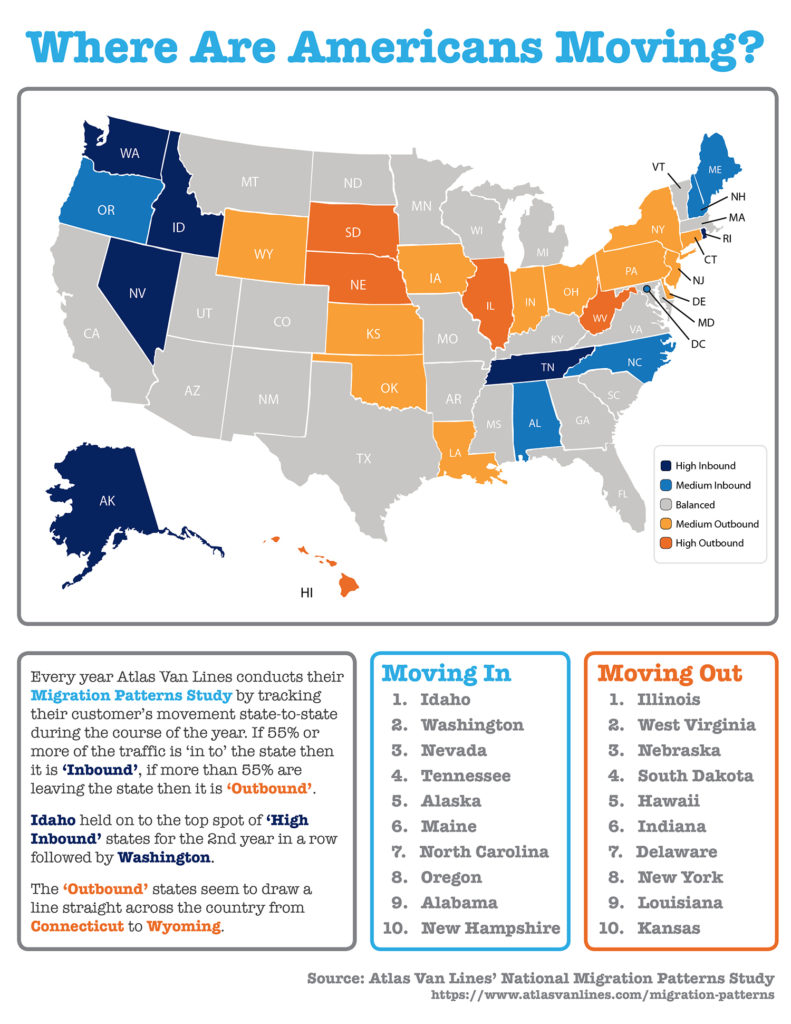

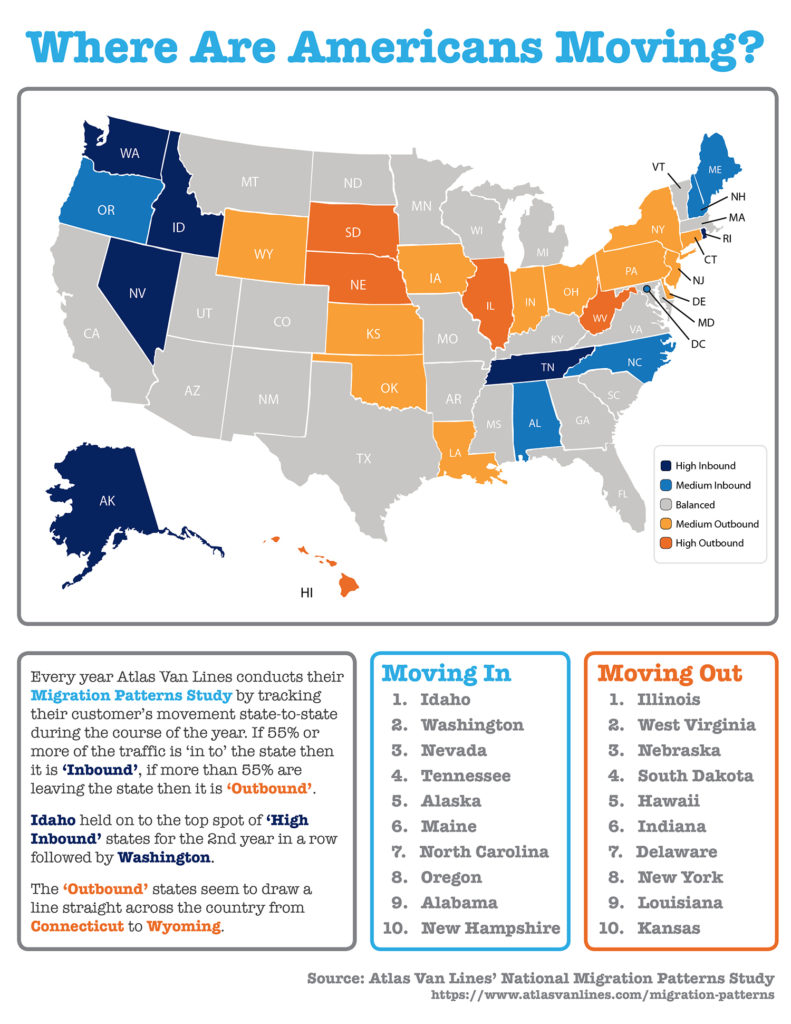

Some Highlights:

- Atlas Van Lines recently released the results of their annual Migration Patterns Survey in which they tracked their customer’s movement from state-to-state over the course of 2017.

- Idaho held on to the top spot of ‘high inbound’ states for the 2nd year in a row followed by Washington.

- The ‘outbound’ states seem to draw a line straight across the country from Connecticut to Wyoming.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

January 18th, 2018 by Lum Hugh

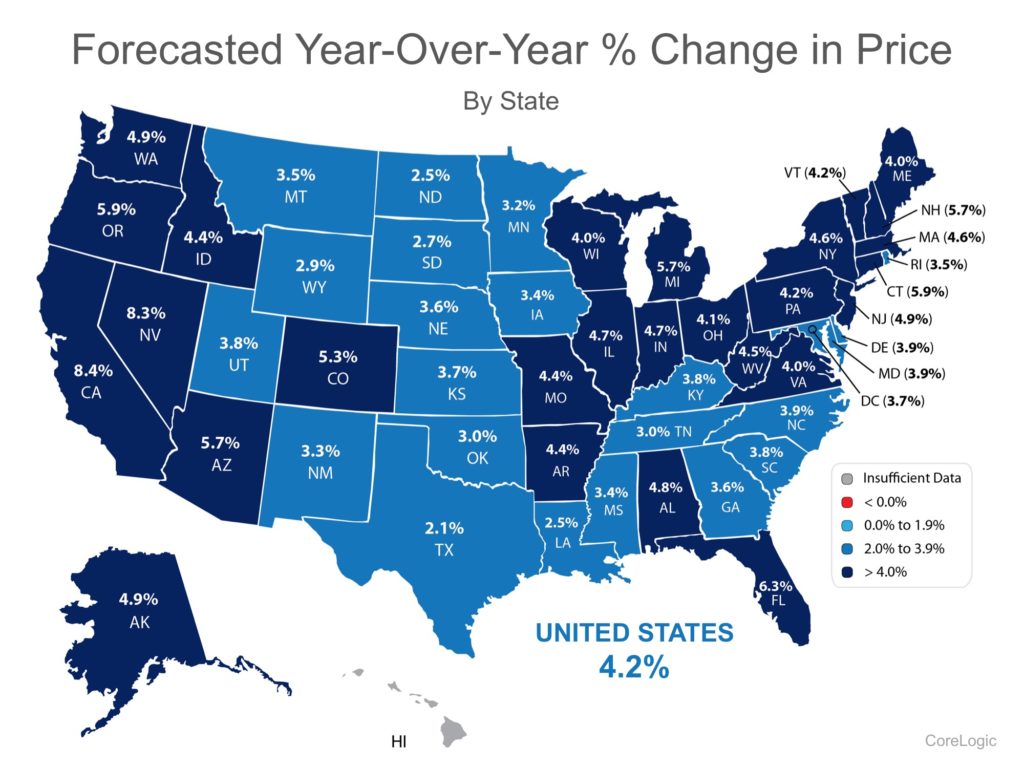

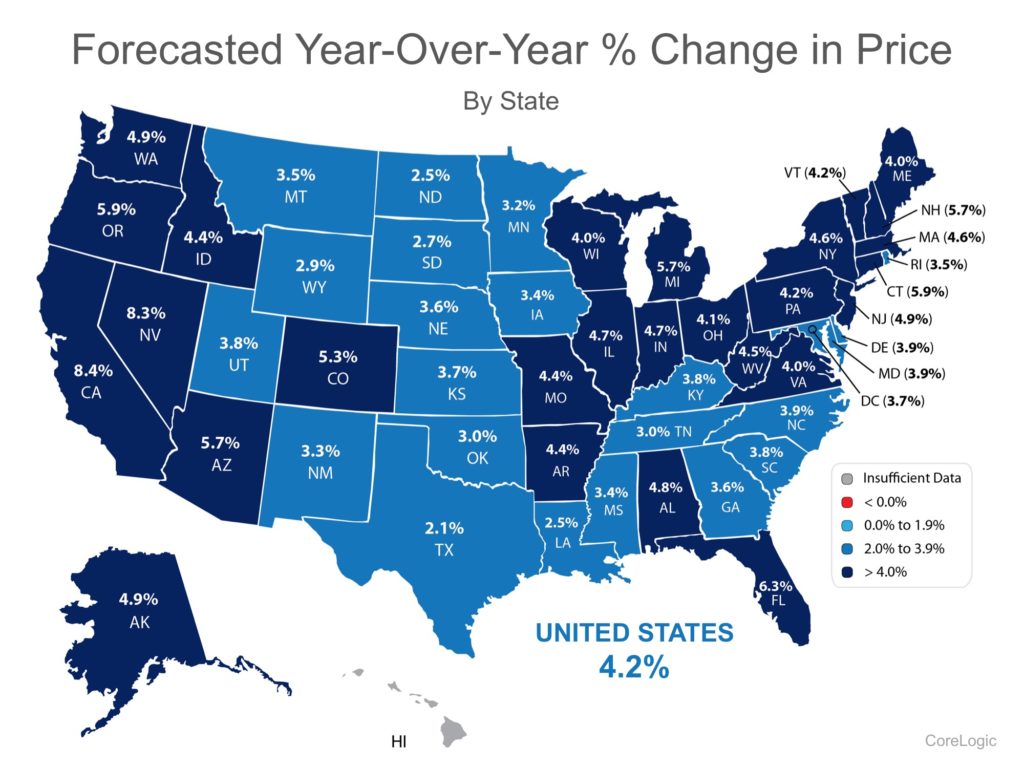

Every month, CoreLogic releases its Home Price Insights Report. In that report, they forecast where they believe residential real estate prices will be in twelve months.

Below is a map, broken down by state, reflecting how home values are forecasted to change by the end of 2018 using data from the most recent report.

As we can see, CoreLogic projects an increase in home values in 49 of 50 states, and Washington, DC (there was insufficient data for HI). Nationwide, they see home prices increasing by 4.2%.

How might the new tax code impact these numbers?

Recently, the National Association of Realtors (NAR) conducted their own analysis to determine the impact the new tax code may have on home values. NAR’s analysis:

“…estimated how home prices will change in the upcoming year for each state, considering the impact of the new tax law and the momentum of jobs and housing inventory.”

Here is a map based on NAR’s analysis:

Bottom Line

According to NAR, the new tax code will have an impact on home values across the country. However, the effect will be much less significant than what some originally thought.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, Pricing

January 15th, 2018 by Lum Hugh

It is common knowledge that a great number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year.

The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed the months in which most people listed their homes for sale in 2017. Here is a graphic showing the results:

The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,680,000.

That number spiked to 1,970,000 by May!

What does this mean to you?

With the national job situation improving, and mortgage interest rates projected to rise later in the year, buyers are not waiting until the spring; they are out looking for homes right now. If you are looking to sell this year, waiting until the spring to list your home means you will have the greatest competition amongst buyers.

Bottom Line

It may make sense to beat the rush of housing inventory that will enter the market in the spring and list your home today.

Posted in For Sellers, Move-Up Buyers

January 12th, 2018 by LHugh

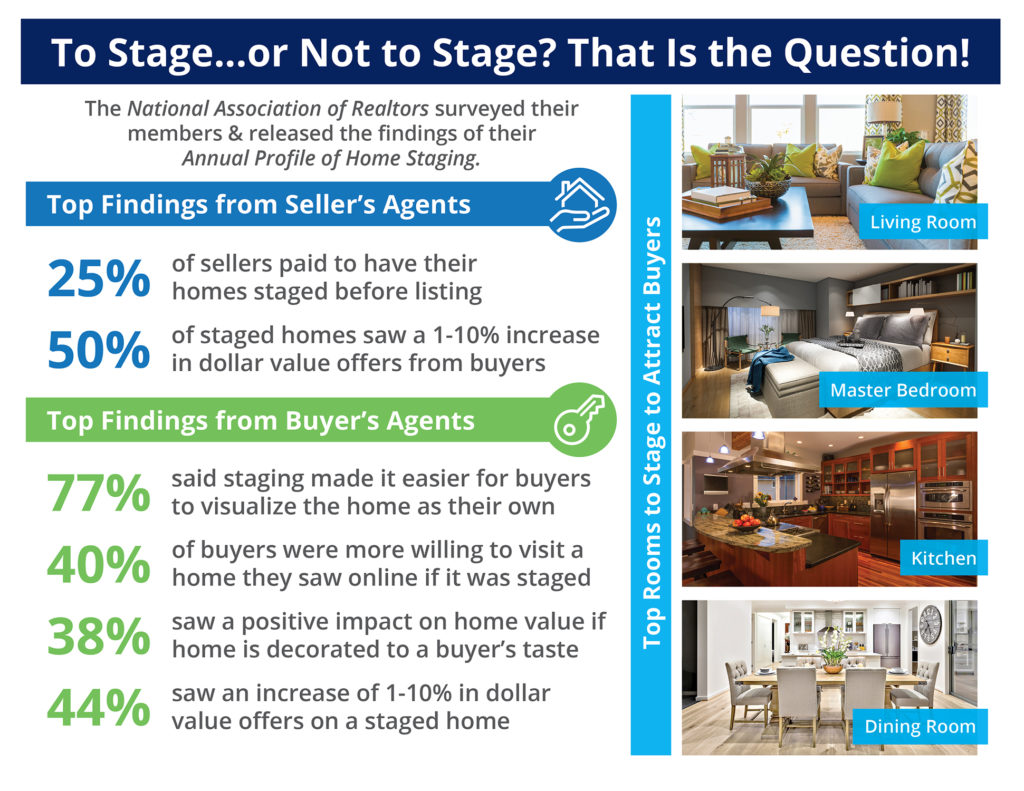

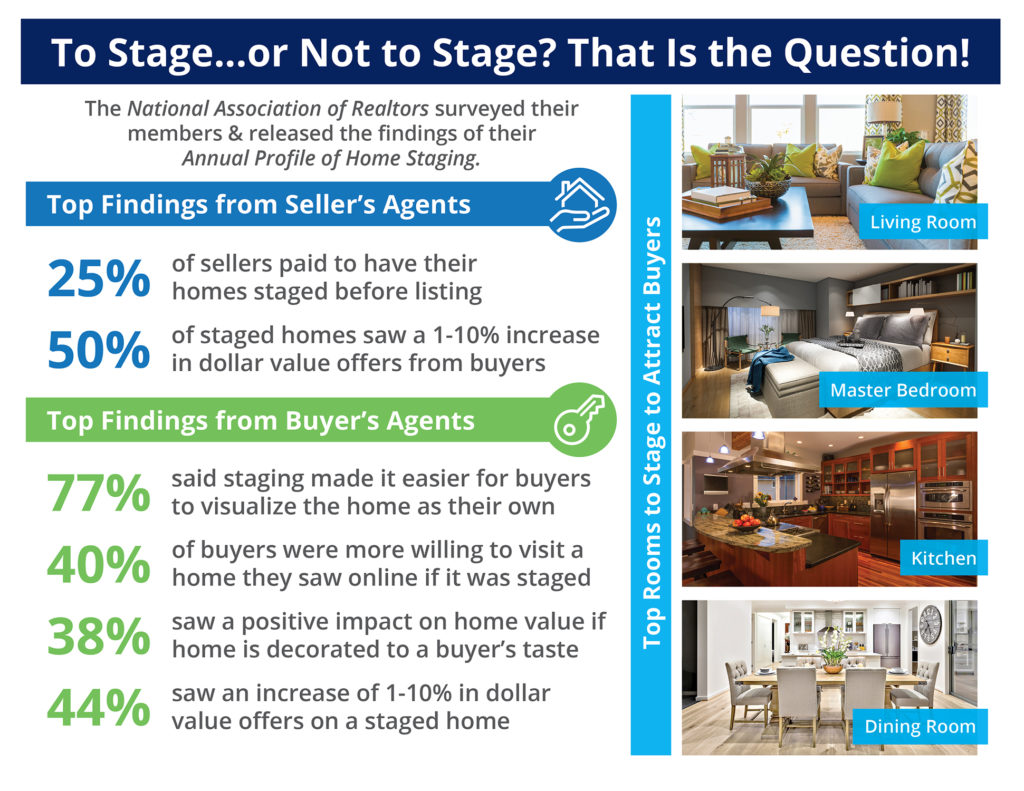

Some Highlights:

- The National Association of Realtors surveyed their members & released the findings of their Annual Profile of Home Staging.

- 50% of staged homes saw a 1-10% increase in dollar value offers from buyers.

- 77% of buyer’s agents said staging made it easier for buyers to visualize the home as their own.

- The top rooms to stage in order to attract more buyers are the living room, master bedroom, kitchen, and dining room.

Posted in For Buyers, Infographics, Move-Up Buyers

January 10th, 2018 by LHugh

According to Ellie Mae’s latest Origination Report, the average FICO® Score on all closed loans dropped to 722 which is its lowest mark since April. The average includes all approved refinance and purchase loans.

FHA and VA loans showed the most opportunity for millennials looking to enter the market with low down payments and even lower FICO® Score requirements.

Ellie Mae’s Millennial Tracker revealed that those who purchased homes in December with an FHA Loan were able to do so with an average down payment of 4% and a FICO® Score of only 684.

Joe Tyrell, EVP of Corporate Strategy at Ellie Mae commented on the opportunity this brings to buyers,

“With the average credit score dipping, lenders are extending credit to borrowers who may have had no previous access to the housing market.”

Bottom Line

More and more potential buyers are able to qualify for a mortgage loan now! If you are debating a home purchase, let’s get together and evaluate your ability to buy today!

Posted in First Time Home Buyers, For Buyers, Move-Up Buyers

![Where Did Americans Move in 2017? [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/09171302/20180119-STM-Share.jpg)