Category: For Buyers

Should I Buy Now? Or Wait Until Next Year? [INFOGRAPHIC]

Sep

28

2018

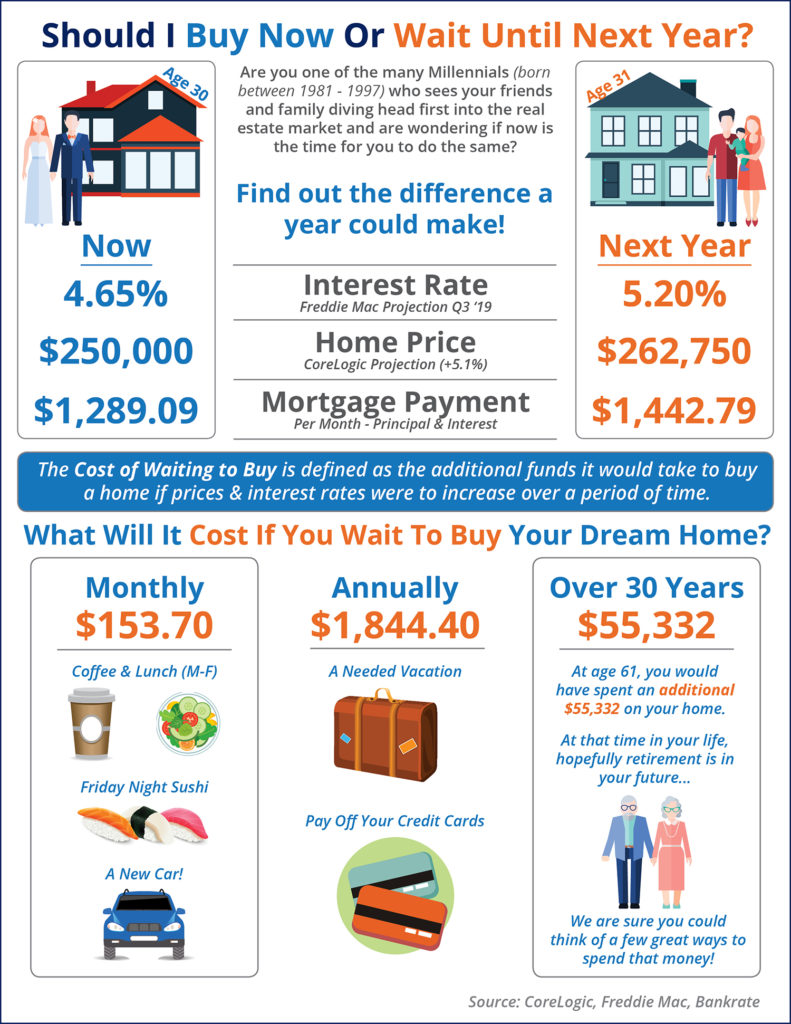

Some Highlights:

- The cost of waiting to buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac predicts interest rates to rise to 5.2% by the third quarter of 2019.

- CoreLogic predicts home prices to appreciate by 5.1% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Millennials, Move-Up Buyers, Pricing

Are Home Prices Softening or Are They Falling?

Sep

27

2018

We are beginning to see reports that more housing inventory is coming to the market and that buyer demand may not be increasing at the same pace it did earlier this year. The result will be many headlines written to address the impact that these two situations will have on home values.

Many of these headline writers will confuse “softening home prices” with “falling home prices,” but there is a major difference between the two.

The data will begin to show that home values are not appreciating at the same levels as they had over the last several years (softening prices). This does NOT mean that prices are depreciating (falling prices).

Here is an example: Over the last several years, national home values increased by more than 6% annually. If you had a home worth $300,000 at the beginning of the year, it would be worth $318,000 by year’s end. If the appreciation rate “falls” to 4%, that $300,000 house would be worth $312,000 at the end of next year – a $6,000 difference.

The price of the home did not fall. It just didn’t increase at the level it had the previous year.

Appreciation rates are projected to end this year at approximately 5%, and then drop to somewhere between 4-5% next year. This drop in appreciation rate will cause home price increases to soften.

Again, this does not mean that home prices will depreciate, but instead that they will appreciate more slowly.

Bottom Line

Be careful when reading headlines that discuss home values. Some headline writers will be legitimately confused and will use the word falling in place of softening. Others will realize that the headline “Home Prices are Falling!” will get more clicks than “Home Prices are Softening” and will intentionally write the more compelling headline. Read the article. If the word depreciation is not mentioned, home values are not falling.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, Pricing

The Cost of NOT Paying PMI

Sep

26

2018

Saving for a down payment is often the biggest hurdle for a first-time homebuyer as median incomes, rents, and home prices all vary depending on where you live.

There is a common misconception among homebuyers that a 20% down payment is required, and it is this limiting belief that often adds months, and sometimes even years, to the home-buying process.

So, if you can purchase a home with less than a 20% down payment… why aren’t more people doing just that?

One Possible Answer: Private Mortgage Insurance (PMI)

Freddie Mac defines PMI as:

“An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.

Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. The monthly cost of your PMI depends on the home’s value, the amount of your down payment, and your credit score.

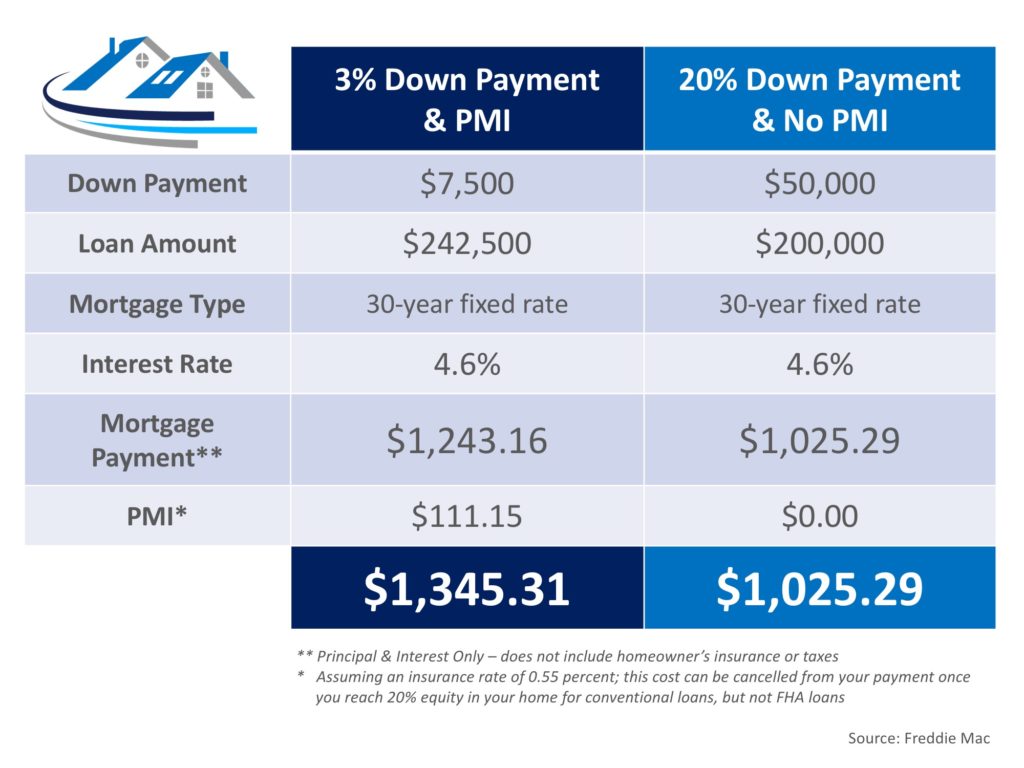

Below is a table showing the difference in monthly mortgage payment for a $250,000 home with a 3% down payment and PMI vs. a 20% down payment without PMI:

The first thing you see when looking at the table above is no doubt the added $320 a month that you would be spending on your monthly mortgage cost. The second thing that should stand out is that a 20% down payment is $50,000!

If you are buying your first home, $50,000 is a large sum of money that takes discipline and sacrifice to save. Many first-time buyers save for 5-10 years before buying their homes.

To save $50,000 in 10 years, you would need to save about $420 a month. On the other hand, if you save that same $420 a month, you could afford a 3% down payment in less than a year and a half.

In a recent article by My Mortgage Insider, they explain what could happen in the market while you are waiting to save for a higher down payment:

“The time it takes to save a (larger) down payment could mean higher home prices and tougher qualifying down the road. For many buyers, it could prove much cheaper and quicker to opt for the 3% down mortgage immediately.”

The article went on to say,

“Since renters typically devote a higher percentage of their income to housing than homeowners, providing flexible down payment options can help renters with solid earnings purchase a home – and gain a fixed-rate mortgage with principal and interest payments that will not increase over the life of the loan.”

If the prospect of having to pay PMI is holding you back from buying a home today, Freddie Mac has this advice,

“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.”

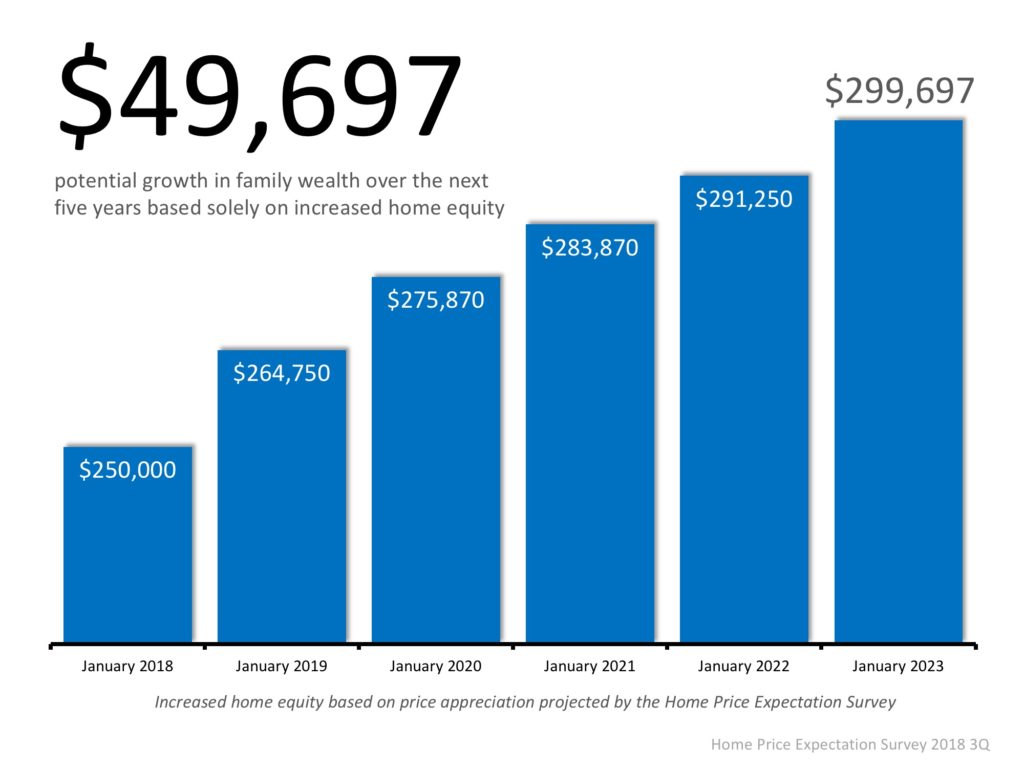

Based on results of the most recent Home Price Expectation Survey, a homeowner who purchased a $250,000 home in January would gain $50,000 in equity over the next five years based on home price appreciation alone (shown below).

Bottom Line

If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, let’s get together to discuss our market’s conditions and help you make the best decision for you and your family.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Move-Up Buyers

Is the Real Estate Market Finally Getting Back to Normal?

Sep

20

2018

The housing market has been anything but normal for the last eleven years. In a normal real estate market, home prices appreciate 3.7% annually. Below, however, are the price swings since 2007 according to the latest Home Price Expectation Survey:

After the bubble burst in June 2007, values depreciated 6.1% annually until February 2012. From March 2012 to today, the market has been recovering with values appreciating 6.2% annually.

These wild swings in values were caused by abnormal ratios between the available supply of inventory and buyer demand in the market. In a normal market, there would be a 6-month supply of housing inventory.

When the market hit its peak in 2007, homeowners and builders were trying to take advantage of a market that was fueled by an “irrational exuberance.”

Inventory levels grew to 7+ months. With that many homes available for sale, there weren’t enough buyers to satisfy the number of homeowners/builders trying to sell, so prices began to fall.

Then, foreclosures came to market. We eventually hit 11 months inventory which caused prices to crash until early 2012. By that time, inventory levels had fallen to 6.2 months and the market began its recovery.

Over the last five years, inventory levels have remained well below the 6-month supply needed for prices to continue to level off. As a result, home prices have increased over that time at percentages well above the appreciation levels seen in a more normal market.

That was the past. What about the future?

We currently have about 4.5-months inventory. This means prices should continue to appreciate at above-normal levels which most experts believe will happen for the next year. However, two things have just occurred that are pointing to the fact that we may be returning to a more normal market.

1. Listing Supply is Increasing

Both existing and new construction inventory is on the rise. The latest Existing Home Sales Report from the National Association of Realtors revealed that inventory has increased over the last two months after thirty-seven consecutive months of declining inventory. At the same time, building permits are also increasing which means more new construction is about to come to market.

2. Buyer Demand is Softening

Ivy Zelman, who is widely respected as an industry expert, reported in her latest ‘Z’ Report:

“While we continue to expect a resumption of growth in resale transactions on the back of easing inventory in 2019 and 2020, our real-time view into the market through our Real Estate Broker Survey does suggest that buyers have grown more discerning of late and a level of “pause” has taken hold in many large housing markets.

Indicative of this, our broker contacts rated buyer demand at 69 on a 0- 100 scale, still above average but down from 74 last year and representing the largest year-over-year decline in the two-year history of our survey.”

With supply increasing and demand waning, we may soon be back to a more normal real estate market. We will no longer be in a buyers’ market (like 2007-February 2012) or a sellers’ market (like March 2012- Today).

Prices won’t appreciate at the levels we’ve seen recently, nor will they depreciate. It will be a balanced market where prices remain steady, where buyers will be better able to afford a home, and where sellers will more easily be able to move-up or move-down to a home that better suits their current lifestyles.

Bottom Line

Returning to a normal market is a good thing. However, after the zaniness of the last eleven years, it might feel strange. If you are going 85 miles per hour on a road with a 60 MPH speed limit and you see a police car ahead, you’re going to slow down quickly. But, after going 85 MPH, 60 MPH will feel like you’re crawling. It is the normal speed limit, yet, it will feel strange.

That’s what is about to happen in real estate. The housing market is not falling apart. We are just returning to a more normal market which, in the long run, will be much healthier for you whether you are a buyer or a seller.

Posted in For Buyers, For Sellers, Housing Market Updates

A+ Reasons to Hire a Real Estate Pro [INFOGRAPHIC]

Aug

31

2018

![A+ Reasons to Hire a Real Estate Pro [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/08/21152250/20180831-Share-STM.jpg)

Some Highlights:

- Hiring a real estate professional to help you buy your dream home or sell your current house is one of the most ‘educated’ decisions you can make!

- A real estate professional has the experience needed to help you through the entire process.

- Make sure that you hire someone who knows current market conditions and can simply and effectively explain them to you and your family!

Posted in For Buyers, For Sellers, FSBOs, Infographics

Why are Existing Home Sales Down?

Aug

30

2018

The latest Existing Home Sales Report issued by the National Association of Realtors (NAR) revealed that home sales have decreased for four consecutive months and are at their slowest pace in over two years. This has some industry leaders puzzled considering the fact that the economy is strengthening, unemployment is down, and wages are beginning to rise. This begs the question: “Where are the buyers?”

Actually, agents in the field of most communities are still seeing strong desire from prospective purchasers. They have a list of potential buyers ready to go if the right houses come on the market and they claim it is not a shortage of demand, but is instead a shortage of inventory that is causing the market to soften.

Why is there a shortage of inventory?

You only need to look at the graph below to understand:

New construction sales over the last ten years are far below historic numbers from 1995-2002.

A recent industry report looked at building permits and concluded:

“If construction over the past decade matched historic norms, accounting for population change, the country would have had 2.3 million more single-family home permits.”

That decade of not building enough homes is the primary reason for the concerns about today’s market.

Wait, weren’t we talking about ‘existing’ home sales?

Some may argue that NAR’s sales report deals with existing home sales and not new construction, and they would be correct. However, reports have shown that one of the main reasons why existing homeowners are not selling is because they can’t find homes that meet the needs of their current lifestyles. Historically, the upgrades in a newly constructed home were the answers to those needs.

Over the last decade, however, there were fewer homes built to satisfy this move-up seller. Consequently, there are many homeowners who stayed in their homes for a longer tenure, instead of putting their homes up for sale.

Bottom Line

As more new homes are being built, there will be more housing inventory to satisfy current demand which will cause prices to moderate and sales volumes to increase.

Posted in For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers, Pricing

Top 3 Myths About Today’s Real Estate Market

Aug

29

2018

There are many conflicting headlines when it comes to describing today’s real estate market. Some are making comparisons to the market we experienced 10 years ago and are starting to believe that we may be doomed to repeat ourselves. Others are just plain wrong when it comes to what it takes to qualify for a mortgage.

Today, we want to try and clear the air by shedding some light on what’s causing some of these headlines, as well as what’s truly going on.

Myth #1: We Are Headed for Another Housing Bubble

Home prices have appreciated year-over-year for the last 76 straight months. Many areas of the country are at or near their peak prices achieved before the last housing bubble burst. This has many worried that we are headed towards another housing bubble.

Reality: The biggest challenge facing today’s real estate market is a lack of homes for sale! Demand is strong, as many renters have come off the fence and are searching for their dream homes.

Historically, a normal market requires a 6-month supply of inventory in order for prices to rise with the rate of inflation. According to the National Association of Realtors (NAR) there is currently a 4.3-month supply of inventory.

The US housing market hasn’t had 6-months inventory since August 2012! The concept of supply and demand is what is driving home prices up!

Myth #2: The Rumored Recession Will Lead to Another Housing Market Crash

Economists and analysts know that the country has experienced economic growth for almost a decade. When this happens, they also know that a recession can’t be too far off. But what is a recession?

Merriam-Webster defines a recession as “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two consecutive quarters.”

Reality: Recession DOES NOT equal housing crisis. Many people associate these two terms with one another because the last time we had a recession it was caused by a housing crisis. According to the Federal Reserve, over the last 40 years, there have been six recessions. In each of the previous five recessions, home values appreciated.

Myth #3: There is an Affordability Crisis Looming

Rising home prices have many concerned that the average family will no longer be able to afford the most precious piece of the American Dream – their own home.

There are many different affordability indexes supported by different organizations that all measure different data. For this reason, there is a lot of confusion about what “affordable” actually means.

The monthly cost of a home is determined by the home’s price and the interest rate on the mortgage used to purchase it. According to Freddie Mac, interest rates have risen from 3.95% in January to 4.59% just last week.

Reality: As we mentioned earlier, home prices have appreciated year-over-year for the last 76 months, largely driven by high demand and low supply.

According to a recent study by Zillow, the percentage of median income necessary to buy a home in today’s market (17.1%) is well below the mark reached in 1985 – 2000 (21%), as well as the mark reached in 2006 (25.4)! Interest rates would have to increase to 6% before buying a home would be less affordable than historical norms.

The starter-home market has appreciated at higher levels (9.4% year-over-year) than any other market. One reason for this is the fact that many of the first-time buyers who have flocked to the starter-home market are being met with high competition. For some hopeful buyers, it may take more than a good offer to stand out from the crowd!

Bottom Line

There is a lot of confusion in today’s real estate market. If your future plans include buying or selling, make sure you have a trusted advisor and market expert by your side to help guide you to the best decision for you and your family.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Move-Up Buyers

Rent or Buy: Either Way You’re Paying A Mortgage!

Aug

27

2018

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

With home prices rising, many renters are concerned about their house-buying power. Mark Fleming, Chief Economist at First American, explained:

“Over the last three years, renter house-buying power has increased fast enough to keep pace with house price appreciation, so the share of homes that a renter can afford to buy has remained the same since 2015.

Although mortgage rates are expected to rise, they are still low by historic standards, and real household incomes are the highest they have ever been. Assuming this trend continues, our measure of affordability, which takes into account income, interest rates, and house prices, indicates that homeownership is still within reach for renters.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.51% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers, Rent vs. Buy

Having Trouble Saving Enough for Your Down Payment? Crowdfund It!

Aug

22

2018

You read that right! First-time buyers across the country are getting creative when it comes to saving the necessary down payment to buy a home.

Many couples are asking their wedding guests to contribute to their “Down Payment Fund” rather than fulfilling a traditional registry. This is fueled by the fact that many couples live together prior to marriage and already have the necessary items to make a house a home…they just need the house!

The average wedding in the United States has 120 guests who give wedding gifts valued, on average, at $186. This means that couples could walk away from their nuptials with over $22,000 towards their down payment!

Services like HomeFundMe allow friends, family members, and almost anyone else in a buyer’s network to contribute funds toward the buyer’s down payment. Contributors can determine, at the time of their donation, if their gifts are ‘conditional’ or ‘non-conditional’ on the beneficiary buying a home.

According to a recent Wall Street Journal article, “about 400 borrowers have used HomeFundMe to help buy homes since the program launched in October and on average, they raise about $2,500.” The article went on to explain that most borrowers use these funds in combination with their personal savings to shorten the time needed to achieve their goal of homeownership.

There are more and more programs surfacing from lenders that allow buyers to put down as little as 3% to buy their dream home. Fannie Mae and Freddie Mac loan programs require 3% down payments, while FHA programs require as little as 3.5%, and VA Loans are often approved with 0% down!

Bottom Line

Gone are the days of 20% down or no loan! If your dreams include buying a home of your own in the next year, you can get creative with your down payment savings to make it happen!

Posted in Down Payments, First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Americans Rank Real Estate Best Investment for 5 Years Running! [INFOGRAPHIC]

Jul

27

2018

![Americans Rank Real Estate Best Investment for 5 Years Running! [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/18142501/20180727-Share-STM.jpg)

Some Highlights:

- Real estate has outranked stocks/mutual funds, gold, savings accounts/CDs, and bonds as the best long-term investment among Americans for the last 5 years!

- The generations agree! Real estate is the best investment!

- Generation X leads the way with 37% believing in real estate as the top investment.

Posted in Baby Boomers, First Time Home Buyers, For Buyers, Generation X, Infographics, Millennials, Move-Up Buyers, Rent vs. Buy