Category: Move-Up Buyers

Access is an Important Factor in Getting Your House SOLD!

Nov

21

2017

So, you’ve decided to sell your house. You’ve hired a real estate professional to help you with the entire process, and they have asked you what level of access you want to provide to potential buyers.

There are four elements to a quality listing. At the top of the list is Access, followed by Condition, Financing, and Price. There are many levels of access that you can provide to your agent so that he or she can show your home.

Here are five levels of access that you can give to buyers, along with a brief description:

- Lockbox on the Door – this allows buyers the ability to see the home as soon as they are aware of the listing, or at their convenience.

- Providing a Key to the Home – although the buyer’s agent may need to stop by an office to pick up the key, there is little delay in being able to show the home.

- Open Access with a Phone Call – the seller allows showings with just a phone call’s notice.

- By Appointment Only (example: 48-Hour Notice) – Many buyers who are relocating for a new career or promotion start working in that area prior to purchasing their home. They often like to take advantage of free time during business hours (such as their lunch break) to view potential homes. Because of this, they may not be able to plan their availability far in advance or may be unable to wait 48 hours to see the house.

- Limited Access (example: the home is only available on Mondays or Tuesdays at 2pm or for only a couple of hours a day) – This is the most difficult way to be able to show your house to potential buyers.

In a competitive marketplace, access can make or break your ability to get the price you are looking for, or even sell your house at all.

Posted in For Sellers, Move-Up Buyers

Homeowners: Your House Must Be Sold TWICE

Nov

20

2017

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

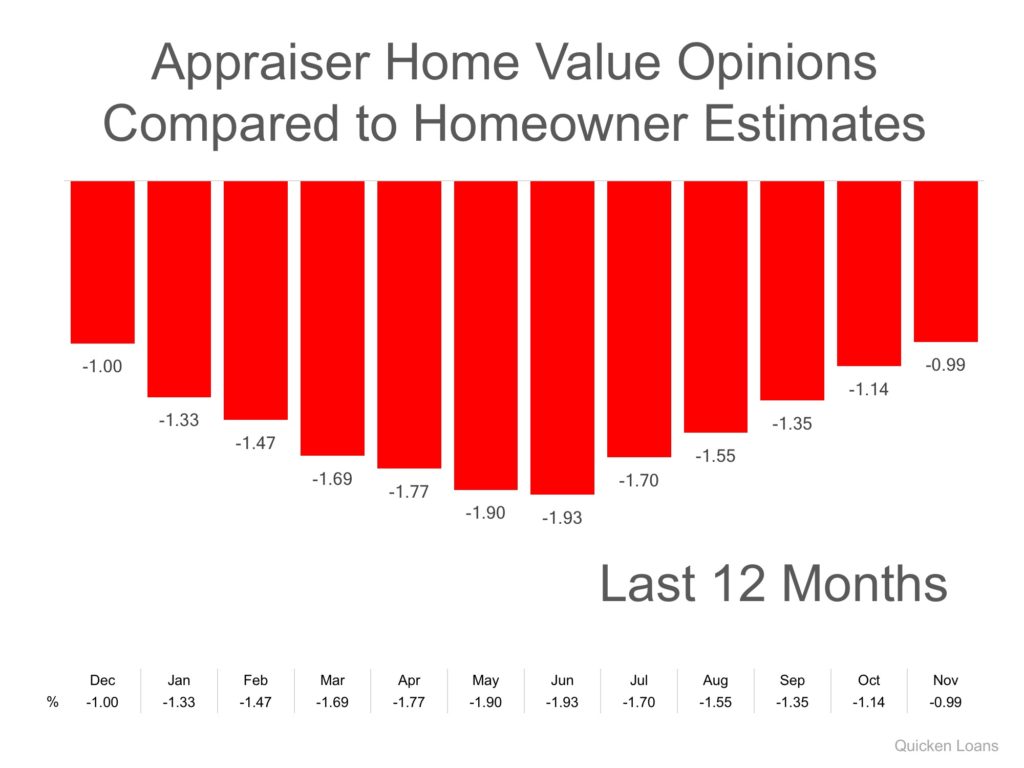

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth, and an appraiser’s evaluation of that same home.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges anyone looking to buy or sell in today’s market to remember the impact of this challenge:

“Based on the HPPI, it appears homeowners in the markets where prices are rising faster than the national average – like Denver, Seattle and San Francisco – are continuing to underestimate just how quickly home values are rising, so the average appraisal is higher than homeowner estimate.

On the inverse of that, homeowners in areas where the values aren’t rising as fast may think they are rising faster than they are, leading to the appraisal lagging the estimate.”

The chart below illustrates the changes in home price estimates over the last 12 months.

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

Posted in For Sellers, Move-Up Buyers

Top 4 Home Renovations for Maximum ROI [INFOGRAPHIC]

Nov

17

2017

![Top 4 Home Renovations for Maximum ROI [INFOGRAPHIC] | Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/11/14114524/20171117-Share-STM.jpg)

Some Highlights:

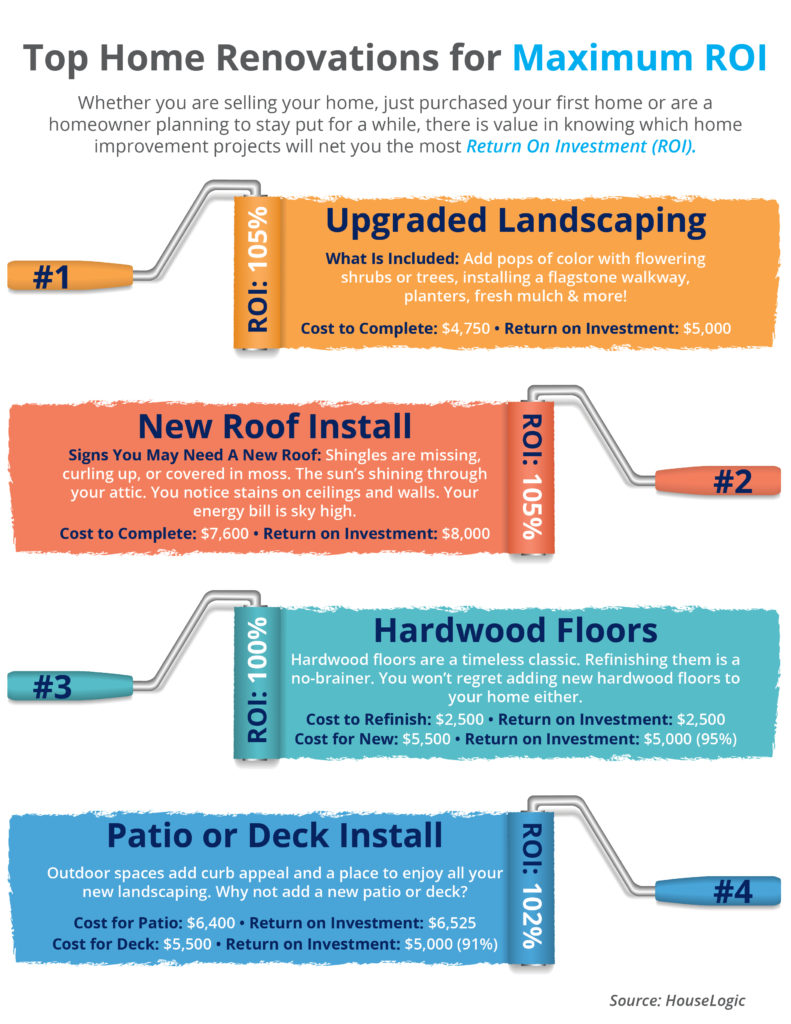

- Whether you are selling your home, just purchased your first home, or are a homeowner planning to stay put for a while, there is value in knowing which home improvement projects will net you the most “Return On Investment” (ROI).

- While big projects like adding a bathroom or a complete remodel of a kitchen are popular ways to increase a home’s value, something as simple as updating landscaping and curb appeal can have a quick impact on a home’s value.

Posted in First Time Home Buyers, For Buyers, For Sellers, Infographics, Move-Up Buyers

Your Friends Are Crazy Wrong If They’re Telling You Not to Buy

Nov

16

2017

The current narrative is that home prices have risen so much so that it is no longer a smart idea to purchase a home. Your family and friends might suggest that buying a home right now (whether a first-time home or a move-up home) makes absolutely no sense from an affordability standpoint. They are wrong!

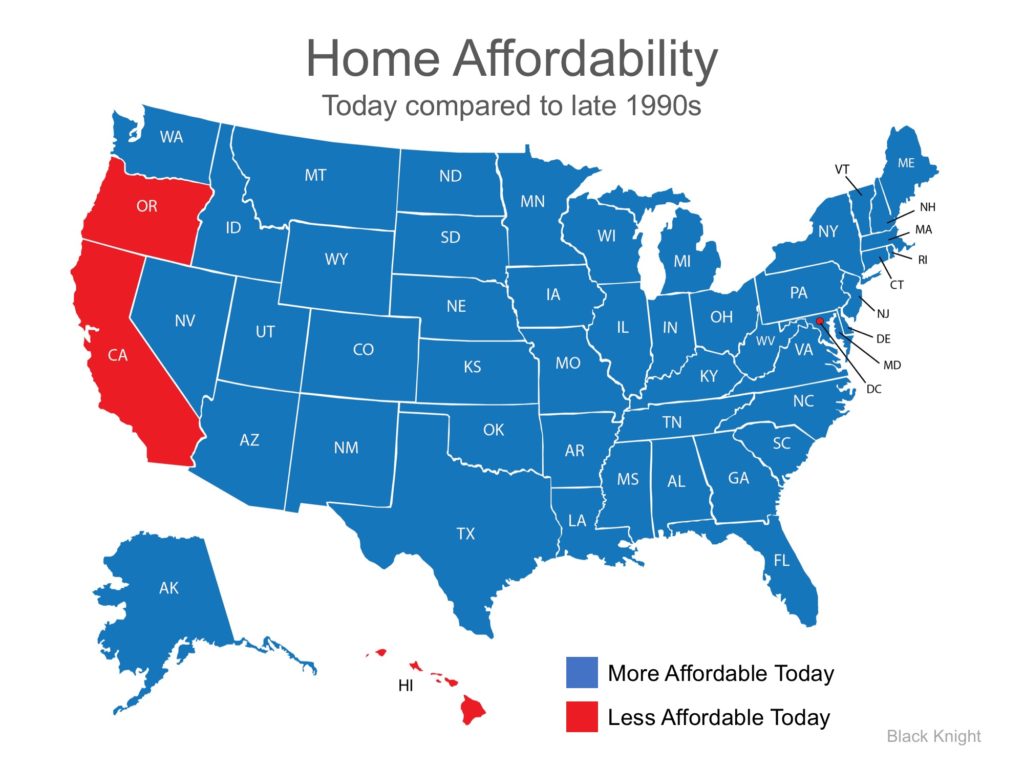

Homes are more affordable right now than at almost any time in our country’s history except for the foreclosure years (2009-2015) when homes sold at major discounts. As an example, below is a graph from the latest Black Knight Mortgage Monitor showing the percentage of median income needed to buy a medium-priced home in the country today in comparison to prior to the housing bubble and bust.

As we can see, the percentage necessary is less now than in those time periods.

The Mortgage Monitor also explains that home affordability is better today than it was in the late 1990s in 47 of 50 states.

Bottom Line

Your friends and family have your best interests at heart. However, when it comes to buying your first home or selling your current house to buy the home of your dreams, let’s get together to discuss what your best move is, now.

Posted in Buying Myths, First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers

Feeling ‘Stuck in Place’? You Aren’t Alone… And There’s Hope!

Nov

15

2017

Whether you are a renter who is searching for your dream home or a homeowner who feels like your only option is to renovate, you have at least one thing in common: feeling stuck in place.

According to data from the National Association of Realtors’ Profile of Home Buyers & Sellers, the average amount of time that a family stays in their home remained at 10 years in 2017. This mark ties the highest marks set in 2014 and 2016. Back in 1985, when data was first collected on this subject, homeowners stayed in their homes for an average of only 5 years.

There are many reasons why homeowners have decided to stay and not to sell. A recent Wall Street Journal article had this to say,

“Americans aren’t moving in part because inventory levels have fallen near multidecade lows and home prices have risen to records. Many homeowners are choosing to stay and renovate, in turn making it more difficult for renters to enter the market.”

Sam Khater, Deputy Chief Economist for CoreLogic, equated the lack of inventory to “not having enough oil in your car and your gears slowly [coming] to a grind.”

Historically, a normal market (in which prices increase at the rate of inflation) requires a 6-7 month supply of inventory. There hasn’t been that much supply since August of 2012! Over the course of the last 12 months, inventory has hovered between a 3.5 to 4.4-month supply, meaning that prices have increased and buyers are still out in force!

Challenges in the new-home construction market have “helped create a bottleneck in the market in which owners of starter homes aren’t trading up to newly built homes, which tend to be pricier, in turn creating a squeeze for millennial renters looking to get into the market.”

“Economists said baby boomers also aren’t in a hurry to trade in the dream homes they moved into in middle age for condominiums or senior living communities because many are staying healthy longer or want to remain near their children.”

So, what can you do if you feel stuck & want to move on?

Don’t give up! If you are looking to move-up to an existing luxury home, there are deals to be had in the higher-priced markets. Demand is strong in the starter and trade-up home markets which means that your house will sell quickly. Let’s work together to build in contingencies that allow you more time to find your dream home; the right buyer will wait.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers

Mortgage Interest Rates Are Going Up… Should I Wait to Buy?

Nov

14

2017

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Freddie Mac, along with Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors, is calling for mortgage rates to continue to rise over the next four quarters.

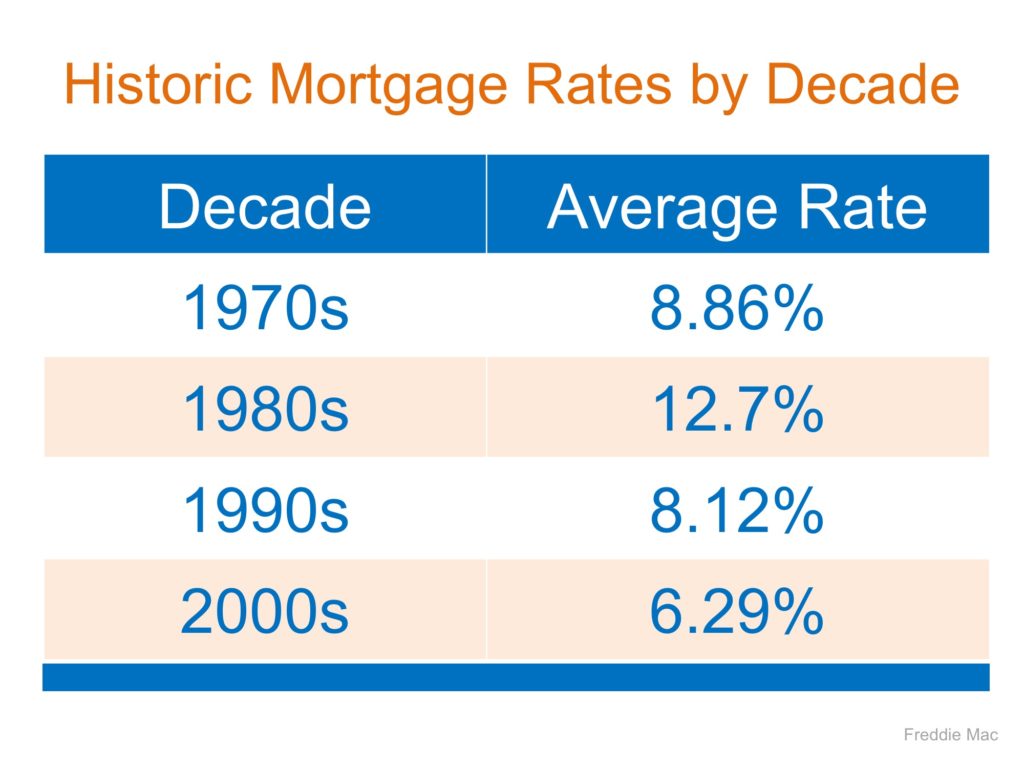

This has caused some purchasers to lament the fact that they may no longer be able to get a rate below 3.5%. However, we must realize that current rates are still at historic lows.

Here is a chart showing the average mortgage interest rate over the last several decades:

Bottom Line

Though you may have missed getting the lowest mortgage rate ever offered, you can still get a better interest rate than your older brother or sister did ten years ago, a lower rate than your parents did twenty years ago, and a better rate than your grandparents did forty years ago.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

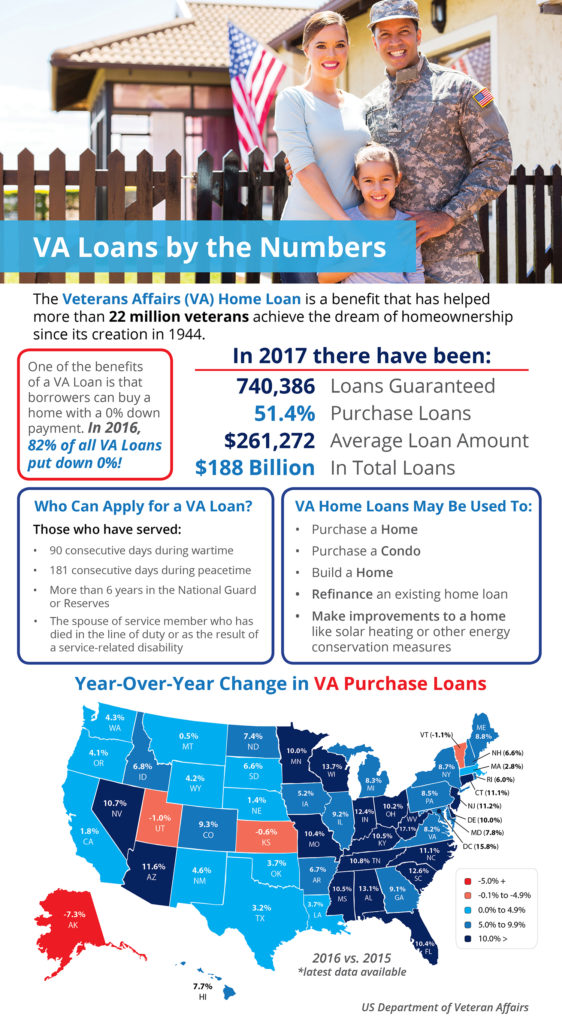

Veterans Affairs Loans by the Numbers [INFOGRAPHIC]

Nov

10

2017

Some Highlights:

- Since the creation of the VA Home Loans Program, 22 million veterans have been able to achieve the American Dream of homeownership.

- So far in 2017, $188 billion has been loaned to veterans and their families through the program.

- VA Purchase Loans are on the rise in 46 out of 50 states and Washington, DC.

Posted in First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

A Housing Bubble? Industry Experts Say NO!

Nov

09

2017

With residential home prices continuing to appreciate at levels above historic norms, some are questioning if we are heading toward another housing bubble (and subsequent burst) like the one we experienced in 2006-2008.

Recently, five housing experts weighed in on the question.

Rick Sharga, Executive VP at Ten-X:

“We’re definitely not in a bubble.”

“We have a handful of markets that are frothy and probably have hit an affordability wall of sorts but…while prices nominally have surpassed the 2006 peak, we’re not talking about 2006 dollars.”

Christopher Thornberg, Partner at Beacon Economics:

“There is no direct or indirect sign of any kind of bubble.”

“Steady as she goes. Prices continue to rise. Sales roughly flat.…Overall this market is in an almost boring place.”

Bill McBride, Calculated Risk:

“I wouldn’t call house prices a bubble.”

“So prices may be a little overvalued, but there is little speculation and I don’t expect house prices to decline nationally like during the bust.”

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices:

“Housing is not repeating the bubble period of 2000-2006.”

“…price increases vary unlike the earlier period when rising prices were almost universal; the number of homes sold annually is 20% less today than in the earlier period and the months’ supply is declining, not surging.”

Bing Bai & Edward Golding, Urban Institute:

“We are not in a bubble and nowhere near the situation preceding the 2008 housing crisis.”

“Despite recent increases, house prices remain affordable by historical standards, suggesting that home prices are tracking a broader economic expansion.”

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers, Pricing

5 Reasons Homeownership Makes ‘Cents’

Nov

08

2017

The American Dream of homeownership is alive and well. Recent reports show that the US homeownership rate has rebounded from recent lows and is headed in the right direction. The personal reasons to own differ for each buyer, but there are many basic similarities.

Today we want to talk about the top 5 financial reasons you should own your own home.

- Homeownership is a form of forced savings – Paying your mortgage each month allows you to build equity in your home that you can tap into later in life for renovations, to pay off high-interest credit card debt, or even send a child to college. As a renter, you guarantee that your landlord is the person with that equity.

- Homeownership provides tax savings – One way to save on taxes is to own your own home. You may be able to deduct your mortgage interest, property taxes, and profits from selling your home, but make sure to always check with your accountant first to find out which tax advantages apply to you in your area.

- Homeownership allows you to lock in your monthly housing cost – When you purchase your home with a fixed-rate mortgage, you lock in your monthly housing cost for the next 5, 15, or 30 years. Interest rates have remained around 4% all year, marking some of the lowest rates in history. The value of your home will continue to rise with inflation, but your monthly costs will not.

- Buying a home is cheaper than renting – According to the latest report from Trulia, it is now 37.4% less expensive to buy a home of your own than to rent in the US. That number varies throughout the country but ranges from 6% cheaper in San Jose, CA to 57% cheaper in Detroit, MI.

- No other investment lets you live inside of it – You can choose to invest your money in gold or the stock market, but you will still need somewhere to live. In a home that you own, you can wake up every morning knowing that your investment is gaining value while providing you a safe place to live.

Bottom Line

Before you sign another lease, let’s get together to help you better understand all your options.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Rent vs. Buy

Multigenerational Households May Be the Answer to Price Increases

Nov

07

2017

Multigenerational homes are coming back in a big way! In the 1950s, about 21%, or 32.2 million Americans shared a roof with their grown children or parents. According to an article by Realtor.com, “Nearly 1 in 5 Americans is now living in a multigenerational household – a household with two or more adult generations, or grandparents living with grandchildren – a level that hasn’t been seen in the U.S. since 1950.”

Another report that proves this point is the National Association of Realtors’ (NAR) 2017 Profile of Home Buyers and Sellers which states that 13% of home buyers purchased multigenerational homes last year. The top 3 reasons for purchasing this type of home were:

- To take care of aging parents (22%, up from 19% last year)

- Cost savings (17%)

- Children over the age of 18 moving back home (16%, up from 14% last year)

Valerie Sheets, Spokesperson for Lennar, points out that,

“Everyone is looking for the perfect home for any number of family situations, such as families who opt to take care of aging parents or grandparents at home, or millennials looking to live with their parents while they attend school or save for a down payment.”

For a long time, nuclear families (a couple and their dependent children) became the accepted norm, but John Graham, co-author of “Together Again: A Creative Guide to Successful Multigenerational Living,” says, “We’re getting back to the way human beings have always lived in – extended families.”

This shift can be attributed to several social changes over the decades. Growing racial and ethnic diversity in the U.S. population helps explain some of the rise in multigenerational living; “Data suggest that multigenerational living is more prevalent among Asian (28%), Hispanic (25%), and African-American (25%) families, while U.S. whites have fewer multigenerational homes (15%).”

Additionally, women are a bit more likely to live in multigenerational conditions than are their male counterparts (12% vs. 10%, respectively). Last but not least, basic economics.

Valerie Sheets brings to light the fact that home prices have been skyrocketing in recent years. She says that, “As home prices increase, more families tend to opt for living together.”

Bottom Line

Multigenerational households are making a comeback. While it is a shift from the more common nuclear home, these households might be the answer that many families are looking for as home prices continue to rise in response to a lack of housing inventory.

Posted in For Buyers, For Sellers, Move-Up Buyers, Pricing