Category: For Buyers

Calm Down! The Real Estate Market is NOT Falling Apart

Feb

15

2018

There has been tremendous volatility in certain markets over the last few weeks (for example, the stock and currency markets). When this happens, some tend to lump all of their investments together and create an almost ‘Armageddon’ scenario where everything loses value quickly and dramatically. Real estate is an investment that can get caught up in this hysteria. Does the concern about the current housing market have merit?

Financial advisors have been warning us for months that the stock market was ripe for a “correction.”

Experts have been questioning the value of alternative currencies for over a year.

In contrast, here are the opinions of three major players in the residential housing market:

Ralph DeFranco, Chief Economist, Arch Capital Services Inc.

“It’s premature to worry about a housing bubble. The typical warning signs – excessive debt levels, poor quality loans, exponentially increasing home prices, rising vacancy rates and/or poor affordability compared to the past, and a high number of internet searches on house flipping – are not present.”

Liu-Down, Genworth Chief Economist

“My thoughts on many recent discussions of ‘housing bubble’ – the bar for a housing bubble is higher than just prices being above some fundamental value. There must be widespread behavior change as well such as higher levels of fraud and speculation.”

Fitch Report

“US home prices are on track for a 5% nominal gain for the 4th consecutive year, returning national prices to their highest level since 2007. The growth has been driven by historically low mortgage rates and unemployment plus solid population and personal income growth rates…a meaningful correction should only be triggered by an unexpected economic shock.”

Bottom Line

Speculation has driven certain markets over the last year. However, it has not been speculation, but instead people’s desire for homeownership, that has driven the real estate market.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

Which Comes First… Marriage or Mortgage?

Feb

14

2018

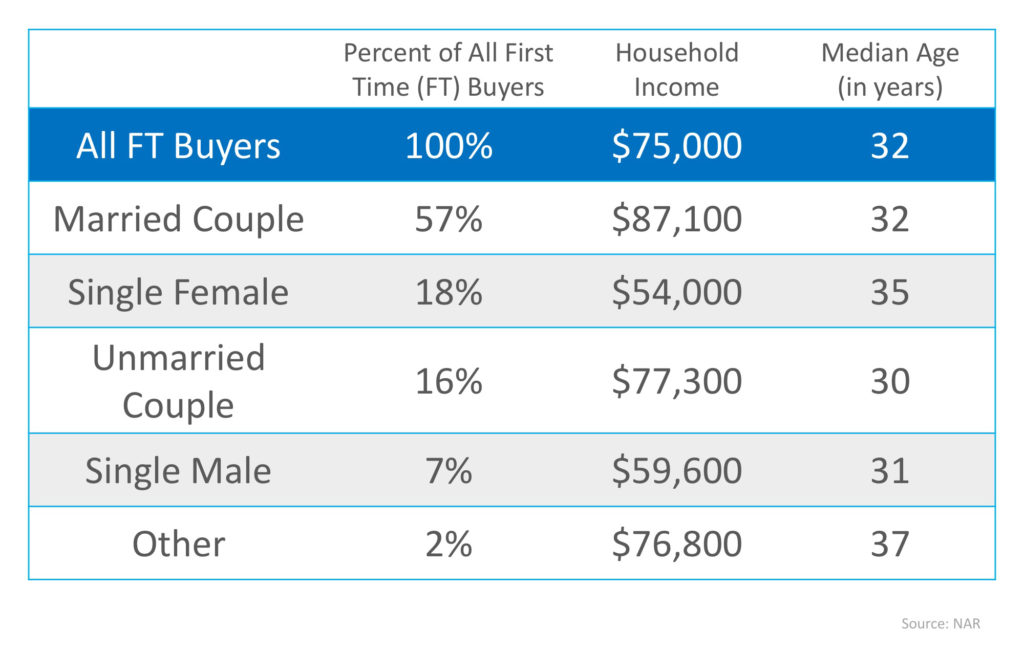

According to the National Association of REALTORS most recent Profile of Home Buyers & Sellers, married couples once again dominated the first-time homebuyer statistics in 2017 at 57% of all buyers. It is no surprise that having two incomes to save for down payments and contribute to monthly housing costs makes buying a home more attainable.

But, many couples are also deciding to buy a home before spending what would be a down payment on a wedding, as unmarried couples made up 16% of all first-time buyers last year.

If you’re single, don’t fret! Single women made up 18% of first-time buyers in 2017, while single men accounted for 7% of buyers. A recent report pointed to a sense of responsibility and commitment that drives many single women to want to own their own homes rather than rent someone else’s.

Here is the breakdown of all first-time homebuyers in 2017 by percentage of all buyers, income, and age:

Bottom Line

You may not be that much different than those who have already purchased their first homes. Let’s get together to determine if your dream home is already within your grasp!

Posted in First Time Home Buyers, For Buyers

Low Inventory Pushes Home Prices Higher

Feb

13

2018

According to CoreLogic’s latest Home Price Index, prices appreciated by 6.9% year-over-year from December 2016 to December 2017 on a national level. This marks the fifth month in a row with at least a 6.9% increase.

Dr. Frank Nothaft, Chief Economist for CoreLogic, gave insight into the reason behind the large appreciation,

“The number of homes for sale has remained very low. Job growth lowered the unemployment rate to 4.1 percent by year’s end, the lowest level in 17 years. Rising income and consumer confidence has increased the number of prospective homebuyers. The net result of rising demand and limited for-sale inventory is a continued appreciation in home prices.”

This is great news for homeowners who have gained nearly $15,000 in equity (on average) in their homes over the last year! Those homeowners who had been on the fence as to whether or not to sell will be pleasantly surprised to find out that they now have an even larger profit to help cover a down payment on their dream homes.

As we near the traditionally busy spring buyers season, there is still hope for buyers as mortgage rates remain low compared to recent decades. The report also predicted that home price appreciation will slow slightly, rising by 4.3% by this time next year.

Bottom Line

If you are looking to enter the housing market, as either a buyer or a seller, let’s get together to go over exactly what’s going on in our neighborhood and discuss your options!

Posted in First Time Home Buyers, For Buyers, For Sellers, Move-Up Buyers, Pricing

Homeownership: “The Reports of My Death Have Been Greatly Exaggerated”

Feb

08

2018

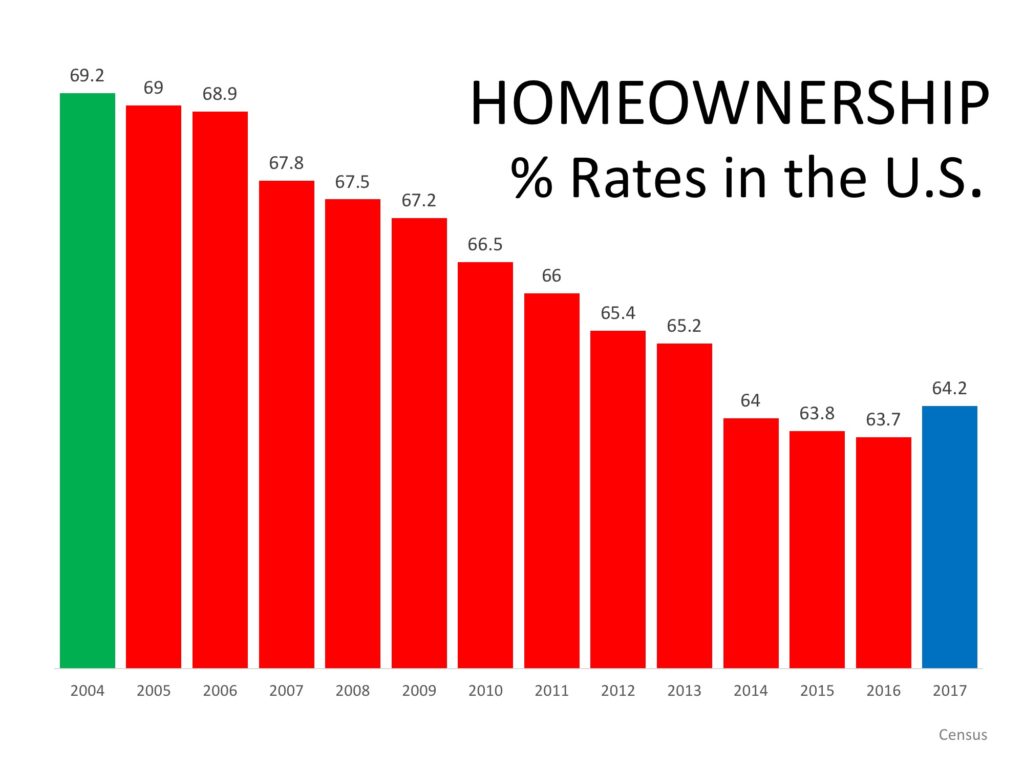

The famous quote by Mark Twain in the title of this article can be used to describe homeownership in America today. Last week, the Census revealed that the percentage of homeowners in the country increased for the first time in thirteen years.

A story in the Wall Street Journal gave these new homeownership numbers some context:

“The annual increase marks a crucial turning point because it comes after the federal government reined in bubble-era policies that encouraged banks to ease lending standards to boost homeownership. This time, what’s driving the market is a shift in favor of owning rather than renting.

‘This is market, market and market…There’s no government incentive program in sight that is having this effect,’ said Susan Wachter, a professor of real estate and finance at the Wharton School at the University of Pennsylvania, ‘This is back to basics.’”

In a separate report comparing the rental population in America to the homeowner population, RentCafé also concluded that the gap is now shrinking.

“Undoubtedly, the recession had a great impact on homeownership…However, it looks like it takes more to discourage Americans from buying a house than that.

As the years go by, it seems more and more certain that the fact that renting has seen a sudden gain in popularity is more a reaction to the economic crisis than a paradigm shift in the Americans’ attitude toward housing.”

America’s belief in homeownership was also evidenced in a recent survey by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not important

Bottom Line

Homeownership has been, is and will always be a crucial element of the American Dream.

*Pictured Above – Mark Twain’s home in Hartford, Connecticut.

Posted in First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

Where Are Mortgage Interest Rates Headed in 2018?

Feb

07

2018

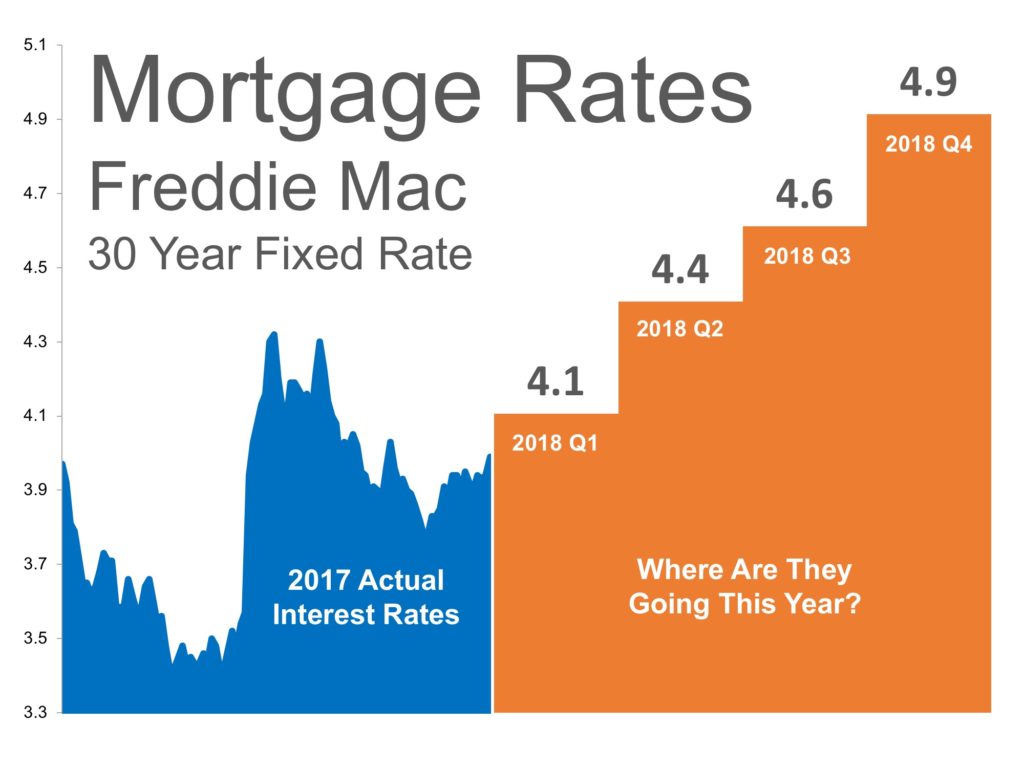

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search.

Below is a chart created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily over the course of the next 12 months.

How Will This Impact Your Mortgage Payment?

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly.

According to CoreLogic’s latest Home Price Index, national home prices have appreciated 7.0% from this time last year and are predicted to be 4.2% higher next year.

If both the predictions of home price and interest rate increases become reality, families would wind up paying considerably more for their next home.

Bottom Line

Even a small increase in interest rate can impact your family’s wealth. Let’s get together to evaluate your ability to purchase your dream home.

Posted in Featured, First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

Millionaire to Millennials: Don’t Rent a Home… Buy!

Feb

06

2018

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”

Then he explains the secret in order to buy that home!

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”

What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.

He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

Feb

05

2018

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Posted in First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers, Rent vs. Buy

5 Reasons Homeowners Can Throw Better Super Bowl Parties! [INFOGRAPHIC]

Feb

02

2018

![5 Reasons Homeowners Can Throw Better Super Bowl Parties! [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/25125455/20180202-Share-STM.jpg)

Highlights:

- Watching the big game at home with your friends & family offers many advantages.

- There’s more room to entertain a large crowd and you don’t have to worry about complaints to your landlord if you cheer too loudly!

- The kitchen is big enough to make as many appetizers as you want, and if some of your guests are only there to watch the commercials, they can do so on a different TV in another room!

Posted in First Time Home Buyers, For Buyers, Infographics, Move-Up Buyers

Bidding Wars Abound… How Long Will They Continue?

Feb

01

2018

Just like with any product or service, the law of supply and demand impacts home prices. Any time that there is less supply than the market demands, prices increase.

In many areas of the country, the supply of homes for sale in the starter and trade-up home markets is so low that bidding wars have ensued, and the busy spring-buying season is just around the corner.

CoreLogic recently conducted an analysis on national home prices at the time of sale for their January 2018 MarketPulse Report and found that a third of homes sold for at least list price.

“The share selling above list price was almost three times the trough in January 2008 and represented more than one-fifth of total sales.”

Many markets in the western part of the country and around major cities are experiencing higher shares of homes selling above list price.

“San Francisco had the largest share of homes—76 percent—that sold for at least the list price, and Seattle and Los Angeles followed with 63 and 51 percent, respectively. Miami had the lowest share—16 percent—of homes selling at or above the list price.”

Increased demand during the spring and summer months, the traditionally busier seasons for real estate, will no doubt influence how many homes continue to sell over list price.

This should not be seen by sellers as permission to overprice their homes, though. Buyers are becoming more and more educated, especially those who have been searching for their dream homes for a while now while waiting for new inventory to come to market.

Realtor.com gives this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

Bottom Line

Without a large wave of new listings coming to market, buyers will continue competing with each other for the homes that are available. If you are thinking of selling your home, now may be the time to do so before more competition comes this spring. Let’s get together to determine the demand for your house in our area.

Posted in For Buyers, For Sellers, Move-Up Buyers, Pricing

Study Shows “Millennials Deserve More Credit”

Jan

31

2018

When it comes to talking about millennials, there are many stereotypes out there that have influenced the way the public feels about the generation. Whether it’s the assumption that millennials are irresponsible with money and would rather buy avocado toast than save for a down payment, or that millennials jump from job to job, the majority of these stereotypes paint the generation in a negative light.

A new study by Bank of America entitled Better Money Habits Millennial Report recently came to the defense of the generation when it reported that:

“Millennials deserve more credit – both from themselves and from others – for their mindfulness when it comes to money and their lives.”

Here are some key takeaways from the study proving that millennials deserve more credit for what they are already doing:

- 63% are saving – (47% have $15,000 or more in savings)

- 54% are budgeting – (73% who have a budget stick to it every month)

- 57% have a savings goal – (67% who have a goal stick to it every month)

- 46% have asked for a raise in the past 2 years – (80% who asked for a raise got one)

- 59% feel financially secure – (16% have $100,000 or more in savings)

Many have wondered if millennials even want to own their own homes or if they would choose to rent instead. Well, not only do they want to own their own homes, but many already do and are looking to trade up! A recent study by realtor.com shows that 49% of Americans who plan to sell their home in the next 12 months are millennials!

Danielle Hale, realtor.com’s Chief Economist, gave some insight into why millennials are looking to sell,

“The housing shortage forced many first-time homebuyers to consider smaller homes and condos as a way to literally get their foot in the door. Our survey data reveals that we may see more of these homes hitting the market in the next year.”

Bottom Line

Not every millennial fits into the stereotypes that are so prominent in our society. Those who have risen above the stereotype are ready and willing to buy a home of their own, and many others already have!

Posted in First Time Home Buyers, For Buyers, For Sellers, Millennials, Move-Up Buyers