Category: Down Payments

Millennials Flock to Low Down Payment Programs

Apr

12

2017

A recent report released by Down Payment Resource shows that 65% of first-time homebuyers purchased their homes with a down payment of 6% or less in the month of January.

The trend continued through all buyers with a mortgage, as 62% made a down payment of less than 20%, which is consistent with findings from December.

An article by DS News points to the new wave of millennial homebuyers:

“It seems that the long-awaited influx of millennial home buyers is beginning. Ellie Mae reported that mortgages to millennial borrowers for new home purchases continued their ascent in January, accounting for 84 percent of closed loans.”

Among millennials who purchased homes in January, FHA loans remained popular, making up 35% of all loans closed. Ellie Mae’s Executive Vice President of Corporate Strategy Joe Tyrrell gave some insight into why:

“It is not surprising to see Millennial borrowers leverage FHA loans because they typically offer lower down payments and lower average FICO score requirements than conventional loans. Across the board, we’re continuing to see strong interest in homeownership from this younger generation.”

Bottom Line

If you are one of the many millennials who is debating a home purchase this year, let’s get together to help you understand your options and set you on the path to preapproval.

Posted in Down Payments, First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Again… You Do Not Need 20% Down to Buy NOW!

Apr

03

2017

A survey by Ipsos found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. There are two major misconceptions that we want to address today.

1. Down Payment

The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 40% of consumers think a 20% down payment is always required. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

The survey also revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

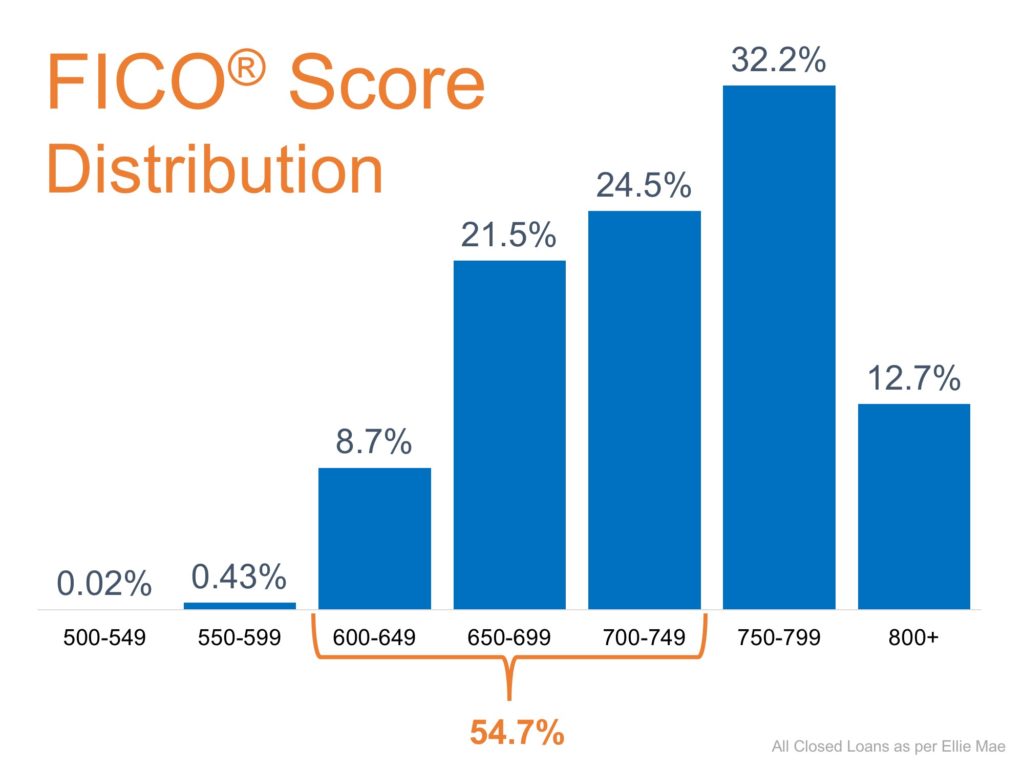

The average conventional loan closed in February had a credit score of 752, while FHA mortgages closed with a score of 686. The average across all loans closed in February was 720. The chart below shows the distribution of FICO® Scores for all loans approved in February.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

Posted in Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

2 Myths That May Be Holding Back Buyers

Jan

30

2017

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.”

Myth #1: “I Need a 20% Down Payment”

Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required.

Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%.

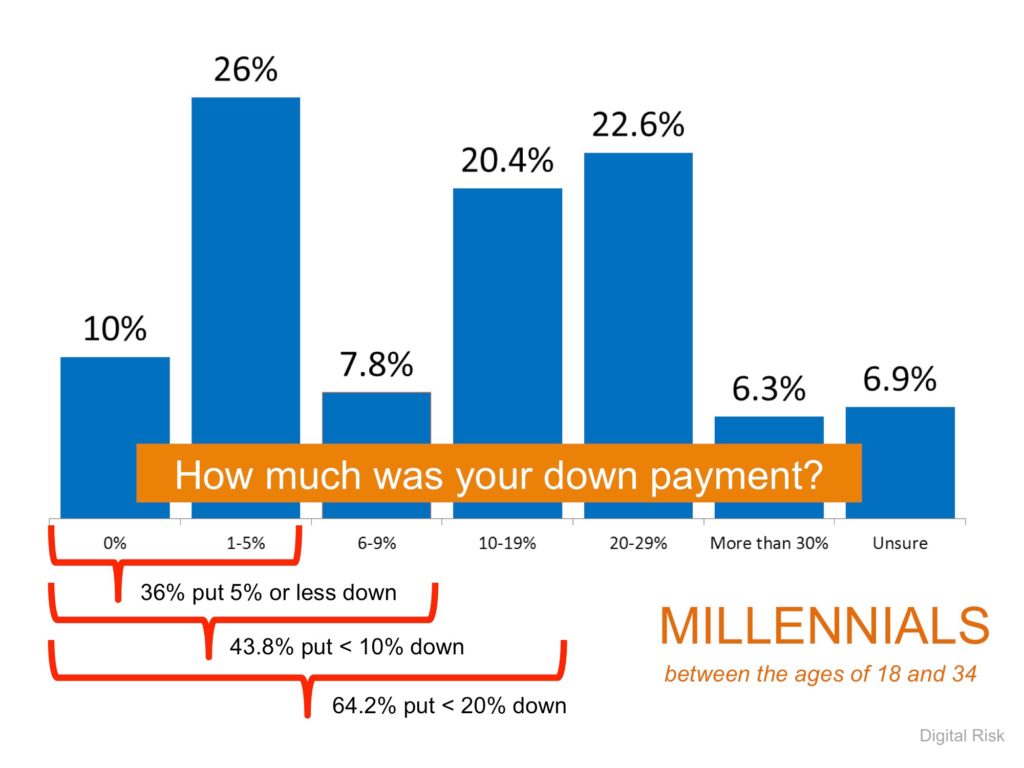

Below are the results of a Digital Risk survey of Millennials who recently purchased a home.

As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%!

Myth #2: “I need a 780 FICO Score or Higher to Buy”

The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.7% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Posted in Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

3 Tips for Making Your Dream of Buying a Home Come True [INFOGRAPHIC]

Jan

06

2017

![3 Tips for Making Your Dream of Buying a Home Come True [INFOGRAPHIC] | Simplifying The Market](http://www.simplifyingthemarket.com/wp-content/uploads/2017/01/3-Tips-STM.jpg)

Some Highlights:

- Realtor.com recently shared “5 Habits to Start Now If You Hope to Buy a Home in 2017.”

- Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking a lot about it.

- Living within a budget now will help you save money for down payments and pay down other debts that might be holding you back.

Posted in Down Payments, First Time Home Buyers, For Buyers, Infographics