If you plan on purchasing your first home this year, let’s get together to determine how much house you can afford. You may be pleasantly surprised.

Category: Millennials

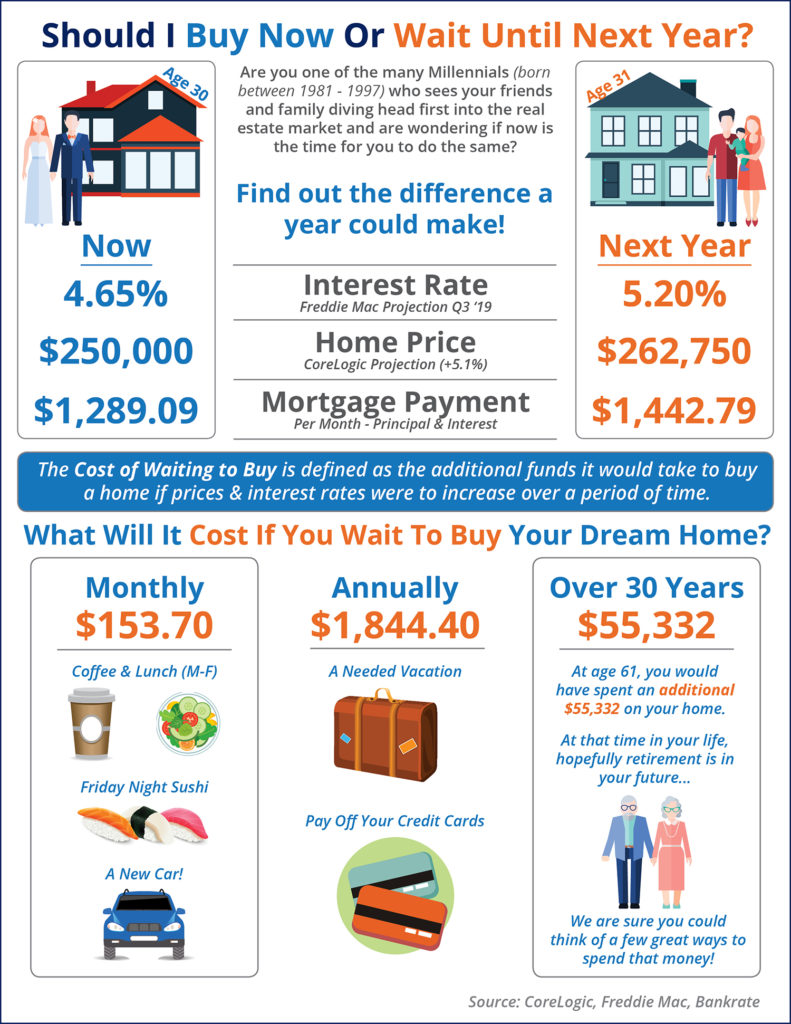

Should I Buy Now? Or Wait Until Next Year? [INFOGRAPHIC]

Sep

28

2018

Some Highlights:

- The cost of waiting to buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac predicts interest rates to rise to 5.2% by the third quarter of 2019.

- CoreLogic predicts home prices to appreciate by 5.1% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Millennials, Move-Up Buyers, Pricing

Having Trouble Saving Enough for Your Down Payment? Crowdfund It!

Aug

22

2018

You read that right! First-time buyers across the country are getting creative when it comes to saving the necessary down payment to buy a home.

Many couples are asking their wedding guests to contribute to their “Down Payment Fund” rather than fulfilling a traditional registry. This is fueled by the fact that many couples live together prior to marriage and already have the necessary items to make a house a home…they just need the house!

The average wedding in the United States has 120 guests who give wedding gifts valued, on average, at $186. This means that couples could walk away from their nuptials with over $22,000 towards their down payment!

Services like HomeFundMe allow friends, family members, and almost anyone else in a buyer’s network to contribute funds toward the buyer’s down payment. Contributors can determine, at the time of their donation, if their gifts are ‘conditional’ or ‘non-conditional’ on the beneficiary buying a home.

According to a recent Wall Street Journal article, “about 400 borrowers have used HomeFundMe to help buy homes since the program launched in October and on average, they raise about $2,500.” The article went on to explain that most borrowers use these funds in combination with their personal savings to shorten the time needed to achieve their goal of homeownership.

There are more and more programs surfacing from lenders that allow buyers to put down as little as 3% to buy their dream home. Fannie Mae and Freddie Mac loan programs require 3% down payments, while FHA programs require as little as 3.5%, and VA Loans are often approved with 0% down!

Bottom Line

Gone are the days of 20% down or no loan! If your dreams include buying a home of your own in the next year, you can get creative with your down payment savings to make it happen!

Posted in Down Payments, First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Americans Rank Real Estate Best Investment for 5 Years Running! [INFOGRAPHIC]

Jul

27

2018

![Americans Rank Real Estate Best Investment for 5 Years Running! [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/18142501/20180727-Share-STM.jpg)

Some Highlights:

- Real estate has outranked stocks/mutual funds, gold, savings accounts/CDs, and bonds as the best long-term investment among Americans for the last 5 years!

- The generations agree! Real estate is the best investment!

- Generation X leads the way with 37% believing in real estate as the top investment.

Posted in Baby Boomers, First Time Home Buyers, For Buyers, Generation X, Infographics, Millennials, Move-Up Buyers, Rent vs. Buy

5 Reasons Millennials Choose to Buy a Home [INFOGRAPHIC]

Jun

29

2018

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day when they will be able to paint the walls whatever color they’d like or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials, Rent vs. Buy

Are You Wondering If You Can Buy Your First Home?

Jun

26

2018

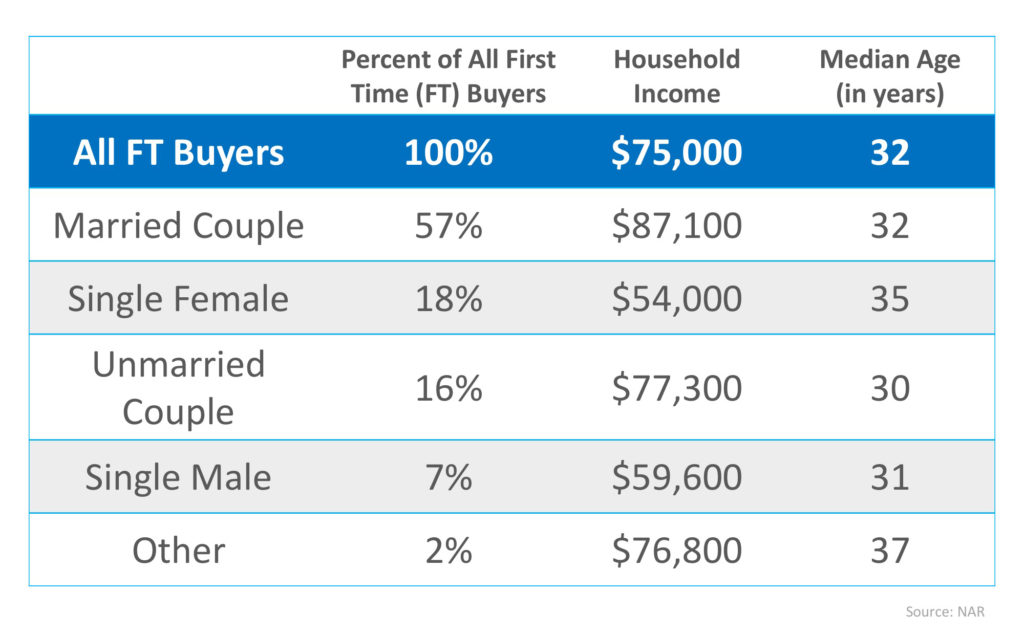

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they get married or start a family, some might think they are too young, and still, some others might think their current incomes would never enable them to qualify for a mortgage.

We want to share what the typical first-time homebuyer actually looks like based on the National Association of Realtors’ most recent Profile of Home Buyers & Sellers. Here are some interesting revelations on the first-time buyer:

Bottom Line

You may not be much different than many people who have already purchased their first homes. Let’s meet to determine if your dream home is within your grasp today.

Posted in First Time Home Buyers, For Buyers, Millennials

3 Issues Facing Today’s Real Estate Market

Jun

20

2018

Last week, the National Association of Real Estate Editors (NAREE) held their 52nd Annual Journalism Conference in Las Vegas, NV. Among the many highly anticipated sessions was one called “Top Ten Issues Affecting Real Estate™,” given by Joseph Nahas, Jr., Chair of the Counselors of Real Estate & Senior Vice President of Equus Capital Partners.

The Counselors of Real Estate (CRE) “is an international organization of high profile property professionals which include principals of prominent real estate, financial, legal, and accounting firms as well as recognized leaders of government and academia.”

Their annual “top 10” list spans any and all issues that could have an impact on the real estate market. This year, the list was broken up into “Current” and “Long-Term Issues.”

Today we’re going to focus on three of the five “Current” issues with a brief explanation of their impacts on the housing market today!

E-Commerce & Logistics

With promises of 2-day shipping no matter where you live, we are benefiting more now than ever before from the speed and ease-of-use of online retailers like Amazon. These e-retailers haven’t changed whether or not we buy certain items, but rather HOW we buy them!

Many traditional malls or big-box stores are being repurposed as warehouses or distribution centers for online retailers so that they can get their products out faster.

A Look to the Future: “Developers who are including experiences into their locations are the ones who will succeed. It’s about the experience and gaining something over just going to buy a product.”

Generational Change & Demographics

By now we’ve all heard that the millennial generation is the largest yet, just by sheer volume. The largest group of millennials turns 30 years-old in 2020. The average first-time homebuying age is between 30 and 32, depending on marital status. Real estate professionals will be inundated with more and more buyers as the years roll on. Nahas commented on this in his presentation, saying that,

“Too many developers have become dependent on making decisions based on baby boomer’s preferences.

The 75 million millennials are coming, and they will influence real estate and commerce even faster than the baby boomers in the 50s and 60s.”

Interest Rates & the Economy

The interest rate that you secure for your mortgage is a big factor in your monthly housing cost and in how much you ultimately pay for your home. According to Freddie Mac’s Primary Mortgage Market Survey, rates rose to 4.62% on a 30-year fixed rate loan last week.

The Federal Reserve also raised the federal funds rate for the second time this year. If unemployment continues to be at or near record lows, two more hikes are likely to come later this year.

Nahas added,

“Rising rates can be good and bad for the economy. Bad for borrowing money with additional costs, but good to control inflation and help grow the economy at a moderate pace.”

Bottom Line

If you are planning on buying and/or selling a home this year, let’s get together to help you navigate the conditions in your market and set you up for success.

Posted in First Time Home Buyers, For Buyers, For Sellers, Housing Market Updates, Millennials

Millennials Are Skipping Starter Homes for Their Dream Homes

May

30

2018

A new trend has begun to emerge. With home prices skyrocketing in the starter home category, many first-time homebuyers are skipping the traditional starter homes and moving right into their dream homes.

What’s a Starter Home?

According to the National Association of Realtors (NAR), simply put, a starter home is a one or two-bedroom home (sometimes even a small, three bedroom). “Prices vary widely by market but starters on average cost $150,000 to $250,000 while trade-up and premium homes cost upwards of $300,000.”

Finding Their Forever Homes Now

A recent CNBC article revealed that there are many factors that delayed older millennials (ages 25-35) from buying a home earlier in their lives. The aftereffects of the Great Recession teaming up with larger education costs forced many to either remain living in their parent’s homes or to rent.

With the economy continuing to improve, many millennials have been able to break into better-paying jobs which has helped spur down payment savings. As the dream of homeownership comes closer to reality, many millennials are saving for their forever homes.

According to the latest statistics from NAR, 30% of millennials bought homes for $300,000 or more this year (up from 14% in 2013). Diane Swonk, Chief Economist at Grant Thornton weighed in saying, “They rented for longer. Now they’re going to where they want to stay.”

More and more millennials are settling down, getting married, and starting families, which is a huge factor driving them to look for larger homes.

Increased competition in the starter home market has also been a driving force in waiting to afford their dream homes. Inventory in the starter home market is down 14.2% from last year, according to research from Trulia. This has driven prices up and has led to bidding wars.

Many first-time buyers who were originally looking for starter homes are realizing that for just a little bit more of an investment, they could afford trade-up or premium homes instead.

Bottom Line

Posted in First Time Home Buyers, For Buyers, Millennials

Dreaming of a Luxury Home? Now’s the Time!

Mar

19

2018

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! Recently, the Institute for Luxury Home Marketing released its Luxury Market Report which showed that in today’s premium home market, buyers are in control.

The inventory of homes for sale in the luxury market far exceeds the number of people searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer or can be found at a discount.

Those who have a starter or trade-up home to sell will find buyers competing, and often entering bidding wars, to be able to call their house their new home.

The sale of your starter or trade-up house will help you come up with a larger down payment for your new luxury home. Even a 5% down payment on a million-dollar home is $50,000.

But not all who are buying luxury properties have a home to sell first.

A recent Bloomberg article gave some insight into what many millennials are choosing to do:

“A new generation of affluent homebuyers powered by a surge in inherited wealth is driving the luxury-home market, demanding larger spaces and fancier finishes, according to a report heralding ‘the rise of the new aristocracy.’”

Bottom Line

The best time to sell anything is when demand is high, and supply is low. If you are currently in a starter or trade-up house that no longer fits your needs and you are looking to step into a luxury home, now’s the time to list your house for sale and make your dreams come true.

Posted in First Time Home Buyers, For Buyers, Luxury Market, Millennials, Move-Up Buyers

80% of Renters Believe Homeownership is a Part of Their American Dream

Feb

21

2018

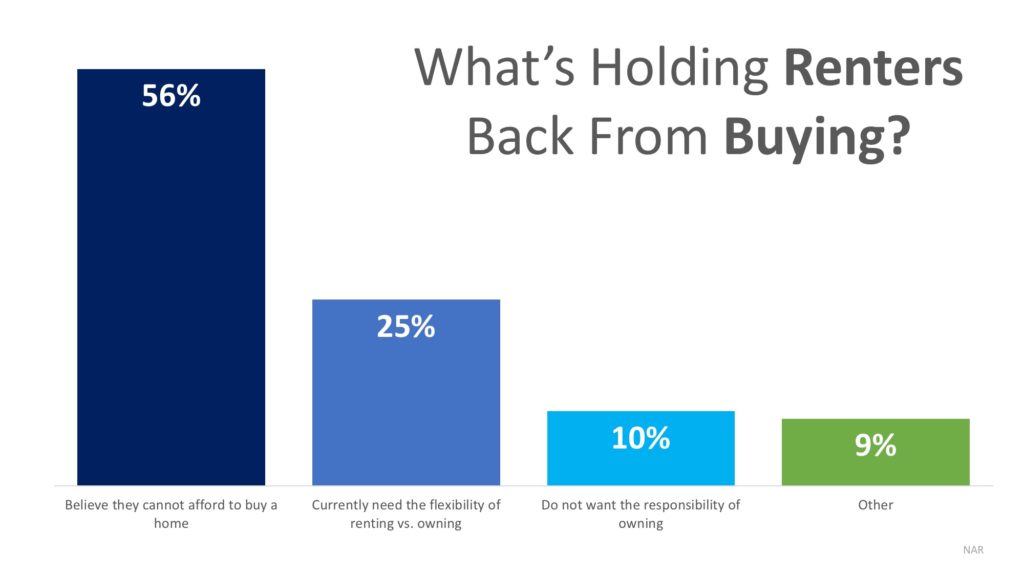

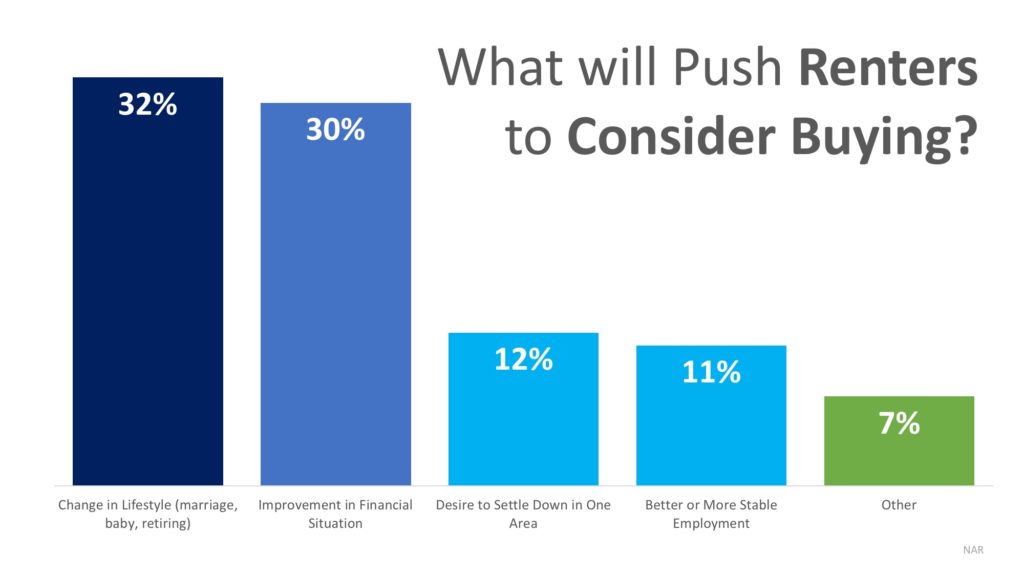

According to the latest Aspiring Home Buyers Profile by the National Association of Realtors (NAR), 82% of surveyed renters desire to own a home in the future, with 80% believing homeownership is a big part of achieving their American Dream.

The profile went on to state that 50% of millennials believe that their rent will increase, with 20% believing that an increase in rent will be the catalyst that pushes them to consider buying a home vs. renewing their lease.

So, what is holding renters back?

What would make renters take the plunge?

NAR’s Chief Economist, Lawrence Yun believes that,

“Housing demand in 2018 will be fueled by more millennials finally deciding to marry and have kids and the expectations that solid job growth and the strengthening economy will push incomes higher.”

Yun goes on to warn that,

“However, with prices and mortgage rates also expected to increase, affordability pressures will persist. That is why it is critical for much of the country to start seeing a significant hike in new and existing housing supply. Otherwise, many would-be first-time buyers will be forced to continue renting and not reach their dream of being a homeowner.”

Bottom Line

If you are one of the many homeowners whose houses no longer fit their needs and are looking to move up to your dream home, now is a great time to list your starter home! First-time buyers are out in force looking to achieve their American Dream.

Posted in First Time Home Buyers, For Buyers, Millennials, Rent vs. Buy

Should I Wait Until Next Year to Buy? Or Buy Now? [INFOGRAPHIC]

Feb

16

2018

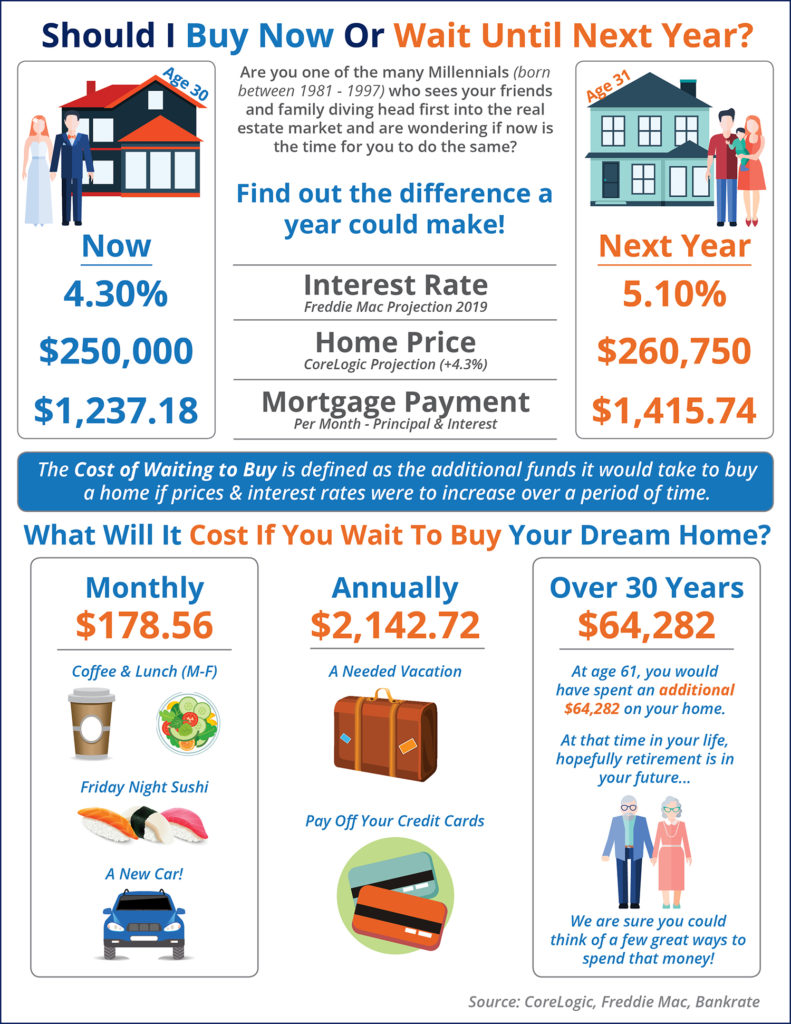

Some Highlights:

- The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac predicts interest rates to rise to 5.1% by 2019.

- CoreLogic predicts home prices to appreciate by 4.3% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Millennials, Move-Up Buyers, Pricing

![5 Reasons Millennials Choose to Buy a Home [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/26162117/20180629-STM-ENG.jpg)