Category: For Buyers

4 Reasons Why We Are Not Heading Toward Another Housing Bubble

Jul

26

2018

With home prices continuing to appreciate above historic levels, some are concerned that we may be heading for another housing ‘boom & bust.’ It is important to remember, however, that today’s market is quite different than the bubble market of twelve years ago.

Here are four key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

- Housing Affordability

1. HOME PRICES

There is no doubt that home prices have reached 2006 levels in many markets across the country. However, after more than a decade, home prices should be much higher based on inflation alone.

Last week, CoreLogic reported that,

“The inflation-adjusted U.S. median sale price in June 2006 was $247,110 (or $199,899 in 2006 dollars), compared with $213,400 in March 2018.” (This is the latest data available.)

2. MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a monthly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Their July Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

3. FORECLOSURE RATES

A major cause of the housing crash last decade was the number of foreclosures that hit the market. They not only increased the supply of homes for sale but were also being sold at 20-50% discounts. Foreclosures helped drive down all home values.

Today, foreclosure numbers are lower than they were before the housing boom. Here are the number of consumers with new foreclosures according to the Federal Reserve’s most recent Household Debt and Credit Report:

- 2003: 203,320 (earliest reported numbers)

- 2009: 566,180 (at the valley of the crash)

- Today: 76,480

Foreclosures today are less than 40% of what they were in 2003.

4. HOUSING AFFORDABILITY

Contrary to many headlines, home affordability is better now than it was prior to the last housing boom. In the same article referenced in #1, CoreLogic revealed that in the vast majority of markets, “the inflation-adjusted, principal-and-interest mortgage payments that homebuyers have committed to this year remain much lower than their pre-crisis peaks.”

They went on to explain:

“The main reason the typical mortgage payment remains well below record levels in most of the country is that the average mortgage rate back in June 2006, when the U.S. typical mortgage payment peaked, was about 6.7 percent, compared with an average mortgage rate of about 4.4 percent in March 2018.”

The “price” of a home may be higher, but the “cost” is still below historic norms.

Bottom Line

After using these four key housing metrics to compare today to last decade, we can see that the current market is not anything like that bubble market.

Posted in For Buyers, For Sellers, Housing Market Updates

What You Need to Know About the Mortgage Process [INFOGRAPHIC]

Jul

20

2018

![What You Need to Know About the Mortgage Process [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/17145720/20180720-Share-STM.jpg)

Some Highlights:

- Many buyers are purchasing a home with a down payment as little as 3%.

- You may already qualify for a loan, even if you don’t have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

Housing Will Not Fall Victim to Next Economic Storm

Jul

19

2018

Some experts are calling for a slowdown in the economy later this year and most economists have predicted that the next recession could only be eighteen months away. The question is, what impact will a recession have on the housing market?

Here are the opinions of several experts on the subject:

Ivy Zelman in her latest “Z Report”:

“While economic activity appears to have accelerated so far in 2018, some prominent economic forecasters have become more cautious about growth prospects for 2019 and 2020…

All told, while solid long-term demographic underpinnings support our positive fundamental outlook for housing, in the event micro-economic headwinds surface, we would expect housing transaction volumes and home prices to weather the storm.”

Aaron Terrazas, Zillow’s Senior Economist:

“While much remains unknown about the precise path of the U.S. economy in the years ahead, another housing market crisis is unlikely to be a central protagonist in the next nationwide downturn.”

Mark Fleming, First American’s Chief Economist:

“If a recession is to occur, it is unlikely to be caused by housing-related activity, and therefore the housing sector should be one of the leading sources to come out of the recession.”

Mark J. Hulbert, Financial Analyst and Journalist:

“Real estate may be one of your best investments during the next bear market for stocks. And by real estate, I mean your home or other residential properties.”

U.S. News and World Report:

“Fortunately – and hopefully – the history of recessions and current issues that could harm the economy don’t lead many to believe the housing market crash will repeat itself in an upcoming decline.”

Posted in For Buyers, For Sellers, Housing Market Updates

5 Reasons Millennials Choose to Buy a Home [INFOGRAPHIC]

Jun

29

2018

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day when they will be able to paint the walls whatever color they’d like or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials, Rent vs. Buy

Next Recession in 2020? What Will Be the Impact?

Jun

28

2018

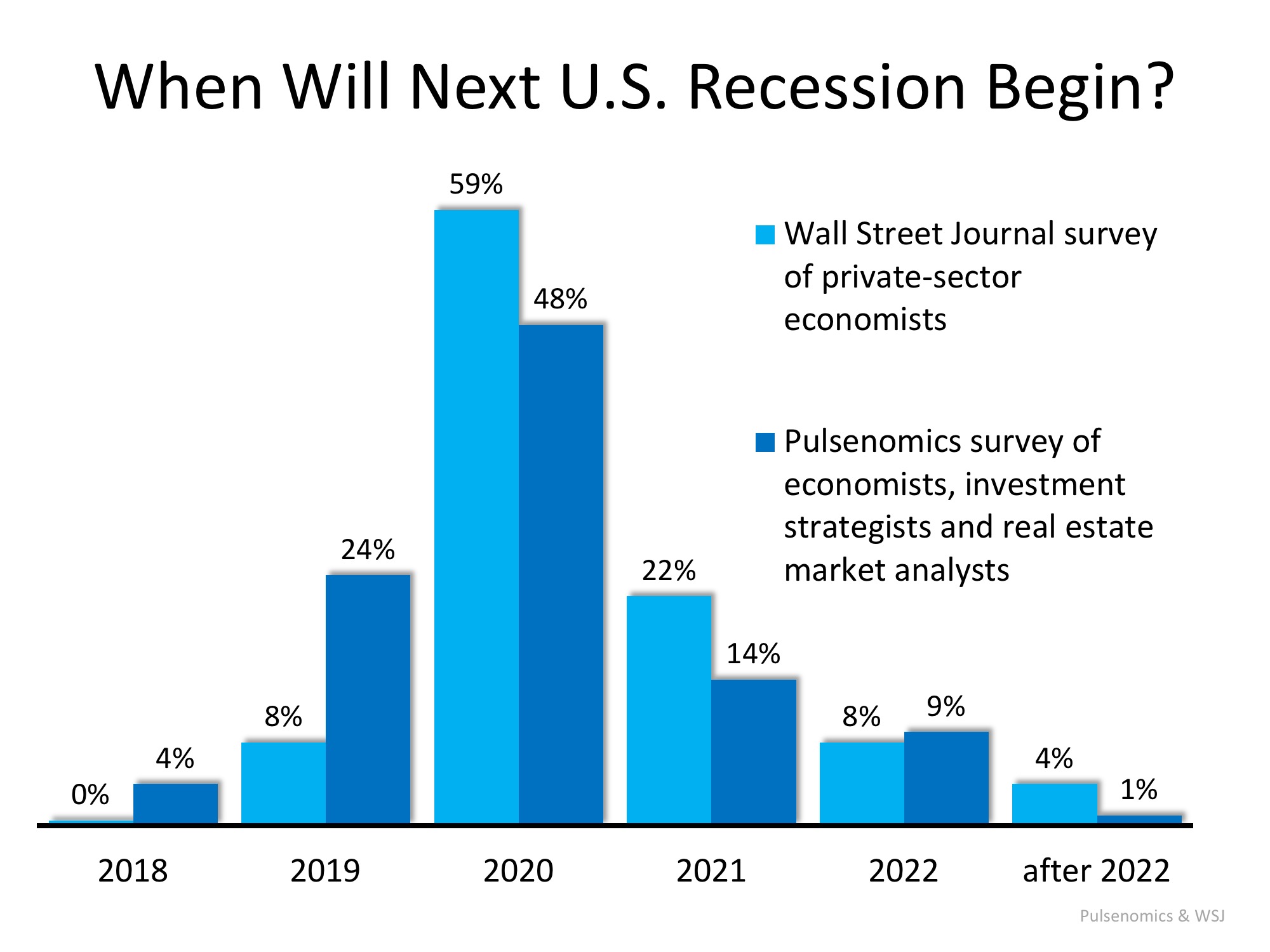

Economists and analysts know that the country has experienced economic growth for almost a decade. They also know that a recession can’t be too far off. A recent report by Zillow Research shed light on a survey conducted by Pulsenomics in which they asked economists, investment strategists and market analysts how they felt about the current housing market. That report revealed the possible timing of the next recession:

“Experts largely expect the next recession to begin in 2020.”

That timing concurs with a recent survey of economists by the Wall Street Journal:

“The economic expansion that began in mid-2009 and already ranks as the second-longest in American history most likely will end in 2020 as the Federal Reserve raises interest rates to cool off an overheating economy, according to forecasters surveyed.”

Here is a graph comparing the opinions of those surveyed by both the Wall Street Journal and Pulsenomics:

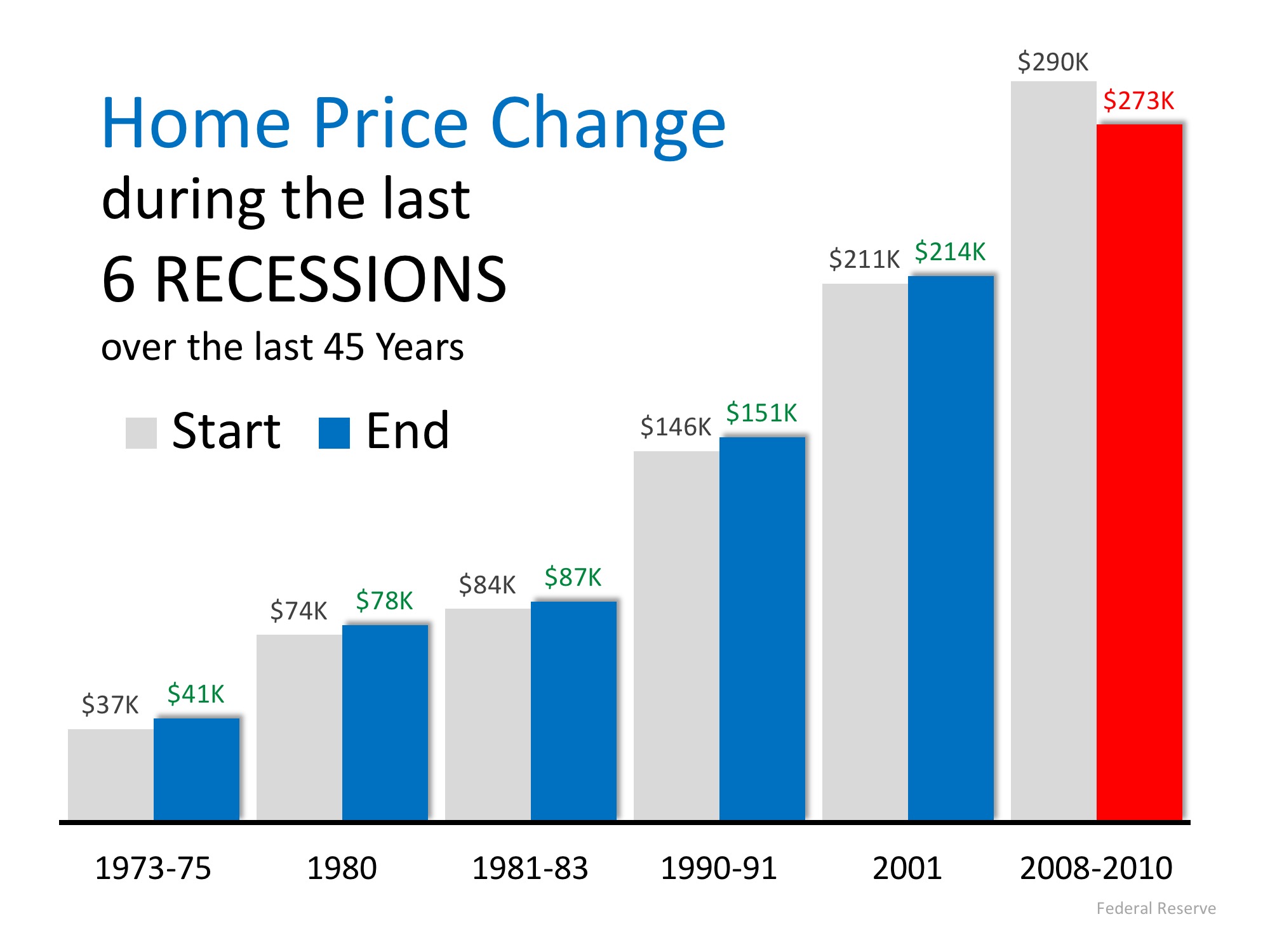

Recession DOES NOT Equal Housing Crisis

According to the Merriam-Webster Dictionary, a recession is defined as follows:

“A period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

A recession means the economy has slowed down markedly. It does not mean we are experiencing another housing crisis. Obviously, the housing crash of 2008 caused the last recession. However, during the previous five recessions home values appreciated.

According to the experts surveyed by Pulsenomics, the top three probable triggers for the next recession are:

- Monetary policy

- Trade policy

- A stock market correction

A housing market correction was ranked ninth in probability. Those same experts also projected that home values would continue to appreciate in 2019, 2020, 2021 and 2022.

Others agree that housing will not be impacted like it was a decade ago.

Mark Fleming, First American’s Chief Economist, explained:

“If a recession is to occur, it is unlikely to be caused by housing-related activity, and therefore the housing sector should be one of the leading sources to come out of the recession.”

And U.S. News and World Report agreed:

“Fortunately – and hopefully – the history of recessions and current issues that could harm the economy don’t lead many to believe the housing market crash will repeat itself in an upcoming decline.”

Bottom Line

A recession is probably less than two years away. A housing crisis is not.

Posted in For Buyers, For Sellers, Housing Market Updates, Pricing

What’s the Median Home Value in Your State?

Jun

27

2018

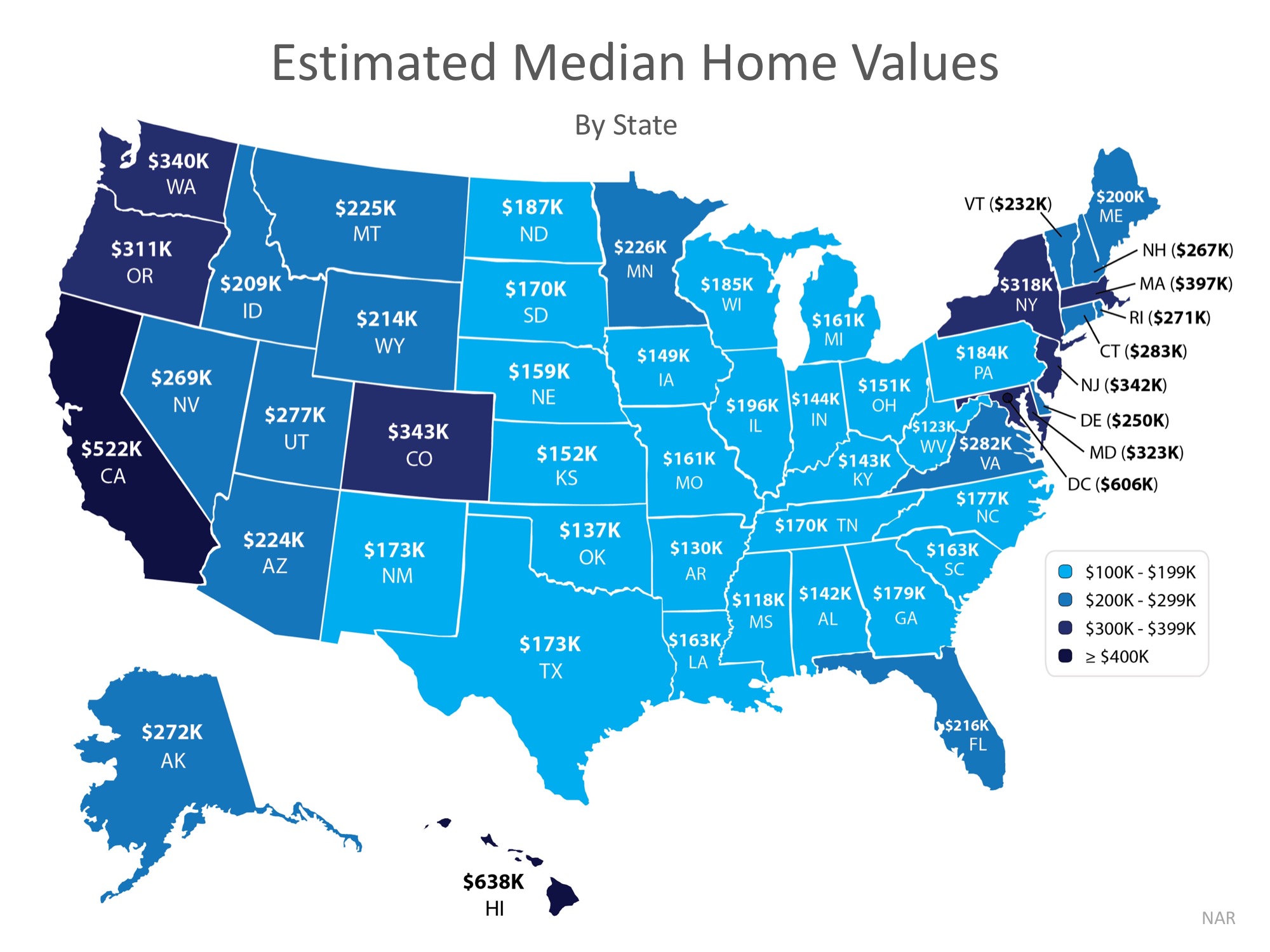

If you’ve entered the real estate market as a buyer or a seller, you’ve inevitably heard the mantra “location, location, location” in reference to identical homes increasing or decreasing in value based on where they’re located.

In today’s housing market where home prices are appreciating quickly, it’s important to know that not every home appreciates at the same rate. The map below demonstrates that point on a state-by-state basis using data from the National Association of Realtors.

Demand often dictates value, even for houses in the same area of the country! High demand for starter and trade-up homes have driven prices up in these categories by nearly 10% over the past year, while those in the premium markets have appreciated at closer to 6%.

Bottom Line

If you are debating whether or not to buy and/or sell a home this year, let’s get together to help you figure out exactly what’s going on in our market.

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Pricing

Are You Wondering If You Can Buy Your First Home?

Jun

26

2018

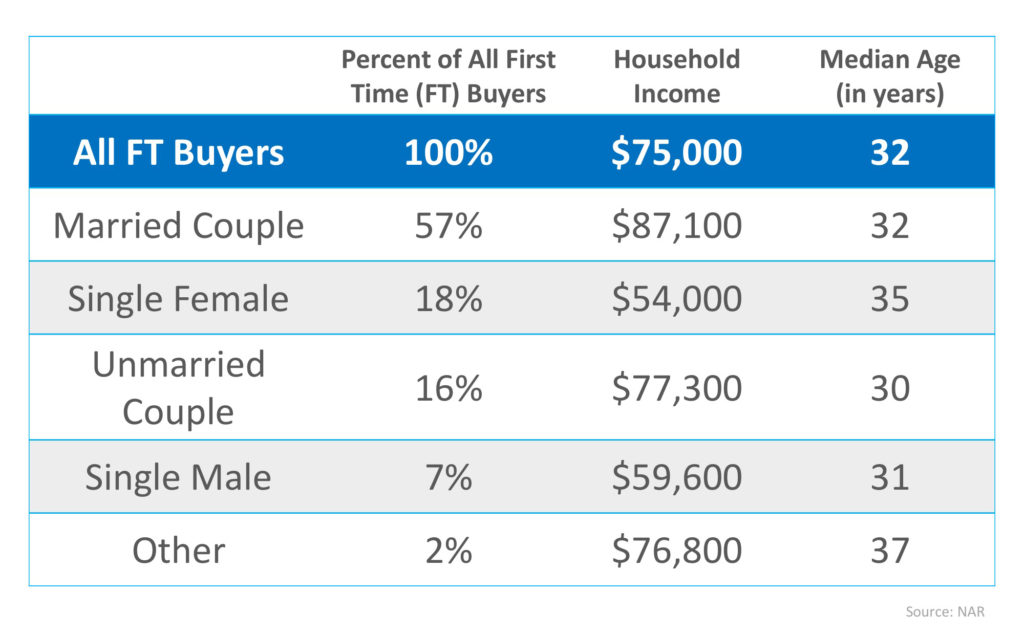

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they get married or start a family, some might think they are too young, and still, some others might think their current incomes would never enable them to qualify for a mortgage.

We want to share what the typical first-time homebuyer actually looks like based on the National Association of Realtors’ most recent Profile of Home Buyers & Sellers. Here are some interesting revelations on the first-time buyer:

Bottom Line

You may not be much different than many people who have already purchased their first homes. Let’s meet to determine if your dream home is within your grasp today.

Posted in First Time Home Buyers, For Buyers, Millennials

You DO NOT Need 20% Down to Buy Your Home NOW!

Jun

25

2018

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that the main reason why non-homeowners do not own their own homes is because they believe that they cannot afford them.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

A recent survey by Laurel Road, the National Online Lender and FDIC-Insured Bank, revealed that consumers overestimate the down payment funds needed to qualify for a home loan.

According to the survey, 53% of Americans who plan to buy or have already bought a home admit to their concerns about their ability to afford a home in the current market. In addition, 46% are currently unfamiliar with alternative down payment options, and 46% of millennials do not feel confident that they could currently afford a 20% down payment.

What these people don’t realize, however, is that there are many loans written with down payments of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO®Scores

An Ipsos survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores for approved conventional and FHA mortgages are much lower.

The average conventional loan closed in May had a credit score of 753, while FHA mortgages closed with an average score of 676. The average across all loans closed in May was 724. The chart below shows the distribution of FICO® Scores for all loans approved in May.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but you are not sure if you are ‘able’ to, let’s sit down to help you understand your true options today.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers

Homes are More Affordable in 44 out of 50 States

Jun

21

2018

With both home prices and mortgage rates increasing this year, many are concerned about a family’s ability to purchase a major part of the American Dream – its own home. However, if we compare housing affordability today to the average affordability prior to the housing boom and bust, we are in much better shape than most believe.

In Black Knight’s latest monthly Mortgage Monitor, they revealed that in the vast majority of the country, it is actually more affordable to purchase a home today than it was between 1995 to 2003 when looking at mortgage payments (determined by price and interest rate) as compared to incomes. Home prices are up compared to 1995-2003, but mortgage rates are still much lower now than at that time. Today, they stand at about 4.5%. Here are the average mortgage rates for each of the years mentioned:

- 1995 – 7.93%

- 1996 – 7.81%

- 1997 – 7.6%

- 1998 – 6.94%

- 1999 – 7.44%

- 2000 – 8.05%

- 2001 – 6.97%

- 2002 – 6.54%

- 2003 – 5.83%

On the other hand, wages have risen over the last twenty years.

Black Knight’s research revealed that, when comparing “the share of median income required to buy the median-priced home” today, to the average between 1995 to 2003, it is currently more affordable to purchase a home in 44 of 50 states.

Here is a state map of the percentage change in the price-to-payment ratio. Positive numbers indicate that it is less affordable to buy while negative numbers indicate that it is more affordable.

Bottom Line

Whether you are moving up to the home of your dreams or purchasing your first house, it is a great time to buy when looking at historic affordability data.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers, Pricing

3 Issues Facing Today’s Real Estate Market

Jun

20

2018

Last week, the National Association of Real Estate Editors (NAREE) held their 52nd Annual Journalism Conference in Las Vegas, NV. Among the many highly anticipated sessions was one called “Top Ten Issues Affecting Real Estate™,” given by Joseph Nahas, Jr., Chair of the Counselors of Real Estate & Senior Vice President of Equus Capital Partners.

The Counselors of Real Estate (CRE) “is an international organization of high profile property professionals which include principals of prominent real estate, financial, legal, and accounting firms as well as recognized leaders of government and academia.”

Their annual “top 10” list spans any and all issues that could have an impact on the real estate market. This year, the list was broken up into “Current” and “Long-Term Issues.”

Today we’re going to focus on three of the five “Current” issues with a brief explanation of their impacts on the housing market today!

E-Commerce & Logistics

With promises of 2-day shipping no matter where you live, we are benefiting more now than ever before from the speed and ease-of-use of online retailers like Amazon. These e-retailers haven’t changed whether or not we buy certain items, but rather HOW we buy them!

Many traditional malls or big-box stores are being repurposed as warehouses or distribution centers for online retailers so that they can get their products out faster.

A Look to the Future: “Developers who are including experiences into their locations are the ones who will succeed. It’s about the experience and gaining something over just going to buy a product.”

Generational Change & Demographics

By now we’ve all heard that the millennial generation is the largest yet, just by sheer volume. The largest group of millennials turns 30 years-old in 2020. The average first-time homebuying age is between 30 and 32, depending on marital status. Real estate professionals will be inundated with more and more buyers as the years roll on. Nahas commented on this in his presentation, saying that,

“Too many developers have become dependent on making decisions based on baby boomer’s preferences.

The 75 million millennials are coming, and they will influence real estate and commerce even faster than the baby boomers in the 50s and 60s.”

Interest Rates & the Economy

The interest rate that you secure for your mortgage is a big factor in your monthly housing cost and in how much you ultimately pay for your home. According to Freddie Mac’s Primary Mortgage Market Survey, rates rose to 4.62% on a 30-year fixed rate loan last week.

The Federal Reserve also raised the federal funds rate for the second time this year. If unemployment continues to be at or near record lows, two more hikes are likely to come later this year.

Nahas added,

“Rising rates can be good and bad for the economy. Bad for borrowing money with additional costs, but good to control inflation and help grow the economy at a moderate pace.”

Bottom Line

If you are planning on buying and/or selling a home this year, let’s get together to help you navigate the conditions in your market and set you up for success.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Millennials

![5 Reasons Millennials Choose to Buy a Home [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/26162117/20180629-STM-ENG.jpg)