Category: Millennials

Millionaire to Millennials: Don’t Rent a Home… Buy!

Feb

06

2018

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”

Then he explains the secret in order to buy that home!

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”

What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.

He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Study Shows “Millennials Deserve More Credit”

Jan

31

2018

When it comes to talking about millennials, there are many stereotypes out there that have influenced the way the public feels about the generation. Whether it’s the assumption that millennials are irresponsible with money and would rather buy avocado toast than save for a down payment, or that millennials jump from job to job, the majority of these stereotypes paint the generation in a negative light.

A new study by Bank of America entitled Better Money Habits Millennial Report recently came to the defense of the generation when it reported that:

“Millennials deserve more credit – both from themselves and from others – for their mindfulness when it comes to money and their lives.”

Here are some key takeaways from the study proving that millennials deserve more credit for what they are already doing:

- 63% are saving – (47% have $15,000 or more in savings)

- 54% are budgeting – (73% who have a budget stick to it every month)

- 57% have a savings goal – (67% who have a goal stick to it every month)

- 46% have asked for a raise in the past 2 years – (80% who asked for a raise got one)

- 59% feel financially secure – (16% have $100,000 or more in savings)

Many have wondered if millennials even want to own their own homes or if they would choose to rent instead. Well, not only do they want to own their own homes, but many already do and are looking to trade up! A recent study by realtor.com shows that 49% of Americans who plan to sell their home in the next 12 months are millennials!

Danielle Hale, realtor.com’s Chief Economist, gave some insight into why millennials are looking to sell,

“The housing shortage forced many first-time homebuyers to consider smaller homes and condos as a way to literally get their foot in the door. Our survey data reveals that we may see more of these homes hitting the market in the next year.”

Bottom Line

Not every millennial fits into the stereotypes that are so prominent in our society. Those who have risen above the stereotype are ready and willing to buy a home of their own, and many others already have!

Posted in First Time Home Buyers, For Buyers, For Sellers, Millennials, Move-Up Buyers

5 Reasons Millennials Choose to Buy [INFOGRAPHIC]

Jan

26

2018

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day when they will be able to paint the walls whatever color they’d like, or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials

Buying a Home Can Be Scary… Unless You Know the Facts [INFOGRAPHIC]

Oct

27

2017

Some Highlights:

Many potential homebuyers believe that they need a 20% down payment and a 780 FICO® score to qualify to buy a home, which stops many of them from even trying! Here are some facts:

- 40% of millennials who purchased homes this year have put down less than 10%.

- 76.4% of loan applications were approved last month.

- The average credit score of approved loans was 724 in September.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Infographics, Millennials

Millennials Flock Towards Low Down Payment Programs

Oct

24

2017

A report released by Down Payment Resource shows that 61% of first-time homebuyers purchased their homes with a down payment of 6% or less.

The trend continued among all buyers with a mortgage, as 73% made a down payment of less than 20%.

An article by Chase points to a new wave of millennial homebuyers:

“We teamed up with Google to help us better understand what customers are searching for and how the home buying landscape is evolving. We found that millennials and first-time homebuyers are making a big splash in the market, and affordability remains top of mind.”

Among millennials who purchased homes, David Norris, Loan Depot’s Head of Retail Lending, said:

“It’s clear from the survey results that Millennials have a lot of anxiety built up about the home buying process.

There is good news, however, as there’s more flexibility than most Millennials think regarding how to qualify for a loan and what’s needed for a down payment.”

Bottom Line

If you are one of the many millennials who is debating a home purchase this year, let’s get together to help you understand your options and set you on the path to preapproval.

Posted in Buying Myths, Down Payments, First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Moving-Up to a Luxury Home? Now’s the Time!

Oct

18

2017

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! We recently shared data from Trulia’s Market Mismatch Study which showed that in today’s premium home market, buyers are in control.

The inventory of homes for sale in the luxury market far exceeds those searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer which can eventually lead to a price change.

Those who have a starter or trade-up home to sell will find buyers competing, and often entering bidding wars, to be able to call your house their new home.

The sale of your starter or trade-up house will aid in coming up with a larger down payment for your new luxury home. Even a 5% down payment on a million-dollar home is $50,000.

But not all who are buying luxury properties have a home to sell first.

In a Washington Post article, Daryl Judy, an associate broker with Washington Fine Properties, gave some insight into what many millennials are choosing to do:

“Some high-earning millennials save money until they are in their early 30s to buy a place and just skip over that starter-home phase. They’ll stay in an apartment until they can afford to pay for the place they want.”

Bottom Line

The best time to sell anything is when demand is high and supply is low. If you are currently in a starter or trade-up house that no longer fits your needs and you are looking to step into a luxury home, now’s the time to list your house for sale and make your dreams come true.

Posted in For Sellers, Luxury Market, Millennials, Move-Up Buyers

Builder Offering to Pay Off Student Loans for Buyers

Oct

11

2017

Millennials are on track to become the most educated generation in history. This means they are also the generation with the most student debt. Depending on the type of degree earned, as well as the prestige of the institution attended, there are some millennials who graduate college with what equates to a mortgage payment.

For those first-time buyers, and even some move-up buyers, who took advantage of the First-Time Homebuyer Tax Credit in 2008, there is an interesting program being introduced by Lennar Home Builders and Eagle Home Mortgage.

“Borrowers with Eagle Home Mortgage’s Student Loan Debt Mortgage Program can direct up to 3% of the purchase price (up to $13,000) to pay their student loans when they buy a new home from Lennar, one of the nation’s largest homebuilders. The contribution doesn’t directly increase the purchase price of the home or add to the balance of the loan.”

The program allows borrowers, whose credit and income requirements qualify, to put down as low as 3% and have a maximum loan amount of $424,100. At the time of closing, Lennar contributes up to 3% to pay down student loans incurred while attending universities, colleges, community colleges, trade schools and other certificate-granting programs.

Jimmy Timmons, President of Eagle Home Mortgage, gave more context about the reasons behind the creation of the program,

“Americans are more burdened than ever by student loans, with $1.3 trillion in outstanding student loans spread out among 42 million borrowers.

Particularly with millennial buyers, people who want to buy a home of their own are not feeling as though they can move forward. Our program is designed to relieve some of that burden and remove that barrier to owning a home.”

According to the Wall Street Journal, “housing observers said other builders are likely to look to mimic the program, which could help lure more of the critical first-time-buyer segment into home purchases.”

Bottom Line

If you are one of the many millennials who may have delayed purchasing your first home, or feel stuck in a house that no longer fits your needs, there are programs and options available to help you achieve your dream!

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

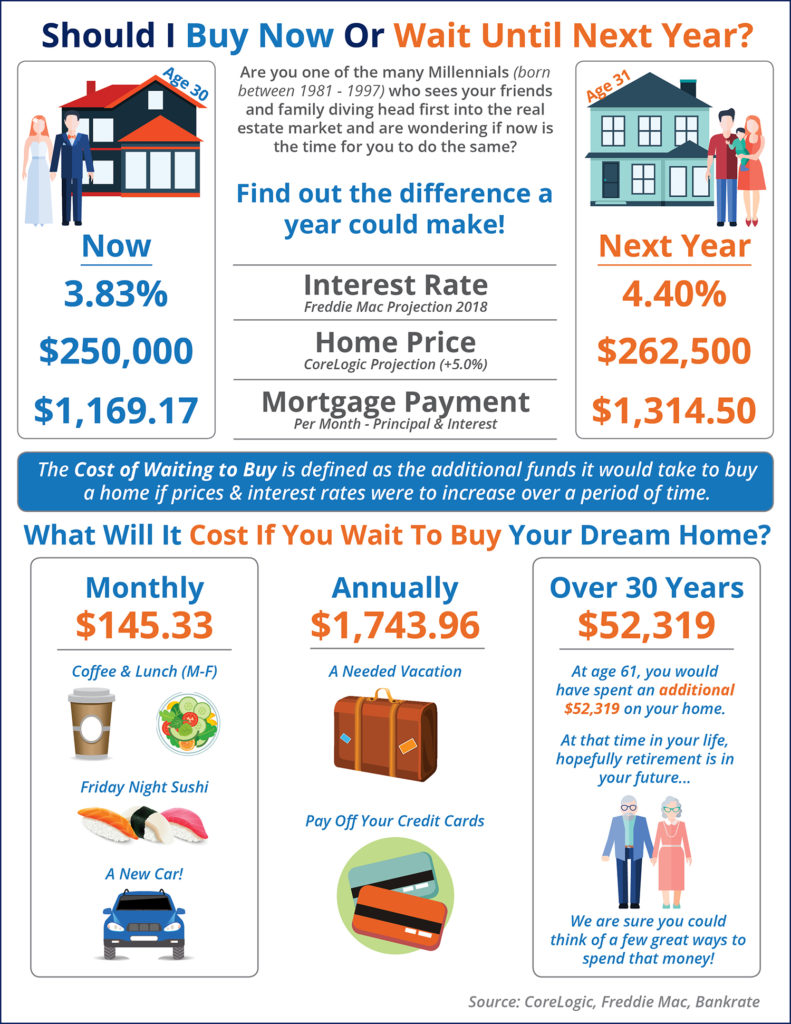

Should I Buy a Home Now? Or Wait Until Next Year? [INFOGRAPHIC]

Sep

29

2017

![Should I Buy a Home Now? Or Wait Until Next Year? [INFOGRAPHIC]| Simplifying The Market](http://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/09/28125015/20170929-Share-STM.jpg)

Some Highlights:

- The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac predicts interest rates to rise to 4.4% by next year.

- CoreLogic predicts home prices to appreciate by 5.0% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Posted in First Time Home Buyers, For Buyers, Infographics, Interest Rates, Millennials, Move-Up Buyers, Pricing

What to Look for in Your Real Estate Team

Sep

27

2017

How do you select the members of your team who are going to help you make your dream of owning a home a reality? What should you be looking for? How do you know if you’ve found the right agent or lender?

The most important characteristic that you should be looking for in your agent is someone who is going to take the time to really educate you on the choices available to you and your ability to buy in today’s market.

As Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Do your research. Ask your friends and family for recommendations of professionals whom they have used in the past and have had good experiences with.

Look for members of your team who will be honest and trustworthy; after all, you will be trusting them with helping you make one of the biggest financial decisions of your life.

Whether this is your first or fifth time buying a home, you want to make sure that you have an agent who is going to have the tough conversations with you, not just the easy ones. If your offer isn’t accepted by the seller, or they think that there may be something wrong with the home that you’ve fallen in love with, you would rather know what they think than make a costly mistake.

According to a Consumer Housing Trends Study, millennials have already started to prefer a more hands-on approach to their real estate experience:

“While older generations rely on real estate agents for information and expertise, millennials expect real estate agents to become trusted advisers and strategic partners.”

Look for someone to invest in your family’s future with you. You want an agent who isn’t focused on the transaction but is instead focused on helping you understand the process while helping you find your dream home.

Bottom Line

In this world of Google searches, where it seems like all the answers are just a mouse-click away, you need an agent who is going to educate you and share the information that you need to know before you even know you need it.

Posted in First Time Home Buyers, For Buyers, Millennials, Move-Up Buyers

Top 5 Reasons Why Millennials Choose to Buy [INFOGRAPHIC]

Sep

15

2017

Some Highlights:

- “The majority of millennials said they consider owning a home more sensible than renting for both financial and lifestyle reasons — including control of living space, flexibility in future decisions, privacy and security, and living in a nice home.”

- The top reason millennials choose to buy is to have control over their living space, at 93%.

- Many millennials who rent a home or apartment prior to buying their own homes dream of the day that they will be able to paint the walls whatever color they’d like, or renovate an outdated part of their living space.

Posted in First Time Home Buyers, For Buyers, Infographics, Millennials