Category: Move-Up Buyers

January 9th, 2018 by LHugh

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up, home sales are up, and distressed sales (foreclosures and short sales) have fallen to their lowest points in years. It seems that the market will continue to strengthen in 2018.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the winter, supply is not keeping up.

Here are the thoughts of a few industry experts on the subject:

National Association of Realtors

“Total housing inventory at the end of November dropped 7.2 percent to 1.67 million existing homes available for sale, and is now 9.7 percent lower than a year ago (1.85 million) and has fallen year-over-year for 30 consecutive months. Unsold inventory is at a 3.4-month supply at the current sales pace, which is down from 4.0 months a year ago.”

Joseph Kirchner, Senior Economist for Realtor.com

“The increases in single-family permits and starts show that builders are planning and starting new construction projects, that’s a good thing because it will help to relieve the shortage of homes on the market.”

Sam Khater, Deputy Chief Economist at CoreLogic

“Inventory is tighter than it appears. It’s much lower for entry-level buyers.”

Bottom Line

If you are thinking of selling, now may be the time. Demand for your house will be strong at a time when there is very little competition. That could lead to a quick sale for a really good price.

Posted in For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

January 5th, 2018 by LHugh

Some Highlights:

- Buyer demand continues to outpace the supply of homes for sale which means that buyers are often competing with one another for the few listings that are available!

- Housing inventory is still under the 6-month supply needed to sustain a normal housing market.

- Perhaps the time has come for you and your family to move on and start living the life you desire.

Posted in For Buyers, For Sellers, Infographics, Move-Up Buyers

January 4th, 2018 by LHugh

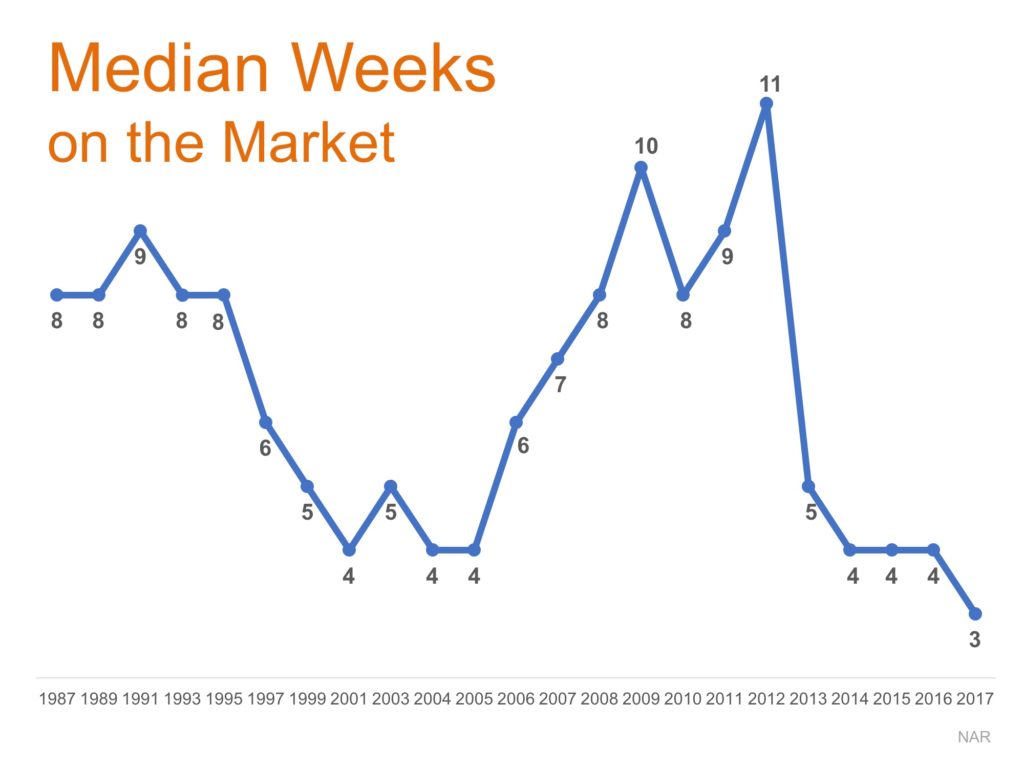

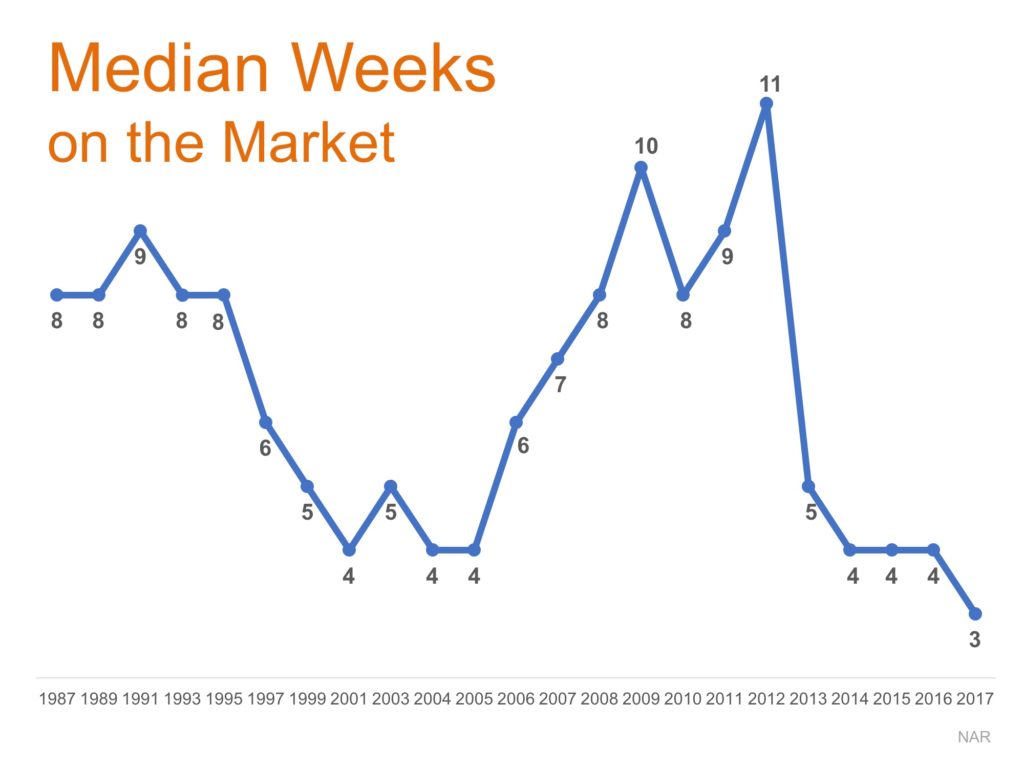

According to recently released data from the National Association of Realtors (NAR), the median amount of time a home spent on the market hit an all-time low of only three weeks in 2017.

Strong buyer demand, a good economy, and a low inventory of new and existing homes for sale created the perfect storm to accelerate the time between listing and signing a contract. The time needed to sell a home has dropped substantially since its highest mark of 11 weeks in 2012.

The chart below shows the median weeks on the market from 1987 to today.

Bottom Line

If you are a homeowner who is debating whether or not to list your home for sale, know that national market conditions are primed for a quick turnaround! Let’s get together to discuss exactly what’s going on in our area, today!

Posted in For Buyers, For Sellers, Move-Up Buyers

January 2nd, 2018 by LHugh

Over the next five years, home prices are expected to appreciate on average by 3.35% per year and to grow by 24.34% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

As an example, let’s assume a young couple purchases and closes on a $250,000 home this month (January). If we only look at the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Since the experts predict that home prices will increase by 4.2% in 2018, the young homeowners will have gained $10,500 in equity in just one year.

Over a five-year period, their equity will increase by nearly $45,000! This figure does not even take into account their monthly principal mortgage payments. In many cases, home equity is one of the largest portions of a family’s overall net worth.

Bottom Line

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, find out if you are able to today!

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers

December 29th, 2017 by Lum Hugh

![Buying or Selling in 2018? 5 Reasons to Resolve to Hire a Pro [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2017/12/19171354/20171229-Share-STM.jpg)

Some Highlights:

- As we usher in the new year, one thing is for certain… if you plan to buy or sell a house this year, you need a real estate professional on your team!

- There are many benefits to using a local professional!

- Pick a professional who knows your local market and can help you achieve your dreams!

Posted in First Time Home Buyers, For Buyers, For Sellers, Infographics, Move-Up Buyers

December 28th, 2017 by Lum Hugh

What truly causes a housing bubble and the inevitable crash? For the best explanation, let’s go to a person who correctly called the last housing bubble – a year before it happened.

“A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation…Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the ‘bubble’ bursts.

I have taken to calling the housing market a ‘bubble’.”

– Bill McBride of Calculated Risk calling the bubble back in April 2005

Where do we stand today regarding speculation?

There are two measurements that are used to determine the speculation in a housing market:

- The number of homes purchased by an investor and

- The number of homes being flipped (resold within a twelve-month period)

As compared to 2005, investor purchases are down dramatically (from 23% to 13%) and so is flipping (from 8.2% to 5.7%). McBride explains:

“There is currently some flipping activity, but this is more the normal type of flipping (buy, improve and then sell). Back in 2005, people were just buying homes and letting them sit vacant – and then selling without significant improvements. Classic speculation.”

What are the experts saying about speculation in today’s market?

DSNews recently ran an article which asked two economists to compare the speculation in today’s market to that in 2005-2007. Here is what they said:

Dr. Eddie Seiler, Chief Housing Economist at Summit Consulting:

“The speculative ‘flipping mania’ of 2006 is absent from most metro areas.”

Tian Liu, Chief Economist of Genworth Mortgage Insurance:

“The nature of housing demand is different as well, with more potential homeowners and far fewer speculators in the housing market compared to the 2005-2007 period.”

And what does McBride, who called the last housing bubble, think about today’s real estate market?

Sixty days ago, he explained:

“In 2005, people were just buying homes and letting them sit vacant – and then selling without significant improvements. Classic speculation. And even more dangerous during the bubble was the excessive use of leverage (all those poor-quality loans). Currently lending standards are decent, and loan quality is excellent…

I wouldn’t call house prices a bubble – and I don’t expect house prices to decline nationally like during the bust.”

Bottom Line

Speculation is a major element of the housing bubble formula. Right now, there are not elevated percentages of investors and house flippers. Therefore, there is not an elevated rate of speculation.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

December 27th, 2017 by Lum Hugh

We often talk about the financial reasons why buying a home makes sense. But, more often than not, the emotional reasons are the more powerful or compelling reasons.

No matter what shape or size your living space is, the concept and feeling of home can mean different things to different people. Whether it’s a certain scent or a favorite chair, the emotional reasons why we choose to buy our own homes are typically more important to us than the financial ones.

1. Owning your home offers stability to start and raise a family

From the best neighborhoods to the best school districts, even those without children at the time of purchase may have this in the back of their minds as a major reason for choosing the location of the home that they purchase.

2. There’s no place like home

Owning your own home offers you not only safety and security, but also a comfortable place that allows you to relax after a long day!

3. You have more space for you and your family

Whether your family is expanding, an older family member is moving in, or you need to have a large backyard for your pets, you can take this all into consideration when buying your dream home!

4. You have control over renovations, updates, and style

Looking to actually try one of those complicated wall treatments that you saw on Pinterest? Tired of paying an additional pet deposit for your apartment building? Or maybe you want to finally adopt that puppy or kitten you’ve seen online 100 times? Who’s to say that you can’t in your own home?

Bottom Line

Whether you are a first-time homebuyer or a move-up buyer who wants to start a new chapter in your life, now is a great time to reflect on the intangible factors that make a house a home.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Rent vs. Buy

December 26th, 2017 by Lum Hugh

In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers.

Here are the top five reasons:

1. Exposure to Prospective Buyers

Recent studies have shown that 95% of buyers search online for a home. That is in comparison to only 17% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you?

2. Results Come from the Internet

Where did buyers find the home they actually purchased?

- 49% on the internet

- 31% from a Real Estate Agent

- 7% from a yard sign

- 1% from newspapers

The days of selling your house by just putting up a sign and putting it in the paper are long gone. Having a strong internet strategy is crucial.

3. There Are Too Many People to Negotiate With

Here is a list of some of the people with whom you must be prepared to negotiate if you decide to For Sale By Owner:

- The buyer who wants the best deal possible

- The buyer’s agent who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house

- The appraiser if there is a question of value

4. FSBOing Has Become More And More Difficult

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

The 8% share represents the lowest recorded figure since NAR began collecting data in 1981.

5. You Net More Money When Using an Agent

Many homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save the commission.

A study by Collateral Analytics revealed that FSBOs don’t actually save anything, and in some cases, may be costing themselves more, by not listing with an agent. One of the main reasons for the price difference at the time of sale is:

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

If more buyers see a home, the greater the chances are that there could be a bidding war for the property. The study showed that the difference in price between comparable homes of size and location is currently at an average of 6% this year.

Why would you choose to list on your own and manage the entire transaction when you can hire an agent and not have to pay anything more?

Bottom Line

Before you decide to take on the challenges of selling your house on your own, sit with a real estate professional in your marketplace and see what they have to offer.

Posted in For Sellers, FSBOs, Move-Up Buyers

December 22nd, 2017 by Lum Hugh

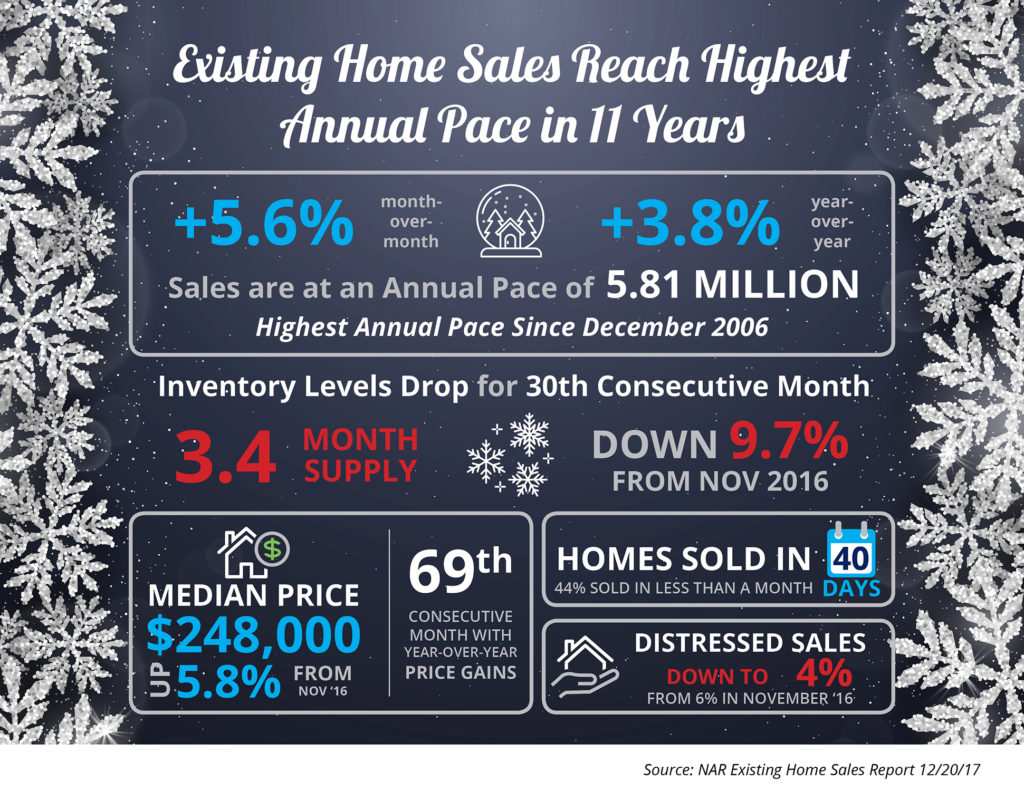

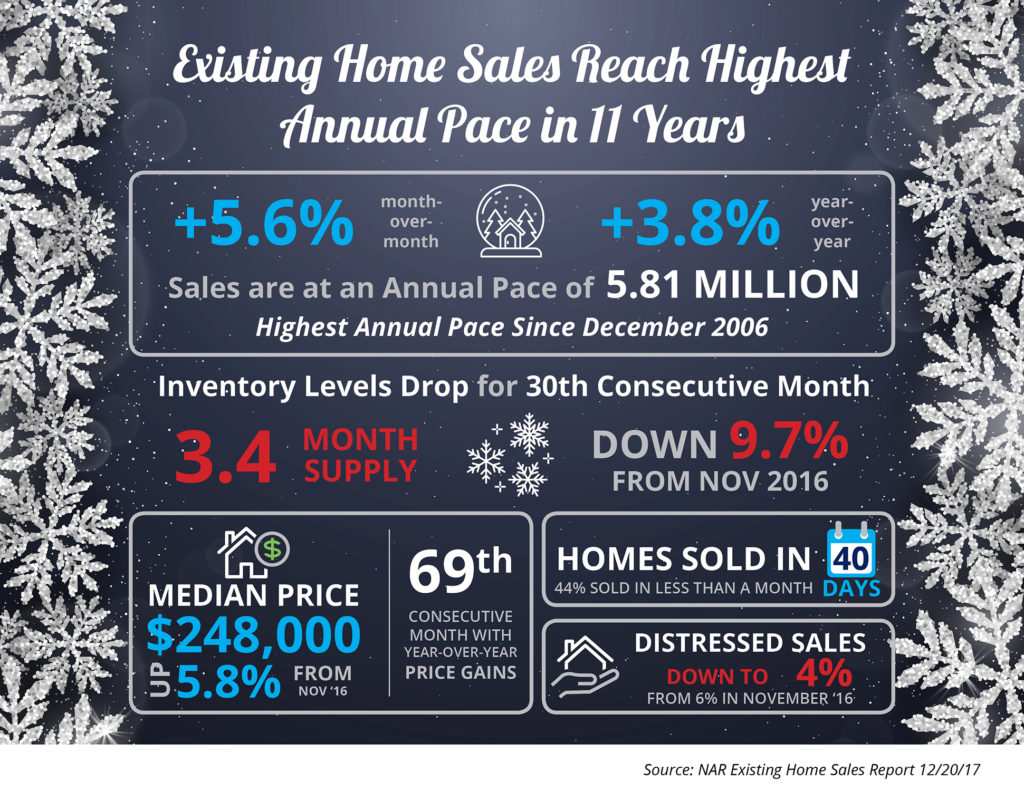

Some Highlights:

- Existing home sales are currently at an annual pace of 5.81 million, the highest pace since December 2006.

- The inventory of existing homes for sale has dropped year-over-year for the last 30 consecutive months and is now at a 3.4-month supply.

- NAR’s Chief Economist Lawrence Yun had this to say: “Faster economic growth in recent quarters, the booming stock market and continuous job gains are fueling substantial demand for buying a home as 2017 comes to an end.”

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Infographics, Move-Up Buyers

December 20th, 2017 by Lum Hugh

The National Association of Realtors (NAR) recently released their 2017 Profile of Home Buyers and Sellers in which they surveyed recent home buyers and sellers about their experiences. An entire section of the profile is dedicated to buyers’ experiences with their real estate agents.

If you are looking to buy in 2018, here are the top 5 benefits of using a real estate agent when buying your dream home as cited by recent buyers:

1. Helped the buyer understand the process – 60%

If you are new to the home buying process, an experienced real estate professional can explain exactly what to expect during the entire transaction so you aren’t caught off guard.

2. Pointed out unnoticed features/faults with the property – 56%

Whether it’s pointing out possible uses for an extra bedroom/office, or using their trained eye to see potentially disastrous hazards that may be hiding out of site, your agent is there to protect your interests and make sure your home buying experience is a good one.

3. Negotiated better sales contract terms – 47%

When it comes to negotiating the complex terms of your contract and coming to an agreement with the seller, it never hurts to have someone who has been there before on your side. If earlier in your search you found a couple of less than desirable features on the home you are going to purchase, your agent can make sure that contingencies are in place for you to pay the best price. Their analysis of comparable properties in the area will also help to make sure that your dream home is priced properly for the market.

4. Provided a better list of service providers – 46%

Real estate agents are titans of networking. Many have a list of preferred providers who they have worked with in the past and who they trust to work as a part of your team to make your dream come true. This can include mortgage professionals (listed as the #8 reason to use an agent at 22%), home inspectors, plumbers, contractors, painters, landscapers, home stagers, and so many more!

5. Improved the buyer’s knowledge of search areas – 44%

Local real estate professionals are often members of community organizations and are usually well versed in their area’s history. Their ties to the community make them a great resource whether you plan to relocate to a new area or across town.

Bottom Line

If your plans for 2018 include purchasing your dream home, let’s get together to discuss your options and to help you make the most powerful and confident decisions for you and your family.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers

![Buying or Selling in 2018? 5 Reasons to Resolve to Hire a Pro [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2017/12/19171354/20171229-Share-STM.jpg)